Organigram Overview

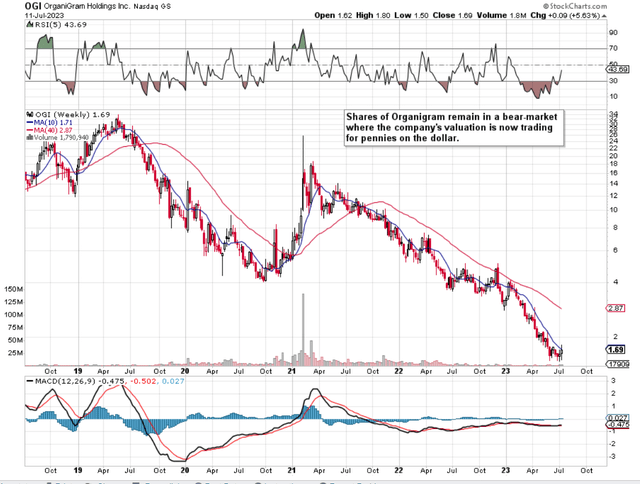

We wrote about Organigram Holdings Inc. (NASDAQ:OGI) back in February of 2021 (shares were trading at approximately $13.60 a share) when we favored a short-term long setup in the cannabis company over a long-term play. Although Organigram Holdings Inc. had a strong balance sheet at the time, the company’s lack of bottom-line profitability combined with a pretty steep valuation made us veer more towards the short-term opportunity on offer. In the end, the bullish trend that Organigram was enjoying at the time lasted only a further 4 weeks before topping out on the 8th of March of that year. Bullish short-term strategies would have been successful in this period as long as one liquidated long-delta positions once the trend change was confirmed in earnest. From a long-term perspective, however, that March 2021 top resulted in a sustained bearish pattern in Organigram Holdings which has culminated in losses of over 87% over the past 27 months or so.

OGI Intermediate Technicals (Stockcharts.com)

OGI Stock – Cheap Valuation

Suffice it to say, with shares now trading with a trailing book multiple of 0.35 and a trailing sales multiple of a mere 1.08, it is a given that value investors will be interested here especially given how low these multiples compare to the cannabis sector in general. Furthermore, the absence of interest-bearing debt as well as the fact the shares are trading for well under three times their cash position may convince investors that OGI is in it for the long haul.

Strong Fundamentals

We state this because of the long-term decision-making management has made in recent times with respect to the company’s production capability and the development of its brands. Fundamentally sound decision-making where the ‘long-term’ strategy always remains the priority resulted in a top-line increase of 24% and a record adjusted gross margin of 34% in the company’s most recent second quarter. Although pricing pressure clearly remains evident in this industry, international sales were to the forefront in Q2 as SHRED and JOLTS continued to gain traction.

Moreover, the company’s Moncton and Winnipeg production facilities continue to become more efficient and the recently finished Lac-Supérieur facility is expected to meaningfully add to production numbers promptly. OGI’s recent investment in Green Tank Technologies in the ‘vape’ space is not surprising given British American Tobacco’s (BTI) $120+ million stake in OGI a few years ago. In fact, given the sizable investment at the time by the large tobacco player, OGI investors most likely believed that cannabis would begin to have a much larger role to play going forward as opposed to traditional cigarettes. The technical chart though as mentioned clearly illustrates that OGI’s share price thus far has not benefited from BAT’s investment.

What To Expect From Organigram’s Q3 Earnings

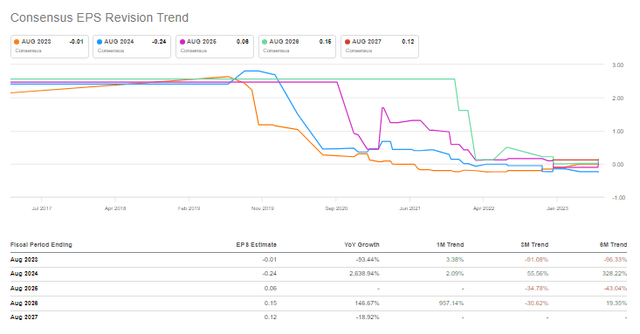

OGI is expected to announce its upcoming Q3 earnings after the close on the 13th of July where -$0.06 is the bottom-line GAAP EPS estimate on sales of $31.78 million. Suffice it to say, despite the bullish trends discussed above including strong revenue growth in Q1 as well as an elevated adjusted gross margin number, OGI is expected to continue to report negative earnings for some time to come. Therefore, what investors need to comprehend here is that no matter how cheap the stock may be from a valuation perspective or no matter how bullish the company’s fundamentals may be from a growth standpoint, negative earnings (which continue to result in a negative generated cash flow print) means the balance sheet will likely need to be drawn upon or external funding will be required.

Furthermore, given how sales growth is crucial to OGI’s profitability, forward-looking sales revisions (especially over the near term) have struggled in recent months as consensus has continued to dial down its estimates as we see below.

OGI Consensus Sales Revisions (Seeking Alpha)

Risks

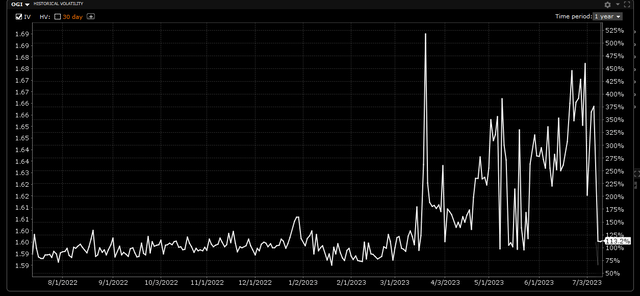

Therefore, based on worrying top-line revisions as well as negative earnings which are expected to continue for some time, it does not make sense to initiate a long position in OGI before the company announces its Q3 earnings. Being a micro-cap stock where trading volume is below average (which opens up the risk to unfavorable price swings) and seeing that the company’s 12-month implied volatility number (expected move, or fear index) remains over 100% as we see below, this means that risk remains elevated in this play, This risk is particularly evident around binary events such as earnings reports where a significant ‘miss’ could meaningfully move the share price. Suffice it to say, this stock remains a hold for us in that we would need to see OGI’s 10-week moving average trade above its corresponding 40-week average before we would contemplate changing our rating here.

OGI Implied Volatility Chart (Interactive Brokers)

Conclusion

To sum up, Organigram Holdings is expected to announce its third-quarter earnings after the close on the 13th of July. Shares have shown promise over the past six weeks or so and may very well be bottoming out. In saying this, negative profitability remains an issue especially with analysts dialing down their forward-looking sales estimates in recent months. Let’s see what numbers OGI reports. We look forward to continued coverage.

Read the full article here