Thesis

Pioneer Floating Rate Fund (NYSE:PHD) is a leveraged loan CEF. The fund has a classic structure, with its composition solely focused on leveraged loans and a 32% leverage ratio on top. As per its literature:

The Fund seeks to outperform its benchmark over a full market cycle with lower volatility. We strive to construct a highly diversified portfolio with attractive risk/return characteristics. The Fund has a consistent bias towards the higher credit quality portion of the market.

Leveraged loans have been an incredible asset class in the past two years due to their low duration. Not only have they successfully managed to navigate the increase in rates from a price perspective, but they have also substantially increased the distributed cash flows on the back of higher LIBOR/SOFR rates. PHD for example now yields more than 11% versus roughly 6% two years ago. That is quite the journey!

However, not all leveraged loan CEFs are created equal, and the portfolio manager and their track record matter. In this article we are going to take a look at PHD’s build, the performance of its discount to NAV, and its overall total return versus its competition.

Performance

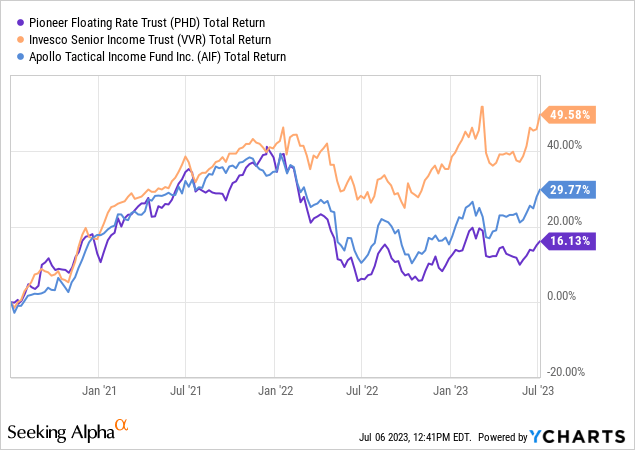

The CEF has done quite poorly versus its competition since the advent of higher floating rates:

The clear winner from the cohort is our favorite leveraged loan fund, namely the Invesco Senior Income Trust (VVR). VVR in effect has posted a 3x total return when compared to PHD.

As much as we can analyze a CEF in an article, the ultimate performance or outperformance for such vehicle lies with the credit selection. From an investor perspective, if two funds are overweight BB leveraged loans, we would consider them similar. What if one of them outperforms the other by 10%? That means the portfolio manager was more competent in choosing good risk/reward credits. The same story is told by the above graph. All three funds from the cohort have similar credit profiles and leverage ratios. Yet one of them has done 3x better than PHD.

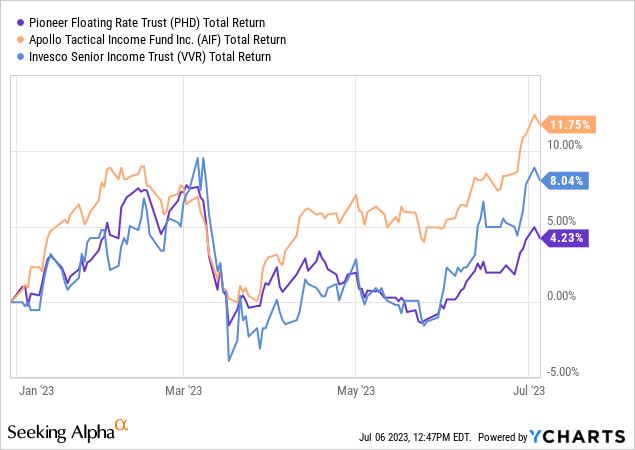

Even year to date, PHD lags its peers from the cohort:

For a fund with a 30% leverage ratio and investing in high yield at 4% total return is nothing to brag about. Think about the fact that risk-free short-term treasuries have posted an almost 3% return this year!

