Introduction

I am a big fan of stocks that fall in the growth/value hybrid category. Companies that are profitable with a wide moat, capable of returning cash to shareholders, and able to grow consistently. These stocks are, more often than not, compounders capable of beating the market on a consistent basis.

In the financial sector, it’s not always easy to find good compounders. Finance is a highly competitive, service-focused sector dominated by large banks and financial institutions.

Hence, I’m a fan of operators of stock exchanges and related services. One of these companies is Intercontinental Exchange (NYSE:ICE), the owner of NYSE with a market cap of roughly $66 billion.

This company is a top-tier compounder, which isn’t just doing well thanks to its dominance in stock exchanges, but also because it is increasingly leveraging its capabilities using new technologies and opportunities.

In this article, I want to shed some light on these developments, as I believe that ICE is one of the best compounders in its industry that money can buy.

So, let’s get to it!

What’s ICE?

Headquartered in Atlanta, Georgia, ICE is a leading provider of market infrastructure, data services, and technology solutions to a wide range of customers, including financial institutions, corporations, and government entities.

The company operates three segments.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Exchanges |

5,878 | 64.1 % | 6,415 | 66.6 % |

|

Fixed Income and Data Services |

1,883 | 20.5 % | 2,092 | 21.7 % |

|

Mortgage Technology |

1,407 | 15.3 % | 1,129 | 11.7 % |

Intercontinental Exchange

- Exchanges Segment ICE operates regulated marketplaces for trading and clearing various derivatives contracts and financial securities. Its trading venues include 13 regulated exchanges and six clearing houses strategically located in major market centers worldwide. These include the New York Stock Exchange.

- Fixed Income and Data Services Segment ICE’s Fixed Income and Data Services segment offers fixed income pricing, reference data, indices, analytics, execution services, global credit default swaps (“CDS”) clearing, and multi-asset class data delivery solutions.

- Mortgage Technology Segment ICE’s Mortgage Technology segment aims to address inefficiencies in the US residential mortgage market. It provides a technology platform that offers advanced digital workflow tools from application through closing and the secondary market.

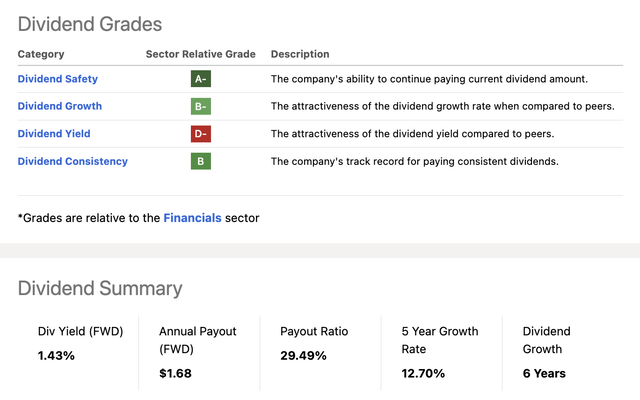

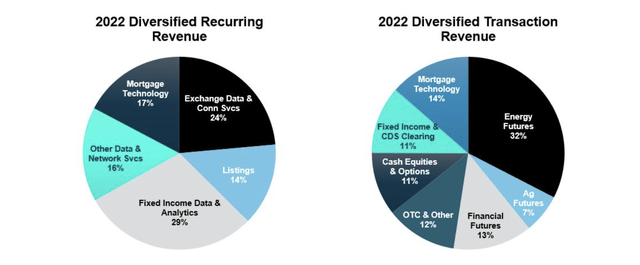

The company is consistently expanding its services through M&A, which explains why it yields just 1.4%. ICE is not a high-yielding financial stock but a company that is still aggressively expanding through both organic and inorganic growth measures.

Intercontinental Exchange

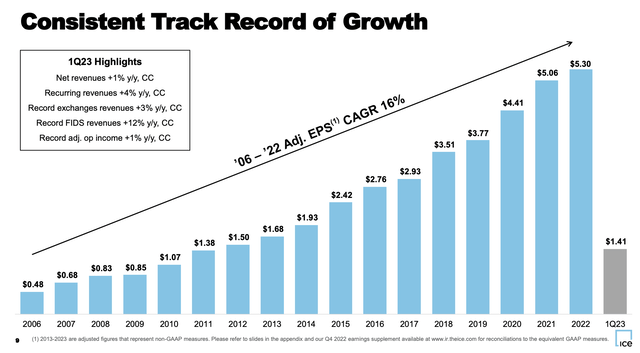

Having said that, ICE has a terrific track record of growth. Thanks to its transaction-focused business, it even did well during the Great Financial Crisis, which came with exploding volatility. Since 2006, the company has grown its adjusted earnings per share by 16% per year, which makes it one of the strongest performers in its sector.

