Covered call strategies have not been a winning portfolio play so far in 2023. With steady stock market gains and declining volatility, simply owning an index outright through a low-cost ETF has been the way to go. And right now, with the VIX in the low to mid-teens, it is hard to get much added income selling options. Could that be about to change, though? We are entering that time of year when volatility can kick up.

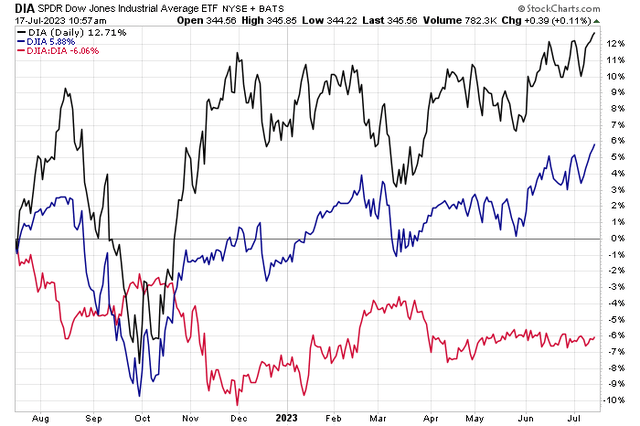

For now, though, I merely have a hold rating on the Global X Dow 30 Covered Call ETF (NYSEARCA:DJIA). I see some signs of exhaustion on the chart of the Dow 30, but implied volatility is just so low that the income yield from writing calls is modest. Notice in the total return performance chart below that the SPDR Dow Jones Industrial Average ETF Trust (DIA) has easily beaten DJIA over the last year, though the two have performed about in line over the past three months.

1-Year Total Returns: DJIA Loses Ground to DIA

Stockcharts.com

For background, DJIA seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility, according to the issuer. The ETF expects to make distributions on a monthly basis while the perceived benefit to investors is that the fund writes call options on the Dow Jones Industrial Average, saving investors the time and potential expense of doing so individually.

DJIA is a somewhat new product, with shares beginning to trade back in February of last year. You’re going to pay about half a percentage point more for DJIA compared to owning just the index ETF – its total expense ratio is 0.60% as of July 14, 2023. Holding 30 stocks and derivatives packages, it is not all that liquid considering the 30-day median bid/ask spread is high at 0.32%, per Global X. The distribution yield is about 5.4% over the last 12 months and total assets under management sums to $77.7 million.

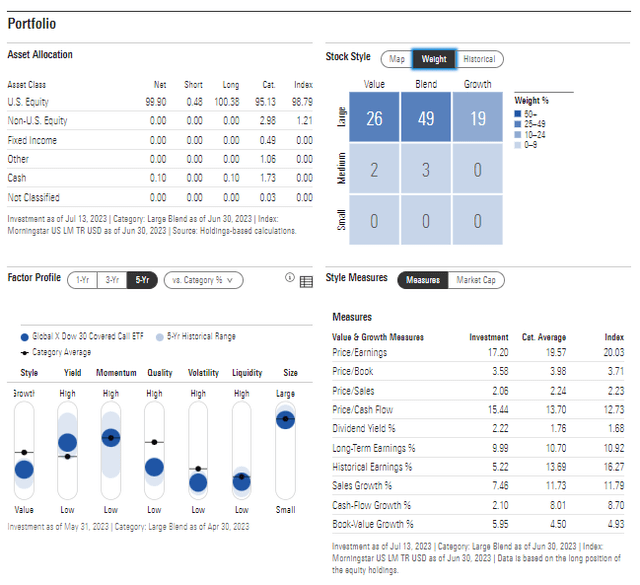

Digging into the portfolio, data from Morningstar reveal that the equities in DJIA are large-cap in nature with just 5% considered mid-cap. What is different about the Dow 30 as opposed to the S&P 500 is that the former is more oriented toward the value style whereas the latter is growth-heavy, as you can see in the Style Box below. The equities’ weighted-average price-to-earnings ratio on a 2022 basis is reasonable at 16.0 and DJIA’s equity beta is quite low at just 0.52 while its standard deviation is modest at 13.8%.

