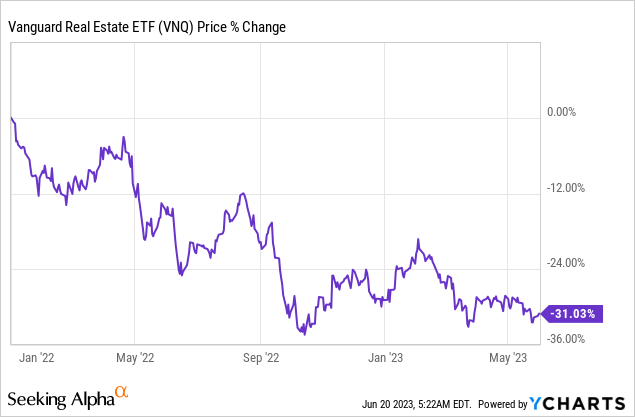

REITs (VNQ) crashed over the past year because of one primary reason:

Rising interest rates

The market fears that the surge in interest rates will cause REIT cash flows and asset values to collapse, and this is well reflected today in their market sentiment. REITs are down by 30% on average since the beginning of 2022:

And that’s just the average.

Some individual REITs are down as much as 50, 60, or even 70% – as if the surge in interest rates would be an existential crisis for them.

But what this also means is that as interest rates eventually return to lower levels, many of these REITs could soar in value.

If your stock is down 50% because of rising interest rates, and rates now return to lower levels, then your stock could essentially double as it returns to where it used to trade.

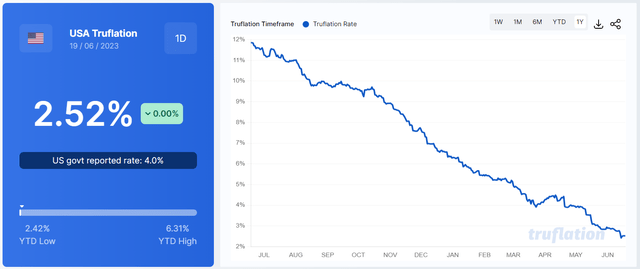

That’s a big opportunity if, like me, you think that interest rates are headed lower over the coming years. It is worth remembering that interest rates surged because of high inflation, but this high inflation was mainly caused by temporary factors and it is now getting back under control.

According to Truflation, the current inflation is just 2.5% and it is rapidly trending lower. (Truflation takes the government data and makes a series of adjustments based on real-time data.)

Truflation

This means that we are already near the 2% target rate and this recently prompted the Fed to pause further rate hikes.

As we cross below the 2% inflation target, I expect the Fed to do a rapid U-turn and begin to cut interest rates to stimulate the economy as it always does when things get tough. With that, I expect the two following REITs to roughly double in value:

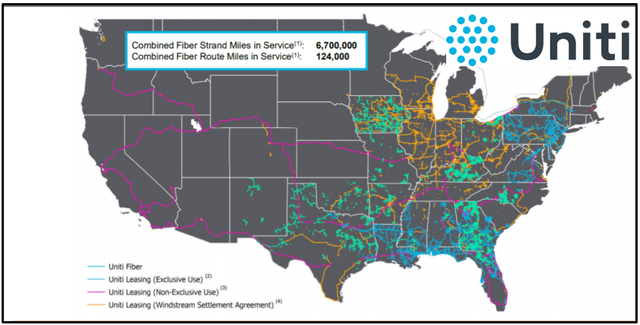

Uniti Group (UNIT)

UNIT is one of the best bets on lower interest rates because it is overleveraged and needs to pay off a bunch of debt.

This worries the market.

It thinks that the company could face bankruptcy if interest rates remain at today’s levels, and as a result, it has priced it at 4x FFO, a ridiculously low valuation for a company that owns a portfolio of fiber infrastructure that generates steady and predictable income:

Uniti Group

But if you now remove the high interest rates, the market will have a lot less to worry about and the company’s share price could rapidly recover from here.

Just last year, there were talks of a potential buyout at $15 per share, which is about triple today’s share price. Will it get back to $15 if interest rates return to lower levels?

Perhaps not.

But could it return to $10? I believe that it will.

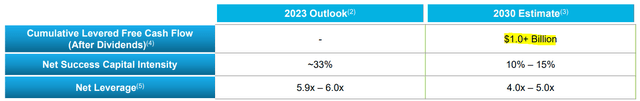

And here’s more good news: the company has managed to push all major debt maturities until 2027 and it retains a lot of cash flow to deleverage organically.

So even if interest rates remain high, it will have reduced its debt by the time it needs to deal with major debt maturities.

Uniti Group

Therefore, I don’t think that this is a binary outcome.

