Canaan Inc. (NASDAQ:CAN) is recognized as a pioneer in cryptocurrency mining infrastructure, launching the first-of-its-kind application-specific integrated circuit (AISC) machine built to mine Bitcoin (BTC-USD) way back in 2013. The China-based tech company benefited from the explosive growth in the sector over the past decade leading up to its 2019 U.S. Nasdaq listing.

Fast forward, and it’s clear the landscape has changed significantly given the emergence of larger global competitors and the extreme volatility in the price of Bitcoin in recent years.

The company was particularly pressured when crypto trading and Bitcoin mining were completely banned in its home country in 2021 while also dealing with supply chain disruptions. Indeed, shares of CAN are off by more than 60% from its initial offering price with an even greater fall compared to its record high.

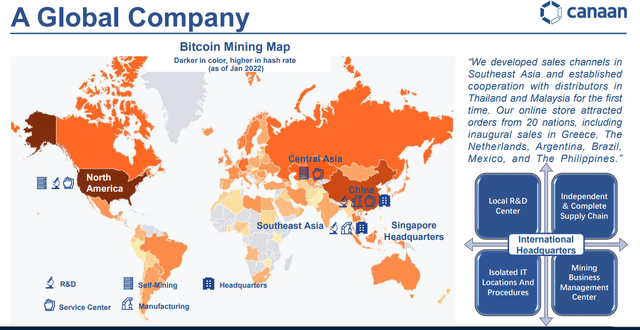

That being said, we’re looking at CAN as a survivor of the turmoil highlighting some strategy initiatives and encouraging developments we believe represent an emerging turnaround. Importantly, Canaan has shifted its operations outside of China while the ongoing rally in the price of Bitcoin has provided a new wave of bullish sentiment supporting a more positive outlook.

Is CAN a Good Stock?

With a current market cap of around $500 million, the first point to note here is that Canaan remains a speculative investment and otherwise high-risk stock. The core business is the sale of Bitcoin mining machines, with demand tied to the prospects of Bitcoin and typically following the price action of the market.

At the same time, we want to dispel any notion that CAN is simply a “penny stock”. Canaan generated more than $490 million in revenue over the past year while the strong point in our view is likely its balance sheet.

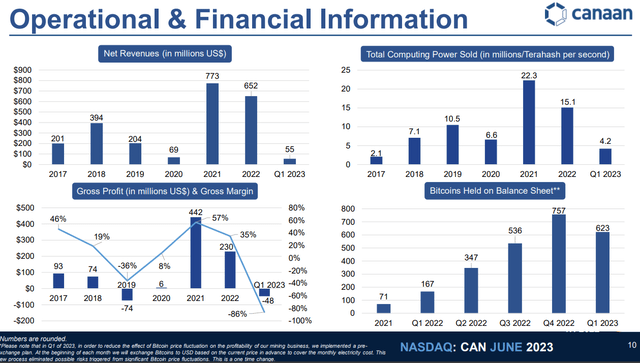

source: company IR

The company ended Q1 with $72 million in liquidity which includes 623 Bitcoins translating into a current market value of nearly $19 million against effectively zero long-term debt. In other words, CAN is trading around 1x sales net of cash, and we’ll make the case there is some real value in the business.

The story since 2022 has been a decline in top-line and the key metric of “computing power sold” in terms of Terahash per second, compared to the record in 2021. This reflects the weakness in the broader crypto sector and the large selloff of cryptocurrencies last year, directly hitting demand. Still, with $55 million in net revenues during Q1, the annualized run rate is on track to exceed levels from 2019 and 2020.

source: company IR

For context, product revenue represented approximately 80% of the business in Q1 while the company also runs a smaller “self-mining” operation where it essentially operates the mining rigs for its accounts. In Q1, that side of the business generated $11 million in revenues, more than double the $4.8 million in the same period last year.

