Over the years, I have found myself to be drawn to companies that have a unique business model. There’s something about the novelty that a company brings to the table that awakens my curiosity. And few companies are as unique as funeral home and cemetery operator Service Corporation International (NYSE:SCI). Earlier this year, I found myself taking a rather bullish stance on the company. In the long run, I fully expect that the picture for shareholders will be positive. Since then, however, we have seen some weakness, not only from a share price perspective, but also from a financial perspective. Given the data that’s out there now, this makes sense. But when you focus on the long haul, I do believe that the firm still makes for a solid opportunity for investors who don’t mind being patient.

Assessing recent weakness

At the tail end of February of this year, I wrote a bullish article discussing the investment worthiness of Service Corporation International. Even at that time, the firm was seeing some of its financial performance weaken compared to what it had been in prior years. While this was disappointing, it was not surprising to me. The firm experienced a boon thanks to the COVID-19 pandemic. But as the pandemic died down, demand for its services were destined to pull back some. As a result of this, the stock has gotten a bit pricier. And the market has not been very happy about that. In fact, since the publication of my article, shares have dipped by 0.5% at a time when the S&P 500 has jumped 15%.

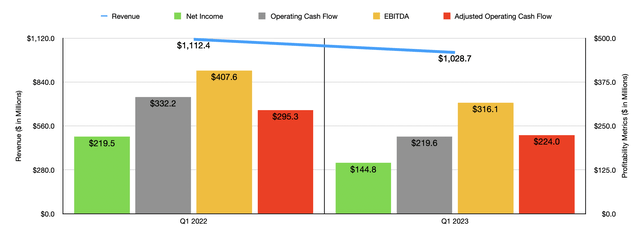

Author – SEC EDGAR Data

To understand exactly why the market has been fickle when it comes to Service Corporation International, we should dig into the company’s most recent financial performance. This involves the first quarter of the 2023 fiscal year. Revenue during that time came in at $1.03 billion. That represents a decline of 7.5% compared to the $1.11 billion the company generated one year earlier. A big chunk of this decline came from a drop in the company’s funeral revenue from $649.1 million to $609.7 million. That revenue drop came even as the comparable average revenue per service inched up from $5,396 to $5,449. The decline, then, was driven by a drop in the comparable services performed from 105,276 to 94,217. Similarly, cemetery revenue for the company also took a beating, dropping from $463.3 million to $418 million.

Naturally, the drop in sales brought with it a decline in profitability. Net income, as an example, declined from $219.5 million to $144.8 million. Part of that pain was driven by a 23.7% plunge in gross profit for the company’s funeral operations. This, according to management, brought the gross profit margin for this part of the enterprise down from 30.3% to 24.6%. In addition to suffering from a reduction in revenue, the firm also suffered from higher selling costs on higher preneed insurance sales production during the quarter. On the cemetery side of things, gross profit margin plummeted from 39.1% to 33.5% because of the aforementioned factors and because of higher maintenance costs that the company experienced.

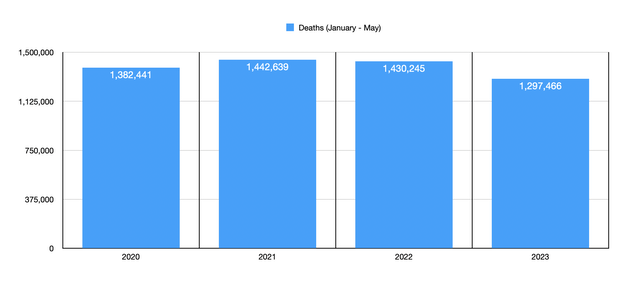

Author – Census Bureau

It may seem peculiar for there to be a drop in revenue and profits for a company that should continue to benefit from a continually growing population. But the fact of the matter is that the end of COVID-19 has brought with it a decline in the number of deaths occurring. Take the first five months of this year compared to the same time over the past three years. As you can see in the chart above, during this window, the US reported just under 1.3 million deaths from January through May. This is down from the 1.43 million seen in 2022 and the 1.44 million that we temporarily peaked at in 2021.

