Recently, I wrote a cautious article on the Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX), noting Nuveen’s ‘dynamic’ overwriting strategy appears to be actually adding ‘negative alpha’ compared to a mechanical call-write strategy.

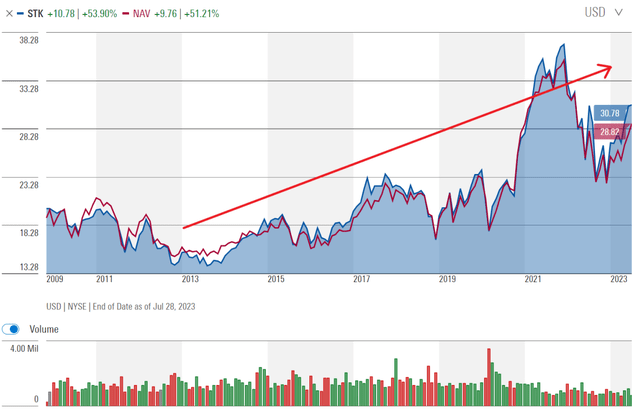

This article reviews the Columbia Seligman Premium Technology Growth Fund (NYSE:STK), another technology-focused close-end fund that also uses call-write strategies to generate income. Does the STK fund suffer from the same issues as the QQQX fund?

Fund Overview

The Columbia Seligman Premium Technology Growth Fund is a closed-end fund (“CEF”) that aims to deliver capital appreciation and current income from a portfolio of technology stocks. The STK fund also seeks to write call options on the Nasdaq-100 Index to generate income.

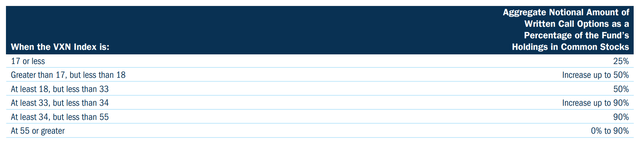

STK’s call-write overlay is rules-based and depends on the level of the CBOE Nasdaq-100 Volatility Index (“The VXN Index”), a measure of the expected 30-day volatility implied in Nasdaq 100 Index options. In general, the STK fund will write more call options when the VXN Index is high, and fewer options when the VXN index is low (Figure 1).

Figure 1 – STK’s rules-based call-write overlay (STK annual report)

In addition to the rules-based options strategy noted above, the STK fund may write additional call options up to 25% of the notional value of the fund if the manager deems the options to be attractively priced. Furthermore, the manager may also buy or write other call and put options on securities, indices, and ETFs to generate additional income or protect the portfolio on the downside.

The STK fund has $466 million in assets and charges a 1.26% total expense ratio.

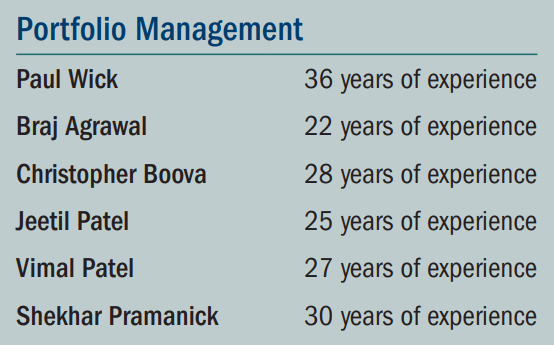

Long-Tenured Portfolio Management Team

The STK fund benefits from a long-tenured management team that collectively has 168 years of experience (Figure 2). STK is led by Paul Wick, a seasoned technology investor with 36 years of experience, making him the most tenured manager in the technology space according to Columbia Threadneedle Investments.

Figure 2 – STK has a long-tenured portfolio management team (STK factsheet)

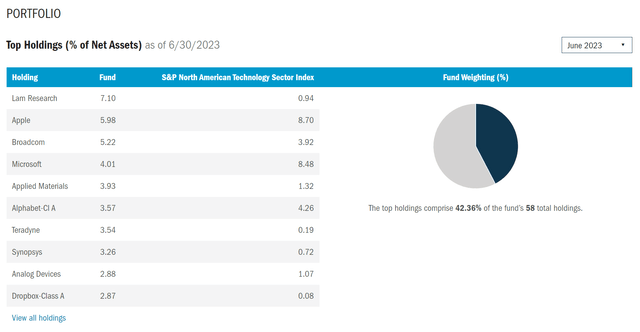

Portfolio Holdings

The STK fund is not an index hugging fund, as we can see that the fund’s top holdings differ materially from that of the S&P North American Technology Sector Index, with the top holding being Lam Research Corporation (LRCX). Overall, the top 10 holdings of the STK fund contribute 42.4% of the fund’s portfolio (Figure 3).

