RH (NYSE:RH), together with its subsidiaries, operates as a retailer in the home furnishings industry. It offers products in various categories, including furniture, lighting, textiles, bathware, decor, outdoor and garden, and child and teen furnishings.

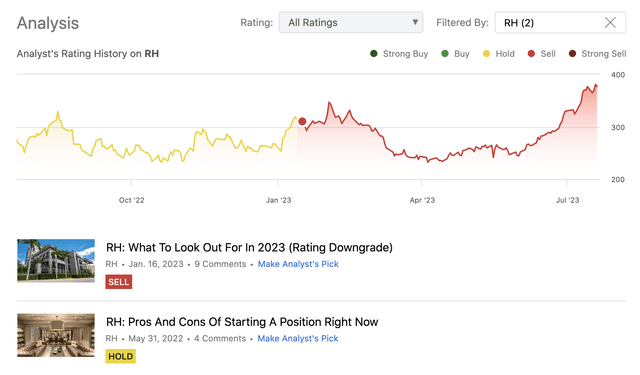

We previously initiated coverage on the firm in May 2022, assigning the company a neutral rating. In early 2023, we published a second article about RH, in which we had a more pessimistic view on the near-term prospects of the business, so we downgraded our initial “hold” to “sell”.

Rating history (Author)

Since our second article, the stock price has increased by as much as 23%, outperforming the broader market, which has gained only about 13% over the same period. For this reason, we have decided to revisit RH and discuss whether we think the recent rally in the stock price is justified and sustainable. During our discussion, we will be focusing on macroeconomic factors, like the consumer confidence and the health of the housing market, but we will also refer to company specific metrics, including profitability and efficiency ratios.

Economic indicators

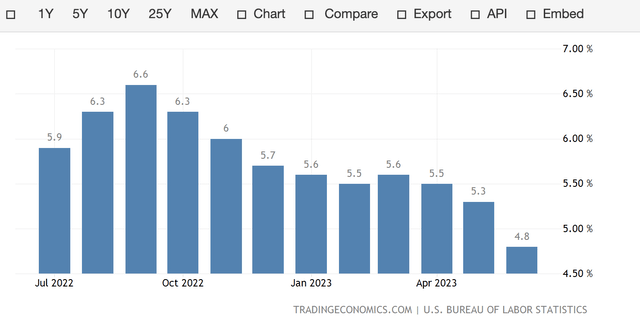

Core inflation rate

Since our last writing, the core inflation rate has substantially fallen. In our opinion this development is definitely positive for RH’s business and for the overall economy in general. We believe that as a result of the moderating inflation, RH may experience moderating costs and therefore expanding margins in the coming quarters.

Core inflation rate – U.S. (tradingeconomics.com)

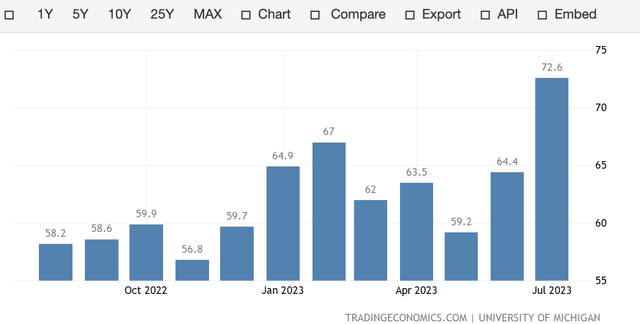

Consumer confidence

The development of consumer sentiment is showing an optimistic picture about the near future as well. Consumer confidence has also significantly improved since the beginning of the year, which is a strong signal that people may start to be more comfortable with spending larger sums on non-essential discretionary items.

U.S. Consumer confidence (tradingecnomics.com)

While it may not yet be evident in the upcoming earnings report, in the second half of the year we would like to see the revenue and volume growth to get a confirmation about our thesis of increasing demand.

Housing

In contrast to the above metrics, the housing market has not seem to be sharply rebounding just now. The three metrics that we have looked at are: existing home sales, building permits and 30-year mortgage rate.

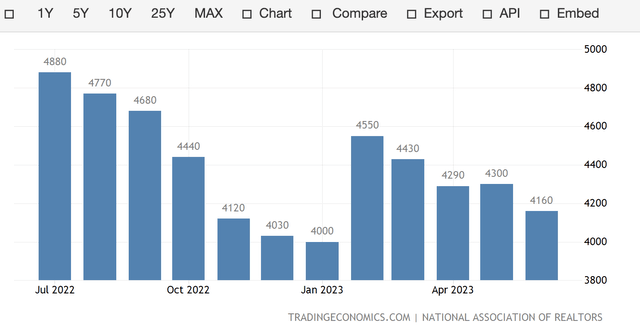

Existing home sales

Despite the jump in the beginning of 2023, existing home sales are still exhibiting a downwards trend. Important to note, however, is that the new home sales have exhibited a slightly better development.

