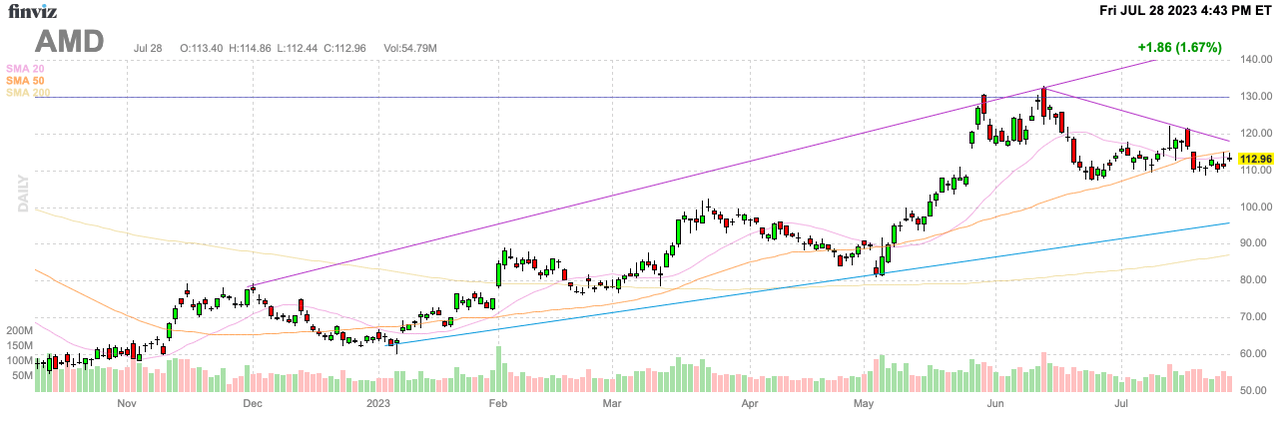

As with any competitor, a quarterly earnings report from a peer can provide great insight into the market. For Advanced Micro Devices (NASDAQ:AMD), the Q2’23 earnings report from Intel (INTC) provides great views on the surging demand for AI chips and a rebound in PC demand crucial for AMD. My investment thesis remains ultra Bullish on AMD with the stock still trading down around $112 while other chips companies have rallied to multi-year highs.

Source: Finviz

PC Rebound

The most immediate signal from Intel beating Q2’23 estimates and guiding up for Q3 is the rebound in PC demand. Most importantly, the inventory correction appears over with OEMs no longer digesting chip inventory.

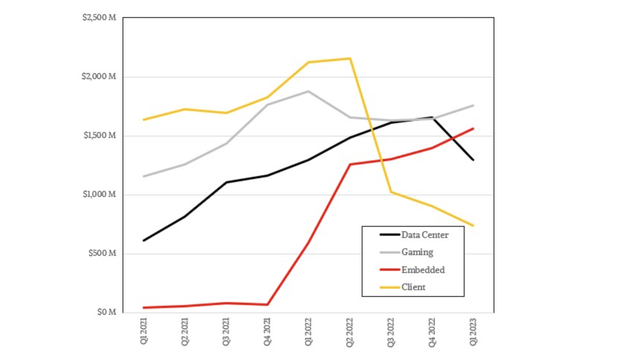

Back in Q3’22, AMD shocked the market by cutting PC revenue estimates by $1 billion. The company quickly went from $2 billion in quarterly CPU sales for PCs to less than $1 billion.

Intel still reported Q2 Client Computing revenue was down 12% YoY to $6.8 billion, but the number was up $1.0 billion sequentially. The chip giant guided up Q3 revenue to $13.4 billion, up $0.5 billion sequentially.

In Q1’23, AMD reported that client revenues had fallen further to only $739 million. AMD CPU revenues are now far over $1 billion per quarter below the peak levels providing substantial upside potential when the PC market normalizes.

