One of our big calls coming into 2023 was that this would be “the year of disinflation”. I have to admit though – by some measures it’s happening even faster than I expected. Inflation is slowing fast, but is that a good thing or a bad thing? Let’s dig into it.

Headline CPI came in at 3.1%. Core CPI (ex food and energy) came in at 4.8%. That headline figure is a head turner given we were at 9% just a year ago. The core figure is a little more alarming.

Remember, the Fed has a 2% target and core CPI and Core PCE (their preferred metric) are still hovering around 4.5-4.8%. That’s way too high for the Fed. So even though we’ve made a lot of progress on the inflation front, the Fed is still a long way from declaring victory.

I think the Fed will want to see or get very near confirmation of a 2% inflation print in the core PCE before they hint at cutting rates. They remain very concerned about a 1970s/1940s style resurgence in inflation.

I think that resurgence is very unlikely, but the Fed doesn’t have the luxury of making risky forecasts like I do. They have to be able to justify why they have the stances they have, hence their “data dependent” approach. This is also why the Fed is often behind the curve. If you recall in 2020 I said:

“I don’t see how there can’t be some inflation that comes out of this (stimulus)…I’m not transitioning into a hyperinflation sort of mentality but I don’t see how there’s any chance that coming out of like, say 2021 or 2022, that if the economy is really rebounding that we don’t have three, four, five percent [core] inflation and I think you could have the Federal Reserve chasing their own tail raising rates.“

As I recently noted, Monetary Policy feels like it’s been tight for a long time, but the gears are really only just starting to grind the economy. So this leaves the Fed in an unenviable position.

There has been a lot of talk in recent months about the “soft landing” scenario, but this is a bad analogy for the economy. The economy is more like a plane that usually gains altitude. Sometimes we hit a big air pocket and lose a lot of altitude.

We call that a recession. But 80% of the time the plane is just climbing. It never lands, and it doesn’t lose altitude for long periods of time. When inflation is high, you can think of it as though the cabin pressure is falling (perhaps from climbing too fast).

We’re gaining altitude, but the passengers don’t feel better off because their ears are about to burst. So sometimes we have to put up the flaps to slow the plane (raise interest rates). This helps the plane climb more slowly, so we can better adjust to the pressure.

But sometimes we leave the flaps up for too long and the plane stalls. This is where we are right now in the flight pattern. And so far, all looks good, but when you reduce speed like this with the flaps up, your plane is especially vulnerable to unforeseen events.

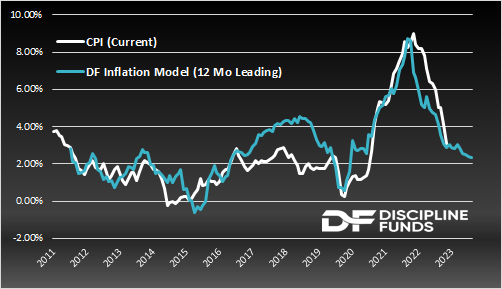

So here’s how to visualize this in terms of future inflation and the Federal Reserve. The Discipline Funds Inflation Model is currently forecasting a modest rate of continued disinflation into 2024. The easy disinflation prediction is now behind us.

Importantly, there are no signs of an inflation resurgence. This isn’t the 1940s or 1970s. So we think that the Fed’s concerns of a double bump in inflation are unwarranted.

There is virtually no real-time inflation data showing this risk. But the Fed is very likely to remain tight all through 2023 and well into 2024 unless the economy starts to weaken very materially here.

Our baseline view is still “muddle through” so I still expect the plane to continue climbing (slowly), but we’re in this precarious environment where the flaps are up, we’re climbing more slowly, and any number of unforeseen outcomes could send us into a stall.

As I’ve noted, this isn’t the baseline forecast, but while many people are cheering the “soft landing,” this false analogy could lead them to underestimate the risk of a stall.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here