U.S. Existing home sales (tradingeconomics.com)

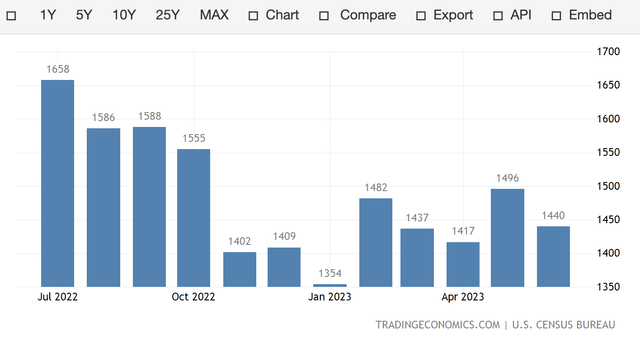

Building permits

Building permits, which are often regarded as a leading economic indicator that can be helpful to gauge the supply of new homes in the future, are not showing clear signs of improvement. The readings have been fluctuating slightly, but have remained low, compared to the 2021-2022 levels.

U.S. Building permits (tradingeconomics.com)

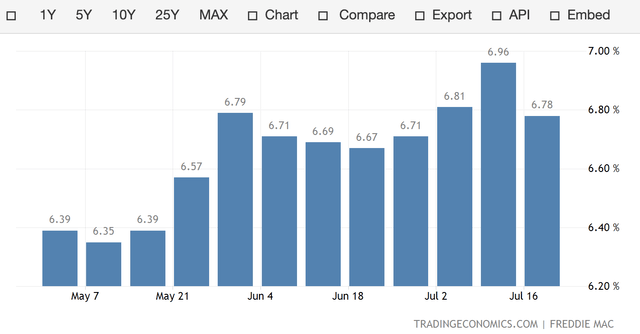

Mortgage rates

As most of the homes in the United States and around the globe are financed or partially financed by loans, it is important to understand how expansive these loans are. The higher the mortgage rate, the more expensive the loan, and the less likely that people will take out a large loan and buy a home. This can lead to a softer demand for homes, which can negatively impact the demand also for RH’s products. Since the beginning of the year, there has been no improvement in this metric.

30-year mortgage rate (tradingeconomics.com)

All in all, the macroeconomic environment looks somewhat better than in the beginning of the year. Consumer confidence has improved, and the core inflation rate has fallen substantially. On the other hand, the health of the housing market, according to several indicators, has not meaningfully improved.

Company specific metrics

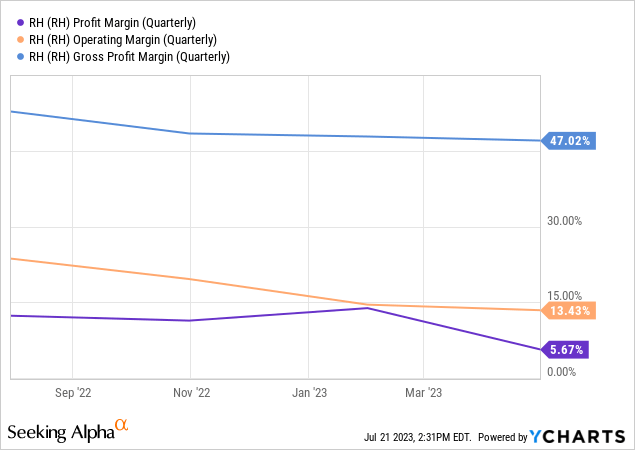

Profitability

To assess the firm’s profitability, we will be looking at the firm’s net profit margin. The following chart shows the net profit margin, the operating margin and the gross profit margin.

Since the beginning of the year, all of these metrics have been deteriorating. While we have mentioned above that the improving macroeconomic environment may change these trends, we would like to first see this theory confirmed in the coming quarters, before we could recommend buying the stock.

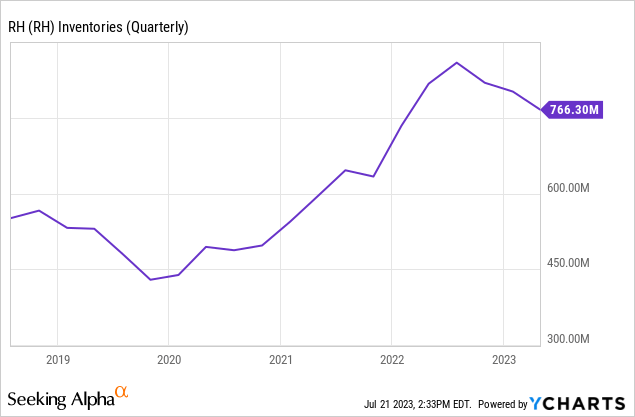

Also, important to note that over the past two years, RH’s inventories have increased significantly. While it is good to see that they have managed to reduce inventories slightly, we are concerned that further reductions may come at a cost. Older inventories may need to be sold at significant discounts, which could lead to further contraction of the margins. Also obsolete inventory could also have negative impacts on the firm’s financial performance.

Once again, before we could recommend buying RH’s stock, we would like to see how the company can deal with inventory management without hurting the profits.

