Prudential Financial (NYSE:PRU), one of the biggest financial services companies in the world, stands out to me amongst peers due to its size and overall strength. The diversified firm, which has multiple lines of business both domestically and internationally, has performed well historically, as well as through the pandemic and the ensuing economic shifts. The high-quality results are due to the company’s size, as well as a competent risk management framework which has allowed the company to pump out profits quarter after quarter, as well as mostly mitigate damage from rising rates in 2022. Now that the company is back on track after a suboptimal 2022 and strong Q1, we believe that Prudential has room to grow the top and bottom line further, while returning capital to shareholders.

The best part? The multiple. Currently, the company’s shares trade at what I believe is an attractive valuation, both on a relative and historical basis. This presents a compelling opportunity for investors.

However, rather than buying shares outright, a less risky and potentially more profitable strategy might be in the cards: selling put options. This strategy, suitable for a hyper-stable stock such as PRU, can generate income, reduce the cost basis on assigned shares if the stock drops, and allow investors to benefit even if the stock price remains stable or decreases moderately.

Let’s jump in.

Financial Results

In case you’re unfamiliar with Prudential, it’s a multi-pronged financial services company based in Newark, New Jersey. The company has three main lines of business:

- PGIM

- ‘U.S. Businesses’, which contains:

- Retirement Strategies

- Group Insurance

- Individual Life

- and ‘International Businesses’

PGIM is the company’s investment management arm, U.S. Businesses covers the company’s insurance and pension operations, and International Businesses account for investment management and insurance businesses internationally, like Prudential Japan, Prudential Africa, etc.

Essentially, the company is a hybrid between an asset manager and an insurance company operating in lots of global markets.

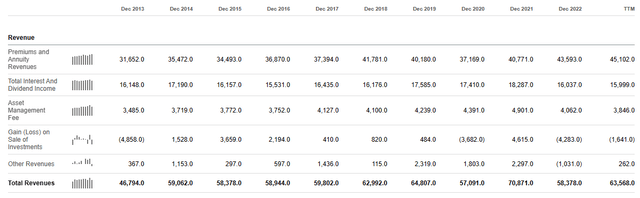

However, at its core, Prudential’s results are still mostly driven by insurance. You can see this evidenced in the firm’s revenue breakdown:

Seeking Alpha

Premiums still account for the majority of top line results, and Asset Management fees make up a very small percentage of revenue.

That said, the PGIM segment does contribute a higher percentage of operating profits, which means it’s likely not worth divesting from a management perspective.

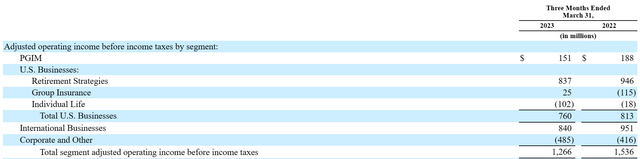

In the company’s most recent quarter, the International Business and U.S. Business segments were about equal in amount of total operating profit generated for the firm, tailed by PGIM which contributed a smaller share of the pie:

10Q

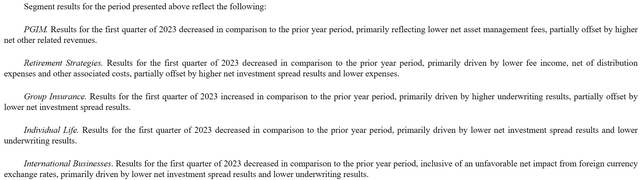

The nice part of Prudential’s setup, though, is that the company is very well diversified. If one segment disappoints, there’s always another segment there to make up the slack. This happened between 2022 Q1 and 2023 Q1 as decreases in individual life and International Businesses were offset somewhat by stronger Group Insurance numbers.

You can also see this dynamic at play when looking at the following screencap from the company’s 10Q:

10Q

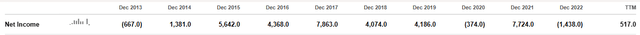

Each segment continually has positive and negative business drivers throughout the business cycle. This diversification compounds with the segment differentiation. Taken together, it’s easy to see how the company has produced incredibly stable results over the last decade-plus:

Seeking Alpha

That said, the road hasn’t been perfect. Net losses in 2022 were a blemish on an otherwise strong track record. These losses were driven primarily by interest rates, and the company itself has said the following about its exposure to the Fed:

As a global financial services company, market interest rates are a key driver of our liquidity and capital positions, cash flows, results of operations and financial position.

