Luxury fashion house Burberry (OTCPK:BURBY) (OTCPK:BBRYF) was facing some headwinds when I last covered it just over a year ago, but a fairly wide discount to my estimate of fair value was ultimately enough to drive a Buy rating.

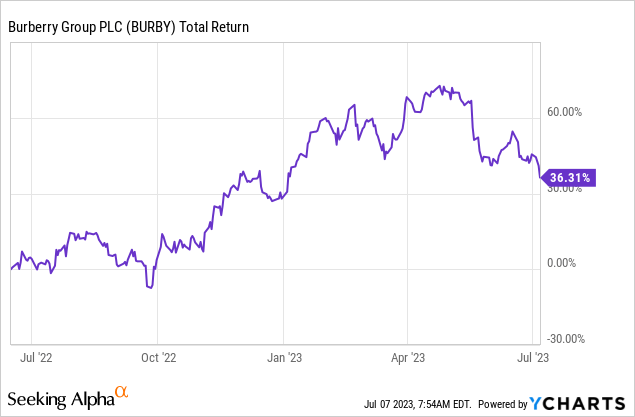

Notwithstanding a steep fall since FY22/23 results landed in May, these shares have done pretty well in the intervening period, returning around 33% in London trading (dividends included). The dollar-denominated ADRs have done a shade better than that on account of currency changes:

13 months on from previous coverage, Burberry isn’t in an all too dissimilar position today save for the valuation. Some of its challenges, chiefly anti-COVID policies in China, seem to have resolved for the better, but my concerns regarding the firm’s sensitivity to asset prices remain, especially given the soft sequential performance in North America. With developed market consumers looking increasingly fragile and currency set to be a drag this year, these shares look less appealing now given the strong share price performance. Hold.

China Reopens; Tourism, FX Boost Results

The luxury goods industry has been one of the last to emerge from COVID given its sensitivity to tourism and its increasing dependency on the Chinese consumer. Burberry is no exception, and as such there are plenty of moving parts to consider with regards to recent results.

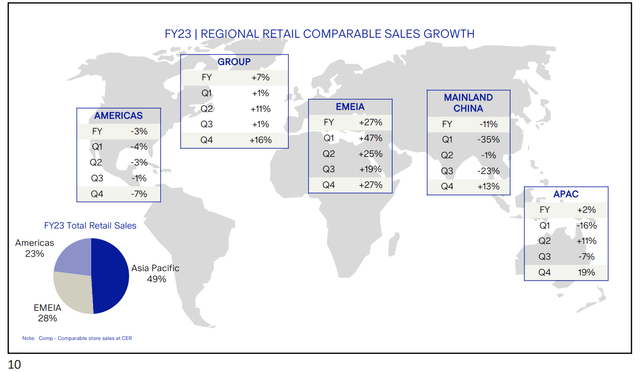

In terms of the good, the lifting of COVID restrictions in China provided a nice boost towards the tail end of the company’s FY22/23 (ended April 1st). The Chinese luxury goods market fell 1% year-on-year in 2022, while at Burberry Mainland China comparable sales were down 11% YoY in FY22/23. That was heavily weighted to COVID-hit Q1 and Q3, though, with the easing of restrictions later in the fiscal year leading to 13% YoY growth in Q4. The stark difference between full-year comparable store sales growth with and without Mainland China (+7% and +14%, respectively) highlights the importance of frictionless business in the country to the group’s overall performance.

Source: Burberry FY22/23 Results Presentation

Also positive was the ongoing recovery of tourism in Europe, with tourist sales accounting for 40% of Burberry’s EMEIA sales last year versus 25% the year prior. As a result, Europe’s luxury goods market ended 2022 up 6% on pre-COVID 2019 levels, while in Burberry’s fiscal Q4 (the calendar year Q1) management noted that the market was “high single digits” above 2019 levels.

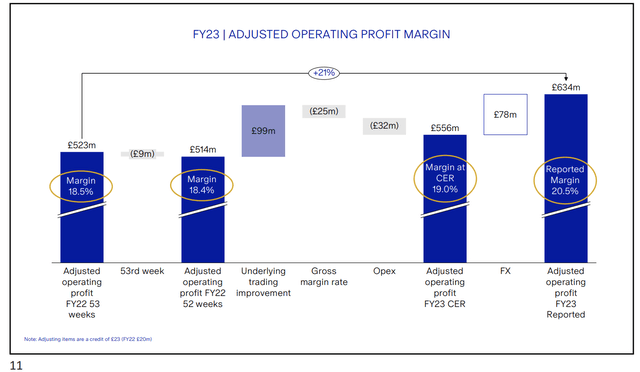

All told, the above helped power 5% growth in sales for the full year on a constant currency basis. On the profit line, margin accretion formed part of the bull thesis last time, and adjusted operating profit margin was duly up around 60bps at constant exchange rates. Adjusted operating profit was up a little over 8% YoY after normalizing exchange rates and the impact of the 53-week year in FY22.

