I’m thankful for the World Series of Fighting. – Marlon Moraes

Investing in financial markets is akin to sailing in a sea, filled with calm and stormy periods. During turbulent times, investors often resort to a strategy known as a “flight to safety.” This strategy, which involves moving investments from riskier assets to safer ones, is a common reaction to financial downturns or periods of high volatility (VIXY). But what triggers this flight? How does it impact the overall market and individual investors? And, most importantly, how can investors effectively navigate through these financial storms?

Decoding the Flight to Safety

The flight to safety trade is a phenomenon where investors collectively shift their investments from riskier assets to safer ones due to uncertainty or turbulence in the financial markets. This behavior can also be observed among individual investors or smaller investor groups who prefer to reduce their exposure to volatile investments. Typical asset reallocation involves moving from stocks to bonds, with the latter considered a safer and higher quality investment in unstable economic conditions. In extreme situations, the flight to quality can lead to investments in even lower-risk assets like Treasuries, money markets, or cash.

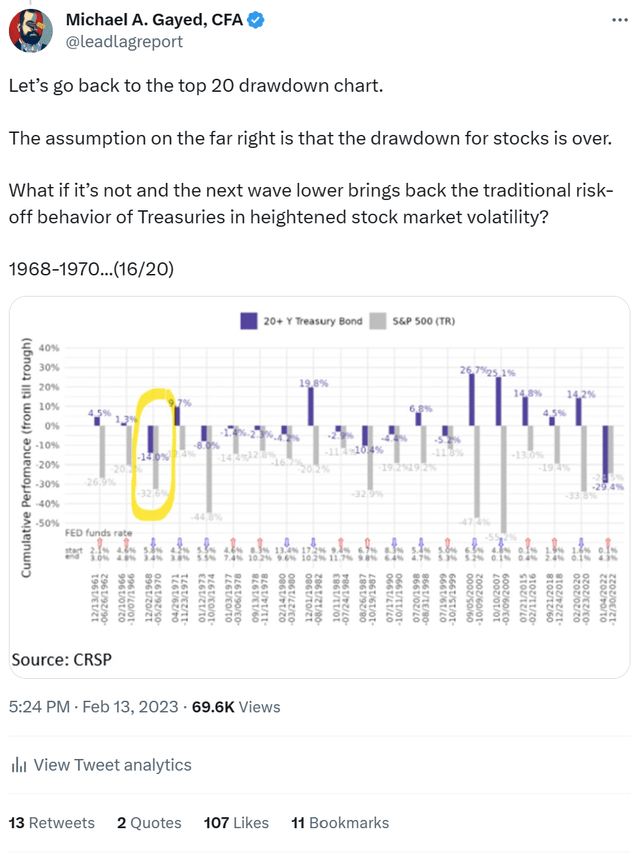

Last year was hellish in this regard and explains the difficulty of my own rules-based risk-on, risk-off strategies to perform. Not only did the flight to safety trade of Treasuries (TLT) fail for the first time in history, but long-duration Treasuries lost more money than stocks in what ended up being a top 20 drawdown for stocks.

Or was it really the first time in history, when we may still be in a bear market and are still technically in the S&P 500 (SP500) drawdown?

Twitter

The Mechanics of Flight to Quality

During periods of financial downturns, such as a bear market, investors tend to withdraw their money from riskier investments like equities and invest in safer alternatives like government securities and money market funds. This shift can also occur on a global scale, where investments move from high-risk countries with political unrest to more stable countries.

One key sign of a flight to quality is a significant drop in the yield on government securities (VGLT), caused by increased demand for these safe-haven assets. Investors often monitor this decrease in bond yields as an indicator of challenging economic conditions.

Note, I’m referencing long-duration Treasuries here. The Fed does NOT control the long end, despite what many argue (incorrectly). If volatility in equities spikes, history would suggest the long-duration Treasury to S&P 500 (SPY) ratio would as well.

TradingView

Conclusion

Candidly, I want to see this. When the flight to safety trade happens in Treasuries, they can outperform equities by thousands of basis points in a matter of weeks. It’s a comparatively less risky way of playing volatility in stocks, and if you believe as I do we are still in a bear market, current complacency in equities makes long-duration Treasuries a potentially powerful trade. The timing remains the question mark, but with Utilities (XLU) showing signs of life and defensive momentum potentially beginning within the stock market, we may be closer to Treasuries running higher in price and lower in yield soon, independent of what the Fed does.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here