While Zoom Video Communications (NASDAQ:ZM) faces some renewal risk following the pandemic, the stock is cheap and the company is flush with cash.

Company Profile

ZM operates a video communication and collaboration platform. Its foundational product is Zoom Meetings, which provides HD video, voice, chat, and content sharing across devices. The platform has features such as a 49-person video gallery view, virtual backgrounds, video breakout rooms, screen sharing, and integration with productivity and communication tools from other companies.

Zoom Meetings in found under its Zoom One category, which also includes Zoom Phone, a cloud phone system; Zoom Team Chat, an instant messaging platform; Zoom Mail and Calendar; and Zoom Whiteboard, which is an interactive canvas. It also has its Zoom Spaces solution, which includes Zoom Rooms, a software-based conference room system, and Workspace Reservation, a service to manage physical room bookings.

Its Zoom Events platform, meanwhile, offers organizations a virtual event management solution. Within this solution is also Zoom Webinars, which can support video presentations up to 50,000 people. The company also offers Zoom Contact Center for customer service; Zoom Developers to help built integrations into Zoom; and Zoom AI, which gives salespeople actionable insights into customer interactions on the platform.

Opportunities and Risks

During the pandemic, ZM became the posterchild of work from home, as its solutions allowed employees to work and connect from anywhere in the world through various devices. This caused a lot of pull-forward in demand as a result, which has both its positives and its negatives.

On the negative side, when you have a lot of pull-forward demand, once that plays out, at the very least growth slows. In addition, investors have become more worried about enterprise renewals, as many companies want to see employees back at their offices and have revolted against work from home. ZM’s Q1 added some fuel to this fire, when its reported number of 215,900 enterprise customers fell short of expectations calling for 218,000 enterprise clients.

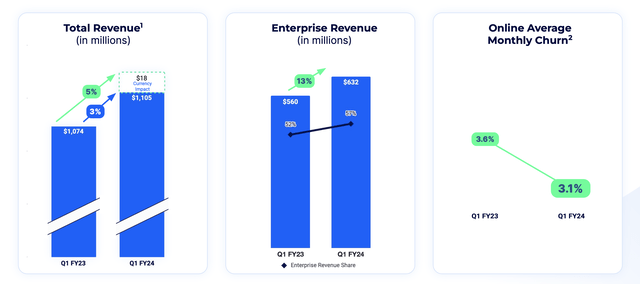

Now the company is still growing, as shown by its 5% constant currency growth in Q1 and 13% enterprise revenue growth. Meanwhile, its 12-month net dollar retention was 112%, showing that it is still growing with its customer base. However, enterprise customer renewals will be one of the biggest risks the company faces going forward.

Company Presentation

On the positive front of this pull-forward in demand, ZM was able to get its solution into many large enterprise customers. This gives it the opportunity to innovate and cross-sell new solutions into this large customer base. It also left the company with a ton of cash on its balance sheet, $5.5 billion, which it can use to also go out and buy complimentary solutions with.

On the home-grown innovation front, ZM has looked to transform from a company that offers a videoing conference product to a more complete communication and collaboration platform. This includes things like offering a chat product that competes with Slack, or its newer cloud-based phone system. The company also gotten into specific vertical solutions, such as its contact center offering.

Discussing its platform approach at a William Blair conference last month, CFO Keely Steckelberg said:

“And what we’ve done is we continue to add services across this scalable infrastructure. So starting with Zoom Meetings. But when you layer in then Zoom Phone, it really leveraged. It was amazing, right, because what it did was it leveraged the voice component of Zoom Meetings by adding on telephone support, phone number support at the end. Now we have a fully natively built integrated cloud contact center solution. And all of these products have come as our customers have come to us and asked for us to help, as you say, solve their problems. And what they’re looking for is the seamless interaction between all of these communication aspects that allow you to do simple things like if you’re in a Zoom Chat, one click, launch a meeting with everybody that’s in that chat channel. Or if you’re — if we were — you and I are having a direct message, one click into a phone call for us, but also then take that and leverage that beyond it to collaboration through whiteboard through chat. As I mentioned, we have both a persistent chat and a meeting chat. You now have the ability, if you’re in a meeting to chat, which has become a very valuable tool, especially we’ve heard during the pandemic. What the meeting chat did was it gave a voice to people that don’t necessarily feel comfortable speaking up in a meeting. So I think that meeting chat has become much more widely used and incorporated. Now you have the ability to have that persist after a meeting is there’s often very important records in there.”

