Back in December, I penned an article on the Simplify Interest Rate Hedge ETF (NYSEARCA:PFIX), arguing it was a good hedge against rising long-term interest rates. It has been more than seven months since my article, so I believe it is timely to revisit my thesis on the PFIX ETF.

Fund Overview

The PFIX ETF provides investors with a hedge against rising long-term interest rates via a portfolio of over-the-counter (“OTC”) interest rate derivatives that provide convex exposure to large upward moves in interest rates and interest rate volatility.

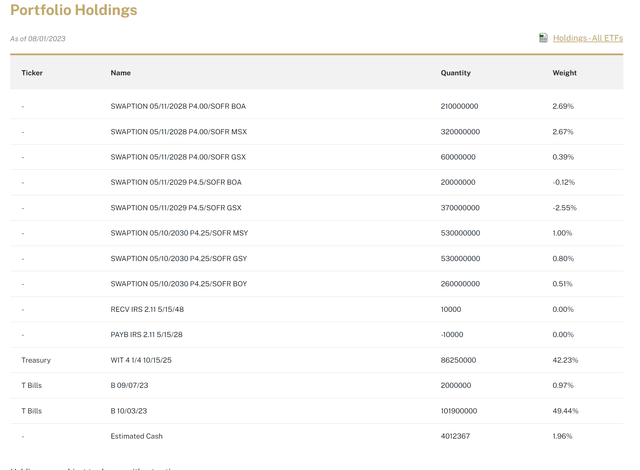

Currently, the PFIX ETF holds swaptions with maturities ranging from 2028 to 2030 paying 4.0% to 4.5% fixed interest rates against major investment banks like Goldman Sachs and Bank of America (Figure 1).

Figure 1 – PFIX portfolio holdings (simplify.us)

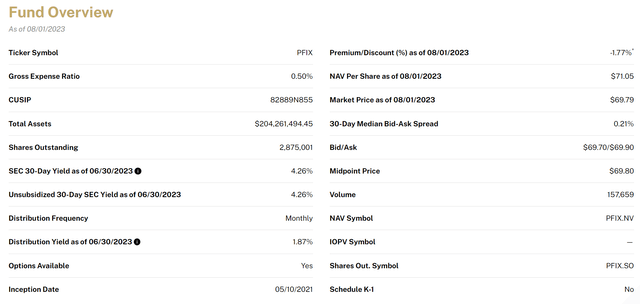

Since my last article, assets in the PFIX ETF have been cut in half, from ~$400 million to $204 million, as many traders believe the top in long-term interest rates have been reached and are no longer hedging their exposures (Figure 2).

Figure 2 – PFIX fund overview (simplify.us)

Interest Rates Breaking Out

However, in recent weeks, long-term interest rates, modeled as the 10Yr treasury yield in Figure 3, have been rallying and are close to breaking out of a consolidation pattern. What is going on and should investors be concerned?

Figure 3 – US 10Yr yields close to breaking out (Author created with price chart from stockcharts.com)

Strong Economy Leading To ‘Higher For Longer’ Fed

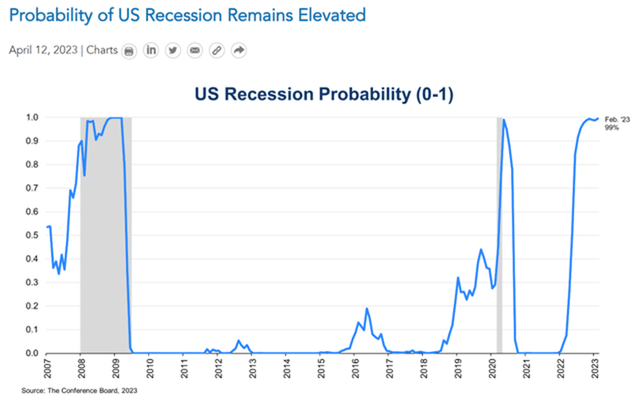

First, it is important to take a step back and discuss why investors may no longer feel the need to hedge for higher long-term interest rates. For most of 2023, economists and investors (myself included) have been forecasting a recession in the U.S. economy, driven by the Fed’s rapid pace of interest rate increases (Figure 4).

Figure 4 – Recession risk had been elevated in the U.S. (Conference Board)

In fact, the regional banking crisis in March that led to the failure and FDIC seizure of multiple regional banks was thought to be a symptom of the Fed’s interest rate hikes ‘breaking’ the financial system.

Thus for investors who believed a recession was imminent, they would naturally think the Fed would stop raising interest rates and quickly change course to ‘cut’ interest rates and stimulate the economy once a recession was apparent.

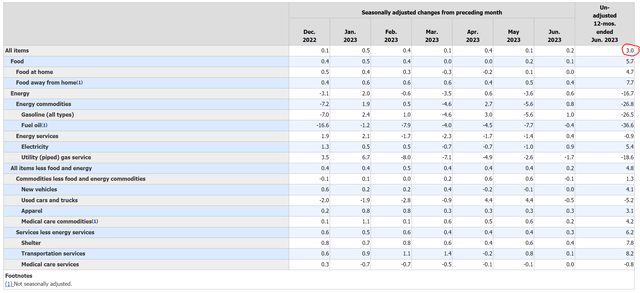

However, in recent weeks, the recession narrative has been turned upside down as inflation continues to moderate, with headline CPI inflation slowing to a 3.0% YoY rate in June (Figure 5), while jobs and economic growth continues to be robust.

