Editor’s note: Seeking Alpha is proud to welcome Diamond Value Seeker as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Thesis

SL Green Realty Corp. (NYSE:SLG), the largest office landlord, faced challenges in the commercial real estate sector and witnessed substantial price reductions.

Despite the overall downturn in the commercial real estate market due to high interest rates, the office market in Manhattan showed signs of recovery, particularly in the financial services industry and high-quality office buildings. I believe this recovery proved beneficial for SLG.

Concerns about SLG’s high debt and decreased demand resulting from remote work situations led to a price decline. However, an examination of SLG’s current debt payment schedule and an evaluation of its historical debt repayment capacity indicates a low risk of default. The recent sale of 245 Park and the addition of $500 million in financing have instilled confidence that SLG is on track to achieve its goal of reducing debt by $2.5 billion (facilitated by a $2 billion disposition target) in 2023 and remaining resilient until the NYC market fully recovers.

Furthermore, SLG does not intend to acquire new debt in 2023. With ongoing asset sales, I think there is potential for SLG’s stock price to reach $70.

While the growth of the leasing market will also benefit SLG, it should not be considered a major factor since SLG already boasts an impressive occupancy rate of 90.2% (as of March 2023). However, the improved leasing market could enhance the appeal of SLG’s assets and increase the likelihood of disposition.

Favorable market conditions

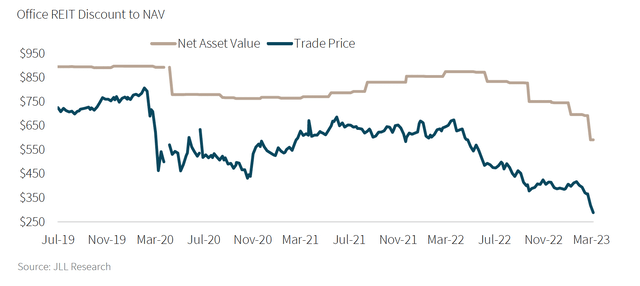

Since early 2022, reduced leasing demand and higher interest rates have adversely affected office REITs. As a result, their Net Asset Values and trade prices have declined, reaching their lowest levels since 2019. The chart provided by JLL Research illustrates the substantial price discounts across all REITs in the office sector.

Office REIT Discount to NAV (JLL Research – US Office Outlook Q1 2023)

Manhattan’s office market is showing signs of recovery

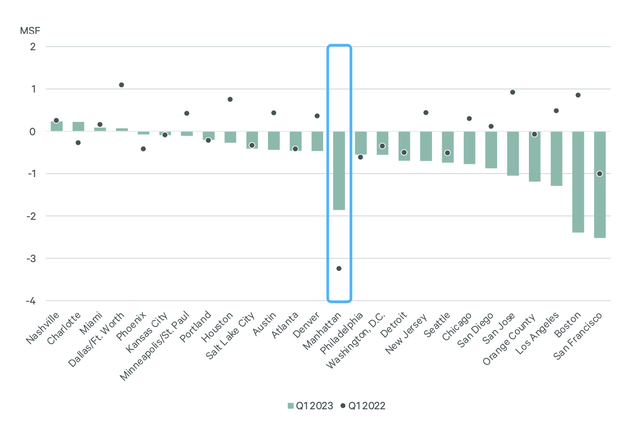

The office market in the United States has experienced a downturn, but there are encouraging signs of recovery in the Manhattan office market in the first quarter of 2023. Despite the net absorption rate still being negative, there has been a substantial year-over-year improvement when compared to other major markets, as indicated by the chart provided by CBRE Research. This positive trend indicates a high potential for the NYC office market to rebound. Continued progress along this trajectory could lead to a promising future for the Manhattan office sector.

Net Absorption by Major Market (CBRE Research – Office Demand Further Weakens, Q1 2023)

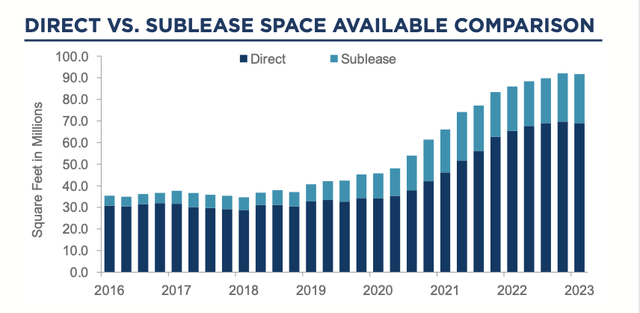

Since 2023, the availability of office space in Manhattan has begun to decline. This decrease in the availability of direct space indicates a positive market condition for office landlords in Manhattan, including SLG. As the return-to-office trend continues, it is expected to improve occupancy rates in the Manhattan office market. This is promising news for landlords like SLG, as a higher demand for office space will likely lead to increased occupancy.