In other words, insurance and asset management businesses are both affected by higher rates. In most cases, higher rates are good for insurance, as they can increase investment spreads. However, the breakneck pace of hiking has caused some losses, not unlike what happened with SIVB and banks that had overweight treasury exposure. Thankfully, the company has a plan in place to manage these risks:

In order to manage the impacts that changes in interest rates have on our net investment spread, we employ a proactive asset/liability management program, which includes strategic asset allocation and hedging strategies within a disciplined risk management framework.

These strategies seek to match the liability characteristics of our products, and to closely approximate the interest rate sensitivity of the assets with the estimated interest rate sensitivity of the product liabilities.

Our asset/liability management program also helps manage duration gaps, currency and other risks between assets and liabilities through the use of derivatives. We adjust this dynamic process as products change, as customer behavior changes and as changes in the market environment occur. As a result, our asset/liability management process has permitted us to manage the interest rate risk associated with our products through several market cycles.

We believe that this has largely worked as advertised. While PRU did realize some losses in 2022, the losses vs. the size of the company’s total assets were extremely small, which we think is a highly positive sign when it comes to company stability in the future.

Valuation

It’s clear that Prudential has a solid business and risk management framework, but none of that would matter if the stock was particularly expensive. Thankfully, right now, it’s trading at what seems a great price.

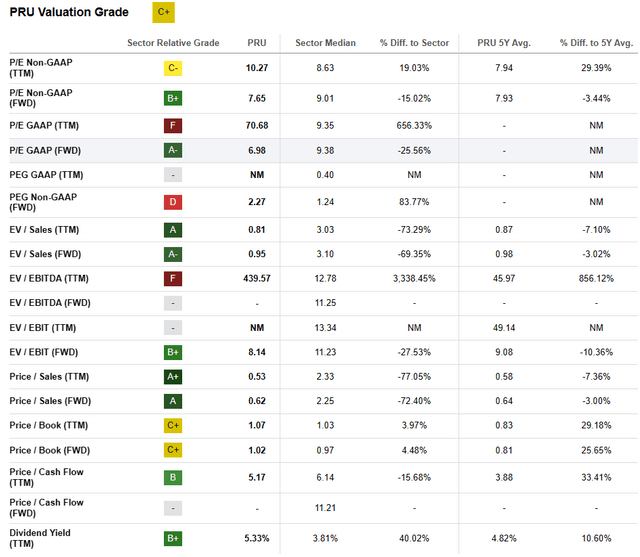

Seeking Alpha’s quant rating system pegs the company’s value at a “C+”, which we think may be misleading:

Seeking Alpha

Yes, the company does have elevated EV/EBITDA and other ratios, but these are skewed significantly as a result of financial adjustments. When looking at sprawling financial conglomerates like PRU, we like to look at the top and bottom line valuations alone. This is because financial and cash flow adjustments are ‘wonkier’ when compared to other industries that have revenue drop down the income statement in a more streamlined way. Thus, we measure top-line revenue in, and bottom-line EPS out.

On those metrics, the company is trading under a 7x forward GAAP P/E, which is significantly below the sector average. It’s also trading at a 0.53x sales multiple, which is below the sector average in addition to being cheaper than the company has traded historically vs. itself over the last 5 years.

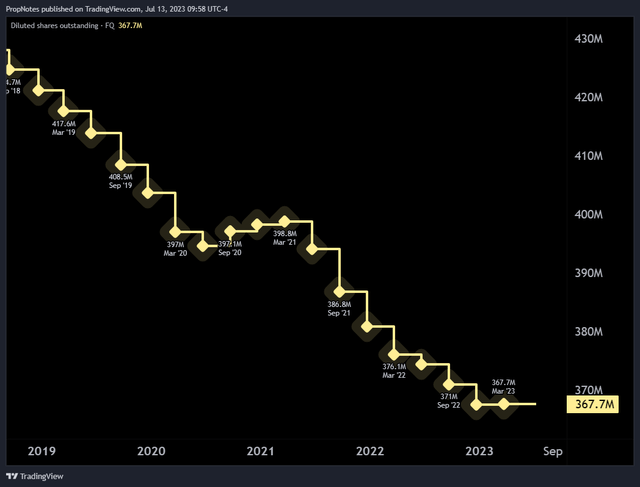

Plus, the company is buying back shares hand over fist:

TradingView

All in all, we think that PRU’s stable & diversified business lines, combined with the attractive valuation, make the stock a compelling long opportunity.

