Spotify Technology S.A. (NYSE:SPOT) reported decent earnings for the second quarter yesterday, but the market was not impressed. SPOT stock tanked more than 14% as investors focused on the revenue miss despite strong subscriber and user metrics. Three months ago, I highlighted why profitability remains elusive for Spotify despite exponential growth in monthly active users and subscribers in the last 5 years. After digesting second-quarter earnings, I believe Mr. Market is being too harsh on Spotify, but I still need a wider margin of safety to invest in the company.

The Monetization Problem

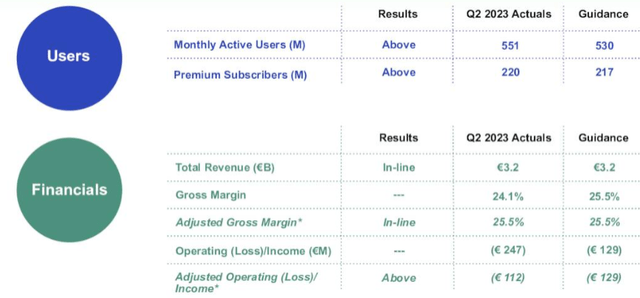

Spotify added 36 million net monthly active users in the second quarter and 10 million subscribers to end the quarter with 551 million MAUs and 220 million premium subscribers, both metrics above the company’s guidance.

Exhibit 1: Q2 earnings snapshot

Earnings presentation

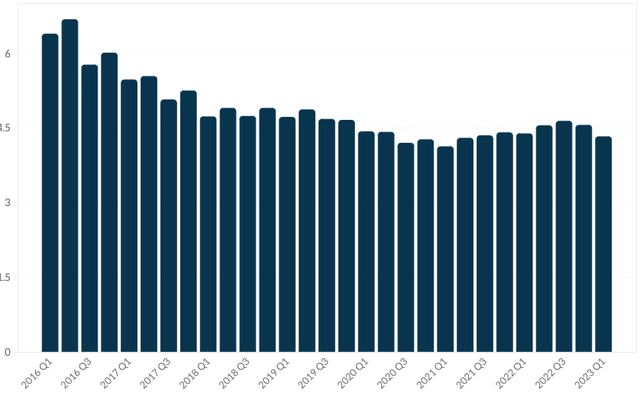

Subscription revenue grew 11% on the back of a 17% YoY subscriber growth, but the company booked a 6% decline in average revenue per user to EUR 4.27. According to company filings, ARPU was impacted by currency headwinds, product mix, and market mix. A closer look at Spotify’s ARPU reveals the company has struggled to gain momentum for several years. In many instances, the company has attributed the steady decline in ARPUs to the growth of its Family Plan, which allows up to 6 people living under one roof to use a subscription. The increasing popularity of this subscription tier has indeed changed the company’s product mix over the years, negatively impacting ARPU. However, investors should not forget that Spotify projected a reversal of this decline back in 2020 with no results to show yet, which makes this challenge a fundamental barrier to revenue growth.

Exhibit 2: Spotify premium ARPU

Business Quant

Spotify CEO Daniel Ek has repeatedly emphasized the company’s strategy of focusing on building scale vs maximizing ARPU growth in the short term. As an investor who has endorsed similar strategies of Netflix, Inc. (NFLX) and Uber Technologies, Inc. (UBER), it would not be justifiable if I were to suggest Spotify do otherwise. However, as I stated in my previous article, I believe Spotify has already amassed enough scale to now focus on profitability, which is the catalyst that could move SPOT stock higher from here. During the Q2 earnings call yesterday, CEO Daniel Ek said:

So now let’s talk about revenue growth. There are three ways for us to drive revenue growth. We can grow our users, we can create new business with new revenue streams, and we can increase revenue per user. Our preference among them is to focus on growing the overall number of consumers on our platform as this gives us scale advantages and retains optionality for the future. However, we’ve also been clear that there will come a time when price increases become a more important tool in the toolbox.