Direct vs. Sublease Space Availability Comparison (Cushman & Wakefield – direct vs. sublease availability comparison, Marketbeat, Manhattan, Q1-2023)

Financial services and high-quality buildings are leading the change

New York City is widely recognized as the center of the financial services industry. According to a report by the Office of the New York State Comptroller, the majority of office space in NYC is occupied by the financial industry (35.6%), followed by TAMI (25.1%) and Professional & Business (15.5%).

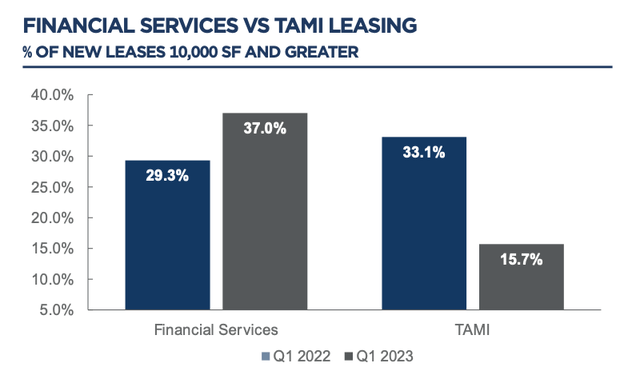

According to research by Cushion & Wakefield, Manhattan witnessed a 7.7% increase in new leases from the financial services sector during Q1 2023. This development is especially advantageous for SLG since 44% of its cash rent is generated from financial services tenants (as reported in SLG’s Q1 2023 earnings supplement).

% of new leases of Financial vs. TAMI in Manhattan office market (Cushman & Wakefield – Marketbeat, Manhattan, Q1 2023)

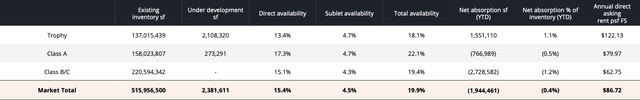

While the office market in Manhattan is showing signs of recovery, it’s important to note that not all building classes are experiencing the same level of improvement. In particular, the Trophy class, representing the highest quality office buildings, demonstrated positive absorption during Q2 2023. The Trophy class also exhibited the lowest availability compared to other building classes. This indicates a favorable market condition for top-tier properties in Manhattan.

Manhattan office market stats by class (Avison Young, Manhattan office market report, Q2 2023)

Office market might experience uncertainty in the short-term

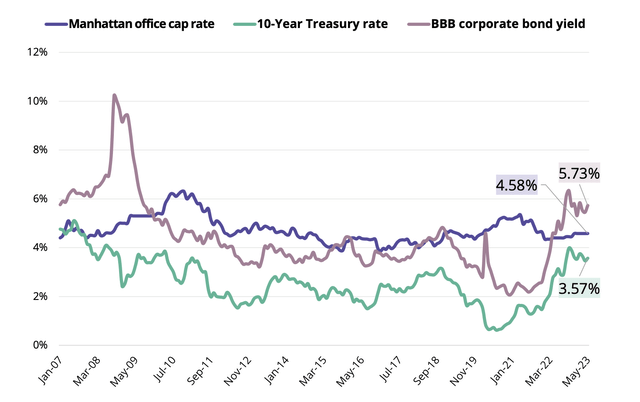

Certainly, the current scenario of high interest rates and stagnant inflation presents a notable risk for office REITs, which may persist until mid-2024. The gap between the cap rates of Manhattan office properties and the 10-year treasury rates reflects the high-risk premium demanded in investing in office spaces. The uncertain macroeconomic conditions may pose challenges for SLG in the short term. However, I believe if SLG can weather the current conditions before the Fed begins to lower interest rates, there will be high opportunities for growth and recovery.

Avison Young, Manhattan office market report, Q2 2023

SLG’s strong debt repayment potential signals promising future

SLG’s 1-year performance has dropped by 33% due to market concerns about its high debt, leading to potential dividend cuts. The company also saw an additional $48 million in interest and preferred dividends expenses compared to its initial guidance.