The Trade

That said, we think there’s a way to actually turn this situation even more to our advantage; by selling put options.

But what does this look like?

When you sell a put option, you’re essentially agreeing to buy the underlying stock at a certain price (the strike price) before a specified date (the expiration date). If the stock price remains above the strike price, the put option will expire worthless, and you keep the premium you received for selling the option. If the stock price falls below the strike price, you will be obligated to buy the stock, effectively at a discount when factoring in the premium received.

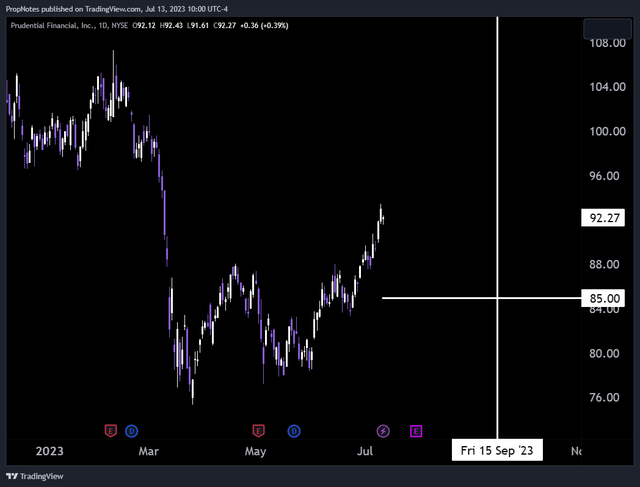

In the case of Prudential, which is currently trading at ~$92.50 per share, one might consider selling a put option with a strike price of $55, expiring on September 15th:

TradingView

Right now, the premium for this option is $1.35. If Prudential’s stock price remains above $85 by expiration, you keep the $1.35 premium per share, effectively a 1.6% return over the next 65 days. (This annualizes to 9.15% per year!)

If Prudential’s stock price drops below $85, you would be obligated to buy the shares for $85 each, effectively reducing your cost basis to $83.65 ($85 strike price – $1.35 premium), a 9% discount from the current price.

Based on the current market volatility and the underlying stock’s price behavior, the estimated probability of this trade being successful—i.e., the stock price staying above the strike price until expiration—is approximately 78%.

This probability, coupled with the potential return or discount if assigned, makes selling put options on Prudential a great looking win-win from my view. Plus, the underlying stock yields 5.4% in dividends. So, if you’re assigned on the shares, you’re still able to sell calls for further income while earning dividend yield on the position.

For a company as stable as PRU, this seems like a solid proposition.

Risks

That said, there are some risks.

Prudential, as an insurance company, deals in a big balance sheet, with enormous amount of assets, and a big pool of liabilities. Complex exposures can be hard to manage, as 2008 taught us. While PRU doesn’t have much in the way of complex insurance exposure, there’s always a fear that improper risk controls in a crisis could cause severe, permanent impairment to equity holders.

Additionally, PRU operates in a highly regulated industry that may see further obligations placed on the company in terms of regulatory & compliance costs. These costs could hurt profits and send the stock down.

Also, any cash flow problems or issues with the dividend would likely lead to a massive selloff in the stock. Given the lack of historical growth, most investors in this business are in it for the capital returns to shareholders. If the dividend comes under threat due to liquidity concerns, then it’s likely a selloff would occur that could hurt put sellers in this underlying stock.

Finally, Prudential reports earnings on August first, which could affect the stock price significantly. Put sellers need to be willing to own the stock, even after a potentially bad quarter that could send the stock down past the strike price of this option. For those who want a larger margin of error, selling the $80 strike puts with the same expiration could make 5% annualized. While lower, the probability of this trade working does increase to 88% as a result, meaning a lower amount of risk as well.

Summary

In summary, Prudential presents a compelling opportunity for investors seeking to capitalize on the benefits of selling put options. Despite the company’s recent challenges around interest rate cyclicality, its solid risk management plan, impressive historical performance, and robust liquidity position point towards a bright future.

With an attractive valuation below sector averages, our solid trade setup offering substantial yield looks to be the best way to play this ultimate SWAN company.

Cheers!

Read the full article here