Source: The Next Platform

AI Rescue

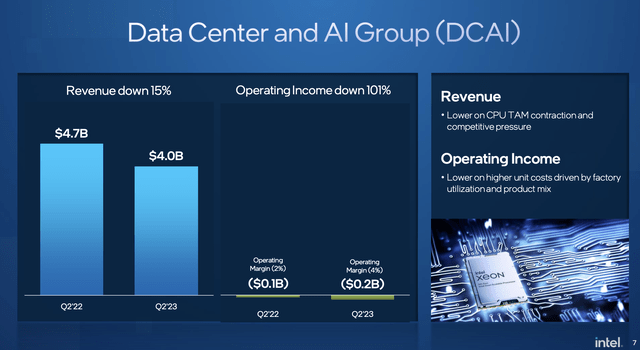

Intel discussed a mixed picture for their business in the near term due to AI. The chip giant is seeing a wallet share shift from the sever CPU spend towards AI chips.

The move is both good and bad for AMD. The company has the MI300 AI GPU chip hitting the market in Q4 providing a strong competitor to the booming demand for the H100 from Nvidia (NVDA), but the chip isn’t out on the market yet.

In the near term, AMD may see some suppressed data center demand while heading into 2024. Ultimately, the company should see upside from AI demand for the MI300 along with the Alveo AI accelerator.

On the Q2’23 earnings call, Intel CEO Pat Gelsinger suggested the AI pipeline for 2024 had surged to $1 billion:

In my formal remarks, we said we now have over $1 billion of pipeline, 6x in the last quarter.

Going back a few months, Morgan Stanley had estimated the AI potential for AMD was only $400 million with upside potential to $1.2 billion. The Intel forecasts would suggest the AI potential for AMD is far higher next year when the MI300 is in full-scale production.

Nvidia guided up current quarter sales estimates by 50% to over $11 billion. The company suggested data center sales would reach $7+ billion in the quarter.

AMD has only seen data center sales reach $1.3 billion in quarterly sales leaving a huge gap from Nvidia. Even Intel still hit $4.0 billion in data center sales during Q2’23, though the amount is down nearly 20% form 2022 levels due in part to losing market share to AMD.

Source: Intel Q2’23 presentation

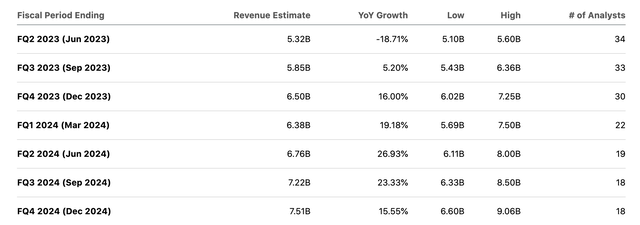

The big issue for AMD is whether data center sales growth stalls causing a miss to 2H sales targets while booming AI demand ultimately boosts sales starting in Q1’24, or maybe Q4. The chip company peaked at quarterly sales of $6.6 billion back Q2’22 and the current quarterly analyst estimates aren’t very aggressive.

Source: Seeking Alpha

A rebound in PC demand to more normalized levels places AMD back at the Q4’23 revenue target of $6.5 billion alone. A PC rebound to normal digestion ($2 billion quarterly run rate) along with higher data center or AI demand leads to vastly higher revenues in 2024.

The current analysts aren’t even factoring in much growth in the Q2’24 revenue estimate of $6.76 billion. The amount is just 4% upside from Q2’22 despite potentially surging demand from AMD entering the AI GPU space.

AMD is set to report earrings after the close on August 1. Investors should focus less on the Q2 numbers or even Q3 guidance and focus more on a return to more normalized revenue levels plus the upside from AI.

Our view has long held that AMD has the earnings potential of $5 to $6 and the AI opportunity is all upside to this view.

Takeaway

The key investor takeaway is that AMD is still $50 below all time highs while Nvidia has soared over $100 above the late 2021 highs. Investors should use the current weakness in AMD to load up on the stock while leaving some capital to buy any weakness following Q2 earnings due to the potential for near term disappointment leading to long term opportunities.

Read the full article here