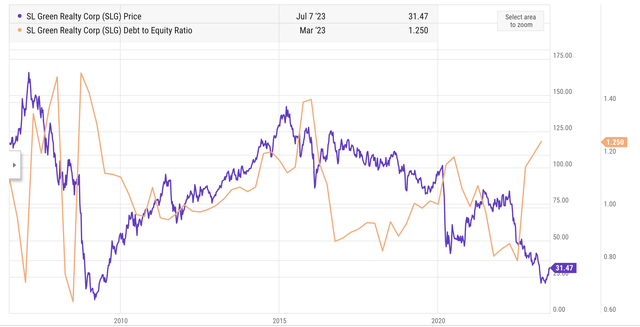

I compared SLG’s stock price with its debt-to-equity ratio: SLG’s debt-to-equity ratio has recently reached its highest level since 2016. Historically, when the company’s debt was elevated, the stock price declined significantly. On the other hand, reducing the debt burden could enhance investor confidence and potentially result in a higher stock price.

YCharts.com – SL Green Price vs Debt to Equity ratio, from 2006

The big question is: will SLG avoid default and survive when the market recovers?

The risk of default is low

Below is a summary of the debt that will reach maturity soon. I sorted the list by maturity date.

| Maturity Date | Building | Ownership interest (%) | Due at maturity |

| Jun-2023 | 919 Third Avenue | JV (51%) | $255 million |

| Jun-2023 | 220 East 42nd Street | JV (51%) | $260 million |

| Sep-2023 | 719 Seventh Avenue | 75% | $50 million |

| Sep-2023 | 280 Park Avenue | JV (50%) | $600 million |

| Sep-2023 | 115 Spring Street | JV (51%) | $33 million |

| Oct-2023 | 2022 Term loan | $400 million | |

| Nov-2023 | 185 Broadway / 7 Dey | 100% | $200 million |

| Dec-2023 | 100 Park Avenue | JV (49.9%) | $180 million |

Source: SLG Q1 2023 – Supplemental

SLG recently secured a $500 million refinancing deal for 919 Third Avenue at a fixed rate of 6.11%. While this higher interest rate increases operating expenses, the refinancing has provided additional liquidity for the company.

As for the next debt maturity, there is no news yet regarding 220 East 42nd. However, the building maintains a high occupancy rate of 91.1%, which can instill confidence in financial institutions if SLG seeks refinancing options.

I believe the successful refinancing of 919 Third Avenue demonstrates the company’s efforts to increase liquidity, bolstering investor confidence in SLG’s ability to avoid default.

Tracking history of exceeding disposition targets

SLG has a track record of surpassing its asset disposition targets, indicating that its executives have meticulously set these goals and made concerted efforts to achieve them. This history of outperforming the disposition targets demonstrates the company’s careful planning and commitment to effectively managing its assets.

| Year | Guideline of Disposition Target | Achieved |

| 2019 | $750 million | $1.2 billion |

| 2020 | $850 million | $2.0 billion |

| 2021 | $1 billion | $1.9 billion |

| 2022 | $750 million | $900 million |

| 2023 | $2 billion | $1 billion YTD (245 Park) |

Source: SLG Institutional Investor Conference

In the challenging year of 2020, amidst a difficult New York commercial real estate market and high debt levels, SLG exceeded expectations by achieving dispositions of around $2 billion, surpassing the $850 million target. Moreover, the company successfully reduced its debt-to-EBITDA ratio to 6.9x, surpassing the targeted ratio of 7.4x. These achievements are noteworthy considering the market conditions and highlight SLG’s effective management strategies.

2023 disposition guideline is realistic and achievable

The major news in Q2 was the sale of 245 Park Avenue to Mori Trust Co Ltd, a Japanese real estate developer, for a valuation of $2 billion. This sale represents a significant milestone, accounting for half of SLG’s 2023 disposition target.

SLG also sold a retail condo 121 Greene Street in Q1 2023 for $14 million.

