For those of you who happened to buy a plane ticket in the past month, you may have noticed a welcome change in price. Airfare was down a good amount in June compared to the same month in 2022 (-18.9%) and compared to May (-8.1%), according to last week’s consumer price index (CPI) data. Declining jet fuel costs were the largest contributor to lower fares.

Although this benefits consumers, especially during the busy summer travel months, investors may be wondering: Will airlines generate less revenue as a result? Not so fast.

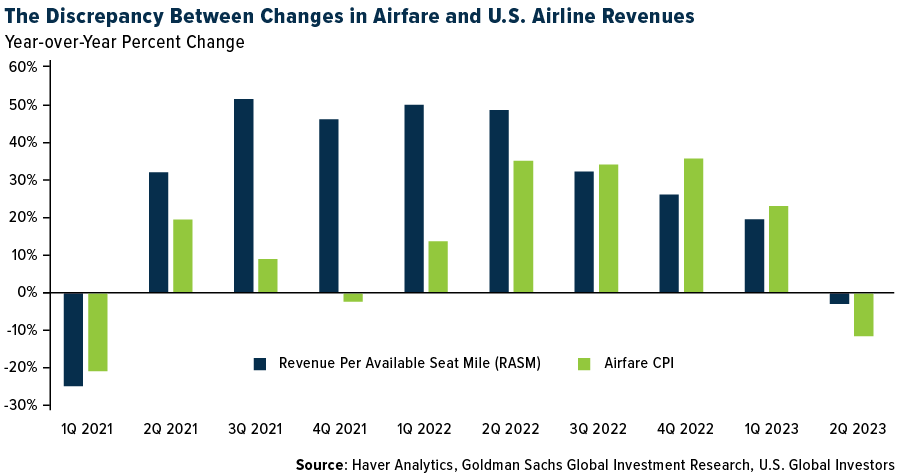

In a letter out last week, Goldman Sachs reports that there doesn’t appear to be a meaningful relationship between airfare CPI and U.S. airlines’ revenue per available seat mile (RASM). Investors, therefore, need not worry—at least not about falling ticket prices.

Check out the chart below. It compares annual percent changes in airfare and airline revenue per seat. Goldman found that there isn’t a strong link between the two, meaning that just because ticket prices are dropping, it doesn’t necessarily mean that carriers are making less money. The bank estimates that second-quarter RASM was off 3% compared to last year’s quarter, but that’s a far cry from how much fares fell during the same period.

U.S. Global Investors

Discrepancies Between CPI And RASM In The Airline Industry

So why the discrepancy? The Goldman report doesn’t provide many insights, but I think I can offer a couple.

For one, the Bureau of Labor Statistics (BLS), which issues the monthly CPI, and the airlines are measuring two separate things. The CPI measures the average change in prices paid by urban consumers for air travel over time (though I’ve raised questions about the methodology many times in the past, most recently here). On the other hand, RASM is an airline industry metric that measures an airline’s operating earnings per seat per mile flown—its efficiency, in other words.

The bigger reason for the discrepancy, as I see it, is revenue composition. As I’ve shared with you many times before, airlines make money in many more ways than simply selling tickets. Ancillary revenues, including fees for non-ticket items like extra luggage, seat selection and onboard food, play an increasingly important role in an airline’s total revenue. Baggage fees alone generated a whopping $29 billion for carriers around the world in 2022, according to IdeaWorks.

None of these fees are captured in the airfare CPI, but they surely contribute to RASM.

Other things the CPI appears to get wrong about airfare? It excludes business travel, even though this form of travel involves higher fares than leisure travel due to last-minute bookings, changes, cancellations and added services. The CPI also gathers ticketing data from the Department of Transportation (DOT), which includes only about 10% of tickets sold. Airlines, by comparison, have access to 100% of the data, so they have a much fuller and more accurate understanding of airfare trends.

Delta Reports Record Quarterly Earnings And Profitability

If you need additional proof that lower airfares don’t necessarily impact earnings, look no further than Delta Air Lines. Last week, the carrier reported record earnings and profits in the June quarter on booming travel demand and cheaper fuel, and it gave investors a heads-up to expect another quarter of record revenue in September. Delta raised its 2023 full-year earnings per share (EPS) guidance to between $6 and $7, up substantially from earlier estimates of between $5 and $6 per share.

United Airlines and American Airlines, both scheduled to report next week, are also forecast to have their best quarterly EPS since 2019.

The earnings boom has helped airline stocks soar in 2023. Investor’s Business Daily (IBD) said last week that the 19 companies in its Transportation-Airline industry group have increased nearly 50% so far this year, making them the eighth-best-performing industry in 2023 among 197 that the publication tracks.

Gearing Up For Growth

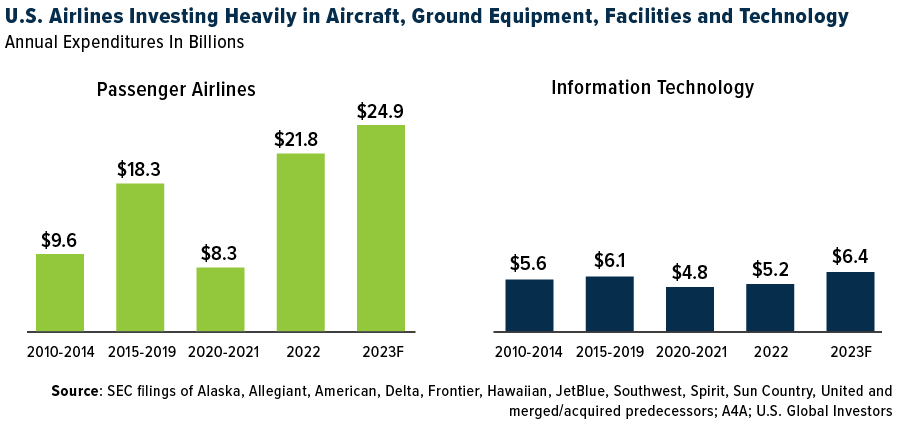

Another sign that airlines are bracing for future growth is the incredible amount they’re investing in aircraft, ground equipment, facilities, technologies and other expenditures. In the U.S. alone, airlines are expected to spend nearly $25 billion this year on passenger aircraft and close to $6.5 billion on information technology (IT), which would be a record high in both cases, according to the latest report by Airlines for America (A4A).

U.S. Global Investors

In June, Boeing delivered 60 new aircraft, its highest since March, despite lagging behind its European rival Airbus, which delivered 72 aircraft in June, for a total of 316 planes so far this year. Boeing’s notable orders included 40 787 Dreamliners for the new Saudi carrier Riyadh Air, confirmed at last month’s Paris Air Show.

Airbus has a substantial backlog of almost 8,000 aircraft, predominantly single-aisle jets like the A320neo and A321neo. This backlog represents about eight years of production. The manufacturer also booked orders for 902 aircraft, primarily from Air India and IndiGo, accounting for over 70% of its order book.

Meanwhile, here in the U.S., Southwest Airlines plans a $450 million expansion at Houston’s William P. Hobby Airport, adding seven new gates operational by 2026 (six exclusively for Southwest), additional baggage carousels and restroom upgrades. This move facilitates growth in Texas, where Southwest’s Dallas Love Field operations are capped at 20 gates.

Read the full article here