Intercontinental Exchange

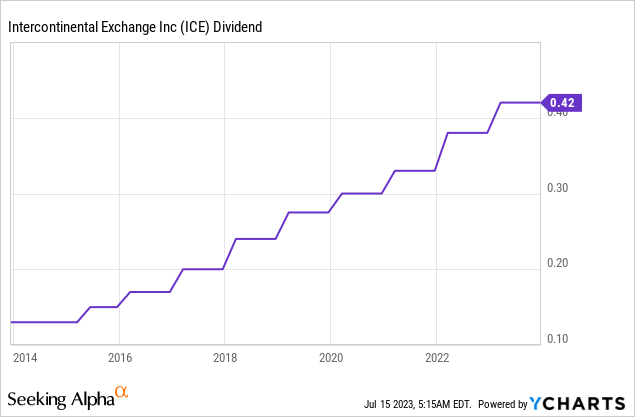

This also resulted in tremendous shareholder value.

Over the past five years, the average annual dividend growth rate was 12.7%.

The company has a sub-30% payout ratio and a yield of 1.4%. This yield is the only issue on its dividend scorecard, as its financial sector peers often have higher yields.

Seeking Alpha

While a 1.4% yield isn’t something to write home about, it’s a simple trade-off.

ICE comes with higher growth than most high-yielding stocks. Investors seeking a decent total return might benefit from buying ICE. Investors requiring income will be forced to buy a higher yield.

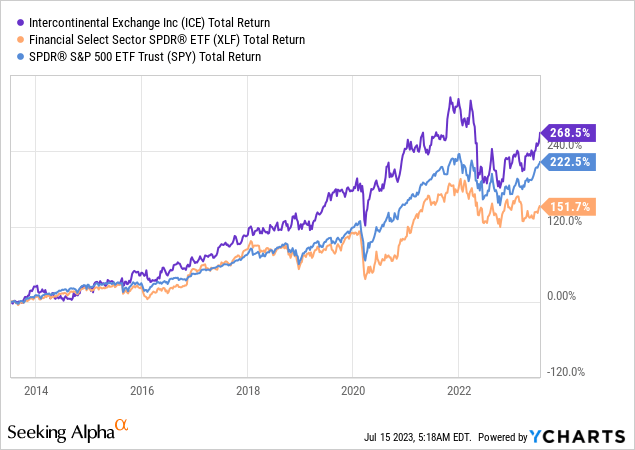

Looking at the past ten years, we see that ICE has returned roughly 270%, including dividends. This beats the S&P 500 by more than 40 points. It beats the financial sector by an even wider margin.

Having said that, ICE is now busy boosting its capabilities, which could result in a continuation of its impressive growth streak.

How ICE Is Optimizing Its Business

I own CME Group (CME), which is a competitor of ICE. What fascinates me about businesses like CME and ICE is their ability to use existing capabilities and leverage these into other products and services.

Intercontinental Exchange

Both CME and ICE are now far more than just companies that benefit when a trader buys or sells a futures contract, stock, or similar product.

During this year’s Bernstein Annual Strategic Decisions Conference, ICE elaborated on its strategy and plans to take its business to the next level.

Essentially, the goal is to create an all-weather stock that can grow in any economic climate. The company believes it has the tools and flexibility to navigate high or low-interest rate environments and even recessions. I agree with that.

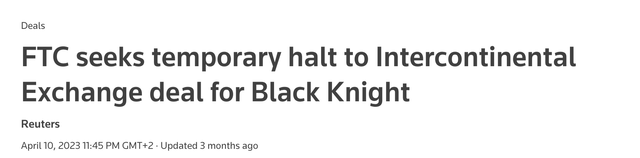

A big part of its business strategy is M&A – including the disposition of businesses that are not doing too well. For example, the pending acquisition of Black Knight (BKI) to enhance its mortgage business is not going smoothly. In general, the company believes that M&A challenges are growing – not just in the US. While I’m making assumptions here, I believe that this will shift the focus to organic growth – wherever possible.

Reuters

Furthermore, ICE’s energy business has experienced challenges in recent years, including issues in Russia and Europe. However, the company remains optimistic about the outlook for the energy market.

ICE, which owns the famous Brent crude oil futures, has expanded its portfolio of tradable assets in the energy space to reflect the global energy transition away from petroleum products.

The company sees growth opportunities in energy transition products, such as renewable energy, carbon emissions, and environmental products.