In addition to its own home-grown solutions, ZM also recently went out and bought fast-growing Workvivo. The Workvivo solution has been described as a corporate intranet or corporate Facebook that fosters employee engagement at a broader level, with things such as an activity feed, surveys, and employee directory. The company has been a strong performer on its own, and was also a big beneficiary of the pandemic, with its ARR soaring 200% in 2020. With ZM able to sell the solution into its large customer base, the product should continue to be a strong grower.

ZM has not been a particularly acquisitive company in the past, but last year it also bought Solvvy, a conversational AI company, to help with its push into contact centers. With its large cash position, the company has plenty of funds to continue to add bolt-on solutions to help drive growth.

When it comes to risk outside of renewal concerns, competition is another risk. With ZM getting into more areas of communication, other companies could also encroach on its core video solution. How AI changes the competitive dynamics of the industry is also worth watching, and something Microsoft (MSFT) could use to better compete. Meanwhile, economic concerns could lead to long sale cycles.

As a large holding in the ARK Innovation ETF (ARKK), which I wrote about here, the company could also get caught up in any pressure that this highly volatile ETF experiences.

Valuation

SaaS companies are generally valued based on a sales multiple given their high gross margins and the companies wanting to pump money back into sales and marketing to grow.

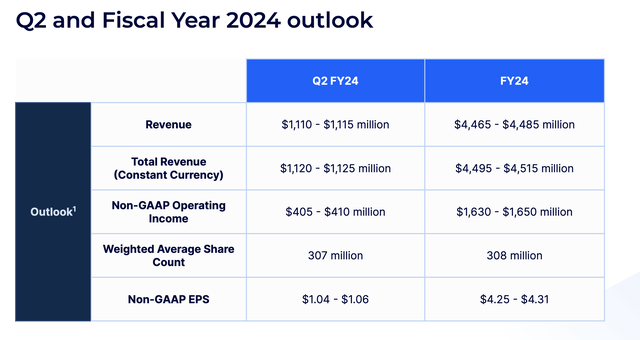

In this regard, ZM is valued at an EV/S ratio of about 3.6x based on the 2003 consensus for revenue of $4.48 billion. Based on the 2024 revenue consensus of $4.7 billion, it trades at an EV/S multiple of 4.4x.

Company Presentation

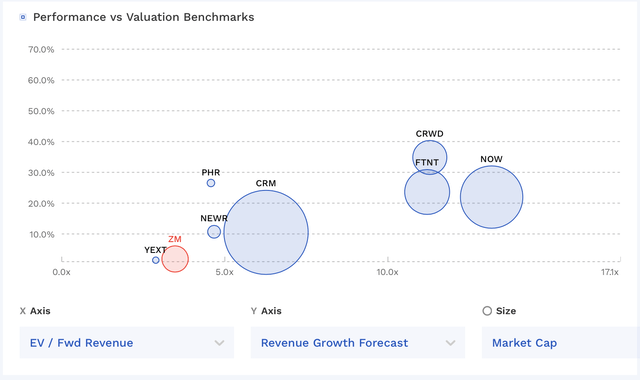

ZM is one of the cheapest SaaS names around, albeit its current growth expectations are among the lowest.

ZM Valuation Vs Peers (FinBox)

Conclusion

ZM is certainly not without risks, but with a cheap valuation and a horde of cash, the company certainly has some opportunities. Building out its platform into other areas of communication and some growth acquisitions should be a priority for the firm.

If it can continue to show growth and renew its large customers, the stock has the potential to double from here. Execution, of course, is key, which is why the stock is a higher risk-reward name. I have a “Buy” rating on the stock, but it is best suited for investors who are not risk adverse.

Read the full article here