Holdings

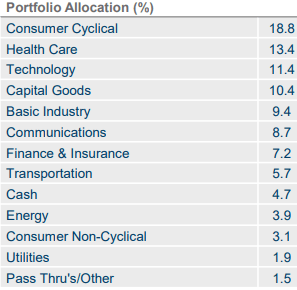

The fund holds a portfolio of well-diversified leveraged loans:

Sectoral Allocation (Fund Fact Sheet)

There is no sectoral concentration here, with the top sleeves taking up below 20% of the portfolio. Numbers in excess of 25% here would be of concern.

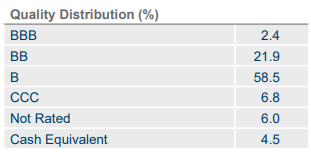

Although the fund asserts its appetite for higher quality credits, its composition tells a different story:

Ratings (Fund Fact Sheet)

Almost 60% of the fund is ‘B’, the lower rung of the junk universe. We would have expected a higher allocation to ‘BB’ credits here.

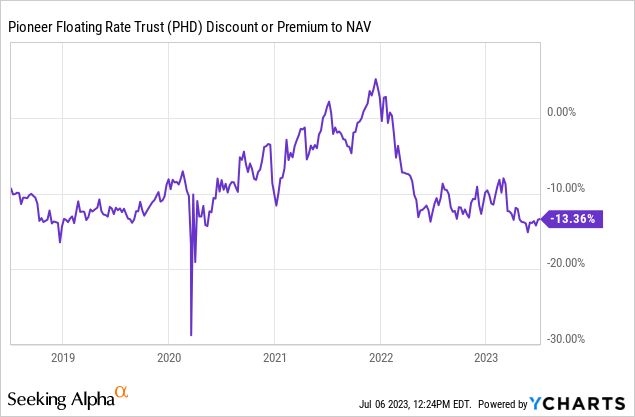

Premium/Discount to NAV

The fund has a beta to the overall macrocycle rather than risk-on/risk-off environments:

We can see the CEF moving to a large discount to NAV ever since rates started to rise and the economic cycle changed. Fundamentally, the fund has started to yield much more from a pure cash flow perspective on the back of higher rates, however, the market has not rewarded the fund with a tighter discount to NAV.

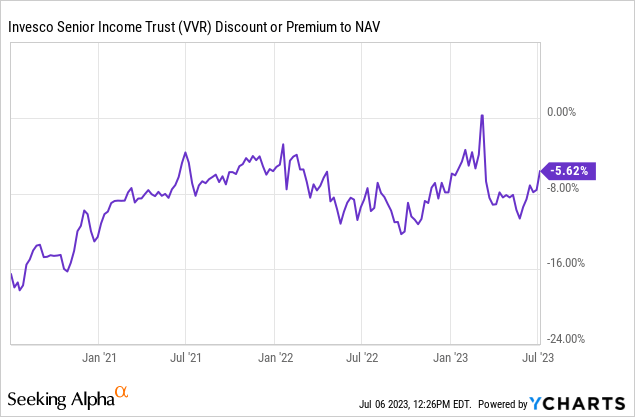

Compare the above graph with the discount to NAV on the premier leveraged loan floating rate fund Invesco Senior Income Trust:

I observe an incredible difference in the stability here versus PHD. The market rewards winners with stable discounts to NAV.

Conclusion

PHD is a leveraged loan CEF. Although rates have violently risen since the beginning of 2022 and its disbursable cash flow has doubled, the fund is down since the beginning of the interest rate hiking cycle. What is more important to note is that the CEF severely lags its peers, with VVR posting a 3x total return since the beginning of 2021 when compared to PHD. There are several factors responsible for this state of affairs. On one hand, the portfolio manager has tended to choose credits with inferior risk/reward metrics, and on the other hand, the market has expressed its dislike for the fund via a larger discount to NAV. We do not expect the current -13% discount to NAV to start narrowing until the next structural bull market. While there is nothing intrinsically wrong with PHD, the CEF is just a very bad laggard in its cohort. To that end, why not own winners such as VVR or AIF? We are assigning a Sell rating here purely on a switch to VVR or AIF, which we think are going to outperform in the leveraged loan space.

Read the full article here