This article was first released to Systematic Income subscribers and free trials on June 29.

In this article, we highlight one of our portfolio rotations. Specifically, we discuss why we chose to add to our Oaktree Specialty Lending Corporation (NASDAQ:OCSL) position.

In brief, we like the company’s valuation, which has now retreated to an attractive level. We also think OCSL has more upside than the broader sector given its practice of marking its portfolio in a more conservative fashion during weaker market periods. And finally, OCSL runs a higher-quality portfolio, which is handy given the increasing chance the economy will tip over into a recession.

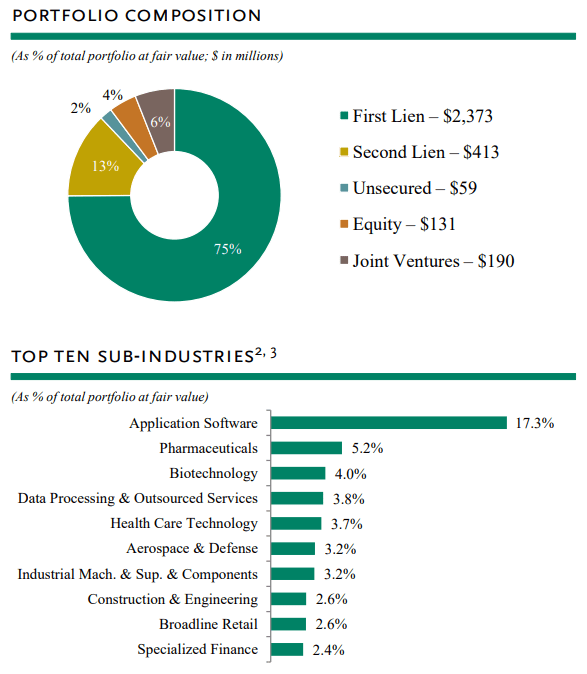

OCSL is primarily focused on secured loans with a low allocation to equity securities. Its sector overweights are software and healthcare – a fairly common combination in the business development company, or BDC, space.

Oaktree

Why We Added To Oaktree Specialty Lending Corporation

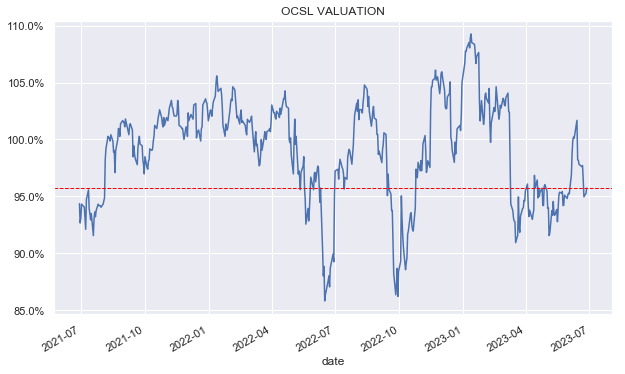

The first reason we added to our OCSL position was on valuation grounds. The chart below shows that after seeing its valuation move briefly above 100%, it has now retreated to an attractive historic level.

Systematic Income

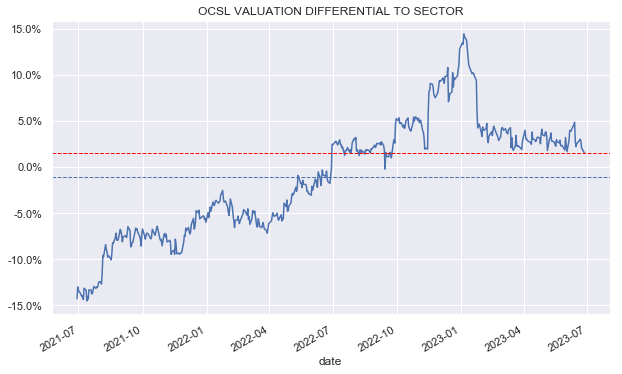

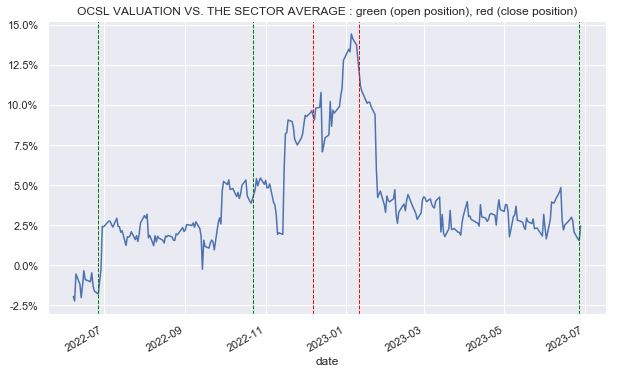

In relative terms, we can see that while the company trades at a small 2% premium to the sector average (96% vs 94%) that’s just about the lowest premium in about a year. It’s true that the company used to trade at a discount to the sector in 2021 (and earlier). However, in our view, those days are long gone. OCSL is now viewed by the market as a higher-quality BDC, which is also now reflected in its valuation.

Systematic Income

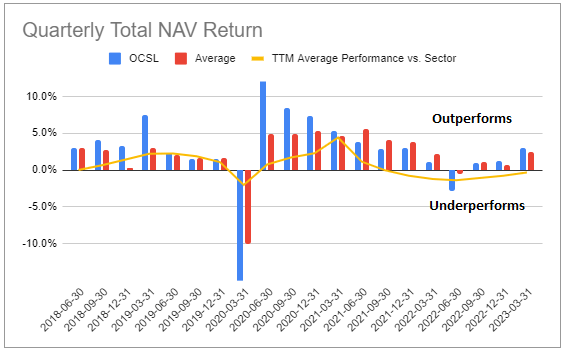

Our view is that the company’s valuation is actually overstated somewhat (i.e., the “real” valuation is lower than the headline number) because of the company’s relatively conservative marking methodology. As we can see in the chart below, the company underperforms during “bad times,” i.e., COVID and 2022 and outperforms in “good times.”

