Thesis

Nomad Foods Limited (NYSE:NOMD) is a European market leader in Frozen foods, underpinned by a dynamic portfolio of leading brands in important staples like frozen fish and vegetables. I believe management has done a good job of focusing its resources on dominating one region and diversifying its business. In my opinion, NOMD is currently trading at an attractive valuation of 9.64x EV/EBITDA when compared to its peers. I will explain each of my thesis’s key parts in the sections that follow.

Company Overview & Outlook

A little history about the company first. NOMD was a SPAC that went public in April 2014 on the London Stock Exchange. Later on, the SPAC acquired Iglo Foods Holdings from private equity firm Permira for 2.6 billion euros. Nomad now trades on the NYSE and is headquartered in the U.K.

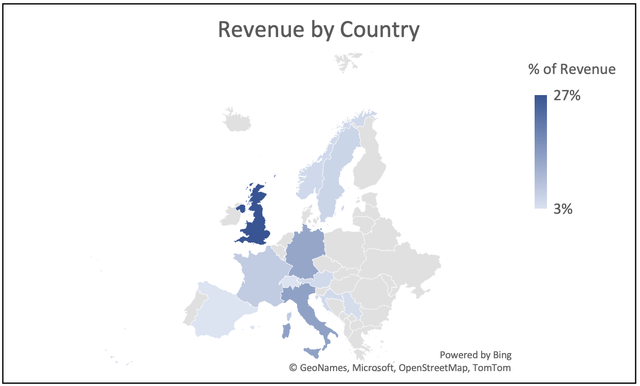

NOMD is a market leader in sixteen European countries, with an 18% market share in the countries it operates in. The firm’s products include frozen fish, vegetables, poultry, meals, pizza, and ice cream. NOMD’s customers are mainly large grocery retailers such as Tesco and Sainsbury’s in the U.K., Coop and Conad in Italy, and Rewe and Edeka in Germany. The company is very diversified in almost all aspects of its business. The top ten customers accounted for only 34% of revenues, and the company’s diverse supplier base minimizes dependency on one supplier.

Created by the author using Bing & 10-K

NOMD owns and operates nineteen manufacturing facilities, all located near the major markets in which it operates, to provide a balance between manufacturing and logistics. NOMD has the largest fish factory in the world. The company’s fish business is so large that only McDonald’s rivals them as the largest fish processor. The firm has three main brands: Birds Eye, Findus, and Igloo. NOMD’s brands have a household penetration rate of around 65% in its top five markets (United Kingdom, Italy, Germany, Sweden, and France).

I believe that management has done well at focusing its resources on dominating only one area (Europe) instead of trying to expand globally. This strategy has allowed the firm to know its customers, provide them with the best products, and minimize competition. I expect the company to always be on the lookout for any potential acquisitions to enter new categories and markets because they have created a lot of value from previous acquisitions. Historically, over the last seven years, the European savory frozen food market has grown on average by 2% per year. I believe that the market will grow at the same rate, if not more, because consumers love easy-to-cook meals in exchange for good value for money.

Recent Performance

In Q1 23, the firm covered nearly 80% of materials for the year. This means the company won’t spend as much on inventory in the coming quarters. For 2023, the company guided for mid-single-digit revenue growth and increased its adjusted EPS guidance from $1.61-$1.66 to $1.67-$1.71. Gross margin increased by 100 basis points YoY, driven by pricing initiatives the company implemented in the second half of 2022 to help fight inflation. These initiatives are expected to start showing up in the company’s financials this year. The company also launched new and innovative products across four of its markets, including the UK, Germany, the Netherlands, and France.

Valuation

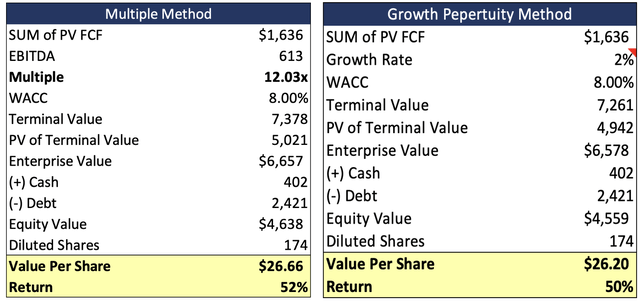

I used two methods to evaluate NOMD. The multiple and DCF method. Using both methods, I arrived at a similar valuation. My fair value estimate of NOMD is $26, representing a 50% upside from the current price of $17. I model revenue to grow at an annual compounded growth rate of ~3% from 2023 to 2027. The CEO had this to say about margins in Q1 23 earnings call.

As we look out to the rest of the year, we expect to deliver flat gross margins supported by price increases and cost discipline.

Using a discount rate of 8.00%, I discounted the future cash flow and terminal value into the present. I arrived at an equity value of $4.6 billion. My valuation implies an 8% free cash flow yield for 2023.

Created by the author

NOMD had 174.4 million shares outstanding, cash of $402 million, debt of $2.4 million, a share price of $17.5, and an enterprise value of $5.1 billion. NOMD also trades at an extreme discount compared to its peers. The company currently trades at an EV/EBITDA ratio of 9.64x, while peers trade at 13.63x, and the firm’s 5-year average EV/EBITDA is 12.81x. The Multiple I used in the valuation above was the average of the three ratios listed above.

Risks

1) The industry is very competitive, especially with competitors such as private labels and Nestle. Consumers can switch to other products at any time. But I think the company’s approach of acquiring brands with a long history provides them with a little edge over competitors.

2) Missteps by management, such as bad acquisitions, paying too much for a business, or making unnecessary acquisitions, could all result in the company losing capital. I think this risk is very unlikely because management has a proven track record when it comes to acquisitions, but I thought I should mention it either way.

3) Given that NOMD operates in many different countries, fluctuations in currency exchange rates can impact the company’s revenue and profitability.

4) The company does carry a lot of debt on its balance sheet. As of Q1 23, The company had $2.4 billion in debt. This is to be expected because the firm uses debt to finance its acquisitions.

Takeaway

In conclusion, NOMD is a dominant leader in the frozen food industry. In my opinion, Management is top-notch, and the company is trading at an attractive valuation compared to its peers. I expect the company to keep dominating, mainly due to its brands, which have a long and outstanding history with customers. The firm managed to grow in 2022 despite the economic downturn that occurred in Europe, especially in the UK. The firm is expecting to have another good year in 2023. The company’s strategy to only focus on Europe has really paid off, as they are the leading European frozen food provider.

Read the full article here