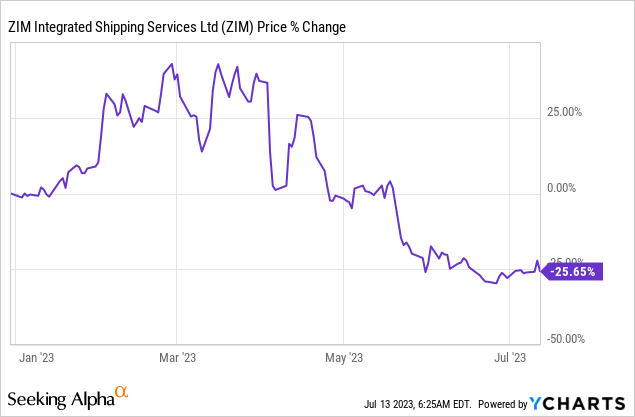

ZIM Integrated Shipping Services (NYSE:ZIM) is finally facing up to reality: the shipping company announced in a new disclosure on Wednesday that it no longer expects to achieve $1.8-2.2B in adjusted EBITDA in FY 2023 due to a broad deterioration of operating conditions in the shipping industry. Falling consumer demand as well as a severe decline in shipping rates have caused serious distress in the shipping sector and resulted in ZIM Integrated Shipping company reporting massive declines in free cash flow and adjusted EBITDA in the first-quarter. With the guidance for FY 2023 withdrawn, I expect a new round of EPS downside revisions which can be expected to add new pressure on ZIM Integrated Shipping’s valuation. ZIM is now also highly unlikely to pay a dividend at all going forward!

ZIM Integrated Shipping faces reality and submits a new EBITDA outlook for FY 2023

Over the last few months, there was a pronounced risk that ZIM Integrated Shipping would have to lower its outlook for FY 2023 due to a combination of falling shipping rates and falling container volumes, and the fact that the company saw a net cash position turn into a net debt position in the first-quarter. In my work “ZIM Integrated: Set For New Lows In 2023”, I specifically warned that the decline in free cash flow and EBITDA raised the risk of a full-year EBITDA revision which the company yesterday confirmed.

In a disclosure, dated July 12, 2023, ZIM Integrated Shipping said that it now sees adjusted EBITDA of $1.2B-$1.6B billion which shows a massive 30% downgrade, on a mid-point basis, compared to the company’s previous forecast. ZIM Integrated Shipping also said that it now expects a rather large operating loss of $100-500M (adjusted EBIT) compared to an outlook of $100-500M profit previously. The outlook for adjusted EBIT completely flipped on its head and it has huge implications for the company’s dividend… which I now expect to be eliminated completely.

Shipping rates continue to decline…

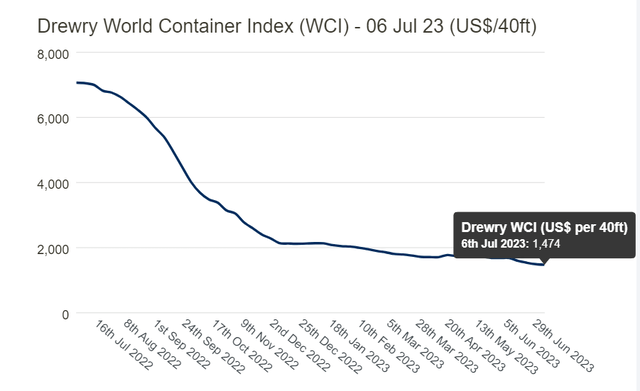

The down-grade of ZIM Integrated Shipping’s forecast comes at a time when shipping rates have failed to stabilize and continued to decline in the last week, reaching a new post-pandemic low. According to the Drewry World Container Index, the shipping rate for a 40-foot container decreased to $1,474/container (as of July 6, 2023), showing a decline of 1.3% to the prior week and a total decline of approximately 31% since the beginning of the year.

