Introduction

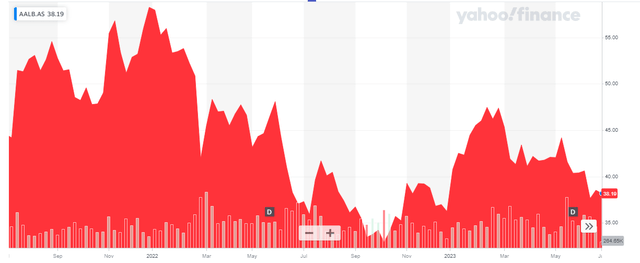

I remember the exact moment when I wrote my previous article on Aalberts N.V. (OTCPK:AALBF), a Dutch leader in the valves and pipes sector. The COVID crisis was at its peak and the article was published on April 2 nd 2020, when the share price had dropped to less than 21 EUR. This meant the company had lost about 50% of its value in just six weeks and was trading at a six-year low. I argued the selloff was overdone (which was hardly rocket science back in the day, as investors were dumping pretty much everything they had)

Yahoo Finance

Aalberts Industries has a very liquid listing on Euronext Amsterdam, where the average daily volume is roughly 225,000 shares per day. The ticker symbol in Amsterdam is AALB, and as Aalberts has 110.6M shares outstanding, the market cap currently is approximately 4.25B EUR.

Slow but steady growth

This article is meant as an update to my thesis from 2020. I’d like to recommend you to have another look at that older article to get a better understanding of the company’s business model.

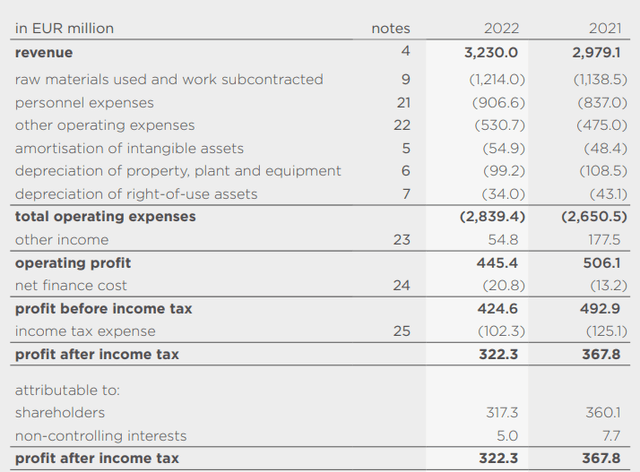

Unfortunately, the company publishes detailed financial results only every six months and the Q1 update was really just a trading update without any numbers. This means it makes more sense to have a look back at the company’s FY 2022 results. And 2022 was a good year for Aalberts, as it reported a revenue increase of almost 10% to 3.23B EUR. Unfortunately, this did not translate into a higher net income and, as you can see below, while the total operating expenses increased by almost 200M EUR, the lack of “other net income” made it difficult for Aalberts to report a higher operating profit.

Aalberts Investor Relations

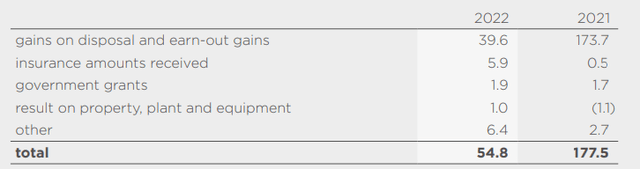

That’s not necessarily a big problem. Excluding the “other income,” the operating profit in FY 2021 would have been just 330M EUR while the FY 2022 operating income would have come in at around 390M EUR, a clear improvement. The relatively high “other income” generated in the first quarter of 2021 was almost entirely related to the sale of a division. Aalberts sold its Lasco division and reported a 174M EUR gain on the disposal, while the disposal of VTI Ventil Tecnik and Elkhart in the first quarter of the current financial year resulted in a gain of less than 40M EUR, as you can see below.

Aalberts Investor Relations

This means we can’t really hold the lower reported operating income against Aalberts, as the operating income in FY 2021 was clearly boosted by non-recurring elements and a comparison of the adjusted operating profit excluding these non-recurring items.

In any case, the reported net income of 322.3M EUR (of which 317.3M EUR was attributable to the shareholders of Aalberts) still includes a chunk of non-recurring items, which likely contributed about 10% of the after-tax income. The EPS in FY 2022 was approximately 2.87 EUR per share, which means the stock is currently trading at 13 times the net income and about 14-14.5 times the net income excluding the non-recurring items.