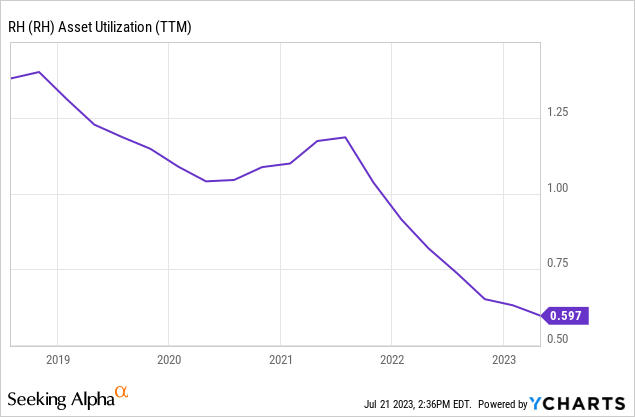

Efficiency

To assess RH’s efficiency, we will look at the asset utilization (or asset turnover). In general, we like to see this metric improving, but in RH’s case there has been a clear downward trend in the last five years.

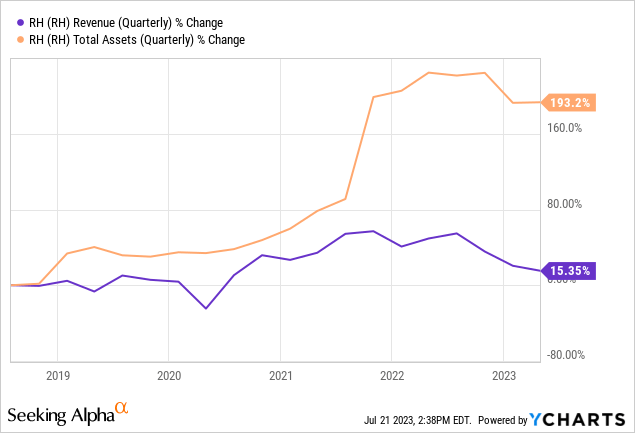

The reason behind is that asset growth has meaningfully outpaced revenue growth. And since mid-2021 revenue has been actually trending downwards.

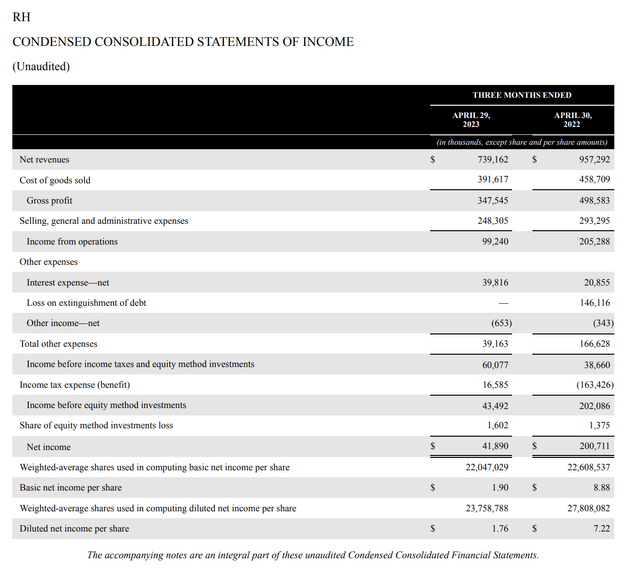

When looking at the latest earnings report, we can quantitatively see the negative change.

10-Q (RH)

Also concerning to see that while revenue has fallen significantly, the accounts receivable have stayed at roughly the same level. In general, we like to see changes in accounts receivable similar to changes in revenue to make sure that we can dismiss any potential thought about the manipulation of the sales figures, by selling more on credit or changing revenue recognition policies. For this reason, we are also not particularly impressed by RH’s last reported financial figures.

To sum up

Since our last writing, the macroeconomic environment has somewhat improved, especially when looking at the core inflation rate and the consumer confidence. The state of the housing market has shown now clear signs of improvement in the past 6 months.

The firm’s profitability and efficiency have not improved since our last writing. Margins have deteriorated, inventory levels continue to remain high and revenue has meaningfully declined.

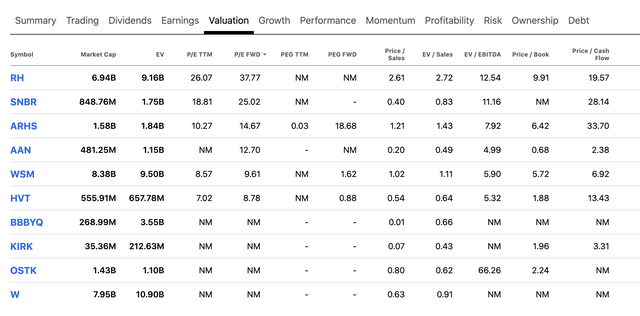

We believe that recent rally and the sharp increase in the stock price is not justified and not sustainable. Also, when comparing RH to its peers in the home furnishing retail industry, we can see that it is selling at a significant premium, according to most price multiples.

Comparison (Seeking Alpha)

For these reasons, we maintain our bearish rating on the stock.

Read the full article here