If rates remain high, the shares won’t enjoy any significant upside for years to come, but if and when interest rates return lower, the share price could rapidly recover.

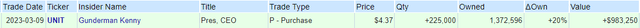

The CEO of the company recently made a $1 million share purchase, and the company once again reaffirmed its dividend, yielding now 13%! It goes without saying that there is no such thing as a safe 13% dividend yield. I think that it would be wise to cut the dividend and use the cash flow to pay off debt, but in any case, the yield will likely remain high in the coming years, and the CEO’s recent purchase is a strong vote of confidence.

OpenInsider

Safehold (SAFE)

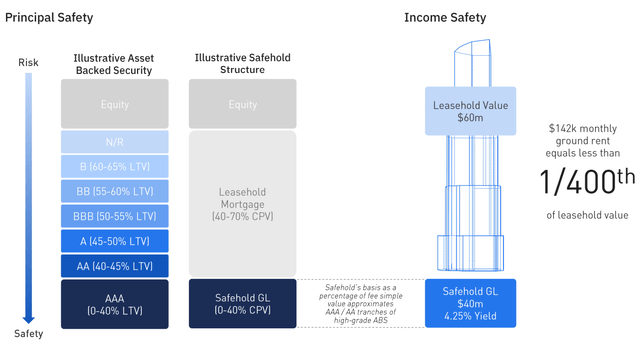

SAFE is the king of bets on lower interest rates because the REIT owns extremely long-term ground leases with contractually fixed rent rates that only reset higher every five years. It is the closest thing to owning a high credit quality, ultra-long-term corporate bond that you can find in the world of real estate.

In ground leases, the landlord owns the land but not the building. The land is leased to the building owner over very long lease terms, typically 99 years. This arrangement allows the building owner to keep full control of the building while extracting some capital from it at a low fixed cost.

Safehold

For SAFE, it provides ultra-safe, long-term fixed-income assets backed by high-quality multifamily, office, and hotel buildings. It is ultra-safe because if the tenant fails to pay the ground rent, then the landlord gains ownership of the building, free of charge.

But because the risk is so low, the cap rate of these properties is also low and the rent bumps are limited, which becomes an issue when interest rates surge like they did in recent years.

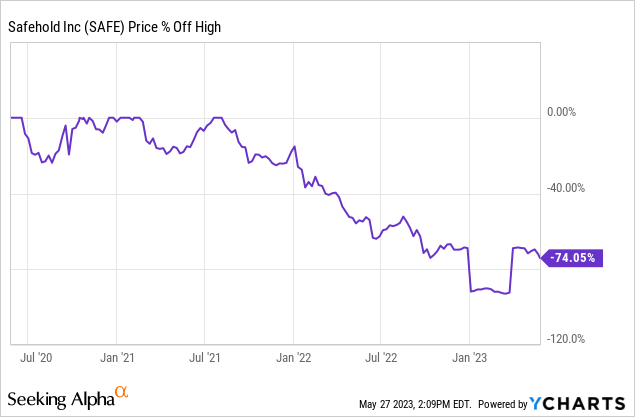

This explains why SAFE has been pummeled as interest rates have surged higher:

This alone should explain why SAFE is one of the best plays on the potential for falling interest rates.

The share price could double from here and it would still be heavily discounted relative to where it used to trade. Heck, it could triple and it would still be discounted.

That’s how worried the market has gotten.

But consider how well SAFE’s balance sheet (given a BBB+ credit rating by Fitch and Baa1 by Moody’s) is positioned for the current elevated interest rate environment. The REIT has a weighted average remaining debt term of 24 years with a weighted average cash interest rate of 3.3%. Operationally, SAFE has almost no interest rate risk for years to come, but its rents will keep rising by 2% per year with periodic additional adjustments for inflation.

However, its stock price will continue to move in an inverse correlation with interest rates. Thus, if rates fall, SAFE should soar, but if rates remain high, it should still be just fine for many years to come.

For this reason, I really like the risk-to-reward of SAFE at today’s valuation.

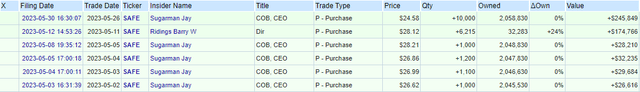

I would add that the CEO and a Director have bought half a million worth of shares in recent weeks and that’s despite already having a lot of skin in the game:

OpenInsider

Bottom Line

The market has been quick to reprice many REITs as if high interest rates were here to stay forever.

I think that a much likelier outcome is that interest rates will once more return to lower levels and when that happens, many of these REITs could enjoy very significant upside potential.

The most extreme examples like SAFE and UNIT could potentially double in value and we are investing in them as part of our Core Portfolio.

Read the full article here