New Life

Seven months earlier, we analyzed MetLife, Inc. (NYSE:MET). We concluded the stock deserved a Hold rating for retail value investors. Headwinds the company faced then still prevail. Our hunch was these headwinds “can potentially drive down (its) volatile share price.” MetLife is now positioned to be an opportunity for portfolios in an improving economy.

Headwinds caused a slip in the share price this year (-20.43% YTD). In May ‘23, shares sold for about $49. The price inched up in June and July to +$58 factoring in moves by management to lift the share price.

- Short interest is a nominal 1.7%.

- The company raised the dividend by about 4% offering a current yield (FWD) of 3.6%.

- Management closed on a ~$19.2B risk transfer transaction with Global Atlantic Financial Group.

- The company continues on an M&A track

- The board approved a $3B repurchase of shares in May in addition to the $202M remaining under the company’s repurchase authorization in 2022.

But there are risks. A great deal depends on future earnings. “If there is no improvement in earnings, it will be hard for equities to continue to rally,” observes Matthias Schrieber, Global Head of multi-asset portfolio management at Allspring Global Investments in London.

We forecast future earnings at MetLife to be on the upswing after the next couple of quarters; thus, we believe conditions are ripe to assess MET stock worth a Buy rating.

Company Profile

MetLife, Inc., is a financial services company selling products and services through and to corporations and businesses. It sports a $43,97B market cap. The company sells insurance, annuities, and employee benefits. MetLife offers asset management services to companies.

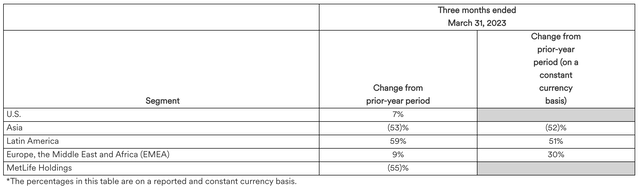

On May 3, ’23, MetLife announced Q1 ’23 results and adjusted earnings by its operational segments:

Segments of MetLife (investor.metlife.com/news/news-details/2023/MetLife-Announces-First-Quarter-2023-Results/default.aspx)

The U.S. segment comprises over 60% of total revenue and Asia ~15%. The CEO explained Asia’s earning calamity to shareholders and analysts in May. He also noted positive sales during Q1 ’23 in Asia:

In total, net income for the quarter was $14 million, driven by losses on opportunistic investment sales in Japan, which offset the tax impact on the gain generated by our recent Japanese A&H reinsurance transaction… In Asia, adjusted earnings of $280 million were below a year ago on lower variable investment income… On a constant currency basis (sales) were up across the board in the region. Japan saw sales rise 17% on the strength of FX annuities, while India led the sales gains in other Asia, up 45% followed by Korea, up 21%.

All About Money

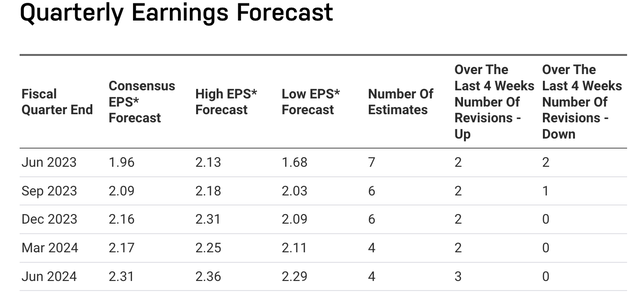

Over the last 5 years, MetLife averaged total revenue of ~$69.9B annually. We estimate FY’23’s annual revenue will be slightly lower contracting to $68.6B. That is mostly due to low-growth economies and their insurance markets not rebounding with the vigor hoped for in the U. S., China, Japan, and Europe. Nevertheless, earnings at MetLife are estimated to sequentially improve over the next 5 quarters. Q2 ’23 earnings are to be reported on August 2, 2023.

MetLife Earnings (nasdaq.com/market-activity/stocks/met/earnings)

The share price during the first 2 months of 2023 hovered in the low $70s. Hints about a weak Q1 brought down the price that bottomed under $50 during May. At times, in Q1, S A’s Quant Rating changed assessments from Hold to Buy ratings. Premiums increased in 2022 by 17.6% but declined 9.7% Y/Y in Q1 ’23.

- Net income was $14M or $0.02 per share compared to net income of $1.6B or $1.89 per share in Q1 ‘22.

- Adjusted earnings of $1.2B or $1.52 per share compared poorly to $1.7B or $2.04 per share Y/Y.

- Book value in Q1 ’23 was down 22% from March 31, 2022.

- Cash and liquid assets at the end of Q1 ’23 totaled $4.2B which hit above the target cash buffer of $3B to $4B.

