Q2-23 Performance

In Q2 I returned +3.2% versus +8.7% for the S&P 500 (SPY). In 2023, I’ve returned +11.6% versus +16.9% for the index, underperforming the index by a significant amount. Worse, I outperformed significantly in January and have underperformed ever since.

This was a quiet quarter on the investing front for me, where I did not initiate any new positions other than short term trades, which have done well. I sold my small Hersha (HT) stake at a 5% gain based on feedback from fellow analyst and friend Siyu LI who rightly pointed out how egregious the executive compensation was.

What I did right:

- I haven’t shorted anything, nor do I plan to. I have all the respect in the world for managers that run over 100% long while maintaining a short book as a hedge, but I’ve learned that this isn’t for me. The biggest key to outperforming in the long run is to avoid doing something stupid, and for me, having shorts open increases the chances of doing that.

- I haven’t significantly added to my energy holdings, despite it being one of the sectors I understand best. I made life changing money last year in energy and sold a lot near the highs, so there’s a natural inclination to go back to what you know when it’s “on sale.” My largest energy holding, Energy Transfer (ET), has done well. I still see value in this sector, but I’m pragmatic about it. Calls for oil returning to and staying above $100 are optimistic. Last year showed that there is both a supply and demand response above this level.

What I could have done better:

- Last year around this time, everyone “knew” there was going to be a recession in 2023 – the only debate was would it be a “short and shallow” recession or “long and protracted.” When everyone believes in a particular outcome, it almost never happens. I wasn’t crazy bearish, and I initiated my Dole (DOLE) position in late September pretty much at the low, and I loaded up in late December for some well-timed January bounces, but my bearish bias had led me to missing some opportunities. We still have reasonable GDP growth, labor is still strong, and inflation is dropping. This doesn’t mean I’m bullish (I’ll cover more in my outlook below), but it caused me to remain too inflexible regarding what, in hindsight, were some very easy setups. In each of these cases, I did a significant amount of work and ultimately passed – not for fundamental reasons, but because I was too bearish on the overall market. This cost me at least 5% in overall performance.

- Missing the rally in technology stocks still stings, especially the opportunities in Google (GOOG) under $90 (twice!), Microsoft (MSFT) under $240, and Meta (META). I knew all three companies very well, and should have bought.

Current Positions

Cash and short duration bond funds (40%)

Still holding the most cash I ever have held, while opportunistically deploying it for trades. I still believe this is a time to be defensive, and this is still more cash than I want.

PBF Energy (6%)

Boy, this has been a fun holding. I’ve traded around my PBF holding overall for a reasonable gain. I still think it has some upside, but this has been quite a run from the low $30’s. PBF closed on half of the Eni (E) deal on June 28th, receiving $431 million (8% of their market cap!) The other half of the $835 million transaction should close soon.

The first half of 2023 featured a lot of cash outflows for PBF: repaying $525 million PBFX debt, significant CapEx from TAR’s and the RD buildout, and payment of some RIN’s. The second half of this year, PBF should have some serious cash coming in as crack spreads remain strong (especially in California) and the second half of PBF deal closes. PBF could repurchase a significant amount of shares in the second half of this year.

Cenovus Energy (4%)

Still holding my position in Cenovus, and remain bullish on the company long term. Cenovus returning 100% of capital in dividends and repurchases is getting closer.

Energy Transfer (18%) units (13%) and preferred shares (5%)

I added a small amount of common units in the low $12’s, and added more of the Series E (ET.PE) under $23. Around $13, I still believe Energy Transfer is one of the easiest setups in the market and common units are worth between $18-$20.

Berkshire Hathaway (10%)

Berkshire Hathaway (BRK.A) (BRK.B) remains an anchor in my portfolio, though its valuation is certainly on the “high end” of fair. I recently bought back my short Jan24 $350 call position at a ~20% profit.

Genesis Energy (6%)

Written up most recently as Thesis Getting Stronger.

