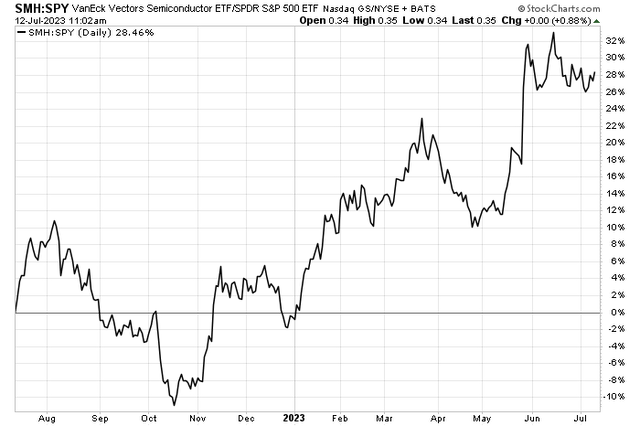

Semiconductor stocks powered higher in May amid downright euphoria around the artificial intelligence theme. A June swoon in the VanEck Semiconductor ETF (SMH) never materialized to any sizable degree, and SMH is now threatening all-time highs.

Relative to the S&P 500, the chip ETF continues to consolidate, and I see more upside ahead in shares of Broadcom (NASDAQ:AVGO). I find it at an appealing valuation considering this company’s growth, massive free cash flow, and some recent positive headlines.

Chip Stocks Consolidating Relative 2023 Gains

Stockcharts.com

According to Bank of America Global Research, AVGO has an extensive semiconductor product portfolio, which addresses applications within the wired infrastructure, wireless communications, enterprise storage, and industrial end markets. Applications for Broadcom’s products in these end markets include data center networking, home connectivity, broadband access, telecommunications equipment, smartphones, base stations, servers, storage, factory automation, power generation, alternative energy systems, and displays.

The California-based $364 billion market cap Semiconductor industry company within the Information Technology sector trades at a somewhat high 27.8 trailing 12-month GAAP price-to-earnings ratio and pays an above-market 2.1% dividend yield, according to Seeking Alpha. With earnings not until early September, implied volatility is tame at 28% while its short interest percentage is small at less than 2%.

There was good news this week from EU regulators regarding the company’s proposed $61 billion acquisition of VMware (VMW). Both stocks were up more than 1% on Wednesday, but VMW surged from $144 on Monday to above $151 by the close of trading on Tuesday once the conditional approval news broke. I find this likewise favorable for AVGO as the acquisition would further diversify its operations. Bigger picture, Broadcom is a free cash flow stalwart and a solid AI portfolio that should power earnings growth over the coming quarters.

The company beat on top line estimates back in late May and guided net sales higher, helping to lift the stock price. Broadcom’s 50% free cash flow margin is best in class and yields the firm’s EV/FCF multiple at a reasonable ~20x at the moment. Moreover, its agreement renewal with Apple (AAPL) should ensure robust wireless sales. Key risks, though, include volatility in the cyclical semiconductor market as well as ongoing (and potentially worsening) US-China tensions, its dependence on Apple, and execution risks around acquisitions.

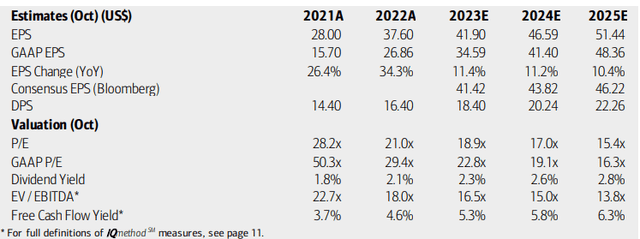

On valuation, analysts at BofA see earnings rising at a steady low-double-digit clip over the coming quarter. Near $42 of operating EPS is seen in 2023 while out-year per-share profits are seen climbing above $46 while $50 should be topped in 2025. The Bloomberg consensus outlook is less sanguine, but I assert the culprit of the discrepancy is simply because analysts have been slow to refresh their recommendations on Broadcom following the recent AI boom, and after Nvidia’s blockbuster quarterly report back in Q2.

AVGO’s dividend is the icing on the cake for total return investors – payouts are expected to rise steadily over the next two years, and I see that as a likely scenario given the firm’s robust free cash flow and profitability trends. With a non-GAAP P/E barely above 20 right now, the PEG ratio is under 2.0, less than that of the S&P 500, which I find attractive.