Source: Burberry FY22/23 Results Presentation

Currency was a major tailwind, increasing reported revenue growth by 5 percentage points, adjusted operating profit by 14 percentage points and adjusted operating profit margin by 1.5 percentage points.

Headwinds Lingering

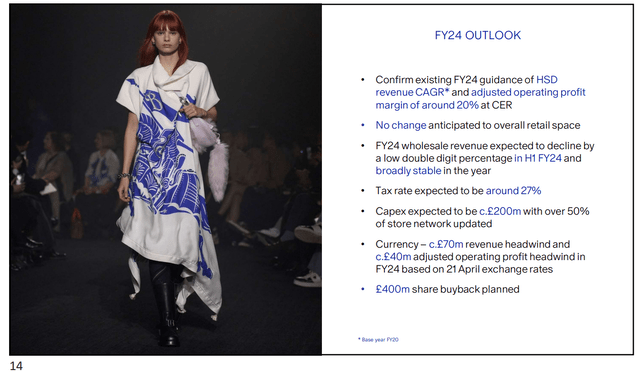

Burberry’s recent results have been good, but there are a couple of headwinds lingering. One worth noting is FX, with management guiding for a circa £70m headwind to revenue and a £40m headwind from currency.

Performance in the Americas is perhaps the most pressing, though, given comparable store sales fell 7% YoY in Q4. Last time out I made a point of repeating management’s warning that Burberry’s customers were fairly sensitive to falling asset prices, or a kind of reverse wealth effect if you like. This seems to be playing out in one of its biggest markets.

We’re much more impacted by real estate prices and the stock market. In terms of the correlation with various macro factors, those are the two main factors that we need to keep an eye on.

Julie Brown, Former Burberry CFO & COO

Further, on the FY23 earnings call management noted “some deterioration” into fiscal Q1, with entry price products seen as a particular weakness. This arguably puts Burberry in a weaker position than peers that operate at higher price points, such as Hermès (OTCPK:HESAY) (OTCPK:HESAF), which reported 20% YoY growth in the Americas in its first quarter (N.B. Hermès’ fiscal Q1 maps to Burberry’s fiscal Q4).

Other developed markets, such as in Europe, are also susceptible to this, though management noted that local EU customers were still contributing positively to growth in Q4. Worth noting, too, is that Chinese tourists to Europe were still down 80% on pre-COVID levels, so there is upside from the normalization of visitor numbers there. Still, I see the macro environment in developed markets as a source of downside risk to management’s FY23/24 revenue and earnings targets (more on that below).

FY23/24 Growth Prospects Looking Flat

For the current fiscal year management is guiding for a revenue print that would map to a high single-digit CAGR on FY20 levels (in constant currency terms). At the low-end that would mean around 11-12% revenue growth this year at constant exchange rates.

Source: Burberry FY22/23 Results Presentation

In terms of earnings, this would likely map into virtually flat reported adjusted operating profit. To put some color to that, management is guiding for around 50bps of margin expansion at constant exchange rates (from 19.5% to 20%). On the above revenue guidance and with a £40m EBIT headwind guided from FX, this implies FY23/FY24 reported adjusted operating profit of around £645m. Note that FY22/23 adjusted operating profit was £634m. EPS would likewise come in virtually flat on these figures, with a higher expected effective tax rate (27% expected in FY23/24 versus 22.2% in FY23) offsetting the impact of a fresh £400m share buyback program. Management’s long-term targets include £5B in sales and a 20%-plus adjusted operating profit margin, enough to drive high single-digit annualized free cash flow growth as per the last piece.

Summing It Up

Incorporating FY23 results and management’s long-term targets moves my fair value up by around £1 per share from last time to the £23 per share mark (~$29.50 per ADR). That does imply around 15% upside from the current £20.13 share price, but with that gap narrowing significantly since last time and FY24 set to be a quieter year in terms of earnings growth I see better opportunities elsewhere. Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here