We certainly live in interesting times.

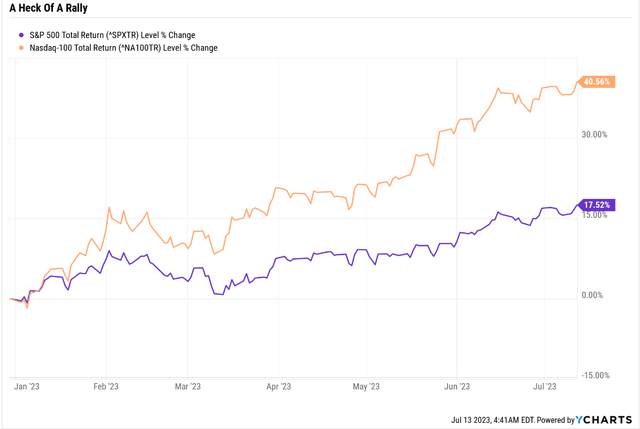

Ycharts

The market is on fire this year, and almost back to record highs.

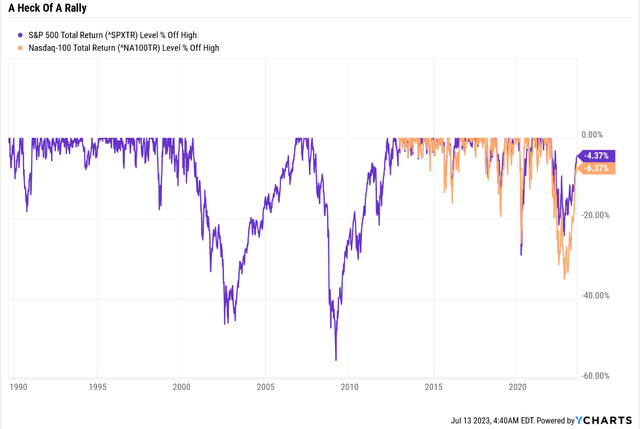

Ycharts

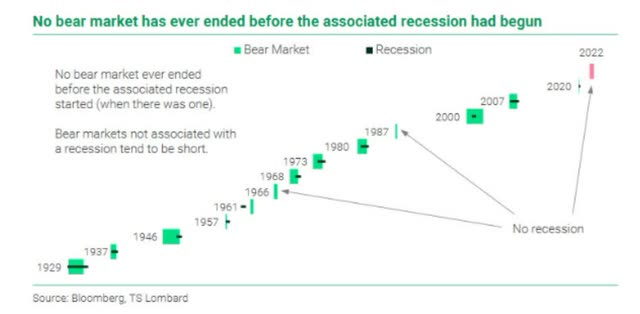

How amazing would it be if we closed at new record highs, thus officially ending the 2022 bear market? If we get a recession in 2024, as the data is saying is all but certain, it would be unprecedented.

Ritholtz Wealth Management

So the question is, can we avoid a recession? Can this market rally, this face-ripping bull market keep going?

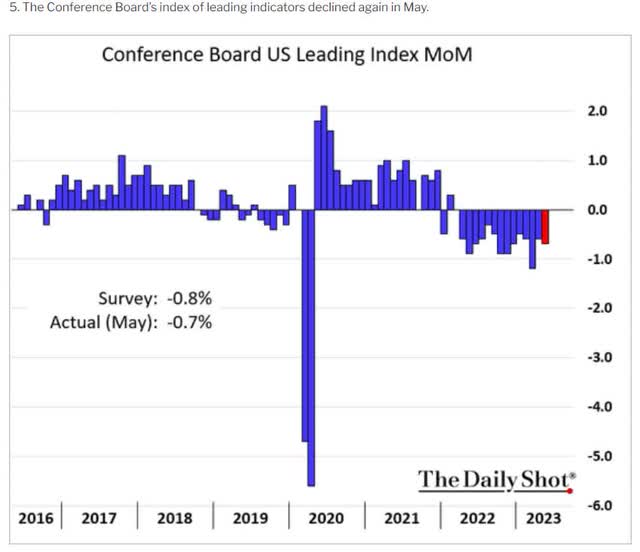

Daily Shot

History and data say not.

Weekly economic real-time indicators confirm that a recession is likely coming by April or May, and the bond market thinks a recession by July 31st, 2024 is 100% certainty.

Let’s think about what’s like to happen in the next year.

If we avoid a recession, which Deutsch Bank says would be “historically unprecedented.” then we avoid a potentially painful earning decline.

