Pinterest’s (NYSE:PINS) second quarter results were solid, indicating ongoing progress realizing the potential of the platform. While Pinterest’s business is likely to do well going forward, particularly when the demand environment improves, it will likely be 2024 before the company’s monetization efforts really begin to pay off. The macro environment remains a risk, but Pinterest is undervalued based on its likely growth path and profitability over a 5-to-10-year period.

Pinterest is significantly under monetized, both in terms of ad load and the value of ad inventory. The company’s CEO believes that the ad load could be as much as tripled from current levels. Pinterest is a platform for shopping as much as it is entertainment and as such users are likely to tolerate high ad loads, with relevant ads actually improving the user experience in many cases.

In support of better inventory pricing, Pinterest is trying to both increase demand and move down the advertising funnel. In the past, Pinterest has primarily been a top of funnel advertising platform, but is trying to drive lower funnel conversions with its shopping business. Pinterest estimates that conversion-based advertising pays roughly 5x more than impression-based advertising. Engagement with shoppable content is growing more than 30% YoY and shopping ad revenue has grown by multiples of total revenue growth over the past year.

This situation provides the potential for enormous growth, but Pinterest still needs to balance ad supply with the user experience and attract sufficient demand to meet the additional supply. Global ad impressions increased by more than 30% YoY in the second quarter, due to engagement gains and dynamically flexing ad load when a user is expressing intent through whole page optimization. This led to a 20% decline in pricing though due to a softer demand environment across all geographies.

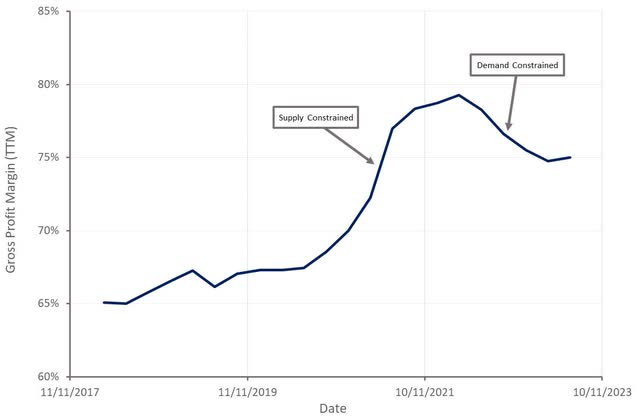

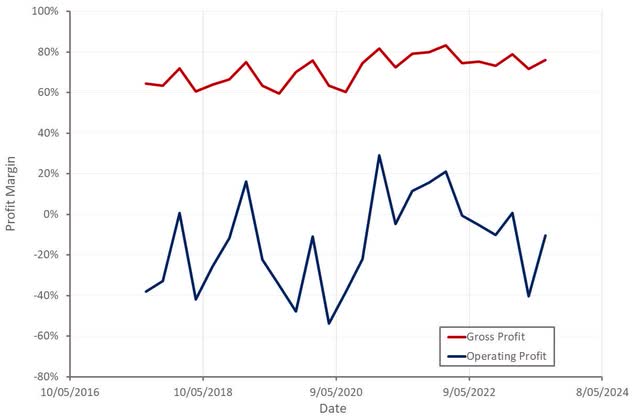

The shift from a supply constrained environment in 2020/2021 to a demand constrained one in 2022 can readily be seen in Pinterest’s gross profit margins. While margins are generally improving as Pinterest scales and monetizes its user base, pricing pressure is currently a headwind.

Figure 1: Pinterest Gross Profit Margin (source: Created by author using data from Pinterest)

The opening of Pinterest’s platform to third-party demand will go a long way to helping resolve this situation though. Pinterest prefers a first-party relationship, but it is currently relatively small, and as a result, many advertisers are not currently on the platform, even if Pinterest can offer an attractive ROAS.

Pinterest recently announced a partnership with Amazon (AMZN) to bring third-party ad demand to the platform. A decision made based on Pinterest’s desire to enable a favorable shopping experience. The partnership with Amazon should help to increase the brands and relevant products on the platform and will be combined with Amazon’s low friction buying experience for consumers. The implementation of this is expected to take multiple quarters though and a meaningful revenue impact isn’t expected until 2024. Pinterest recently began testing live traffic with Amazon ads and has been pleased with the results so far.