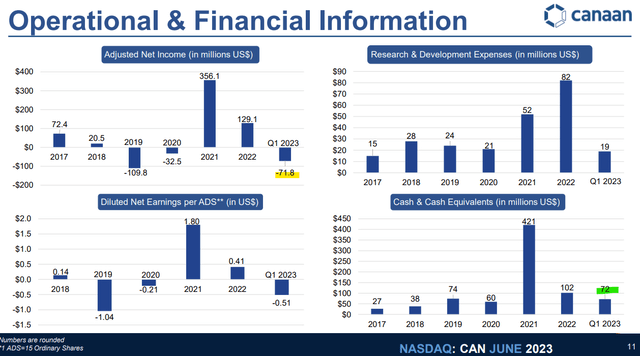

On the other hand, the weakness comes down to the poor earnings trend, with a widening loss in recent quarters. The negative adjusted net income of -$71.8 million in the last quarter, reversed a profit of $81 million in the period last year.

Even with some cost savings efforts, the loss captured a large inventory write-down reflecting the obsolescence of some older models. The company continues to move forward with R&D spending in an attempt to maintain its technological edge, or at least keep up with competitor offerings.

source: company IR

What’s Next For CAN?

Favorably, the setup here is for some stronger trends in Q2 and into the second half of the year. Canaan is one of three major global producers of Bitcoin mining rigs, next to privately-held “Bitmain Technologies” and “MicroBT” often cited as the segment leaders.

On this point, industry sources regularly cite Canaan’s “Avalon Made” line of Bitcoin miners as among the best options incorporating cutting-edge technology including immersion cooling, known for high hash-rate capacity and efficient power consumption.

Indeed, a big recent development for the company was a major sale announced in May to publicly traded Cipher Mining (CIFR) ordering 11,000 of the new “Avalon Made A1346” model for delivery in Q3. While the terms of the deal were not disclosed, each unit retails for over $2,000 providing a sense of the scale and continued relevancy of the company among major potential customers.

We expect that transaction to be included in the upcoming Q2 report, and it also provides a reference point to full-year consensus estimates. The market is forecasting CAN to approach full-year revenue of $330 million, representing a rebound compared to Q1 trends.

The path here based on a more normalized operating environment where the demand for mining machines has picked up can also allow CAN to reclaim profitability. Into 2024, the outlook is for revenues to more than double towards $658 million while EPS is leveraged higher.

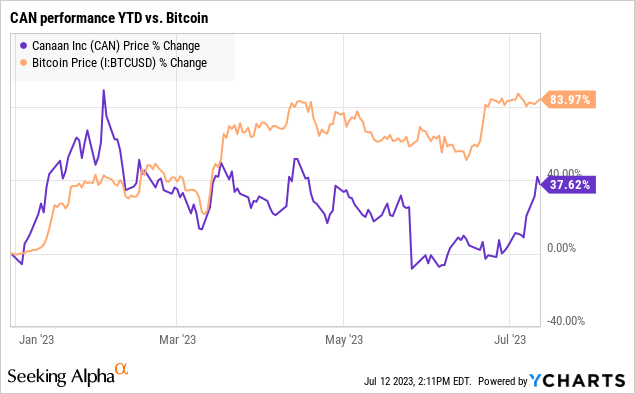

Seeking Alpha

It’s fair to take these estimates with a grain of salt, but they tie into the bullish case for the stock covering where the next leg higher in the price of Bitcoin can further add to the operational and financial momentum.

Ideally, we’d want to see a return to the environment from 2021 where there were shortages of mining rigs worldwide because the demand was so elevated players like Canaan and Bitmain, for example, simply couldn’t keep up. The aspect of running a self-mining segment separately adds a layer of diversification that would add to the earnings potential as the price of Bitcoin climbs in addition to appreciating the value of balance sheet holdings.

source: company IR

CAN Stock Price Forecast

Recognizing the risks, we believe CAN deserves to be on the radar of more investors. With a bullish outlook for Bitcoin, we see room for CAN to rally alongside the broader crypto sector as a relatively unique play on the infrastructure side of the technology.

Looking ahead to the Q2 earnings report likely coming out towards the end of August, this will be an important opportunity for management to present stronger operating and financial trends to set a new tone for the rest of the year.

Monitoring points will be the gross margin and cash flow trends along with any updates on big customer wins. The upside here is that more clarity on the financial trends could work as a catalyst for the stock to reprice higher.

In terms of risks, we mentioned the speculative nature of the stock given its current negative earnings and lack of free cash flow. A scenario where Bitcoin takes a leg lower or some type of major regulatory change undermines the business model of crypto mining would force a reassessment of our outlook.

Seeking Alpha

Read the full article here