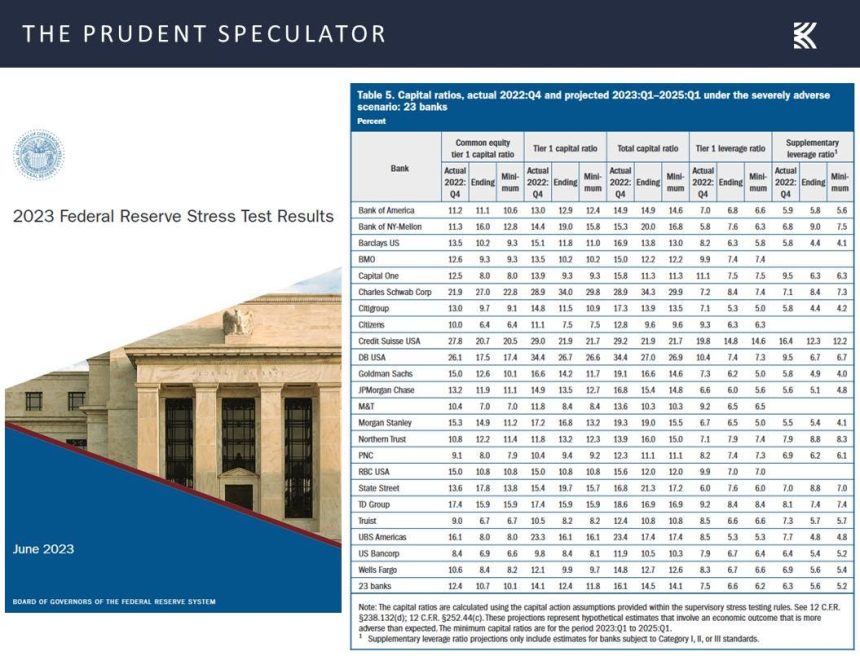

This year’s annual Federal Reserve Stress Test of 23 of the nation’s largest banks included some harsh criteria. As if a severe global recession with a 40% decline in commercial real estate prices, a substantial increase in office vacancies and a 38% decline in house prices was not tough enough, the Test included the unemployment rate rising by 6.4 percentage points to a peak of 10% and economic output declining commensurately.

Happily, each of the banks survived the most adverse scenario with capital levels above the regulatory minimum of 4.5%, with Fed Vice Chair Michael S. Barr stating, “Today’s results confirm that the banking system remains strong and resilient.”

ADVERTISEMENT

THE BIGGEST MIGHT BE THE BEST

It’s hard not to like JPMorgan Chase

JPM

The financial behemoth continues to impress using a combination of scale and prudent management to keep its leadership position, with the company passing the stress test with flying colors. In fact, the Stress Capital Buffer requirement until September 30, 2024, will be 2.9% (down from the current 4.0%) and the Common Equity Tier 1 capital ratio requirement was reduced to 11.4%, down from the current 12.5%.

ADVERTISEMENT

In response, JPM said it will increase its quarterly dividend by 5%, after not raising the payout for two years. The company also indicated that it would continue its previously announced share repurchase program.

CEO Jamie Dimon explained: “The Federal Reserve’s 2023 stress test results show that banks are resilient – even while withstanding severe shocks – and continue to serve as a pillar of strength to the financial system and broader economy. We continue to maintain a fortress balance sheet with strong capital levels and robust liquidity, and we remain prepared for a broad range of potential outcomes, including potentially higher future capital requirements from the finalization of the Basel III capital rules. We will continue to use our capital to invest in and grow our market-leading businesses to support clients and communities throughout the world, pay a sustainable dividend, and return any remaining excess capital to our shareholders.”

Unlike much of the banking space, JPM shares are up on the year, but still trade for an inexpensive 10 times NTM earnings and offer a 2.8% dividend yield. I think JPM should be a core holding in any Value-oriented portfolio.

ADVERTISEMENT

MAKING THE GRADE BUT FEELING DISRESPECTED

For those looking for a potentially deeper bargain, Citigroup

C

Citi was the only large bank whose Stress Capital Buffer requirement will increase, rising to 4.3%, up from 4.0%. The company was not pleased with that decision and also announced that it has “initiated dialogue with the Federal Reserve to understand differences in Non-Interest Income (Non-Interest Revenue per Citi’s Financial Reporting presentation) over the nine-quarter stress period between the Federal Reserve’s CCAR results and Citi’s Dodd-Frank Act Stress Test results.”

CEO Jane Fraser commented, “While we would have clearly preferred not to see an increase in our stress capital buffer, these results still demonstrate Citi’s financial resilience through all economic environments, including the severely adverse scenario envisioned in the Federal Reserve’s stress test. Our robust capital and liquidity position, as well as the diversification of our funding and our business model, allow Citi to continue to be a source of strength for our clients and navigate challenging macro environments securely.”

ADVERTISEMENT

Citi is planning to bump its dividend by 4%, moving the quarterly payout up to $0.53 and pushing the dividend yield up to 4.5%, which is significantly above its major bank peers.

Ms. Fraser continued, “We repurchased $1 billion of common stock during the second quarter, intend to increase our dividend and we will continue to evaluate capital actions on a quarter-by-quarter basis. We are completely committed to simplifying Citi, improving returns and delivering value to our shareholders.”

Still not without a healthy dose of uncertainty, I have liked what I have seen thus far of the turnaround efforts initiated at Citi under Ms. Fraser. Meanwhile, the company continues to offer outsized benefits from its businesses abroad, thanks to its unique exposure to worldwide card loan growth, global transactions and trade volumes.

Trading well below tangible book value, I think C is a very inexpensively priced stock with substantial upside potential.

Read the full article here