Figure 3 – STK top 10 holdings (columbiathreadneedleus.com)

Returns

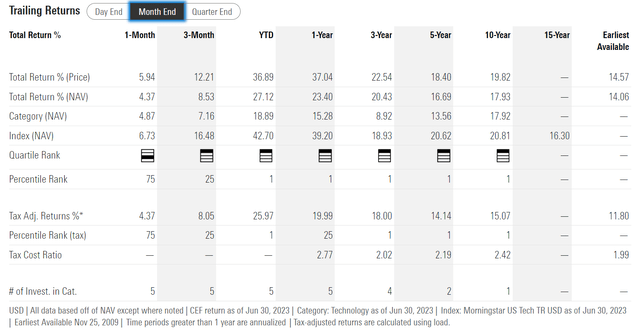

The STK fund has delivered very strong historical returns, with 3/5/10Yr average annual returns of 20.4%/16.7%/17.9% respectively to June 30, 2023 (Figure 4).

Figure 4 – STK historical returns (morningstar.com)

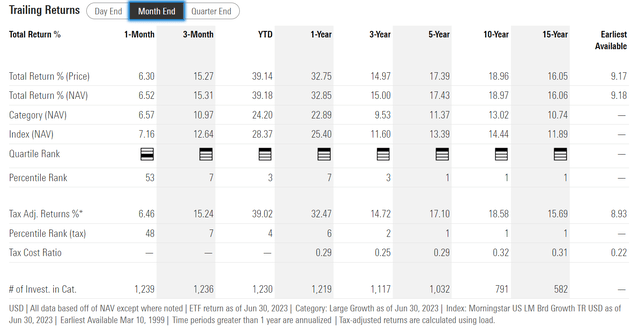

However, investors need to bear in mind that technology stocks have been on a decade-long bull run, so STK’s results should be compared against an appropriate benchmark, like the Nasdaq 100 Index, as represented by the Invesco QQQ Trust (QQQ). The QQQ ETF has delivered 3/5/10Yr average annual historical returns of 15.0%/17.4%/19.0% in comparison (Figure 5). When viewed from this lens, STK’s returns are still strong, but no longer quite as impressive.

Figure 5 – QQQ historical returns (morningstar.com)

Distribution & Yield

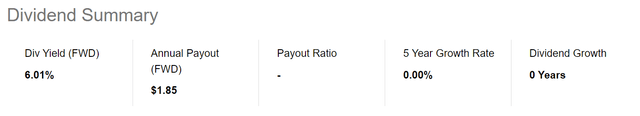

One of the main attractive features of the STK fund is its high distribution yield. Due to its option writing strategy, the STK fund is able to fund a $0.4625 / qtr distribution, which works out to a 6.0% forward distribution yield on market price and 6.4% yield on NAV (Figure 6).

Figure 6 – STK distribution yield (Seeking Alpha)

Aside from the quarterly distribution, the STK fund also pays out realized gains annually. For 2022, the special distribution was $1.0819 / share, which boosted total distribution for 2022 to $2.93 / share.

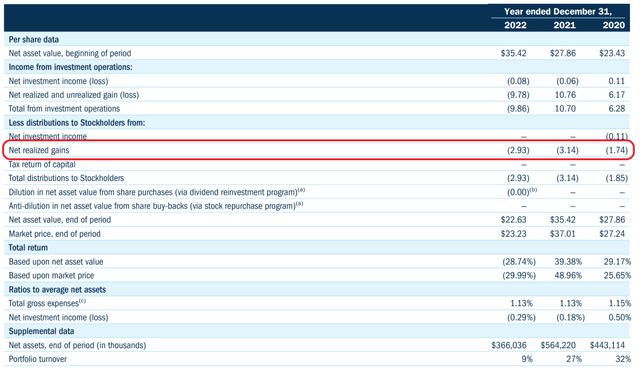

STK’s distribution is primarily funded from realized gains (Figure 7). However, since the fund’s distribution yield (6.4% of NAV) is below its long-term average annual returns, I do not have much concerns regarding the sustainability of STK’s distribution yield. Over a cycle, the STK fund appears to earn more than enough total returns to fund its distribution.

Figure 7 – STK pays distribution from realized gains (STK annual report)

An analysis of STK’s long-term NAV profile shows a generally rising NAV, which confirms my thesis that the STK fund has been able to earn its distribution (Figure 8).

Figure 8 – STK historical NAV (morningstar.com)

STK Trading At A Premium

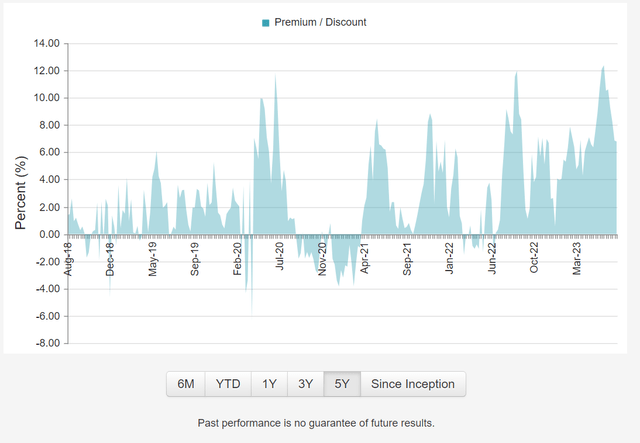

The STK fund is currently trading at a 6.8% premium to NAV, suggesting that it is modestly overvalued. Historically, STK’s premium / discount to NAV has ranged from a discount of ~4% to a premium of 12% (Figure 9).