While it’s not renewable, this also includes successful benchmarking of liquid natural gas products like Northwest LNG contracts.

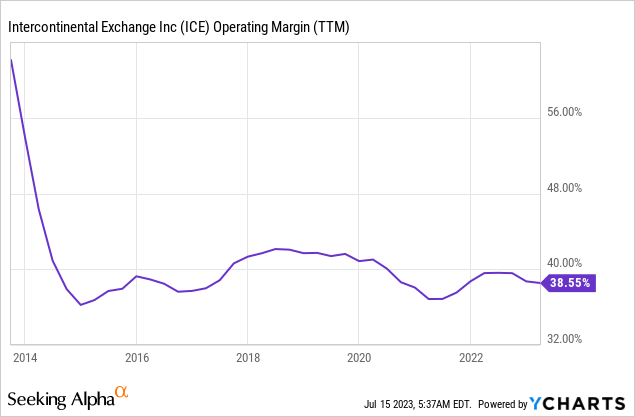

With regard to inflation, ICE has recently taken pricing actions to protect its margins. Historically, the company did not consider adjusting prices, especially during a long period of subdued interest rates and inflation.

However, with their own costs increasing, ICE has started to raise prices modestly. The feedback received so far has been limited, as these price increases have had minimal impact on customers.

Having said that, ICE is also working on bigger things. This includes optimizing its mortgage business.

During the aforementioned Bernstein conference, the company mentioned that it has been lobbying and working on changing laws at the state level to enable digitized mortgages.

Only a small percentage of mortgages in the US have gone through a digital note process, which presents a significant opportunity for innovation.

Hence, ICE has developed a digital note and collaborates with Fannie Mae and Freddie Mac, as well as early adopter lenders, to streamline the mortgage process.

Intercontinental Exchange

Essentially, the goal is to provide software that can underwrite a mortgage while the borrower is filling out the application, reducing the 60-day processing time and improving efficiency.

ICE believes there is a big need to standardize the mortgage process, as thousands of lenders have developed their own systems and software, resulting in unnecessary complexity.

By standardizing the process, around 80% of borrowers could be put into a standardized product with digitized information readily available to decision-makers.

ICE aims to convince large banks with legacy systems that standardizing the mortgage process is feasible and beneficial.

Even better, the company is starting to link its mortgage business to its exchange business through initiatives like Rate Lock futures. These futures provide real-time information on interest rates for mortgages, enabling consumers and lenders to make more informed decisions.

But wait, there’s more.

ICE aims to standardize the cash market for consumer debt, similar to what has been achieved in the corporate debt market. By providing more transparency and innovation in the consumer debt space, ICE believes there is significant growth potential.

ICE foresees the creation of more targeted and specific interest rate products for consumer debt, similar to the differentiation seen in the energy market.

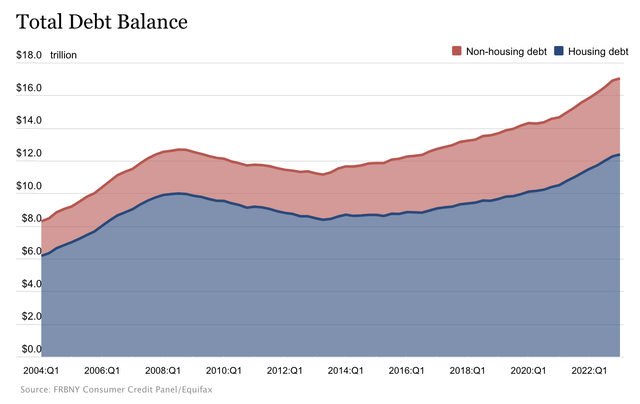

I believe there’s definitely a market for it. Not only is the non-housing consumer debt market huge, but it also comes with the need to hedge risks for operators in the industry.

Federal Reserve Bank of New York

Additionally, when it comes to managing its data, ICE has chosen not to form strategic partnerships with cloud providers, taking a cloud-agnostic approach.

The company runs its own extensive data center infrastructure and allows customers to connect their cloud provider to ICE’s network.

The company has concerns about the escalating costs of cloud services, the lack of control over those costs, and the contractual relationships with cloud providers.

ICE prefers to maintain control over costs and avoid potential copyright and revenue model issues associated with cloud-based AI services.

