With the Supreme Court striking down President Joe Biden’s student loan forgiveness plan, there is much debate about the merits of a 4-year college degree compared to the cost. Is it worth it to be debt-ridden for the next 10 to 20 years for the sake of bragging rights? Does a 4-year degree actually make financial sense?

The answer is a resounding yes, and here’s why.

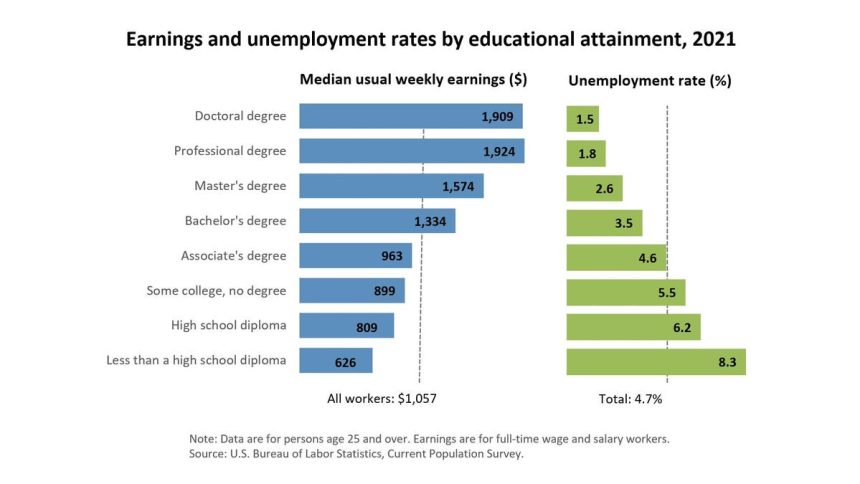

First, having a 4-year degree provides you with higher earning potential. The chart below shows average earnings based on education level.

As you can see, there is a $27,000 annual salary difference between a person with a bachelor’s degree and someone with a high school diploma. But does this increased income offset the debt incurred?

The average student loan debt for college graduates in 2020-21 was $29,100. Federal student loans have an average interest rate of 5%. The average monthly student loan payment is $503 per month and the average borrower takes 20 years to pay off a loan. At the end of the 20 years, the average borrower would have paid $16,991 in interest, totaling $46,091 in student loan debt. Over 20 years, the individual with a 4-year degree is in the green by $493,909 ($540,000 minus $46,091).

Next, having a 4-year degree offers better job security. During economic downturns or recessions, individuals with higher education levels show lower unemployment rates and are more likely to retain their positions or find new opportunities in a challenging job market.

The chart below shows that higher education directly aligns with lower unemployment rates. Moreover, it shows that in tough economic times like April 2020 when unemployment peaked, those with 4-year degrees experienced approximately 9% less unemployment than high school graduates.

In today’s competitive job market, many employers prefer candidates with a college education. Not holding a bachelor’s degree can limit available job options and be an obstacle to securing well-paying positions, thus putting you at higher risk for unemployment or financial instability.

A 4-year degree can also open doors to career advancement and promotion. Many professional roles and leadership positions require a bachelor’s degree as a minimum qualification. When asked if education or experience is the dominating factor when promoting individuals, a survey conducted by the Association of American Colleges and Universities shows most employers value higher education.

The advantages gained with a college education are more than financial or professional. Many employers offer additional benefits and perks to employees with a bachelor’s degree. According to a paper published by the Center & School of Economics at University of Maine, degree holders are 47% more likely to have health insurance provided through their job, and their employers contribute 74% more to their health coverage.

In the same paper, they found life expectancy is also longer for those who attend college. Studies suggest that those who have attended at least some college can expect to live seven years longer than their peers with no postsecondary education. The reasons behind this include higher healthcare coverage, retirement plans, paid time off, and other incentives that contribute to overall financial and physical well-being.

Investing in education and obtaining a 4-year degree is one of the best ways to invest in your future. Over the course of your career, the higher earning potential and career advancement opportunities that come with a degree can contribute to greater financial stability, increased savings, and improved quality of life.

Read the full article here