Source: Drewry

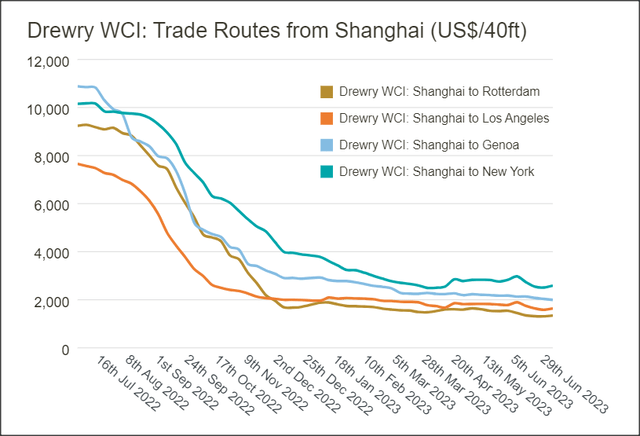

Shipping costs for all major trade routes have declined since June, indicating that hopes of a turnaround in the second half of FY 2023 have been too optimistic. In fact, ZIM Integrated Shipping stated that it now expects “weakness in freight rates across the company’s trade routes to continue during the second half of 2023.”

Source: Drewry

Guidance downgrade has huge implications for dividend investors

The forecast of an operating loss for FY 2023 now has deep implications for investors that bought ZIM’s shares for the dividend. ZIM Integrated Shipping did not pay a dividend for Q1’23 because of losses and it is highly likely, in my opinion, that the company will completely eliminate its dividend for FY 2023. Since ZIM has paid out 30% of its quarterly earnings as a variable dividend, the projected operating loss for FY 2023 strongly indicates that the dividend will be zeroed, although the company said in its Q1’23 report that it “intends to distribute 30-50% of annual net income as a dividend to shareholders.” With operating losses now expected in FY 2023, there simply won’t be any earnings to distribute at all.

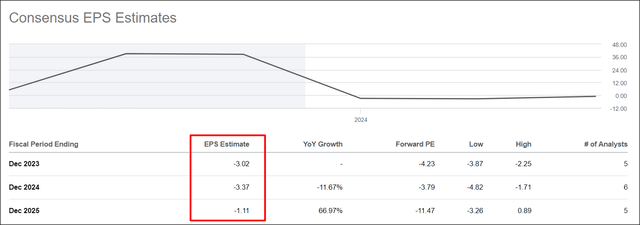

Analysts are set to kick off a new EPS revision cycle

My concern with ZIM Integrated Shipping has been for a while that the shipping industry is entering into a cyclical recession which implies that EPS estimates are set for a potentially broader decline as well. In fact, the cyclical decline of EPS projections already indicated that the company was unlikely to sustain its dividend in the short term. With ZIM cutting its full-year EBITDA guidance by 30%, a new cycle of EPS downside revisions is set to hit ZIM’s shares… which could result in additional valuation pressure.

Due to negative EPS estimates, a P/E ratio is not applicable, but the company does still have a lot of cash on its balance sheet that I expect to cushion the blow from a recession. However, I am having a hard time seeing a reason for positive share price momentum in the short term and the risk profile remains heavily skewed to the downside, in my opinion.

Source: Seeking Alpha

Risks with ZIM

The risks are obvious for ZIM Integrated Shipping and I have discussed them at length in this article: the two biggest commercial risks for the shipping company are a contraction in container volumes due to weak consumer demand as well as falling shipping rates. An additional risk factor is the expected round of EPS downside revisions. What would change my mind about ZIM Integrated Shipping is if the global economy managed to avoid a recession and signs emerged that indicated a recovery in the shipping industry.

Final thoughts

ZIM Integrated Shipping finally downgraded its full-year adjusted EBITDA outlook, but the projected operating loss for FY 2023 is especially striking because it implies that investors will most likely not receive any dividend payments at all this year. ZIM Integrated Shipping said that it expects weak (container) volume growth going forward and no longer expects a turnaround in shipping rates in the second half of the year, and so I believe there is a strong likelihood that analysts will initiate a new cycle of EPS downgrades that I expect to hurt ZIM Integrated Shipping’s shares in the short term. Strong sell.

Read the full article here