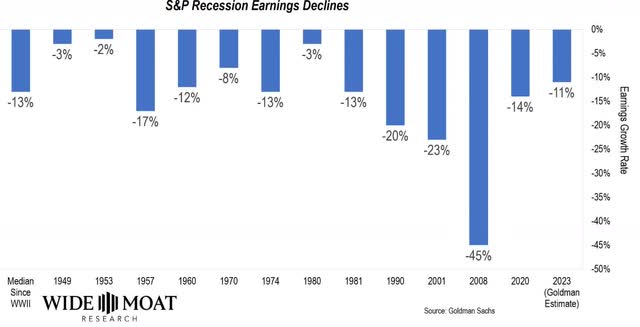

Wide Moat Research

Outside of WWII, there has never been a recession in which earnings didn’t decline.

Wide Moat Research

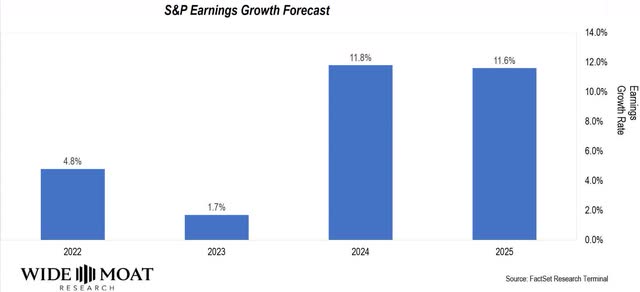

At the moment, this is what analysts are forecasting for S&P earnings. They are not at all expecting a recession.

So let’s imagine we avoid recession. For the first time in history (since its 1953 creation), the 3m-10yr yield curve, the most accurate recession forecasting tool in history, with 100% accuracy and no false signals, is wrong.

- That would make it 90% historically accurate

Daily Shot

The market still has limited upside, very limited.

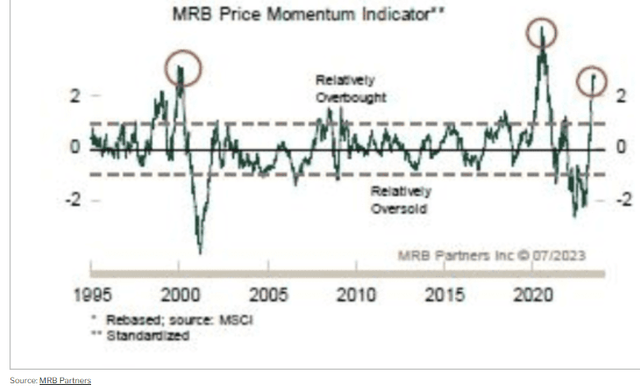

According to MRB Partners’ proprietary momentum index, stocks have only been more overbought twice in the last quarter century.

Ok, but what does that mean?

| Weekly Decline In S&P EPS Consensus | Last Week’s EPS Consensus | Year | EPS Consensus | YOY Growth |

| 0.00% | $206.58 | 2021 | $206.58 | 50.43% |

| 0.00% | $215.93 | 2022 | $215.93 | 4.53% |

| -0.38% | $219.09 | 2023 | $218.25 | 1.07% |

| -0.29% | $245.20 | 2024 | $244.49 | 12.02% |

| -0.10% | $274.26 | 2025 | $273.98 | 12.06% |

| Recession-Adjusted Forward PE | Historical 2024 EPS (Including Recession) | 12-Month forward EPS | 12-Month Forward PE | Historical Overvaluation |

| 21.03 | $212.71 | $232.38 | 19.245 | 14.35% |

(Sources: FactSet Research Terminal, Dividend Kings S&P 500 Valuation Tool)

If there is no recession and analyst estimates for earnings are correct, the S&P is now trading at 19.2X forward earnings and is 14% historically overvalued.

If we experience a recession, and the historically average 13% earnings decline, compared to current expectations, the market trades at 21X forward earnings.

22X was January 4th, 2022, S&P record high, at the start of this bear market.

The idea that “we’ve priced in the recession” appears to be pure hopium, not supported by the facts.