Like many digital advertisers, Pinterest has been negatively impacted by the shift in the privacy landscape and has been developing better measurement tools for retailers and advertisers in response. Advertisers that adopt Pinterest’s measurement tools see a 28% lift in conversions and their spend with Pinterest has increased 30% on average. Only something like 10% of advertisers have adopted these tools so far though. For the 90% of advertisers that haven’t adopted Pinterest’s measurement tools, revenue is declining by mid-single digits YoY. If Pinterest can accelerate adoption, it should provide a large tailwind in coming quarters.

Pinterest also brought its Mobile Deep Linking product to general availability in July. MDL helps retailers to drive purchases on their mobile apps and has been a significant contributor to Pinterest’s ads revenue growth over the past nine months. Pinterest also plans on introducing more low friction site handoffs in the second half of 2023.

Financial Analysis

Revenue increased roughly 6% YoY in the second quarter, with strong growth in impressions offset by weak pricing. The digital ads market appears to be stabilizing, but the recovery has been uneven across verticals, and this is likely negatively impacting Pinterest.

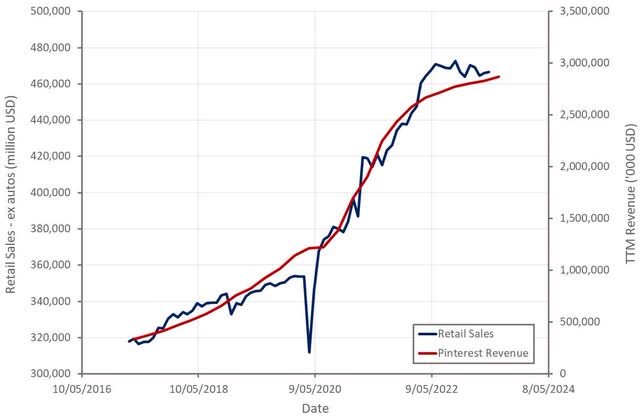

Compared to some of the larger advertising platforms, Pinterest’s revenue base is relatively concentrated and skews more towards areas like retail, particularly fashion, food, beauty and home goods. This is a headwind for Pinterest at the moment as retail sales growth has been weak over a multi-year period and continues to deteriorate.

Pinterest is seeing increased interest outside of its traditional core though, with strong growth in the number of users engaging with men’s fashion, auto, health and travel. This is contributing to increased traction with advertisers in emerging verticals like travel, autos and financial services and helping Pinterest to diversify its advertiser base.

Figure 2: US Retail Sales and Pinterest Revenue (source: Created by author using data from Pinterest and the Federal Reserve)

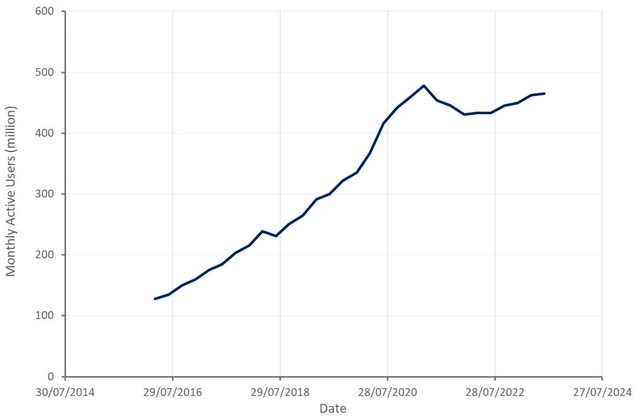

Global MAUs increased by 8% YoY in the second quarter, with mobile MAUs growing by 16%. Mobile users are responsible for 80% of impressions and while this growth is a positive, it highlights the demand problems Pinterest is currently facing. Engagement across a range of metrics (sessions, impressions, saves, etc.) also continues to outpace user growth across regions. Gen Z is also an area of strength for Pinterest, with double digit user growth and deeper engagement than older cohorts on the platform. Several quarters of solid user growth and engagement should have put to rest questions about the health of Pinterest’s platform, but this doesn’t seem to matter to investors at this point.

