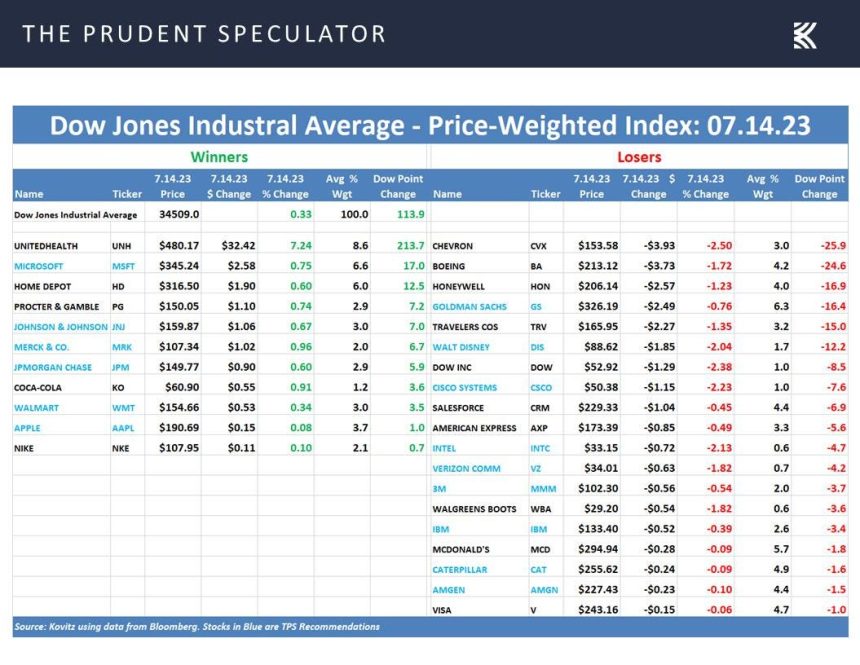

The latest trading week ended on a very sour note, given that the average stock in the broad-based Russell 3000 index declined 1.2% on Friday, even as the Dow Jones Industrial Average managed to close higher by 114 points, or 0.3%.

I suspect that many are aware that unlike most other market indexes, the Dow is price-weighted, meaning that the highest-priced stocks like Microsoft

MSFT

INTC

VZ

CSCO

Believe it or not, the Dow is calculated by adding up the price of all 30 components and dividing by a divisor, which on Friday was 0.15173. This means that a $1 move up or down in the price of a Dow component translates into a 6.6-point move in the index. Obviously, a big change in a stock with a triple-digit stock price will result in a sizable advance or decline in the Dow, as was the case on Friday when managed care provider UnitedHealth Group (UNH), the most important Dow constituent, soared more than $32 after announcing better-than-feared Q2 financials.

Incredibly, UnitedHealth’s 7.2% price increase accounted for nearly 214-points of the Dow’s 114-point advance on Friday, which means that the other 29 stocks collectively lost 100 Dow points. In fact, 19 of the 30 Dow components finished in the red on the day, providing another reminder that it is a market of stocks and not simply a stock market. I also note that we presently hold 15 Dow members (those in blue in the chart above) in our Prudent Speculator diversified portfolios.

LONG-TERM THINKING

And speaking of UnitedHealth and its impact on our holdings in the managed care industry, we again witnessed another example of why we always strive to ignore short-term fluctuations in the price of the stocks that we own. A month ago in The Prudent Speculator, we penned an update on our managed care providers Elevance Health and CVS Health after their stocks were hit hard following a Goldman Sachs investment conference where a UnitedHealth representative highlighted the company’s increasing costs in the Medicare space.

Numerous older adults aged 65 and above covered under Medicare, who had seemingly largely stayed indoors during a long stretch of the pandemic, are getting “more comfortable accessing services for things that they might have pushed off a bit like knees and hips,” UNH management disclosed. Non-urgent surgeries and outpatient services such as heart procedures and knee and hip replacements that had been put off during and after the pandemic were picking up pace.

Short-sighted investors dumped ELV and CVS on the news, even as the former said its medical care trends and costs were in line with expectations, while folks ignored that the latter is broadly diversified across the health care spectrum. Not to everyone’s surprise, UNH reported Q2 financial results that beat both top-and bottom-line expectations, and though margins in its Medicare coverage were squeezed, multiple other parts of the firm were hitting on all cylinders.

UNH CFO John Rex also noted that elevated costs in the Medicare space would continue in Q3, but they were expected to seasonally adjust downwards in Q4. CEO Andrew Witty also added during the earnings call, “If I had the choice on a slightly suppressed margin in Q2 or the very significant growth that we’ve taken in, I’ll take the growth all day long, and I’ll take that growth because it’s going to underpin years of growth going forward.” The results seemed to ease some overdone investor concerns and sent ELV rebounding by 5.0% and allowed CVS to stay in the green on an otherwise ugly market day on Friday.

Elevance just reported its Q2 numbers as this note went to press and they were terrific, exceeding expectations. while management raised forward guidance. Again, we see why I think emotional reactions to bits of sensationalized news or non-full-context quotes or short-term-focused analyst upgrades and downgrades can be “unhealthy” for long-term oriented investors. I also continue to note that ELV trades at 13.5 times forward adjusted EPS estimates and CVS (which owns Aetna) at 9 times, versus UnitedHealth’s 19 times. While UNH is too richly priced for my blood, at present, I would not hesitate to buy ELV and CVS.

Read the full article here