How You Know When Recession Is Just Around The Corner

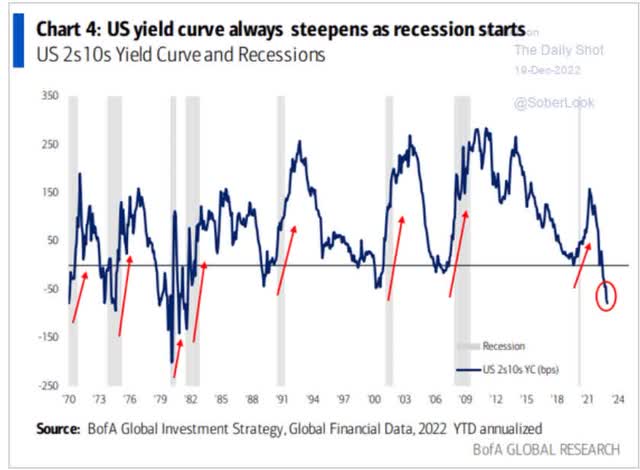

Many people know that when short-term rates go above long-term ones, a yield curve inversion is a historic sign that recession is 8 to 21 months away.

However, most people don’t know that if the yield curve goes positive again, this is a sign the recession is weeks away or already here.

Daily Shot

That’s because the bond market knows the Fed is starting to cut, or soon will, to fight recession.

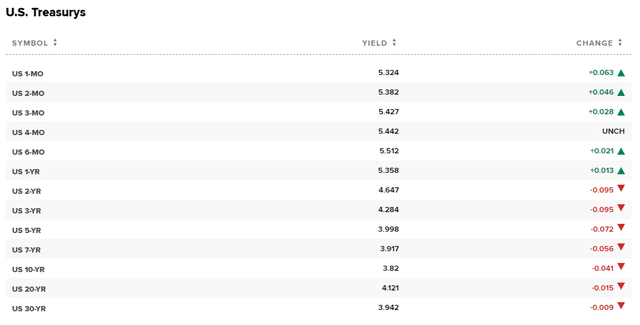

The Yield Curve Is Steepening

CNBC

When short-term rates fall faster than long-term rates, this is called curve steepening. The 2-10 curve is now steepening though the 3m-10yr curve is still inverting.

When the 3m-10yr curve closes positive (above zero) because 3m yields are higher than 10yr yields, that’s a pretty good sign the recession is here.

S&P Bear Market Bottom Optimistic Scenario, Recession Begins In April 2024, Market Historical Bottom July 2024

| Earnings Decline | S&P Trough Earnings | Historical Trough PE Of 14 (13 to 15 range) | Decline From Current Level | Peak Decline From Record Highs |

| 0% Unprecedented, even in the mildest recession in history | 260 | 3906 | 12.7% | -19.0% |

| 5% (blue-chip consensus) | 247 | 3710 | 17.0% | -23.0% |

| 10% (Fed banking data) | 234 | 3515 | 21.4% | -27.1% |

| 13% (average since WWII) | 227 | 3398 | 24.0% | -29.5% |

| 15% (Bank of America) | 221 | 3320 | 25.8% | -31.1% |

| 20% (Morgan Stanley, doesn’t expect a recession, just margin contraction) | 208 | 3124 | 30.1% | -35.2% |

(Source: Bloomberg, FactSet, Dividend Kings S&P 500 Valuation Tool)

My optimistic model agrees with Morgan Stanley’s ultimate market bottom estimate of 3,400 on the S&P.

- Morgan Stanley thinks stocks will bottom at a higher trough PE because it won’t be an economic recession

- just an earnings recession.

In other words, given all the data together, it appears the market will finally bottom at around -30% from current record highs.

Could the S&P hit a new record high first? Yes. Would that change anything? No.

As long as earnings forecasts don’t change and a recession happens, these numbers are most likely.

The S&P could double from here in the next six months, in the most extreme bubble in US history. But as long as the S&P’s earnings in the coming recession decline between 0% and 20% and as long as the historical 13 to 15X trough earnings range holds, this is the range will happen.

- fundamentals driven destiny

How To Potentially Cash In On The Coming Recession And Zombie Bank Apocalypse

Imagine if, rather than fearing a recession, you could actually profit from it.

With the zombie bank apocalypse, you might be able to.

Zombie banks are banks that are dead banks walking; they, and their shareholders, just don’t know it yet.

First Republic was doomed when it lost 50% of deposits in the week after Silicon Valley Bank failed. It simply couldn’t remain profitable. The $100 billion in emergency loans from the Fed, lent against its bonds, was not free money.

It was a loan that had a nearly 5% interest rate. The terms of the loans the government offered First Republic meant it would die by May 15th, unless it got most of its deposits back.

First Republic died on May 1st. When JPMorgan bought it for $10.6 billion, 5 cents on the dollar, JPM investors instantly made a $2.6 billion profit.

First Republic shareholders got wiped out.