Systematic Income BDC Tool

Another way to think about this is that OCSL creates a larger loan reserve when things are looking worse and writes it back up when things are looking better. One reason we know the underperformance is not “real” but reflects this more conservative approach is that the company had no non-accruals for all but three quarters since the start of 2020 – one of the very best results in the sector. In other words, the underperformance did not reflect actual portfolio stress.

Another reason we added to our OCSL position is that we wanted to move up in quality. This is because the macro picture is not getting any better and markets look fairly complacent.

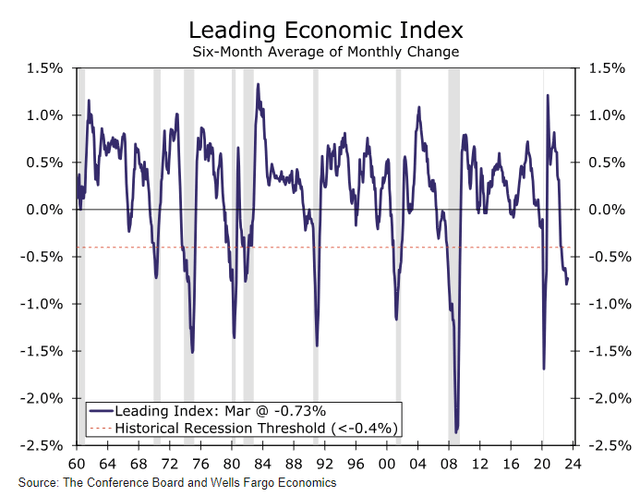

The Leading Economic Index indicator is at a level which has historically corresponded to recessions, while the yield curve is screaming recession.

Wells Fargo

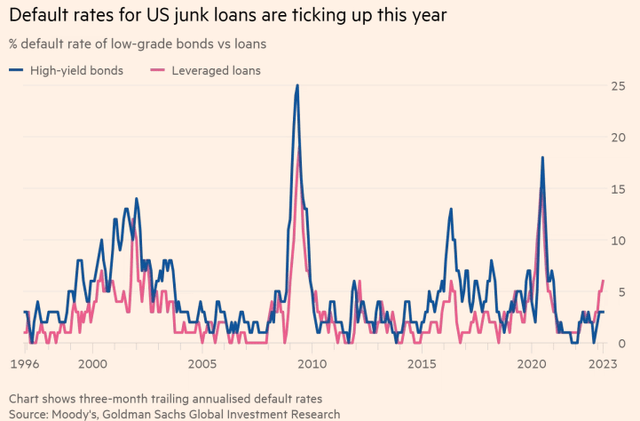

It’s certainly true that recession models are not well calibrated to the current unusual cycle, which experienced a huge post-pandemic recovery that is now normalizing. That said, bank loan defaults are really increasing and running at a historically elevated pace.

FT

As highlighted above, the company’s non-accruals have been extremely low while generating net realized gains over the last few years, all of which points to a high-quality portfolio.

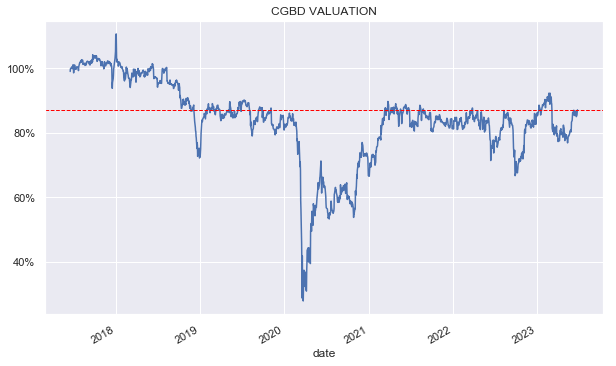

The final reason we added to our OCSL position is that something else now looks rich. In this case, that something else happened to be Carlyle Secured Lending Inc. (CGBD). We run our Income Portfolios fully invested which means that we both try to avoid holding expensive assets and also need to find something to sell if an asset looks very attractive. In this case, OCSL looked attractive while CGBD was looking a tad rich.

CGBD valuation has rallied nicely and is trading close to the top of its range since 2019.

Systematic Income

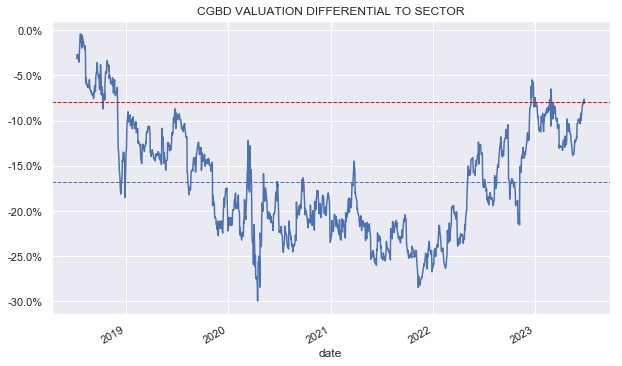

Relative to the sector, the stock looks quite rich even if the market has accepted the fact that its performance can more than keep up with the sector.

Systematic Income

The following chart shows our allocations with respect to OCSL with green lines highlighting open positions and red lines highlighting close positions. As the chart highlights, we think attractive entry points are when Oaktree Specialty Lending Corporation stock trades at a low single-digit premium to the sector, and good exits are when it trades at a double-digit premium valuation to the sector.

Systematic Income

Read the full article here