Figure 5 – Headline CPI inflation slowed to 3.0% YoY (BLS)

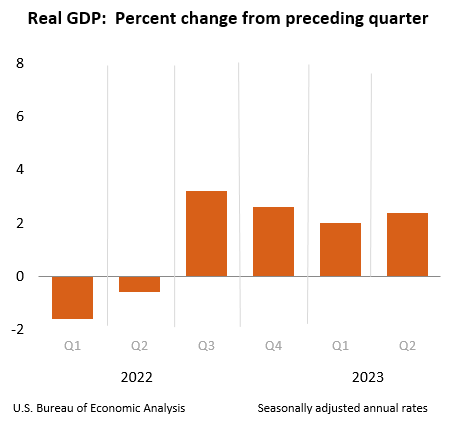

In the latest Q2/2023 GDP estimate from the Bureau of Economic Analysis, the U.S. economy grew at a 2.4% YoY rate, far ahead of consensus estimates of 1.8%. U.S. GDP also accelerated from Q1/2023’s 2.0% YoY rate, suggesting economic activity may have troughed and is beginning to reaccelerate (Figure 6).

Figure 6 – US GDP grew at 2.4% YoY rate in Q2 (BEA)

Against all odds, the Federal Reserve appears to have engineered a ‘soft landing’, where economic growth continues to be strong while inflation moderates.

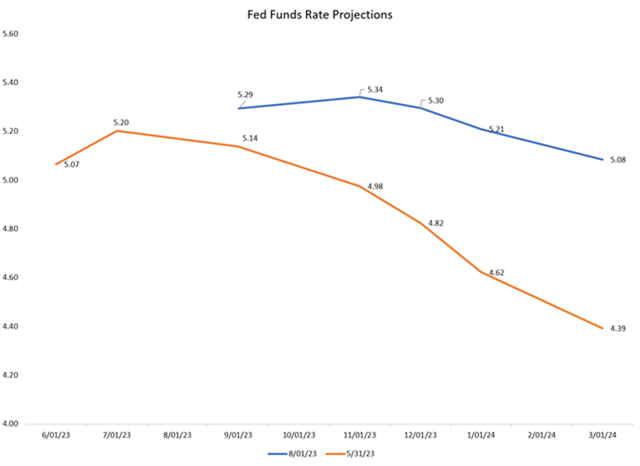

As the ‘soft landing’ narative picked up steam, investors also adjusted their expectations for future Federal Reserve policy decisions. Whereas at the end of May, investors were expecting the Fed to beginning rapidly cutting interest rates by September, the first rate cut has now been pushed out to January 2024 (Figure 7).

Figure 7 – Rate cut expectation now pushed to 2024 (Author created with data from CME)

Furthermore, whereas investors had previously expected 75 bps of interest rate cuts by March 2024, they now expect just a single 25 bps cut. This shift to a ‘soft landing’ economy and a ‘higher for longer’ Federal Reserve is one of the primary reasons long-term interest rates have been rising in the past few weeks, with the 10Yr yield now hovering around 4.0%, as per Figure 3 above.

JGBs Leading Global Yields Higher

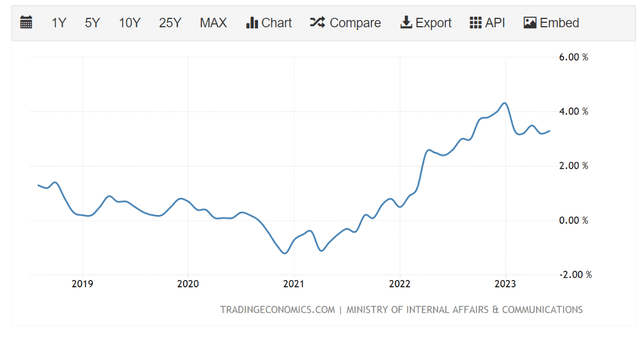

Another reason global interest rates have been rising in recent weeks is because of a change in the Bank of Japan’s (“BOJ”) yield curve control (“YCC”) policies. For much of the past year, the BOJ was the only major central bank that refused to raise interest rates, farcically claiming inflation was still not at its 2.0% target even though actual Japanese inflation had been far above 2% for many months (Figure 8).