DJIA Portfolio & Factor Profiles

Morningstar

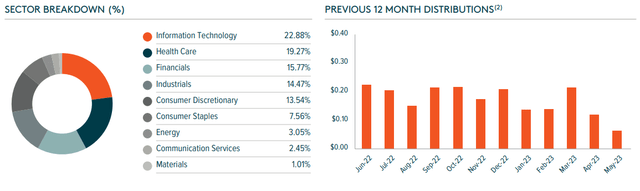

DJIA holds a high amount in the Information Technology sector, but it is still underweight compared to the SPX. Also notice how the monthly distribution rate has been declining lately as volatility in the market has run softer. Less bang for your Dow-30 buck, it appears.

DJIA: Monthly Distributions Turning Lower

Global X

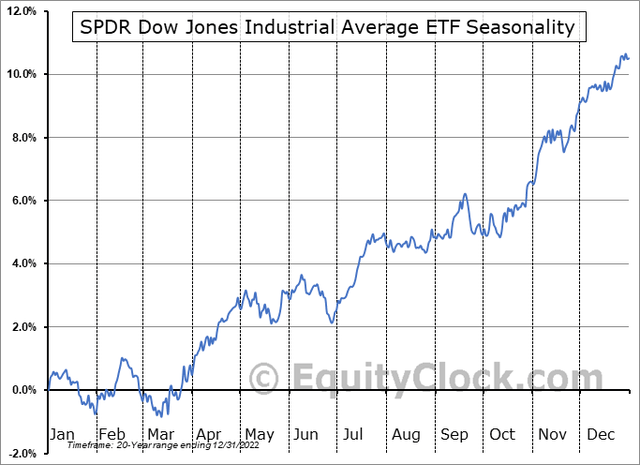

Seasonally, the Dow Jones Industrial Average itself tends to consolidate from late July through early in the fourth quarter, according to performance data trends from Equity Clock. This is a time notorious for volatility and corrections, so it could be an opportunity to sell upside calls on the index once volatility rises (and option prices increase), so be on the lookout for a timely entry into DJIA over the coming weeks should a stock market dip materialize.

DIA Seasonality: Sideways Action Through Early October

Equity Clock

The Technical Take

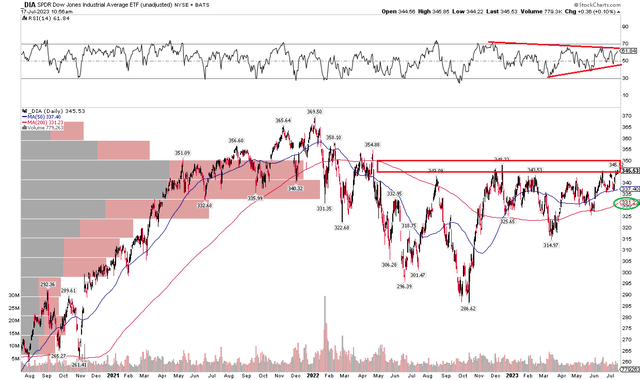

So I went with an analysis of the DIA Dow 30 ETF to determine a technical view on DJIA. Notice in the chart below that DIA has encountered a resistance zone from $343 to $348. I think we could see a pause here as we enter a tougher stretch on the calendar, historically speaking. Also, the RSI momentum gauge at the top of the graph shows a consolidation, that tells me an eventual breakdown or breakout will be all the more important to determine where DIA’s price goes. But with a rising long-term 200-day moving average, the bulls appear to have the reins here. Furthering my assertion for a meandering DIA share price has high volume by price as seen on the left side of the chart; there is much congestion at current levels.

All that together, a covered call strategy (like DJIA) makes sense, but volatility is just so low that it is hard to compensate for deviating much from DIA itself. For now, I am a hold technically.

DIA: Holding Below Resistance, Momentum Coiling

Stockcharts.com

The Bottom Line

DJIA’s elevated expense ratio and overall trends in the Dow 30 itself make me hesitant to issue a buy rating on the DJIA right now. If we see a tick-up in implied volatility to, say, 18%, that would be a more favorable time to sell calls and collect a bigger premium yield.

Read the full article here