The Fed has been trying to tighten financial conditions, to slow bank lending, weaken consumer and business demand, and tame inflation.

- $700 billion in unrealized bond losses for the banking industry

- inverted yield curve hurting underlying bank profitability

- banks tightening lending standards ahead of the most anticipated recession in history

- Fed plans to raise capital requirements, reducing bank leverage and shrinking the money supply

To fight inflation, the Fed is weakening the banks. The weakest banks are doomed. Their shareholders don’t know they are going to zero; just it’s a matter of time.

Stanford estimates that up to 200 regional banks could fail in the coming recession.

Why? Because of the $180 billion in estimated loan losses that are coming according to the Fed’s models.

$120 billion of that is commercial real estate loan losses. $80 billion of that is regional bank commercial real estate loan losses.

All told, about $90 to $100 billion in loan losses for regional banks are expected in this recession.

The entire regional bank industry earned $63 billion in profit in the last year.

What happens when the Fed intentionally weakens the entire banking system, and then a recession blows a $100 billion hole in regional banks, representing 1.5 years’ worth of profits?

A lot more regional bank failures.

But knowing who to trust, and who to buy, can be the difference between losing everything, and potentially tripling your money in the next two years.

As The Next Crisis Looms, New Heroes Rise

When First Republic, the 14th largest bank, was facing extinction the US government turned to 11 banks they considered the strongest, to save it.

The Banks Saving America

- JPMorgan: $5 billion deposit

- Bank of America: $5 billion deposit

- Citigroup: $5 billion deposit

- Wells Fargo: $5 billion deposit

- Goldman Sachs: $2.5 billion deposit

- Morgan Stanley: $2.5 billion deposit

- Bank of New York Mellon: $1 billion deposit

- State Street: $1 billion deposit

- US Bancorp: $1 billion deposit

- PNC Financial (PNC): $1 billion deposit

- Truist Financial (TFC): $1 billion deposit

These are the hero banks of America, the ones the government thinks are least likely to fail and is counting on to gobble up the corpses of the zombie banks about to die.

Assuming the same terms as JPMorgan got when it bought First Republic, and using Moody’s high-risk regional banking list, here is how much PNC and TFC could benefit in the coming zombie bank apocalypse.

PNC Bank Bailout Potential

| At Risk Bank | Loans | Buyout Price (5 cents on the Dollar) | Instant Profit | Instant Earnings Boost For PNC |

| Keybank | $195,191.0 | $9,759.6 | $2,382.6 | 45.0% |

| Huntington Bancshares | $188,441.0 | $9,422.1 | $2,300.2 | 43.4% |

| Comerica | $91,259.0 | $4,563.0 | $1,114.0 | 21.0% |

| Zions | $88,574.0 | $4,428.7 | $1,081.2 | 20.4% |

| Webster Financial | $74,793.0 | $3,739.7 | $913.0 | 17.2% |

| Western Alliance | $70,986.0 | $3,549.3 | $866.5 | 16.3% |

| Valley National Bancorp | $64,314.0 | $3,215.7 | $785.1 | 14.8% |

| PacWest | $44,255.0 | $2,212.8 | $540.2 | 10.2% |

| WesBanco | $17,237.0 | $861.9 | $210.4 | 4.0% |

| First Foundation | $13,586.0 | $679.3 | $165.8 | 3.1% |

| HomeStreet | $9,854.0 | $492.7 | $120.3 | 2.3% |

| Metropolitan Bank | $6,301.0 | $315.1 | $76.9 | 1.5% |

| Total | $864,791.0 | $43,239.6 | $10,556.1 | 199.2% |

(Source: Federal Reserve)

TFC Bank Bailout Potential

| At Risk Bank | Loans | Buyout Price (5 cents on the Dollar) | Instant Profit | Instant Earnings Boost For TFC |

| Keybank | $195,191.0 | $9,759.6 | $2,382.6 | 44.3% |

| Huntington Bancshares | $188,441.0 | $9,422.1 | $2,300.2 | 42.8% |

| Comerica | $91,259.0 | $4,563.0 | $1,114.0 | 20.7% |

| Zions | $88,574.0 | $4,428.7 | $1,081.2 | 20.1% |

| Webster Financial | $74,793.0 | $3,739.7 | $913.0 | 17.0% |

| Western Alliance | $70,986.0 | $3,549.3 | $866.5 | 16.1% |

| Valley National Bancorp | $64,314.0 | $3,215.7 | $785.1 | 14.6% |

| PacWest | $44,255.0 | $2,212.8 | $540.2 | 10.0% |

| WesBanco | $17,237.0 | $861.9 | $210.4 | 3.9% |

| First Foundation | $13,586.0 | $679.3 | $165.8 | 3.1% |

| HomeStreet | $9,854.0 | $492.7 | $120.3 | 2.2% |

| Metropolitan Bank | $6,301.0 | $315.1 | $76.9 | 1.4% |

| Total | $864,791.0 | $43,239.6 | $10,556.1 | 196.2% |

(Source: Federal Reserve)

