A little more than a year ago, we described that we had identified several $ Billions of discounted REIT preferred issues that carried a particularly attractive feature of dividend coupon rates that would convert from fixed to floating interest rates at specified dates in the near future. Upon conversion to floating rate, they would then pay dividends at 3-month London Interbank Offer Rate (LIBOR) plus 350 to 600 basis points. At the time, the Fed had just started its rate hiking campaign and LIBOR stood at about 1.60%; on June 30th, LIBOR had hit 5.53%. If we get two additional rate hikes this year, we will be looking at LIBOR (or its new equivalent SOFR) indexing our floating rate preferreds at 6% +350 to 650 basis points.

Thus far, three issues in the fixed-to-floating pool have converted to floating rate coupons: AGNC Investment Corp. pfd. Series C (AGNCN) Annaly Capital Management pfd. Series F (NLY.PF) Annaly Capital Management pfd. Series G (NLY.PG)

The share price performance of these issues upon conversion to floating rate might be instructive not only as to what to buy, but also as to when to buy it.

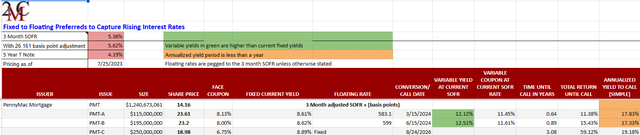

Portfolio Income Solutions maintains a live Google sheet that tracks market price activity for the entire set of Fixed-to-Floating mREIT preferreds and the calendar and terms of their conversion. A quick perusal of the table will tell you that the next issue up for call or conversion is PennyMac Mortgage investment Trust pfd. Series A (NYSE:PMT.PA).

Portfolio Income Solutions

PMT.PA currently carries a face coupon of 8.125% and will next go ex-dividend on or around 08/31/2023. Purchasing shares at today’s price of $23.61 would get you an attractive dividend yield of 8.61%, but that yield will only last for about eight months. On March 15, 2024, if the issue isn’t called, the yield will convert to an adjusted 3-month SOFR + 583.1 basis points. If SOFR remains at today’s levels, that brings the floating rate coupon to 11.45% as measured against a $25 par value. The shares purchased at $23.61 would then produce an annualized yield of 12.12%. But that is only part of the potential return on investment.

Prior to the start of rising interest rates, these preferreds traded around or slightly above their $25 par value. When interest rates rise, bond prices fall and that is exactly what happened with these preferreds, with many of them seeing their market prices fall as much as 25%. Upon conversion to floating rate, however, the three issues that have thus far converted almost immediately resumed trading around par. Surprisingly, the issues that have not yet converted, but soon will, are still available at steep discounts. And that is the case with PMT.PA.

If PMT.PA follows the trading price patterns of AGNCN, NLY.PF, and NLY.PG, its shares will again trade at $25.00. That ~$1.39/share price appreciation adds about 5.9% to your capital, bringing your total return to a 14-18% range over the next 12 months. If the shares are called at $25, you are still net ahead double digits.

Underwriting the Issuer

Prior to the meteoric rise in interest rates, mREIT preferreds traded as if they were fungible; if the underlying issuer was not a capital train wreck, all the issues traded at par or a small premium, depending on the calendar for their potential call. Before investment in any security, you need always perform sufficient due diligence to ascertain that the issuer is, indeed, not a capital train wreck and that it can make good on its financial obligations.

Fortunately, we are heading into the thick of mREIT earnings season. Dynex Capital (DX) and AGNC Investment (AGNC) have already reported, and you can get current on their operations with these links.

PennyMac Mortgage Investment Trust (PMT) will report earnings on 07/27/23, and you can retrieve their reporting and hear their earnings call here. Prospective investors need to understand how a company is performing in the current economic environment, study its capital stack, and determine if investment is a risk worth taking.

Alternatives in an Uncertain Interest Rate Environment

Fixed income investing in a rising interest rate environment can be a precarious proposition. It is difficult to see when the trend will stop or when it will reverse. These floating rate preferreds provide an interesting alternative to capture high/competitive yields that are somewhat cushioned to change.

Some homework will help you not only to determine what to buy, but also when to buy. In the case of PMT.PA, we aim to capture both the high and growing yield at its currently discounted share price and realize capital appreciation when it converts to floating rate next March. If we do everything right, and other, similar issues remain discounted, we can sell the PMT.PA, swap into a new discount and possibly capture the yields and capital gains in succession as the calendar advances.

A little more than a year ago, we described that we had identified several $ Billions of discounted REIT preferred issues that carried a particularly attractive feature of dividend coupon rates that would convert from fixed to floating interest rates at specified dates in the near future. Upon conversion to floating rate, they would then pay dividends at 3-month London Interbank Offer Rate (LIBOR) plus 350 to 600 basis points. At the time, the Fed had just started its rate hiking campaign and LIBOR stood at about 1.60%; on June 30th, LIBOR had hit 5.53%. If we get two additional rate hikes this year, we will be looking at LIBOR (or its new equivalent SOFR) indexing our floating rate preferreds at 6% +350 to 650 basis points.

A little more than a year ago, we described that we had identified several $ Billions of discounted REIT preferred issues that carried a particularly attractive feature of dividend coupon rates that would convert from fixed to floating interest rates at specified dates in the near future. Upon conversion to floating rate, they would then pay dividends at 3-month London Interbank Offer Rate (LIBOR) plus 350 to 600 basis points. At the time, the Fed had just started its rate hiking campaign and LIBOR stood at about 1.60%; on June 30th, LIBOR had hit 5.53%. If we get two additional rate hikes this year, we will be looking at LIBOR (or its new equivalent SOFR) indexing our floating rate preferreds at 6% +350 to 650 basis points.

Read the full article here