Since our last update, “Euronext Continues To Deleverage,” the company stock price declined by an additional 10% (OTCPK:EUXTF). Today, we are not providing a buy case recap; however, we would like to focus on a few positive, positive catalysts that might drive Euronext re-rating over the medium-term horizon. Before going into detail, we should report that the company has done a relevant job diversifying and growing its business over the last decade. Indeed, thanks to organic initiatives and inorganic acquisitions, the company exponentially increased its top-line sales since its Initial Public Offering in 2014. Revenue is three times higher now, and cash trading (Euronext variable revenue generation) as a percentage of the total company’s sales declined to 18% compared to 36% in 2014. Despite that, the cash and post-trading activities result in lower revenue growth generation versus its direct competitors. And they are also volatile; this is one of the reasons why the company’s structural growth is currently lower than other European stock exchanges (London Stock Exchange Group plc and Deutsche Börse – both covered by Mare Evidence Lab). However, despite forecasting another quarter of negative growth for Q2, we believe a few positive catalysts will likely drive a stock re-pricing. The Allfunds offer caused confusion, but we think it was a wake-up call for future M&A with less leverage with new targets with accretive EPS and ROIC above WACC. Even if no transactions happen in the short-medium time horizon, Euronext could deliver above shareholders’ capital generation, increasing dividends while deleveraging. Here at the Lab, we won’t be surprised by a buyback announcement.

Mare Past Analysis

Before moving on with our Q2 preview, there are relevant factors that go in line with our buy rating:

-

Globally, in H1 2023, there were 615 IPOs with collections of $60.9 billion. According to EY, transaction numbers and capital raised declined by 5% and 36% on a yearly basis, respectively. On a quarterly basis, Q2 shows a gradual recovery. Restrictive monetary policies, market volatility, and other unfavorable conditions also characterized the second quarter. However, IPO in some emerging markets are increasing, with the technology sector that maintains leadership. A positive surprise was the Italian case. Italy goes against this negative trend, with growth in the number of IPOs (+25%) and capital raised collection, which achieved a plus 12%. Sixteen transactions were finalized in H1 with four listings on the main Euronext market (EuroGroup Laminations €393m, Lottomatica €600m, Italian Design Brands €70m, Ferretti Yacht: €265m) and allowed the company to become the tenth market in terms of capital raised in the period with an IPO cumulative market cap of over €1.5 billion. On a negative note, but already implied in our numbers, are the companies’ delistings. This involved seven companies with a cumulative market capitalization of €1 billion. To sum up, in our numbers, we are pricing a positive delta of plus €500 million, which is negligible given the total market cap of companies on the Euronext stock exchange, which is circa €5.40 trillion. Despite that, it might be seen as a positive sign for Wall Street analyst’s sentiment;

- In a previous publication released in Sept. 2022 called “We Are Still Positive,” we detailed a positive framework from the EU legislators. In addition, we also emphasized how the Italian regulators were proactively working to streamline IPO admin costs and simplify IPO listing rules. Today, there is support from other countries to unify rule across the European region. There are tax haven countries within the area, such as Ireland, Luxembourg, and the Netherlands, where companies have better fiscal and bureaucratic conditions. The EU does not enjoy the financial uniqueness that NYSE and NASDAQ have. To safeguard Euronext, which the Italian and French Governments also own, the EU Antitrust President was clear that there would be rules to prevent differentiated treatment applied in other countries. This is key to Euronext re-rating given the fact that the EU is the world’s wealthiest continent, where only 9.8% of the world’s population resides but accounts for 50% of the total global wealth;

- Last month, Euronext signed an agreement to sell the 11.1% stake in LCH SA, a French clearing house, to the London Stock Exchange Group for a disclosed amount of €111 million. This transaction is expected to take place in early July. At an accounting level, in 2023 Q3, Euronext will record a capital gain of around €40 million pre-tax, given that LCH’s book value was at €70.6 million at 2022 year-end. Again, this will help the company’s deleveraging plan. This disposal increases our 2023 forecast EPS estimates by 2%.

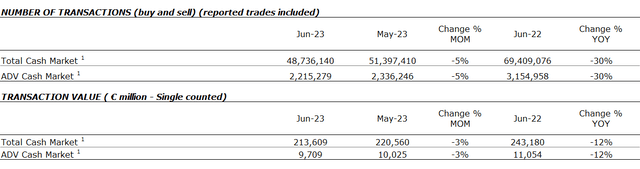

Looking ahead to Q2, we expect lower volumes given the negative currency effect on a weaker NOK and lower trading volumes. While trading revenues significantly decreased in Q1, signing a minus 15% on a yearly basis, we forecast a minus 6% in Q2. We are also lowering our estimates for Q3 and Q4 by 2%. This is supported by the latest data released on a monthly basis by Euronext.

Euronext Latest Month Volumes

Source: Euronext Stats

Considering a positive EPS implication on LCH stake disposal, our overall EPS impact signed a minus 3% in 2023. Our estimates, including the cash flow generation, arrived at a debt of €1.7 billion at year-end. Without additional M&A, our two-year forecast on financial debt, decreased to €835 million with net debt on adj. EBITDA at 1x. Currently, the company is inexpensive compared to history and closest peers (by approximately 40%). Thanks to the company’s 2024 strategy, they forecast a 3-4% organic revenue growth generation with a 5-6% organic EBITDA in the period, thanks to Borsa Italiana consolidation. Here at the Lab, we believe that it offers an attractive valuation. Volume pressure will ease on a quarterly basis, and even valuing the company with a P/E of 15x (still applying a 25% discount vs. peers), we derive a valuation of €85 per share. On average, the main competitors (DB1, LSEG, ICE, and Nasdaq) are trading at 19x. In addition, the Euronext FCF yield is at 8% and well covers the current dividend yield. This adds a margin of safety in evaluating buying additional company shares.

Risks to our buy rating includes lower trading volumes, significant non-accretive acquisitions and potential integration problems, lower volatility & activities in financial markets, and regulatory changes.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here