Both banks could see massive, 2018-style (tax cuts) 40% earnings boosts! They won’t be able to buy all these banks, and not all might fail. But the point is that the potential to boost earnings by the equivalent of 5 to 10 years’ worth of normal growth, overnight, is what this recession is likely bringing.

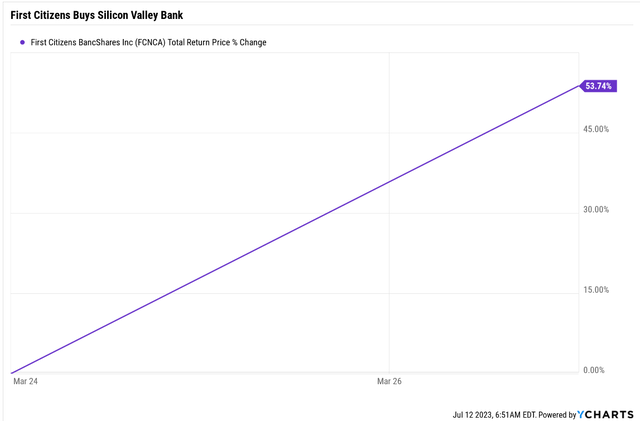

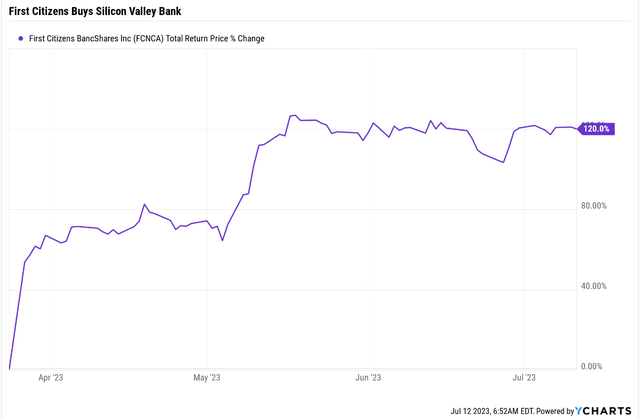

Here’s what happened when First Citizens bought Silicon Valley for pennies on the dollar.

YCharts

And that was just the day of the announcement.

YCharts

Now do you see why I love rescue banks? The A-rated super regionals priced almost zero or even negative growth?

But here’s the best part. PNC and TFC, while the best positioned to profit from the zombie bank apocalypse, are still wonderful investments even if there is no recession!

Heads You Make Money, Tails You Make Even More Money

I like to recommend Buffett-style “fat pitches.” These are blue-chip dividend opportunities with very low fundamental risk but massive upside.

In the case of PNC Financial and Truist, if there is no recession, then they will soar as their earnings will beat very low expectations.

If there is a recession, gobbling up zombie banks that fail, could result in even better earnings growth and a stock price that triples in the next two to three years.

PNC’s Best Rallies Off Bear Market Lows Since 1988

| Time Frame (Years) | Annual Returns | Total Returns |

| 1 | 174% | 174% |

| 3 | 60% (Renaissance Tech Medallion Fund Returns) | 312% |

| 5 | 33% (Peter Lynch Returns) | 317% |

| 7 | 35% (Peter Lynch Returns) | 718% |

| 10 | 29% (Peter Lynch Returns) | 1170% |

| 15 | 19% (Buffett Returns) | 1287% |

(Source: Portfolio Visualizer Premium)

Buying quality super-regional banks in recessionary bear markets is one of the easiest ways for regular income investors like you, to earn long-term returns on par-with the greatest investors in history.