The good news for the company, however, is that the number of deaths occurring in the US is slated to grow for at least the next few decades. In February 2020, before the severity of the COVID-19 pandemic was truly known, it was estimated that the nation would experience 2.8 million deaths for that year. By 2060, according to the US Census Bureau, that number is expected to grow to 3.9 million per year. That’s a 1.1 million increase due to both an aging population and a growing population.

Now, when it comes to the current fiscal year, management has provided some pretty good guidance. They believe that earnings per share will be between $3.45 and $3.75. At the midpoint, that would translate to profits of $559.1 million. Operating cash flow is forecasted to be between $740 million and $800 million. If we take the midpoint there and use some of management’s other assumptions, we would get EBITDA of $935 million. It shouldn’t be shocking, given how the company performed during the first quarter compared to the same time last year, that these results are all a bit worse than what the company experienced in 2022.

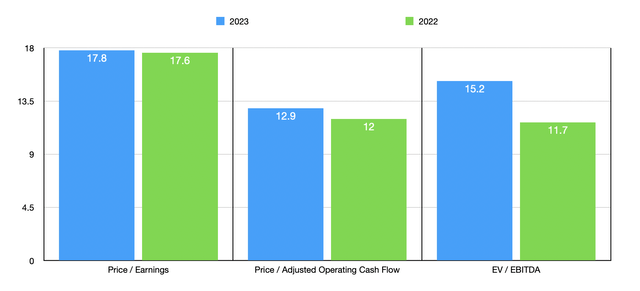

Author – SEC EDGAR Data

Taking these data points, we can easily value the company. In the chart above, you can see how shares are priced using estimates for 2023, as well as using official numbers for 2022. If we were talking about some regular company, I would say that these multiples would make the company more or less fairly valued. However, I do believe that a premium needs to be applied to firms that should be stable in the long run and that are industry leaders. Service Corporation International fits both of these. As part of my analysis, I did also compare the company to three similar firms. As you can see in the table below, it is the most expensive of the group when it comes to the price to earnings approach. When it comes to the price to operating cash flow approach, only one of the companies was cheaper than it. Meanwhile, two ended up being cheaper when we use the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Service Corporation International | 17.8 | 12.9 | 15.2 |

| Carriage Services (CSV) | 15.4 | 7.3 | 11.3 |

| Matthews International (MATW) | N/A | 14.9 | 30.9 |

| Hillenbrand (HI) | 6.0 | 16.1 | 10.9 |

Earnings incoming

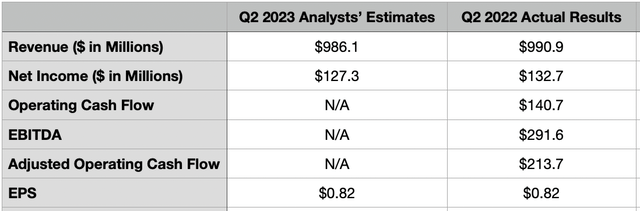

Now, it is important to keep in mind that the picture can always change. And as investors, it’s our responsibility to change our opinions when the data does change. The good news is that some data is going to be coming out in just a few days. In fact, on August 1st of this year, just after the market closes, the management team at Service Corporation International is expected to announce financial results covering the second quarter of 2023. The current expectation is for the business to report revenue of $986.1 million. That would represent a modest decline compared to the $990.9 million reported one year earlier.

Author – SEC EDGAR Data

On the bottom line, analysts are forecasting earnings per share of $0.82. That matches what the company achieved in the second quarter of 2022. Overall net income though would drop slightly because of a change in share count, declining from $132.7 million to $127.3 million. Analysts have not provided guidance when it comes to other profitability metrics. But investors would be wise to pay attention to them. Operating cash flow in the second quarter of 2022 was $140.7 million, while the adjusted figure for it was $213.7 million. And finally, EBITDA for the enterprise totaled $291.6 million.

Takeaway

Based on the data that I see, I understand why some investors might be a bit cautious. But truly, I view this as a bump in the road. In the long run, Service Corporation International should offer attractive growth prospects. Shares are not exactly cheap. But for an industry leader in a space that should be quite stable moving forward, with any instability likely helping it instead of hurting it, I would say that shares are attractively priced. Given these factors, I have no problem keeping the company rated a ‘buy’ for now.

Read the full article here