Broadcom: Earnings, Valuation, Dividend, Free Cash Flow Forecasts

BofA Global Research

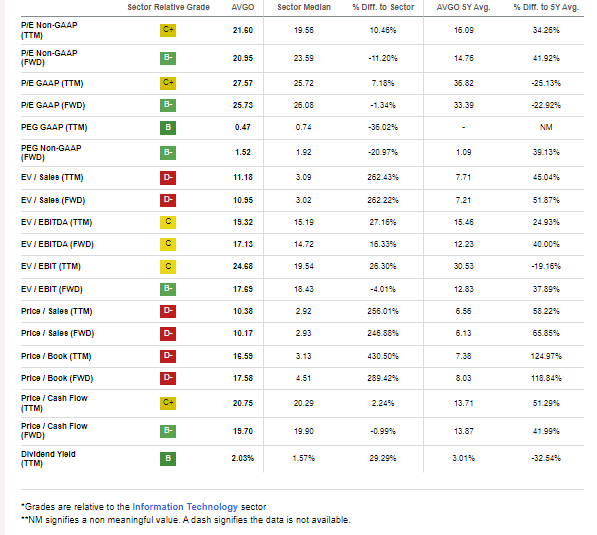

Diving deeper into the valuation situation, AVGO’s 5-year average forward GAAP earnings multiple is more than 33. Today, even after the massive share price run-up, the stock is actually cheaper at just a 28 P/E. Still, I prefer to look at the non-GAAP measure which suggests the stock is no longer a relative bargain.

The same goes for the forward PEG of 1.5. For a fast-growing tech company like this, it is also appropriate to assess the price-to-sales ratio. Currently about 10, that’s likewise at a significant premium to its 6.1 5-year norm. Overall, I see shares slightly undervalued today, but ample free cash flow, a decent dividend, and stock buybacks should support AVGO on pullbacks. If we assume $43 of next-12-month EPS and apply a 23 P/E (above that of the broad market given its robust fundamentals), then shares should be near $990.

AVGO: Mixed Valuation Signals, But A PEG At A Market Discount

Seeking Alpha

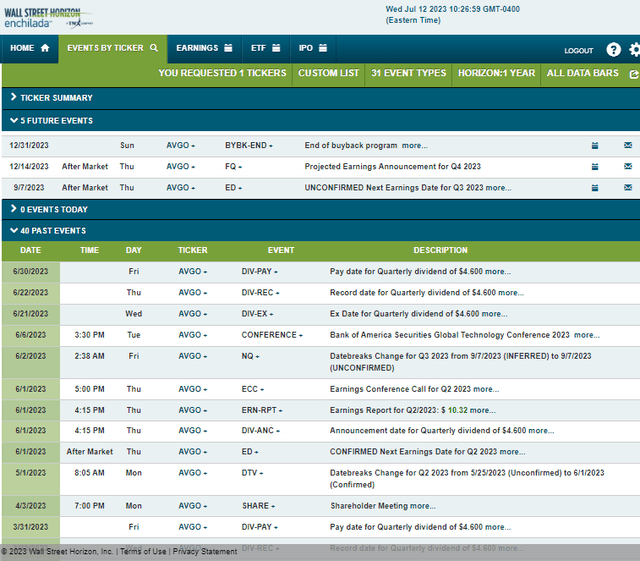

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2023 earnings date of Thursday, September 7 AMC. At year-end, Broadcom’s share repurchase program is slated to end, so be on the lookout for headlines about new buyback plans from the management team.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

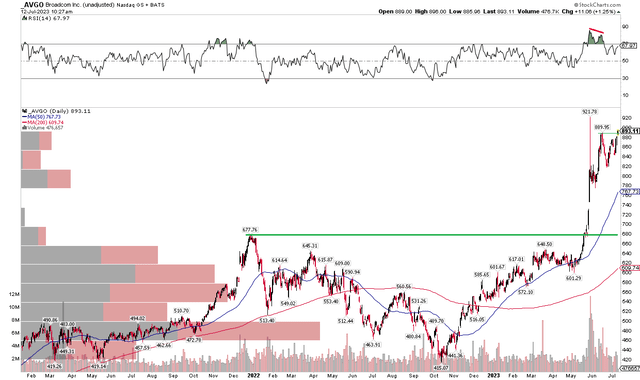

With shares slightly undervalued in my view, let’s assess the chart. The stock is testing recent highs after pulling back from an odd spike seen shortly after Nvidia’s blowout guidance in late May and early June. There was some modest bearish RSI divergence (since RSI is measured on a daily closing basis in this chart, the June 14 high above $880 came on softer momentum compared to the May 29 closing print near $810).

With shares poised to print a new closing peak today, there’s little volume and supply to bring about selling pressure. There is, though, a measured-move price objective to $941 that could be a nearer-term headwind. That price point is calculated from the basing pattern over the early 2022 through May 2023 range ($678 high to the $415 low with subsequent breakout above the January 2022 previous all-time high).

Overall, while the stock may be extended on some timeframes, June and July selling pressure turned out to be modest, and I assert the rally may continue. Long with a stop under the late-June low of $819 is a favorable risk management strategy.

AVGO: Shares Climbing Toward New All-Time Closing Highs, Bearish RSI Divergence Being Negated

Stockcharts.com

The Bottom Line

I see Broadcom’s rally having more legs as dip buyers have shown themselves in recent weeks. I see fair value near $990, while technical support is near $845 and $820.

Read the full article here