Additionally, SLG has proposed a list of assets to be sold in 2023, indicating its commitment to further strategic divestments. Below is a summary of proposed dispositions:

| 2023 Disposition Assumptions | Status |

| 245 Park Avenue | Sold for $2 billion with ~50% JV interest |

| 121 Greene Street (retail condo) | Sold in Q1-2023 |

| 7 Dey Street / 185 Broadway | being marketed for sale |

| 750 Third Avenue | being marketed for sale |

| One Vanderbilt Avenue | JV Interest being marketed for sale |

| 110 Greene Street | Planned to sell since 2021 YE |

| 719 Seventh Avenue |

Planned to sell since 2021 YE |

Source: SLG Institutional Investor Conference 2023

One Vanderbilt Avenue, owned by SLG at a 71% stake, is a prominent asset among the properties listed for sale. With its A+ (trophy) building status and a high occupancy rate of 91.6% as of Q1-2023, it presents an appealing opportunity for buyers in the recovering NYC office market. SLG will hit its 2023 disposition target if it’s able to sell One Vanderbilt Avenue.

110 Greene Street and 7 Dey Street / 185 Broadway, both class-A buildings in the downtown area, are also promising. Avison Young’s Manhattan office market report indicates that downtown is leading the market recovery, with a 1% year-to-date absorption rate, outpacing midtown, which stands at 0.3%.

The company’s 2023 guideline mentioned a $200 million acquisition target, this is far less than a $2 billion disposition target, reflecting it’s focuses on reducing debt and increasing liquidity.

With over 20 years of operating experience in New York and established relationships with buyers and financial institutions, SLG’s premier assets and effective management inspire confidence that the company can further reduce debt and be poised for a rebound.

Price Target

The current price of SLG’s stock is $32.51, indicating a cap rate of 8.3%. This cap rate is determined based on the net operating income (NOI) from the past twelve months (including SLG’s fully owned properties and its share of unconsolidated JV properties), and liabilities totaling $7.36 billion. These figures are derived from the latest 2023 First Quarter Supplement Data.

After considering different scenarios with lower cap rates, such as 5%, 6.5%, and 7.5%, I have concluded that SLG’s stock price has the potential to reach approximately $50 if the cap rate is 7.5%, and $73 if the cap rate is 6.5%.

| NOI (last twelve months) | $785 million | |||

| Liabilities | $7.36 billion | |||

| Shares outstanding | 64.4 million | |||

| Cap rate | 5.0% | 6.5% | 7.5% | 8.3% |

| Price | $ 129.49 | $ 73.22 | $ 48.21 | $ 32.51 |

The Q2 2023 Manhattan office market report by Avison Young states that the cap rate for Manhattan office properties is currently at 4.58%. Based on historical data since 2007, the cap rate has never exceeded 6.5%. Therefore, I believe a cap rate of 6.5% is a conservative estimate for SLG’s price target, which amounts to $70. The estimated price target represents a doubling (2x) of the current stock price of $32.51.

Risks

Investing in SLG carries several risks that should be carefully considered.

Firstly, the market conditions may deteriorate further if the Fed raises interest rates or maintains high rates for an extended period. This could hurt the overall RETIs market, including SLG’s stock price. The cap rate for Manhattan office properties could increase even more, and the return to-office might be slower than anticipated, posing additional challenges for SLG’s performance.

Secondly, in a distressed market, SLG may face challenges in finding buyers for its properties. It will be important to closely monitor the company’s disposition and financing activities until September 2023. The company’s ability to address payment issues related to properties like 719 Seventh Avenue, 280 Park Avenue, and 115 Spring Street will serve as indicators of whether it is on track to achieve its 2023 targets.

Thirdly, the high short interest (currently 27.28%) indicates a bearish sentiment among investors. SLG has been a target for short sellers since the onset of the COVID-19 pandemic. The recovery trajectory remains uncertain. There’s another SA article on SLG’s short interest analysis.

Lastly, SLG may opt for a short-term dividend cut to maintain liquidity. Such a decision could result in a loss of investor confidence and potentially lead to a decline in the stock price.

Conclusion

I believe it’s worth holding onto SLG until it achieves its asset disposition target, as it would alleviate debt concerns and allow the company to fully benefit from a market rebound.

In addition to asset disposition, SLG has shown strength in leasing, signing 31 office leases in Q2. Furthermore, the company is pursuing a Casino project in Times Square, which contributes to business diversification and opens the door for additional growth opportunities.

While SLG may face the possibility of a dividend cut in the short term to preserve liquidity, which could result in price fluctuations, the company has a strong likelihood of weathering the challenges of the market in the long term. The asset dispositions will significantly improve SLG’s financial position and may lead to the resumption of share repurchase authorization, as mentioned in the 2022 investor presentation. I view SLG as a favorable choice for long-term investors.

Read the full article here