Evolution Petroleum (NYSE:EPM) is a solid play on a natural gas price rebound, while offering a nice yield and well-covered dividend.

Company Profile

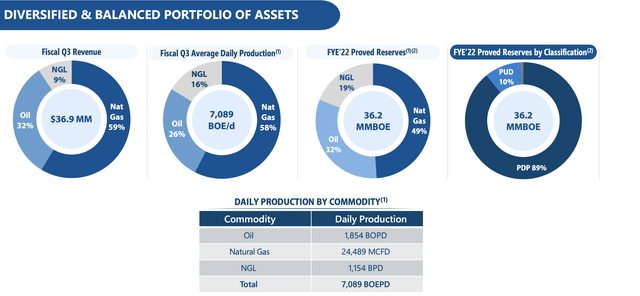

EPM is an energy company that owns non-operated interests in several oil and natural basins. For fiscal Q3, ended March, 59% of its revenue came from natural gas, 32% oil, and 9% NGLs. Its production meanwhile, was 58% natural gas, 26% oil, and 16% NGLs. Proved reserves were 49% natural gas, 32% oil, and 19% NGLs.

Company Presentation

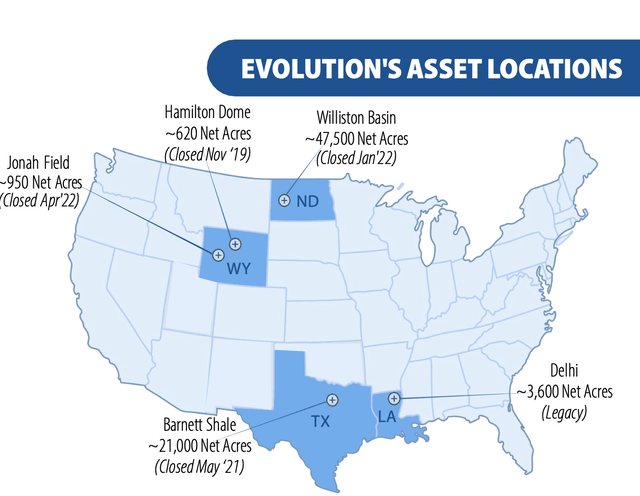

On the oil side, it has a 24% average net working interest in the Delhi Field in Louisiana. Danbury Resources is the operator and production is about 70% oil and 30% NGLs. In the Williston, it has an average net working interest of nearly 39%, where Foundation Energy is the operator. Production is 73% oil. It also has a 23.5% working interest in the Hamilton Dome field where Merit Energy is the operator. Production is 100% oil.

On the natural gas side, it has a nearly 20% working interest in the Jonah Field, operated by Jonah Energy. Production is 88% natural gas. It also has a 17% working interest in the Barnett Shale on acreage operated by Diversified Energy Company. Production for the assets is 73% natural gas and 26% NGLs.

Company Presentation

Opportunities and Risks

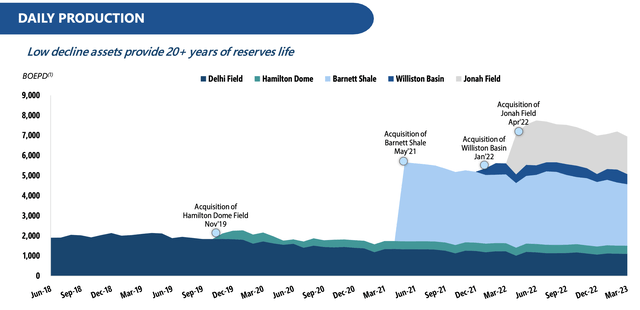

EPM’s stated goal is to “provide investors with a lower risk investment opportunity in the energy sector that prioritizes free cash flow and generates a superior return through consistent dividends and growth.” To do this, it has acquired interests in several more-mature, long-life production assets.