Figure 3: Pinterest MAUs (source: Created by author using data from Pinterest)

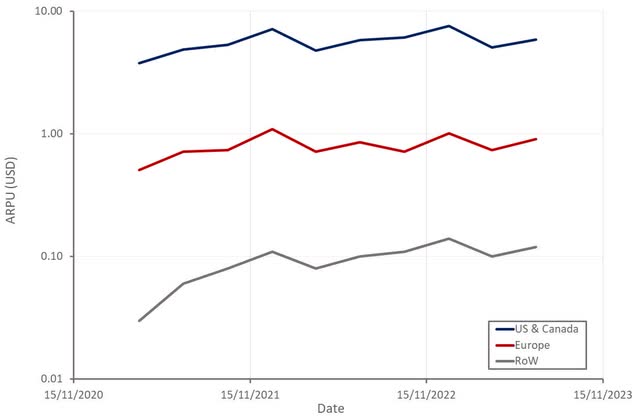

Gains in ARPU have been modest in recent quarters, particularly in North America and Europe. ARPU growth outside of these regions is still fairly strong though as monetization of these users is still low. Pinterest is beginning to invest more in international growth, with a focus on distribution through agencies and partners.

Figure 4: Pinterest ARPU by Region (source: Created by author using data from Pinterest)

Pinterest’s margins remain depressed, although they have likely now bottomed. Gross margins should improve with additional demand being brought onto the platform, dependent on the macro environment. Operating profit margins should also continue to increase as Pinterest realizes operating leverage on the back of stronger growth.

Figure 5: Pinterest Profit Margins (source: Created by author using data from Pinterest)

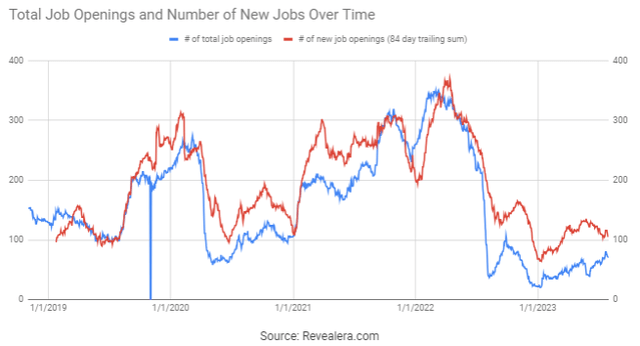

Job openings remain low, indicating that Pinterest remains focused on controlling costs, even as growth continues to improve.

Figure 6: Pinterest Job Openings (source: Revealera.com)

Valuation

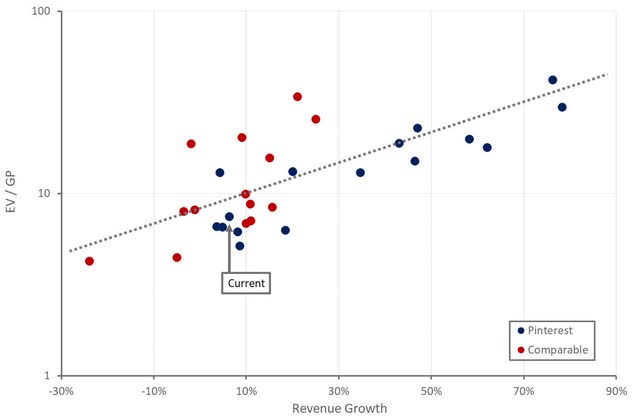

While Pinterest’s stock is up significantly off the lows in May, the company’s valuation is still low. Pinterest will have high margins at scale and still has a long growth runway ahead of it. This is not currently reflected in the share price though, as analysts and investors appear to believe that Pinterest’s current financial performance is all that should be expected going forward.

It is difficult to know what will happen to the macro environment over the next few years, but absent a large deterioration in conditions, based on current pricing Pinterest could be trading on a low double-digit PE multiple in the next five years.

Figure 7: Pinterest Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here