- Cash flow from operations (TTM) was $13.19B, $13.2B in 2022, and $12.6B in 2021.

- Cash flow from investing dived to $3.69B TTM from $2.62B in 2022.

- Insiders and hedge funds bought shares on the price dips during the last quarter and more funds own MetLife shares in 2023 than any time since 2017.

In 2021, MetLife sold its auto and home businesses to another insurance group. The company has grown acquiring 6 or more businesses and investing in 56 others spending over $2B in firms including Alternative Lending, Internet First Insurance Platforms, Legal Tech, Raven in 2023, and more. It spent $1.68B acquiring Versant Health in 2020. Last month, a dealmaker reported Global Atlantic entered a pending $19.2B reinsurance agreement with MetLife, reinsuring a seasoned and diversified block of MetLife’s U.S. retail annuity and life insurance business.

Risks

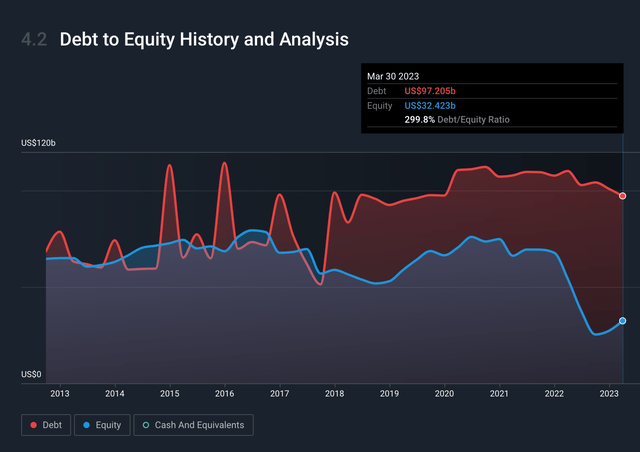

Two risk factors are noteworthy. Cash and equivalents total $27.23B but debt stands at $97.2B. The 5-month Beta rating of 1.08 shows the stock is more volatile than many retail investors might like. These risk factors might be exacerbated if MetLife’s revenue has slower growth than forecast or if cash flow and profit margins sputter and stall.

Debt to Earnings (simplywall.st/stocks/us/insurance/nyse-met/metlife/health)

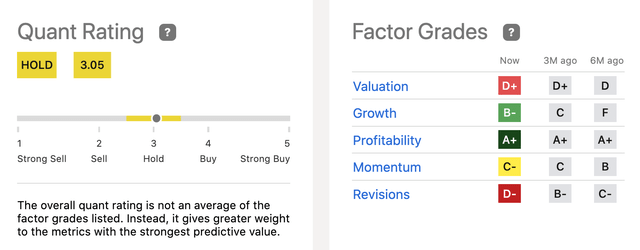

Other risks include Factor Grades for valuation. 3 and 6 months ago grades were Ds and valuation remains a D+ now. We consider its current valuation more in the C range; the company’s P/E and FY ’23 earnings suggest an average price target over $58 per share is a fair figure. If earnings touch $9 per share in 2024, the shares might climb into the mid to upper $60s; the worldwide economies in MetLife’s markets will have to improve dramatically in 2024 if the share price is to pop back to its 52-week high over $77, in our opinion.

Quant Rating & Factor Grades (seekingalpha.com/symbol/MET/ratings/quant-ratings)

The company has paid its dividend consistently. SA tags it a B+ for safety. We do not expect future increases and yields to keep pace, since the dividend payout ratio is already near 200% and the yield is already higher than the industry average of 2.2%. In the past, the dividend yield has kept pace with earnings growth at times exceeding earnings like in 2021, 2022, and this year.

Takeaway

Going forward, we expect management to focus on paying down debt, completing the share repurchase plan in a reasonable time, and expanding M&A activity rather than significantly increasing the dividend. But historically, the company dividend is up Y/Y for the last 5 years; earnings reported in the next quarter or two will give an indication about future dividend increases.

Debt, high Beta, a Hold Quant Rating, and struggling cash flow are risk factors investors must keep in mind. We believe the EPS of ~$2.00 in Q2 ’23 will not be less, but not much more, than it was in Q2 ’22. News sentiment in the 22 articles about MetLife last week tends to be positive about the stock. We do not foresee any immediate risks that will drive down the share price under $50 in the next 2 quarters.

Overall MetLife is a comparatively stable, financially healthy company. MetLife is the largest operation with life insurance “in-force” among companies in North America. It sells financial products and services to over 96 of the top 100 FORTUNE 500® companies. Big isn’t always better but MetLife can be among the best opportunities for safety and growth that potentially benefits long-term investors.

Read the full article here