The electric vehicle industry is showing promising signs of improving investor sentiment after XPeng (NYSE:XPEV) announced that it received a $700M investment from German auto company Volkswagen (OTCPK:VWAGY) (OTCPK:VLKAF) (OTCPK:VWAPY). In a strategic partnership, XPeng and Volkswagen agreed to jointly develop two battery electric vehicles under the Volkswagen brand and the deal could pave the way for similar deals that combine the balance sheet strength of European car companies with the technological know-how and momentum of Chinese electric vehicle start-ups. I believe the deal is a huge positive for XPeng and the industry as well, and I am upgrading my rating from hold to buy as a result!

Previous rating and reasons for rating change

Before the announcement of the XPeng-Volkswagen partnership I rated Chinese electric vehicle company XPeng as a hold because the company suffered from increasing pricing pressure in the industry, resulting in weaker vehicle margins, and because XPeng under-performed rivals such as NIO (NIO) or Li Auto (LI) regarding delivery growth rates. I am upgrading XPeng to buy in response to the Volkswagen partnership announcement.

Why the XPeng-Volkswagen partnership is a big deal

Chinese electric vehicle companies have faced a confidence crisis in the last two years due to slowing growth, challenges to demand as well as mounting profitability problems. XPeng, as an example, is not expected to be profitable until FY 2026 (based off of consensus estimates), a profitability date that has been pushed out by two years lately due to demand challenges in the industry and a weakening price environment that resulted in XPeng reporting negative vehicle margins for the first-quarter. What further weighed on XPeng was a weak outlook for the third-quarter which implies a 39% decline in deliveries Y/Y.

Last week, XPeng reported that it entered into a long term strategic partnership with German auto manufacturer Volkswagen. This agreement states that both companies are going to jointly develop two battery electric vehicles under the Volkswagen brand and that the German car company is going to take a 5% minority position in XPeng, investing a total of $700M (at a valuation of $15 per ADS).

The cooperation and investment partnership between the two auto companies is obviously a hugely positive development for XPeng since the Chinese company has suffered from a deterioration in investor confidence after it successively disappointed investors with its delivery achievements. Shares of XPeng jumped on the news and traded 15.5% higher on Friday, lifting up the entire sector.

By entering into a strategic partnership with Volkswagen, XPeng is not only securing additional funds to ramp up its own production and deliveries in China, but XPeng could ultimately leverage the partnership and enter the European market in a fast and efficient manner without having to build its own production capabilities or distribution network, which costs a lot of money and is a burden especially for start-ups with limited resources. Additionally, the Volkswagen investment shows that a large European car brand has confidence in XPeng’s overall EV strategy and technological development capabilities.

While the deal obviously is a big win for XPeng, I believe it could mark the beginning of a new trend in which established European car brands and Chinese EV start-ups join forces to leverage each other’s development strengths and take on the competition. NIO and Li Auto are two EV companies that could also enter into similar collaboration and investment partnerships with European (or American) car manufacturers in order to share development risks and open up growth opportunities in new regions. For the sector as a whole, the XPeng-Volkswagen partnership is a giant step forward.

Valuation of XPeng relative to other EV rivals

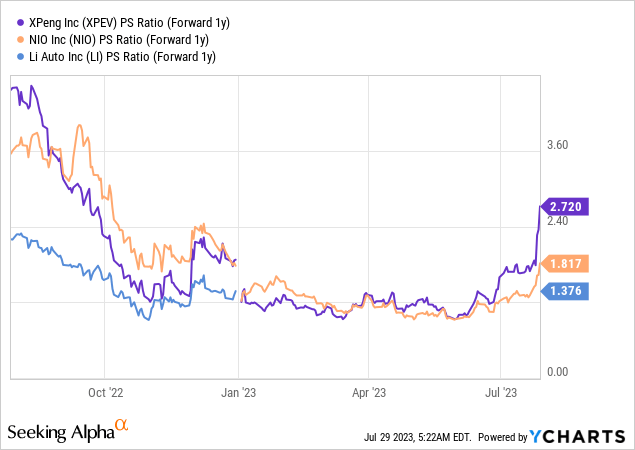

Li Auto still has the lowest price-to-revenue ratio (1.37X) in the EV industry group, which I find amazing considering that Li Auto is crushing it regarding its delivery growth and the company is expected to be profitable this year, way earlier than the competition.

EV valuations as a whole recovered last week, following the announcement of the XPeng-Volkswagen deal, with shares of NIO soaring 11% and Li Auto shooting up 10%. While XPeng is now the highest-valued Chinese EV start-up in the industry group with a price-to-revenue ratio of 2.7X, I believe shares continue to have revaluation upside as investors digest the importance of the deal and its implications for the sector as a whole.

Risks with XPeng

One of the key risks with XPeng is that the EV maker has seen a negative vehicle margin in the first-quarter and slowing delivery growth due to demand challenges in China. In the short term, these are headwinds for XPeng’s valuation. The XPeng-Volkswagen deal, on the other hand, has succeeded in refocusing investors’ attention on the big picture… which is the massive ramp in the EV industry and the increasing acceptance of Chinese EV start-ups and their technology by established European car brands.

Final thoughts

The XPeng-Volkswagen strategic partnership that sets out terms for the joint development of two battery electric vehicles and includes a $700M investment is a much bigger deal, in my opinion, than investors may realize. Established European car brands are now looking to invest in Chinese EV start-ups in a bid to accelerate product development, leverage R&D strengths and share risks/costs. Besides receiving $700M at a time of continual operating losses, the deal potential creates a springboard for XPeng into the European market. I believe the deal is transformative, not just for XPeng, but also for the entire Chinese EV industry and more deals could follow. As European car brands seek out more strategic development and investment partnerships with other EV companies, such as NIO and Li Auto, the industry as a whole could benefit from a return of investor optimism!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here