Truist’s Best Returns from Bear Market Bottoms Since 1990

|

Time Frame (Years) |

Annual Returns |

Total Returns |

|

1 |

100% |

100% |

|

3 |

55% |

274% |

|

5 |

37% |

378% |

|

7 |

34% |

688% |

|

10 |

26% |

940% |

|

15 |

20% |

1420% |

(Source: Portfolio Visualizer Premium)

PNC Financial: The Lowest Risk Way To Profit From The Zombie Bank Apocalypse

Further Reading

- PNC Financial: Buy This 5% Yielding Blue-Chip Bargain Before Everyone Else Does

What Makes PNC A Potentially Great Buy

PNC… has grown substantially from acquisitions. The bank transformed itself with the integration of the troubled National City (doubling the size of PNC) in 2008, acquired RBC’s U.S. branch network in the Southeast in 2012, and more recently acquired BBVA USA in 2021 (a roughly 25% increase in size).

The successful acquisition history and improved credit performance during the 2007 downturn lead us to believe that PNC is one of the better operators we cover.” – Morningstar (emphasis added)

PNC is a master acquirer of other banks and is highly diversified. It’s basically a mini-JPM, just like TFC.

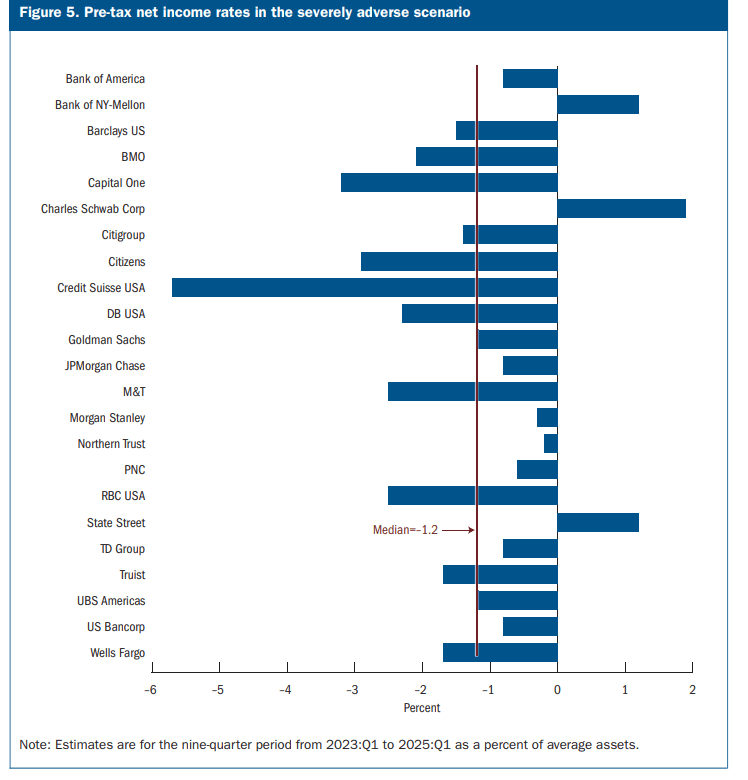

However, due to smaller investment banking (Harris Williams subsidiary) PNC suffered a lot lower losses than Truist in the Fed’s 2023 stress test doomsday scenario.

Federal Reserve

In fact, the net loan loss rate for PNC was almost 1/3rd of that of Truist.

| Bank | Risk-Weighted Assets (Billions) | Net Loan Losses | Net Loan Loss Rate |

| Toronto-Dominion Bank (US Operations) | $254.4 | $3.9 | 1.53% |

| US Bancorp | $496.5 | $5.5 | 1.11% |

| Truist Financial | $434.4 | $9.5 | 2.19% |

| PNC Financial | $435.5 | $3.6 | 0.83% |

| J.P Morgan Chase | $1,635.5 | $30.1 | 1.84% |

| 23 Largest US Banks | $10,089.8 | $190.4 | 1.89% |

(Source: Federal Reserve)

Fundamental Summary

- DK quality score: 77% medium risk 10/13 blue-chip

- DK safety score: 78% safe dividend (2.3% dividend cut risk in severe recession)

- Historical fair value: $189.39

- Current price: $127.23

- Discount to fair value: 33%

- DK rating: potential strong buy

- Yield: 4.9%

- Long-term growth consensus: 15.4%

- Consensus long-term return potential: 20.3%

Most likely those earnings estimates will come down over time, take a look at the short-term return potential for PNC even if it doesn’t buy any zombie banks.

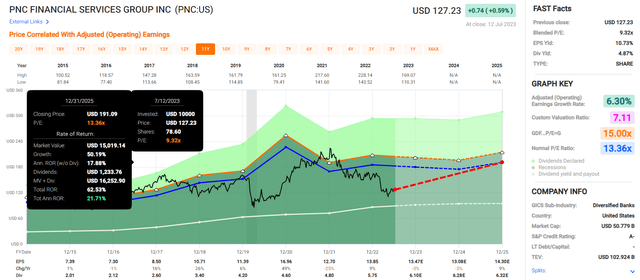

PNC 2025 Consensus Return Potential

FAST Graphs, FactSet

Buffett-like 22% annual returns through the end of 2025 could end up about 20% higher if PNC buys a large, failed bank.