Discussing the company’s strategy earlier this year during a fireside chat with Water Tower Research, CEO Kelly Loyd said:

“So we are currently and what we’ve done in our recent acquisitions, one of the important things that we want to look at is the long-life, low-decline. And, I think, you’ve heard me say that a few times before, but what that really means is we have an asset base which isn’t on a steep sort of fast treadmill where you’re constantly having to make acquisitions to replace large amounts of depleted production and reserves. If you have a long-life, low-decline, you can be a lot steadier, you can be a lot more opportunistic. You’re not forced to go, make acquisitions or to drill in times when it’s inopportune. So in general, that is our focus. We do want to make sure we can buy at a significant discount to what we believe the processing ought to be. So we can make a return even if things go down some. And additionally, we want to make we’re not landing ourselves on a steep treadmill. So these are important things for us. .. We have a machine that we’ve tried to put together that is here to generate cash flow. And in our levers that we can use if we had debt outstanding, which we don’t because we paid it all off. But if we did, that’s one lever to use our free cash flow for. And then next, you can go to paying dividends. It’s been very important for us. You could do the share buyback, which we’ve done. And then last but not least, of course, you have to opportunistically add more COGS to the machine to make more free cash flow. So these are things the Board and all of us here are constantly managing in trying to make sure that we get things right there.”

EPM made two acquisitions last year to add to its portfolio. First it acquired interests in the Williston basin for $25.9 million. The sales included a 39% working interest in 73 producing wells, 47,500 net acres and over 400 drilling locations. The deal was paid with cash on hand and from its credit facility.

It then acquired a nearly 20% working interest in the Jonah field for $26.2 million from Exaro Energy III. It funded the deal with cash on hand and borrowings from its credit facility.

Company Presentation

EPM has quickly been able to pay back any debt from these deals with free cash flow. It ended FQ3 with $18.4 million in cash and no debt, while it generated $22.6 million in free cash flow in the quarter. It paid a little over $4 million in dividends, so while the stock has a nice 6% yield, the dividend is very well covered.

The company’s free cash flow gives it nice flexibility to continue to buy interests in more assets or make other moves. In FQ3, it took some of that FCF to buy back $3.9 million in stock.

The price of oil and natural gas will play a big role in EPM’s results, and at the end of FQ3, it had no open hedges on either oil or natural gas. When it acquired its Jonah assets last year, it did hedge 25% of Jonah’s production. Natural gas prices have collapsed since the deal closed, and those hedges have now rolled off, although hedging gains this fiscal year were minimal. With an LOE and processing of around $1.70 for Jonah, EPM likely overpaid for the deal at current nat gas prices.

In terms of production, EPM as a non-operator doesn’t have much say in if the operators try to boost production. While the company has helped with investments in some workovers and recompletions to help boost production, for the most part, production is likely to slowly, but steadily decline given the assets it is invested in. At the end of the day, EPM is at a bit of the mercy of the operators of the assets it has interests in.

Valuation

EPM trades at 4x EBITDA based on 2023 analyst estimates of $61.2 million. Based on the 2024 consensus of $50.6 million, the stock trades at a 4.8x multiple. Of course, the price of natural gas and oil can change the actual results immensely.

From a P/E perspective, it trades at just under 7x the 2023 consensus of $1.16 and 9.5x the 2024 analyst estimate of 85 cents.

The stock tends to trade at a valuation higher than most small-cap E&Ps, but lower than larger independent E&Ps. Given some of the cost advantages as a non-operator whose assets aren’t really being drilled, this makes sense versus smaller E&Ps that don’t have the scale to absorb higher service costs. However, larger E&Ps can demand a higher multiple as they control their own destiny and can more easily grow production. The company is a bit more akin to a Black Stone Minerals (BSM), which I wrote up here, but the model isn’t quite as attractive as that of BSM, and thus BSM trades at a higher multiple.

Conclusion

Given its free cash flow generation and pristine balance sheet, EPM’s dividend looks solid and the company should be able to make acquisitions if the right one comes along. While an energy company, as a non-operator that acquires long-life mature assets, it’s more of a financial engineering play than anything else – it’s buying assets and expecting to get a potential return on them over a 10+ year period that justifies the price it is paying.

For investors looking for income, I generally prefer the midstream space. However, given the low price of natural gas, I think EPM is a solid option with a nice natural gas price kicker. If you’re looking for income and are a nat gas bull, then EPM is a solid option. I laid out a natural gas bullish thesis in a prior article on EQT (EQT). As such, I lean bullish on EPM and will rate it a “Buy.”

Read the full article here