It has been a frustrating quarter for Genesis (GEL) with it hovering near my purchase price. Looking forward to a stronger second half, hopefully on earnings and oil strengthening. Patience is key for this holding and I’m not expecting a lot of movement until 2024, honestly, but there’s a few catalysts I see that could move units up before then:

- Additional GoM connections that tie-back with minimal additional capital (GoM lease sales have been robust lately.)

- Soda Ash pricing strengthening in time for 2024 pricing negotiations.

- A sale of the Soda Ash business.

Privately held WE Soda, which produces roughly the same amount of Soda Ash as Genesis, recently sought an IPO at a $7.5 billion valuation (it was called off last month due to “investor caution”.) If Genesis could find a buyer for its Soda Ash business at even $4-$5 billion, which I believe is in the range of fair value, especially to a strategic investor, they could become net debt free overnight and the units would triple. Also worth mentioning, the closest thing left to a publicly traded comp now that Sisecam was bought out, Natural Resource Partners (NRP) is at a 52-week high despite Met Coal (its other business besides Soda Ash) pricing being at 52-week lows.

H&R Block (6%)

Cheap again at 8x forward P/E with double digit earnings growth forecast until 2025. Since they repurchase a lot of their own shares, a lower share price increases the future EPS growth rate. Solidly holding this. I bet it finishes the year near $40 again.

Dole (4%)

Dole is up 60% since my October purchase. I’ve trimmed some of the shares in my non-taxable account. Patiently waiting for the Fresh Vegetable sale to close. Shares probably remain rangebound until then.

JPMorgan Chase (3%)

I still hold a small JPMorgan Chase (JPM) position from my original $90 purchase price.

NuStar Preferred C Shares (3%)

These have traded up nicely since my purchases in the mid $23 range. They’re in a taxable account, so no plans to sell at least until sometime next year. These get safer by the quarter as the company continues to redeem the privately held class D Prefs.

Outlook for the rest of 2023

The big money is not in the buying and selling, but in the waiting.

-Charlie Munger

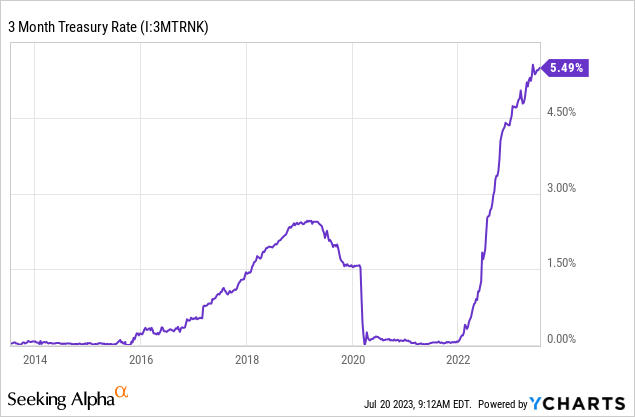

With the S&P500 above 4500, I think now is a poor time to be chasing stocks, especially when you can earn 5% in Treasuries. I’m seeing an awful lot of victory laps from bullish investors these days. While I’m sure there are some folks left to chase, I’m not sure how many folks are still left to buy stocks up here.

The short term treasury rate is the highest it’s been in 10 years, and we’ve raised it awfully fast. Just because we haven’t broken anything yet (well, other than regional banks, CRE, and the federal budget) doesn’t mean that we’re not going to. The Fed keeps engaging in unprecedented policy: first by forcing an unimaginable amount of money into the system in a short amount of time and not having any idea on what would happen (guess it wasn’t just transitory, after all) and now tightening in the same way. Couple this with a reckless Congress and that is running a *1.5 trillion* dollar deficit outside of a major recession, and I’m cautious. I’m not a permabear doomer, but I have to recognize that this environment is anything but normal and predictable.

In the same way that everyone was bearish in late September, now I see everyone saying “See! Everything is fine! Oh look, AI!” Every micro-dip gets bought. Sentiment has certainly shifted, many leading indicators have been weak, and I have serious concerns about the consumer. I think this is a time to be taking some chips off the table.

So, right now, I’m happy with what I’m holding, looking for opportunities, and waiting for the fat pitch.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here