- 40% annual return potential from buying out a large, failed bank

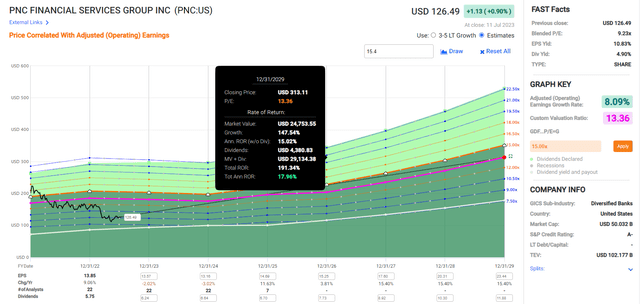

PNC 2029 Consensus Return Potential

FAST Graphs, FactSet

A potential triple in the next 5.5 years. That’s a 22% annual return potential through 2025 and 18% through 2029.

- 14% to 21% 5-year consensus total return potential range

And if PNC buys a large, failed bank, the total return potential through 2029 rises to about 240% return potential or 25% annually.

Truist Financial: The Best Blue-Chip Banking Deal On Wall Street

Further Reading

- Truist Financial: A 7% Yielding 53% Undervalued Blue-Chip With 250% Upside Potential

What Makes Truist A Potentially Great Buy

This A-rated bank has more exposure to investment banking and is highly concentrated in the South East.

However, that is a thriving part of the country, and Truist has done a great job historically managing its risks.

Truist was created by the $66 billion 2019 merger of Suntrust and BB&T but traces its roots to BB&T’s founding in 1872.

BB&T has survived and thrived through the following:

- 31 recessions

- eight depressions

- the Great Depression (when 30% of all US banks failed)

- seven killer Pandemics

- including the Spanish flu that wiped out 5% of humanity

- two world wars

- inflation as high as 22%

- interest rates as high as 20%

- over 27 bear markets

Truist is built to last and will likely outlive us all.

And guess what? Because of the higher (but still low) risks, TFC is a much better value than PNC, or USB, the safest super-regional banks.

TFC is trading at just over 7X earnings, and that’s after rallying from just 6X earnings in early May.

Do you know where its P/E bottomed in the Pandemic? The Great Recession? The two worse economic cataclysms since the Depression? 6X earnings!

TFC is reporting earnings on Thursday, July 20th. And as long as they report results that “suck less than feared,” this coiled spring could continue soaring.

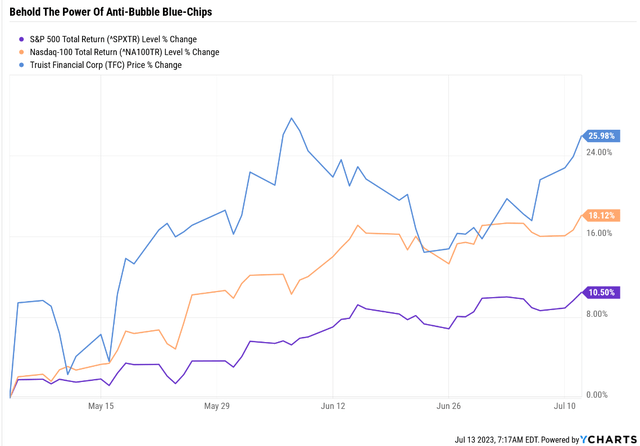

Ycharts

Investors who were “greedy when others are fearful” on TFC have seen short-term gains that have left even the Nasdaq in the dust.

The market was pricing in an apocalypse that isn’t coming. But in the expected recession, TFC is well positioned to make a $5 to $10 billion zombie bank buy and turn itself into an even stronger super regional bank.

And the Truist profit party is just getting started.

