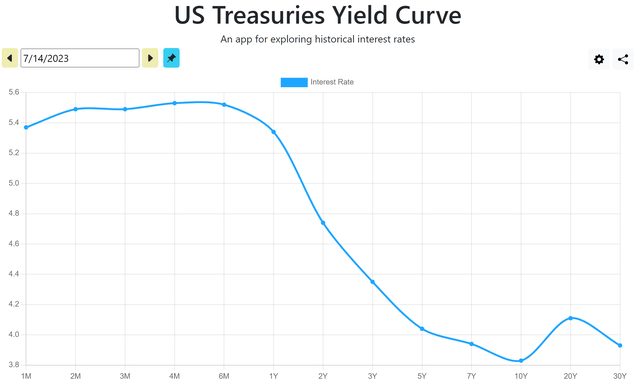

Due to the Federal Reserve’s tightening of monetary policy, interest rate risk has become a serious concern for the economy and the bond market as the cost of capital rises. The yield curve inversion has reflected recession risk is on the horizon.

However, due to the level of the Fed funds rate, it does provide some decent opportunities on the short end and ultra short end of the yield curve. As of the current yield curve, you get more money from a 1 to 6-month treasury than you do from a 10-year treasury. Whether or not there will be a soft landing or hard landing, you’ll still get paid for holding this position. Keep in mind that historically, Treasury bonds have provided investors with a safe haven over many market cycles. Given the extremely low risk of a U.S. government default as well as the fact that the U.S. Treasury Department is backing these bonds with its full faith and credit rating, U.S. Treasuries are typically regarded as the safest investment on the market.

Treasury Yield Curve (US Treasury Yield Curve)

Making Cash Work Harder

The goal of every investor is to make every single dollar of your portfolio work hard for you. While chasing after higher returns, it also pays to have good cash management strategies to help improve overall portfolio performance. Every investor will tend to hold a cash allocation set aside as dry powder. However, if you are holding excess cash in your brokerage account right now, this cash allocation could be generating better returns without sacrificing the safety of sitting and waiting for opportunities in cash.

What you should be doing instead is either buy Treasury Bills yourself or put it in a money market fund or T-Bill fund.

Inverted Yield Curve Opportunity

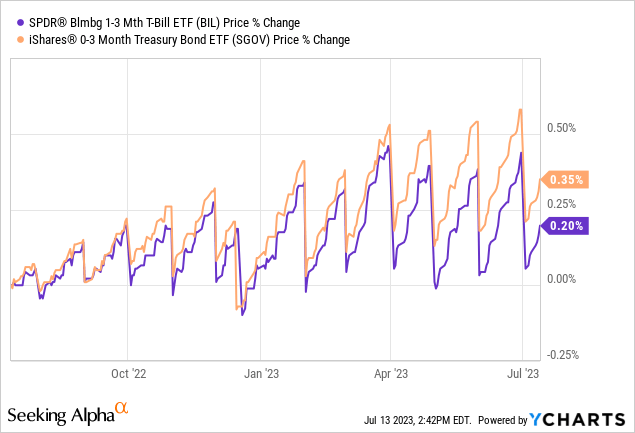

Given the attractiveness of 1-6 month short-term yields right now, I highly recommend SPDR Bloomberg 1-3 Month T-Bill ETF (NYSEARCA:NYSEARCA:BIL) and iShares 0-3 Month Treasury Bond ETF (NYSEARCA:NYSEARCA:SGOV). BIL invests in T-Bills with 1-3 month remaining maturities, while SGOV invests in T-bills with 0-3 month remaining maturities. The obvious difference is that 0-1 month bucket that BIL does not have.

Both ETFs are an excellent place to temporarily park cash and earning a better interest than what your cash sitting in your brokerage account is getting. I think this is something a lot of investors, especially new ones, are used to. We’ve been in a low interest rate environment for far too long to see this kind of yields at the short end of the yield curve. Today, you can get nearly a 5% dividend yield from an essentially risk-free investment in T-bills.

Both ETFs make consistent monthly dividend distributions to shareholders unlike T-bills, which only pay out at maturity. However, one key advantage of using a T-Bill ETF is that if one can liquidate the position to take on other opportunities. As you can see both prices of BIL and SGOV move in a rather predictable manner due to the anticipation of the distribution to be collected, thus making it easy to liquidate any time when needed. (If you are wondering why the prices of both ETFs move in that zigzag manner, it is due to the dividend paid out.)

Key Difference

However, one key difference between SGOV and BIL is the expense ratio.

At the moment, SGOV has an net expense ratio of 0.07% vs. BIL’s expense ratio of 0.1354%. However, that difference is primarily due to a fee waiver that BlackRock has agreed to waive until June 30, 2024. If not, it’ll be almost the exact expense ratio.

Nevertheless, until that waiver expires, that is a huge difference for the T-bill space, and it reflects in the yield return of the ETFs.

Conclusion

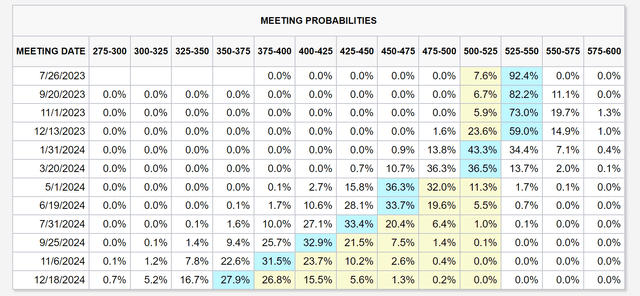

Considering that the market’s expectations that the peak in the federal funds rate is almost at current levels (with 1 or 2 more hikes to be expected) and that Powell is expected is to hold rates at higher for longer, it’ll be wise to put your excess cash in your bank and brokerage account to work and milk the high yields given to you thanks to the Federal Reserve.

CME Federal Funds Rate Expectations (CME FedWatch)

Both SGOV and BIL ETFs provide investors with a safe tool for short-term investing, capital preservation, and more importantly, liquidity. It offers the potential for generating income while minimizing the risks associated with other investments. However, as always, investors should carefully consider their financial goals and if needed, with their financial advisor before allocating funds.

Read the full article here