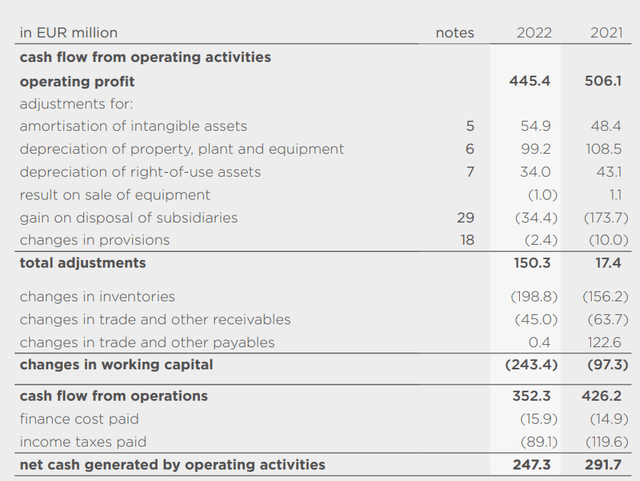

The cash flow statement also helps to isolate the impact of the non-recurring items. As you can see below, the reported operating cash flow does not take the (non-cash) gain on asset sales into account. The total reported operating cash flow was 247M EUR, but this includes a 243M EUR investment in the working capital position, which means the underlying operating cash flow was 491M EUR and about 478M EUR after deducting the total amount of taxes owed based on the FY 2022 result versus the total amount of tax that was actually paid.

Aalberts Investor Relations

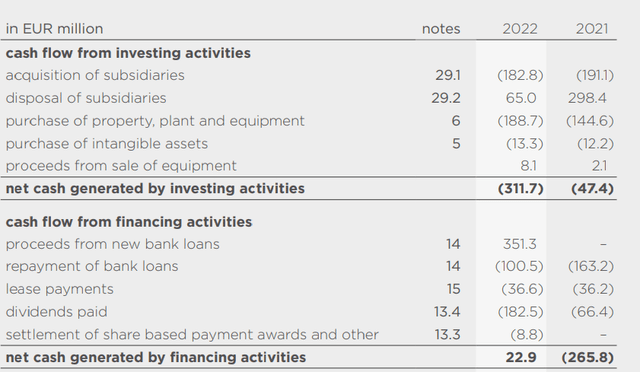

From the 478M EUR, we should also deduct the 37M EUR in lease payments, which means the adjusted operating cash flow was 441M EUR. And as you can see below, the total capex was approximately 202M EUR (excluding acquisitions but including the purchase of intangibles).

Aalberts Investor Relations

This means the FY 2022 free cash flow result was approximately 239M EUR excluding the impact from the gain on the asset dispositions and including a total capex + lease payments of 239M EUR versus a total depreciation expense of just 188M EUR (this clearly shows Aalberts is still investing in growth). The total capex will likely increase further this year as Aalberts continues to pursue high-margin growth. Its financial objectives for the 2022-2026 era are to generate a ROCE of in excess of 18% on its investments.

Aalberts Investor Relations

And using the 3.23B EUR in 2021 revenue as a starting point and applying a 4% annual revenue growth from here on, the FY 2026 revenue would increase to 3.75B EUR and a 17% EBITA margin (not a typo, Aalberts does not provide an EBITDA guidance but an EBITA guidance) would result in a total EBITA of 642M EUR. That’s approximately 30% higher than the FY 2022 EBITA of 500M EUR. This would add about 1-1.10 EUR per share to the earnings profile.

Investment thesis

While Aalberts isn’t cheap right now (the stock is trading at a free cash flow yield of 5% (including growth investments), the market is clearly forward-looking and likes the 2022-2026 plan. This means that by 2026 the sustaining free cash flow will likely exceed 3.75-3.80 EUR per share (excluding the impact from dispositions), and that is not necessarily expensive for a leader in its sector. Applying a 7% required free cash flow yield, the fair share price would be around 55 EUR per share in 2026, and in order to get there the share price would have to increase by 13% per year. Add the 3% dividend yield and the potential for a total annual return of 15% is pretty realistic.

I currently don’t have a position in Aalberts, but I like how this company is managed and I like the anticipated 18-20% ROCE on growth investments. I will likely write some out of the money put options, as I would like to pick up stock in the mid-30 EUR range.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here