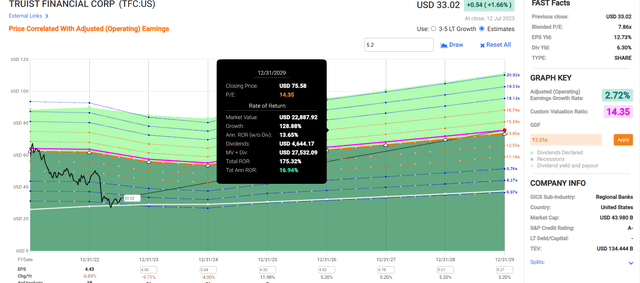

Fundamental Summary

- DK quality score: 63% medium risk 10/13 blue-chip

- DK safety score: 70% safe dividend (3.0% dividend cut risk in severe recession)

- Historical fair value: $62.94

- Current price: $33.02

- Discount to fair value: 48%

- DK rating: potential very strong buy

- Yield: 6.3%

- Long-term growth consensus: 5.2%

- Consensus long-term return potential: 11.5%

TFC isn’t quite as high quality as PNC, which is lower quality than Super SWAN USB. But it’s still an A-rated blue-chip super regional that will outlive us all;)

The long-term return potential is not as good as UBS or PNC but still a very solid 11.5%, slightly better than the dividend aristocrats and 15% better than the S&P 500.

But where TFC shines is value; it’s almost 50% undervalued!

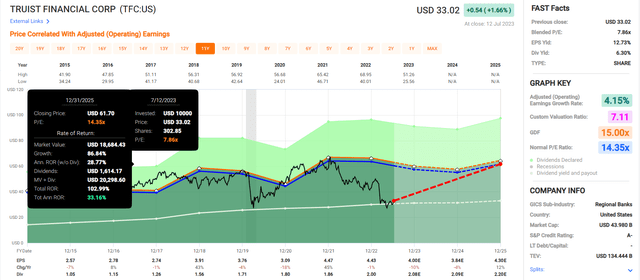

TFC 2025 Consensus Return Potential

FAST Graphs, FactSet

Potentially double your money in 1.5 years. That’s a Peter Lynch-like 33% annual return potential.

And if TFC buys a large, failed bank? Then that return jumps to almost 150% or an incredible 84% annual returns!

TFC 2029 Consensus Return Potential

FAST Graphs, FactSet

Truist has 175% upside potential over the next 5.5 years, and if it buys a large, failed bank? That soars to 215%, more than a triple.

- 23% annual return potential through the end of 2029 if TFC buys a large zombie bank

Once again, Buffett-like return potential from a blue-chip bargain hiding in plain sight.

Bottom Line: PNC And Truist Are Potential 5+% Yielding Blue-Chip Bargains That Could Triple In A Few Years

Imgflip

The market is going crazy, but you don’t have to.

The recession that is almost certainly coming next year, courtesy of the Fed’s crusade against inflation, is likely to cause the stock market to fall 25% to 30%.

It might set new highs before that happens, but the end result will be the same.

But that doesn’t mean you have to sell everything and hide in Robert Kiyosaki’s doomsday bunker.

Finbold Yahoo Finance Robert Rolih

John Hussman’s Most Memorable Doomsday Predictions

- 2010: “Investors dangerously underestimate the risk of an abrupt and possibly severe equity market plunge.”

- 2011: “The expected return/risk profile of the stock market has shifted to hard-negative.”

- 2012: “The present menu of investment opportunities continues to be among the worst in history.”

- 2013: “Stock returns prospectively are very low.”

- 2014: “What concerns us beyond valuations is the full ensemble of overvalued, overbought, overbullish conditions.”

- 2015: “Exit now.”

- 2016: “Current extremes imply 40-55 percent market losses…. These are not worst-case scenarios, but run-of-the-mill expectations.”

- 2017: “The most broadly overvalued moment in market history.”

- 2018: “The music is fading out, and a trap door has opened up in the floor, but they’re still dancing.”

- 2019: “A projected 50-65 percent market loss over the completion of this cycle is actually somewhat optimistic.” – Above The Market

The only difference between me and these hilarious permabears is that my facts and reasoning are right, and they will never tell you to buy any stock.

In contrast, I always highlight smart, safe, and prudent blue-chip investment ideas.

Today I’m pointing out that PNC and Truist are incredibly undervalued, 5+% yielding blue-chip bargains with incredible upside potential in the next few years.

They are potentially triples by 2029, and the zombie bank apocalypse offers both of them the chance to potentially turbocharger their earnings by as much as 45% overnight.

A-rated balance sheets, solid conservative banking practices, and generous, safe and steadily dividends growing dividends.

If there is no recession PNC and TFC are going to fly.

If there is a recession, they will likely gobble up zombie banks, as they always did in the past, and fly even higher when this recessions ends.

It’s a “tails you make money, heads you make even more money” opportunity.

One I don’t think you want to miss;)

In a market full of stupidity, here are two very smart options.

Imgflip

Read the full article here