Tobacco company Altria Group (NYSE:MO), the owner of the Marlboro cigarette brand in the United States, has been trying to pivot away from its legacy smoking business for years.

It has been challenging. The company blew $13 billion on a stake in once-hot electronic cigarette company Juul, which is worthless today. Despite the big miss, management has steadily put together a portfolio of smokeless products that could play a significant role in the company’s future.

Additionally, Altria owns roughly 10% of global beer conglomerate Anheuser-Busch InBev (BUD), which is embroiled in controversy after a partnership with a famous transgender activist divided the company’s customer base.

The heat around Anheuser-Busch might force Altria’s hand, which makes now a great time to consider buying Altria stock.

Here is why.

What is Altria waiting for?

Altria’s stake in Anheuser-Busch is worth a lot of money, approximately $11.5 billion at today’s share price. Altria has owned the stake since beer giants SABMiller and Anheuser-Busch InBev merged in 2016. Altria has been eligible to sell its stake since a lockup provision expired in the fall of 2021.

So why hasn’t it? Anheuser-Busch once had a $250 billion market cap in 2017, but that’s fallen to $115 billion today. Maybe Altria doesn’t want to sell low and leave money on the table. Management announced its intention to hold the stake after the lockup expired, noting confidence in Anheuser-Busch’s strategies, brands, and management team.

But that was before the company’s branding crisis this year. Some customers began boycotting Bud Light and other Anheuser-Busch brands in April, which will begin showing up in the company’s earnings when it reports in a couple of weeks. Channel data reportedly showed a nearly 30% year-over-year decline in Bud Light sales in early July.

Even though Bud Light is a foundational brand for the company, the boycott probably won’t sink the Anheuser-Busch ship. However, it could meaningfully stunt growth, limiting the stock’s near-term upside. In other words, when does Altria decide it can better use that capital elsewhere?

A potential catalyst for the stock

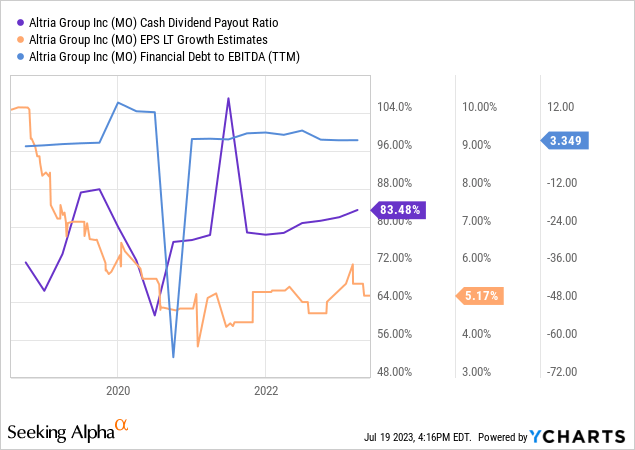

Investors don’t need to squint hard to see what $11.5 billion could do for Altria and its shareholders. That stake represents roughly an eighth of Altria’s market cap. Management could retire an enormous amount of outstanding shares, simultaneously lowering the dividend payout ratio from the current 83% it sits at and driving robust earnings growth, which management already expects to grow by 4% to 6% annually.

While the Juul investment failed, it hasn’t sunken Altria’s balance sheet. The company is still leveraged at a manageable 3.3 times EBITDA.

The company acquired an electronic cigarette brand with FDA marketing authorization in NJOY Holdings earlier this year and is growing its On! brand of oral nicotine pouches. The $11.5 billion infusion of cash would make Altria the strongest it’s been financially in years, with a core business still growing operating profits.

The stock’s valuation is attractive, to begin with

Buying Altria doesn’t have to be a speculative idea. Its hefty 8.3% dividend, steadily growing profits, and bargain-level valuation make Altria a stock you can buy regardless of whether Altria sells its Anheuser-Busch stake now or later.

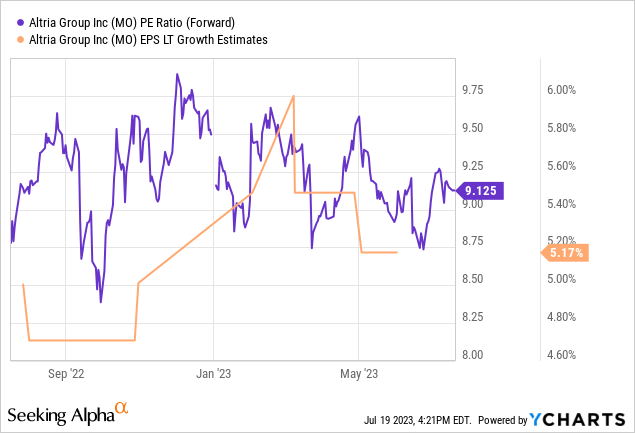

Considering the stock trades at a forward price-to-earnings ratio (P/E) of 9 and analysts expect mid-single-digit earnings growth, the resulting PEG ratio of 1.75 signals an attractively valued stock for its expected growth. Remember, this doesn’t factor in the potential impact of selling the Anheuser-Busch stake.

The dividend and anticipated growth set a straightforward path to annual returns of roughly 13% without any impact from a stake sale or valuation change. Considering the upside if Altria acts on its stake, that’s a hefty margin of safety with enough upside to keep things interesting for long-term investors.

Read the full article here