Figure 9 – STK trading at a premium to NAV (cefconnect.com)

STK vs. Peers

For investors who want exposure to technology stocks while receiving high distribution yields from a call-writing overlay, there are a number of investment vehicles to choose from. I have previously reviewed the Global X NASDAQ 100 Covered Call ETF (QYLD), the Global X Nasdaq 100 Covered Call & Growth ETF (QYLG), and the Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX). How does the STK fund compare to these peer funds?

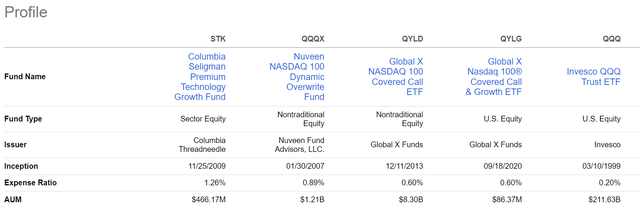

First, on fund structure, the STK fund is the most expensive, charging a 1.26% expense ratio compared to 0.6% for the Global X ETFs and 0.89% for QQQX (Figure 10).

Figure 10 – STK vs. peers structure (Seeking Alpha)

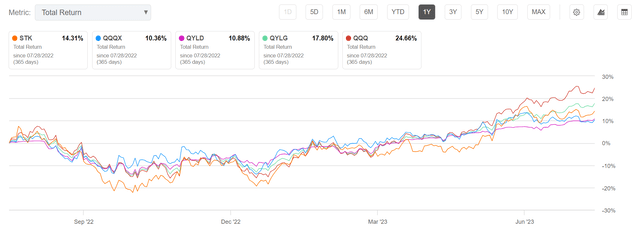

However, STK’s high fees may be justified by its differentiated stock selection methodology, which has produced superior long-term returns. On a 1Yr basis, the STK fund has returned 14.3% compared to 10.4% for QQQX, 10.9% for QYLD, 17.8% for QYLG, and 24.7% for the QQQ (Figure 11). (Investors should note that STK and QQQX are closed-end funds and the returns noted here are market price returns plus distribution yield, which may differ materially from NAV-based returns.)

Figure 11 – STK vs. peers, 1Yr total returns (Seeking Alpha)

On a 3Yr basis, STK’s stock selection really shines through as the STK fund has delivered 87.3% total returns compared to only 28.3% for QQQX and 22.7% for QYLD. In fact, STK has even outperformed the QQQ ETF on a 3Yr basis (Figure 12).

Figure 12 – STK vs. peers, 3Yr total returns (Seeking Alpha)

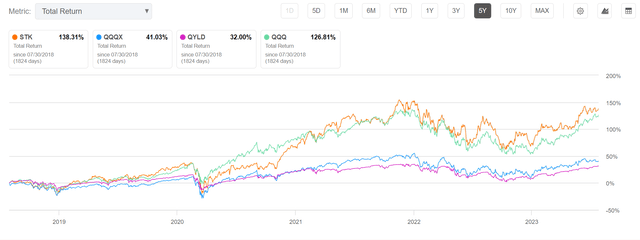

Similarly, on a 5Yr basis, the STK fund has crushed QQQX and QYLD’s returns and has beaten the QQQ ETF (Figure 13).

Figure 13 – STK vs. peers, 5Yr total returns (Seeking Alpha)

Comparing the distribution of the funds, the STK fund does not pay the most attractive distribution. On a trailing 12 month basis, the STK fund only has a 6.0% distribution yield, better than QYLG’s 3.9%, but below QQQX’s 7.4% and QYLD’s 8.5% (Figure 14).

Figure 14 – STK vs. peers, distribution yield (Seeking Alpha)

Overall, the STK fund is the most impressive technology-focused high yield fund I have reviewed to date. Readers may recall my overall criticism of call-write strategies that they generally trade off upside for premium income. However, the STK fund has been able to achieve total returns that are comparable or better than the QQQ ETF while delivering a generous distribution yield, currently set at 6.0%.

Conclusion

The STK fund is a technology-focused closed-end fund (“CEF”) that aims to provide capital appreciation and current income. The STK fund has a very impressive track record, delivering long-term returns that are comparable or better than the Nasdaq 100 Index while paying an attractive distribution yield, currently yielding 6.0%. The only knock against the STK fund is its valuation, which is currently at a 6.8% premium to NAV. I would look for pullbacks to buy this fantastic technology-focused CEF.

Read the full article here