Overview

This is an update to my previous Getty Images (NYSE:GETY) update.

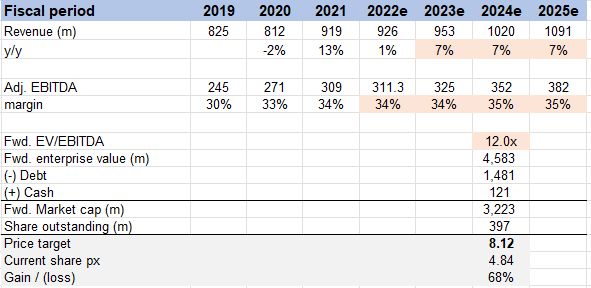

I still recommend buying GETY. Getty Images serves a worldwide clientele as a content creation studio and online marketplace. Getty Images, iStockphoto, and Unsplash all cater to different types of photographers, but editorial and commercial photographers, media outlets, and businesses are among the most common users of the company’s services. It serves a sizable and growing market propelled by multiple growth drivers and provides a unique selling proposition in the form of a product that should allow it to increase its market share. Based on my forecasts ($1.1 billion in revenue and $382 million in EBITDA), I believe GETY will be able to successfully implement its growth strategy, increasing its equity value to $8 per share by FY24.

Long-term growth drivers still strong

I originally expected GETY to generate around $1 billion in revenue in FY23, but now is adjusting my expectation given that run rate 1Q23 revenue is only at $944 million. However, I like to note the silver lining here is that GETY is heavily impacted by FX, and that if we adjust for FX, 1Q23 revenue grew by 5.5% instead. This would bring 1Q23 revenue to $243 million, or a run rate of $975 million, much closer to the $1 billion FY23 I expected. Though the overall revenue was below my expectations, I was heartened to see that it was propelled by rising subscriptions, renewals, new customers, and content consumption. These indicators of future growth interest me more than the overall revenue number, which is susceptible to variations in product mix. To put things in perspective, GETY’s total active annual subs increased by 85.2% y/y to 150,000, and their churn rate was only 0.2%. Through efforts like its partnership with BRIA and the growth of Unsplash+, GETY appears to have the right strategy, and I anticipate that revenue from annual subscriptions will continue increasing (eventually reaching the management target of 60%).

AI strategy

When I heard that management was getting in on the generative AI trend by planning to release its offering with NVIDIA as a standalone service in 2H23, I was very encouraged. Even though generative AI is not currently having any effect on the business, I still think it’s important for GETY to introduce its own because otherwise it will fall behind the competition. The use of AI-generated images is something I anticipate will lead to more overall content creation, larger content libraries, and new avenues for monetization like model training and enhanced customer engagement. This would facilitate an expedited growth trajectory while preserving profit margins, as the anticipated generative AI-driven revenue streams and operational aspects would mirror GETY’s prevailing margin profile, characterized by approximately 70% gross margin and 30% adjusted EBITDA margin.

Valuation

My TP for FY25 has been lowered from $9 to $8. This is in line with the revised FY23 guidance, which impacts my FY25 estimates. I still think GETY is undervalued as the market does not appreciate the underlying long-term growth drivers. I still expect GETY’s long-term revenue growth to be in the low to mid-single-digit range (between 5 and 7 percent), post FY23. Also, as the company moves toward a subscription-based business model, I expect EBITDA margin to continue increasing to mid-30%, just as guided.

Own’s estimates

GETY subscriber base worth a huge amount

When we value GETY based on CLTV, the value of the GETY subscriber base is significant. GETY has an LTM revenue of $697.6 million, which equates to subscription revenue of $355 million (>50% of total revenue comes from annual subscriptions), implying an ARPU of $2.4k. Given its recurring nature, subscription revenue should have a higher gross margin than consolidated revenue. I assume a gross margin of 80% (this could be higher, but I’m being conservative), which translates to a gross profit/sub of $1.9k and a CLTV of $18.6k ($1.9/(0.2% churn + 10% discount rate)). When this CLTV is applied to the entire subscriber base, the value of the subscriber base is $2.8 billion. This implies that the rest of GETY’s non-sub business is only worth $500 million, or 5x EBITDA (assume this business only generates $100 million EBITDA due to the higher mix of subscription business). This doesn’t make sense given that Shutterstock is trading at 7x EBITDA.

Risks

The proliferation of new AI image generators poses a threat to Getty Images and its traditional stock photo competitors because their products may drive down stock image prices.

Conclusion

I maintain my recommendation to buy GETY stock. Despite the adjustment in revenue expectations for FY23, the long-term growth drivers remain robust, fueled by rising subscriptions, renewals, new customers, and content consumption. The company’s strategic efforts, such as partnerships and the implementation of generative AI, indicate a forward-thinking approach that should lead to increased revenue and market share. Furthermore, the valuation of GETY’s subscriber base highlights its significant worth, and the undervaluation of the non-subscription business compared to competitors presents a potential investment opportunity. While competition from AI image generators poses a risk, GETY’s market position and unique offerings should help mitigate this threat.

Read the full article here