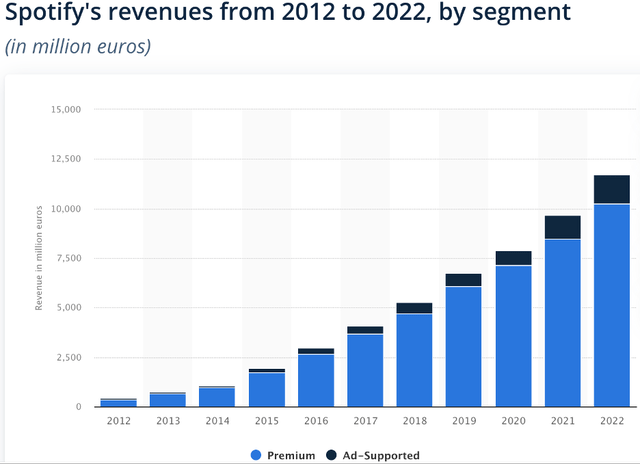

The importance of better monetization can be understood by looking at a simple revenue metric. As illustrated below, subscription revenue accounts for the lion’s share of Spotify’s revenue (87% in 2022) but ad-supported users account for more than half of total users.

Exhibit 3: Spotify revenue by segment

Statista

To improve the monetization of its user base (which includes both premium and free users), the company has embraced advertisements. To improve the ARPU (not just premium ARPU), Spotify can focus on a few different strategies.

- Increase the percentage of premium subscribers.

- Increase the cost of premium subscriptions.

- Improve the monetization of ad-supported users.

A monetization strategy that combines these 3 components will help Spotify realize a notable increase in ARPU. The company has successfully executed price hikes in the past, and on Monday, announced another price hike that would see the prices of some U.S. plans increasing by as much as 20%. This is a welcome move that will help the company reverse the recent trends in ARPU, but amid intensifying competition and challenging macroeconomic conditions, the company may have to settle for an increased subscriber churn as well. If some users downgrade to the ad-supported plan, the overall monetization will take a hit as the company has struggled to gain momentum with ad revenue.

The coming price increases, on the other hand, will not incentivize ad-supported users to pull the trigger to become premium subscribers. This will pose a challenge to Spotify’s mission to increase the penetration of premium subscribers.

Coming to the monetization of ad-supported users, the company is grappling with macroeconomic challenges that have dampened the outlook for the global advertising sector. Although these challenges are likely to prove short-lived, I believe Spotify will continue to find it difficult to grow this business due to fundamental challenges. Unlike Facebook which can seamlessly integrate ads into our feed, Spotify ads come in between music, which can have a meaningful impact on the experience of users. The company has done a commendable job in taking things slow to let users familiarize themselves with advertisements, but I believe the company’s ability to attract and retain advertisers is inherently low compared to social media platforms.

Product innovation is always a welcome sign, and Spotify’s foray into podcast streaming is an exciting move given that podcast consumption is on the rise not just in America but globally. However, the company has faced challenges in monetizing podcasts, primarily because the company does not have the rights to most of these podcasts. According to Jake Barfield, founder and portfolio manager of Asheville Capital Management, Spotify is unable to monetize more than 99% of podcasts streamed on the platform.

Overall, I believe the encouraging user growth that we are seeing today will take years to be reflected in Spotify’s financial performance, if at all. I am not in the least suggesting Spotify’s long-term focus is questionable. In fact, I prefer to invest in companies that prioritize the sustainability of long-term earnings growth over short-term profitability. In Spotify’s case, the path to profitability remains uncertain even in the long run because of the fundamental challenges the company is facing today.

A Valuation Reality Check Is On The Cards

In the best-case scenario, I believe the global advertising industry will recover earlier than expected, paving the way for Spotify to improve the monetization of ad-supported users. The company continues to grow MAUs at a stellar pace, which sets up the platform to benefit from scale advantages in the future. Although an improvement in monetization is a positive development, the company may suffer from a valuation perspective. In the last decade, Mr. Market has attached premium valuation multiples to subscription businesses. In my opinion, investors prefer to invest in subscription businesses because of the reduced revenue volatility resulting from recurring revenue streams. The expected growth of Spotify’s ad business will expose the company to the cyclicality associated with the advertising industry. Cyclical businesses have historically traded at a discount to subscription businesses, and I believe a valuation reality check is on the cards for Spotify when the ad business grows meaningfully to account for a sizeable share of total revenue.

Takeaway

Spotify’s user growth is encouraging, but the company, due to the inherent characteristics of its business, is still finding it difficult to convert user growth into tangible financial results. The company’s lack of profitability coupled with the expectations for growing ad revenue suggests a valuation reality check is on the cards. Spotify is a true disruptor, but I am not comfortable investing in the company in light of the profitability challenges.

Read the full article here