Valuation

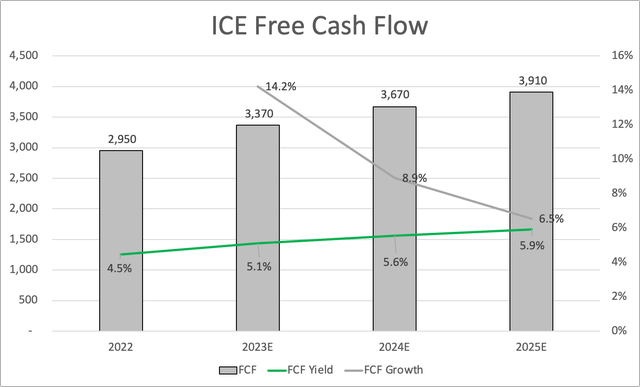

ICE is in a terrific position to boost shareholder returns, as analysts expect the company to consistently grow free cash flow to almost $4.0 billion in 2025. That would imply a free cash flow yield of roughly 6%.

Leo Nelissen

The company has a 2.8x 2024E net leverage ratio and an A- credit rating, which means there is plenty of financial room to boost shareholder returns down the road.

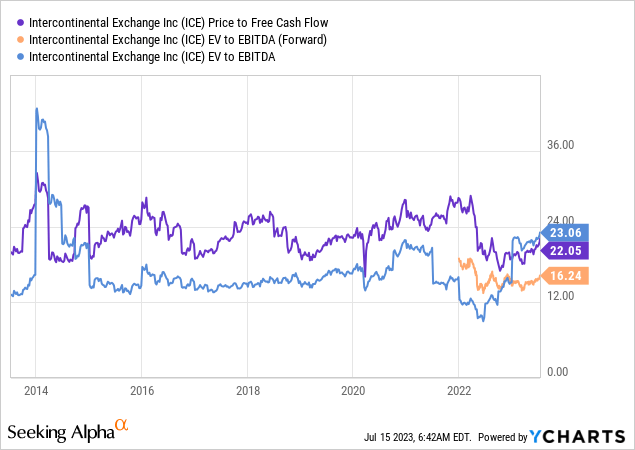

It also means that the company is trading at 18x next year’s expected free cash flow.

While I’m using next year’s estimates, I believe that’s a good deal. The company usually trades close to 24x free cash flow. The same goes for the forward EV/EBITDA ratio.

Based on everything discussed in this article so far, I believe that ICE shares are about 33% below their fair value.

This would put my target price at roughly $155, which is one of the highest.

However, I do not believe that ICE will continue its current uptrend without hiccups. The recent stock price rally was massive, while economic challenges persist. As most readers might know, I’m still in the camp of people who believe that inflation hasn’t been defeated.

Current developments, especially the weaker dollar, make it very likely that inflation will turn out to be more sticky than initially expected.

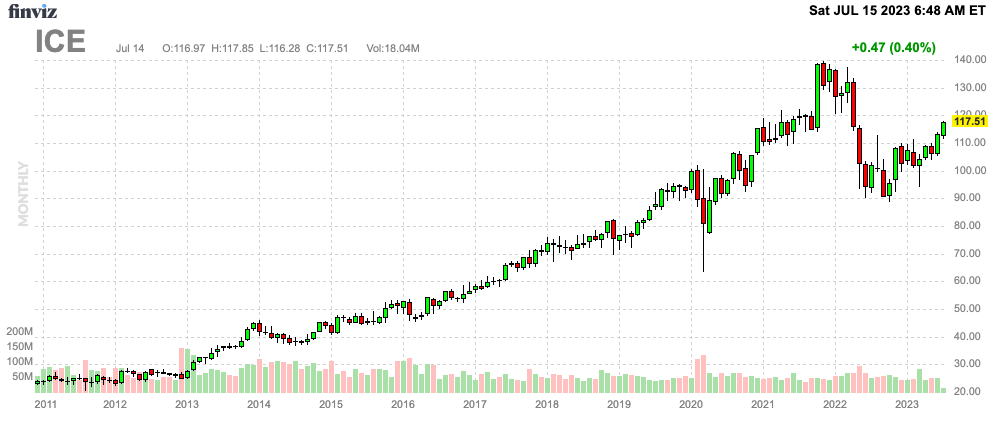

FINVIZ

So, if people are interested in ICE, I would recommend building a position on potential stock price weakness down the road.

Takeaway

Intercontinental Exchange stands out as a top-tier compounder in the financial sector. With a dominant position in stock exchanges and a focus on leveraging new technologies, ICE has consistently outperformed the market.

The company’s growth track record and impressive dividend growth rate showcase its ability to create shareholder value. By expanding its services through strategic acquisitions and organic growth, ICE is optimizing its business and adapting to changing market dynamics.

From enhancing its mortgage technology segment to exploring opportunities in energy transition products, ICE is poised for continued growth.

I believe ICE shares are attractively valued.

Read the full article here