Figure 8 – Japan CPI inflation (tradingeconomics.com)

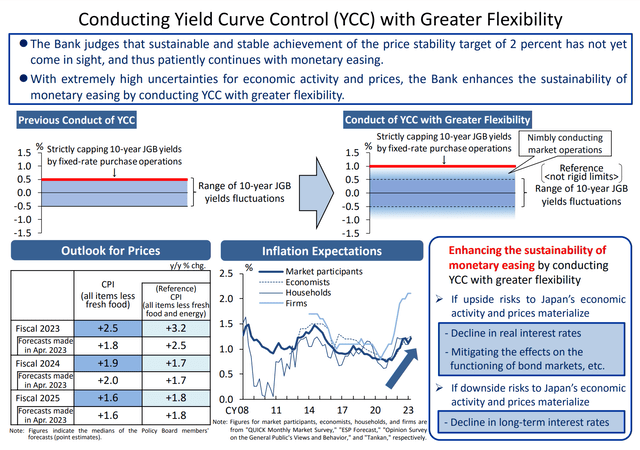

However, the BOJ’s stance abruptly changed on July 28th when it released new guidelines on a more ‘flexible’ YCC policy. While the BOJ did not explicitly raise its policy rates, it did change from a strict cap on 10-Yr JGB yields of 0.5% to a ‘range’ of 10-Yr JGB yields up to 1.0% that will be tolerated (Figure 9).

Figure 9 – BOJ abruptly changed YCC policy (BOJ)

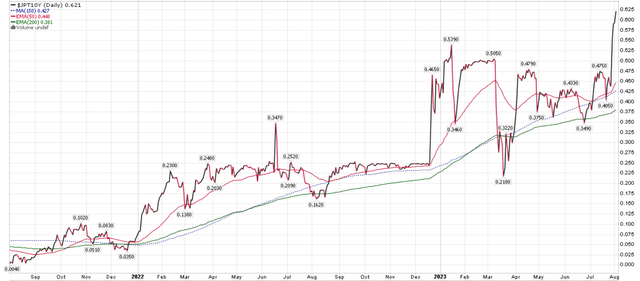

Since the new policy was announced, the 10-Yr JGB yield has quickly climbed to 0.62% (Figure 10). In effect, this policy change gave traders the ‘green light’ to short JGBs and raise 10-Yr JGB yields to test the BOJ’s resolve.

Figure 10 – 10 Yr JGB yields rapidly rising to test BOJ resolve (stockcharts.com)

The market reaction so far is similar to the ‘BOJ’s Christmas Surprise’ policy change from December 2022, when the BOJ initially moved to a 50 bps cap on 10-Yr JGBs.

Investors need to bear in mind that the Japanese Yen is the funding currency behind tens, if not hundreds of billions, in ‘carry trades’ – a macro trade where investors borrow at ultra low Japanese interest rates and invest the proceeds in higher yielding assets across the globe.

When the BOJ allow JGB yields to move higher, this reduces the attractiveness of foreign assets like U.S. treasuries relative to JGBs, and thus may lead to carry trades being unwound and foreign yields to rise.

Fitch Downgrade Raises Yields On The Margin

Finally, on August 1st, Fitch Ratings surprised markets by downgrading the United State’s long-term sovereign credit rating from AAA to AA+.

Fitch based its downgrade on ‘the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.’

While near-term investment implications of the Fitch downgrade is limited, it does highlight the long-term risks to the U.S. government’s fiscal situation.

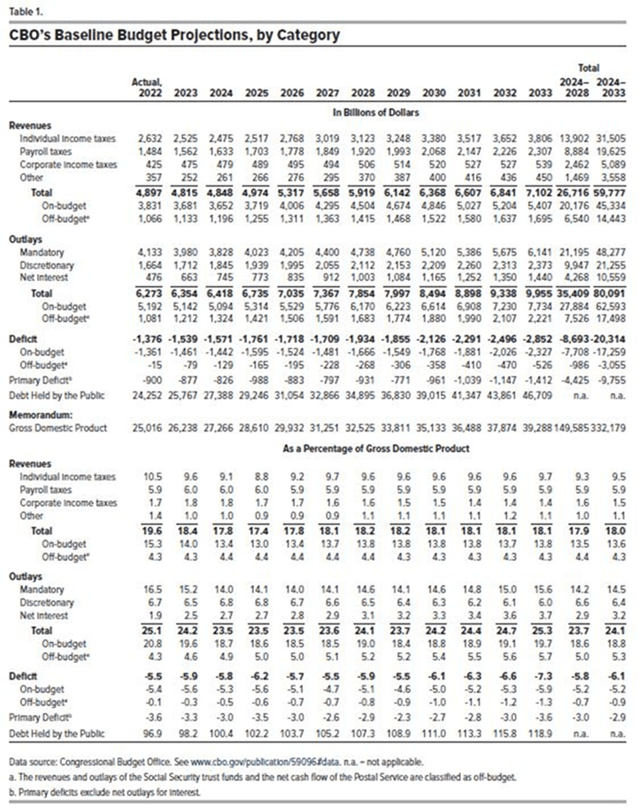

The main driver behind Fitch’s downgrade is the U.S. government’s out of control spending. According to the Congressional Budget Office’s latest baseline projections, the U.S. government is expected to run large and expanding deficits for the foreseeable future, ranging from $1.5 trillion in 2023 to $2.1 trillion in 2030, or 5.9% of GDP in 2023 to 6.1% of GDP in 2030 (Figure 11).

Figure 11 – U.S. government is set to run huge deficits for the foreseeable future (CBO)

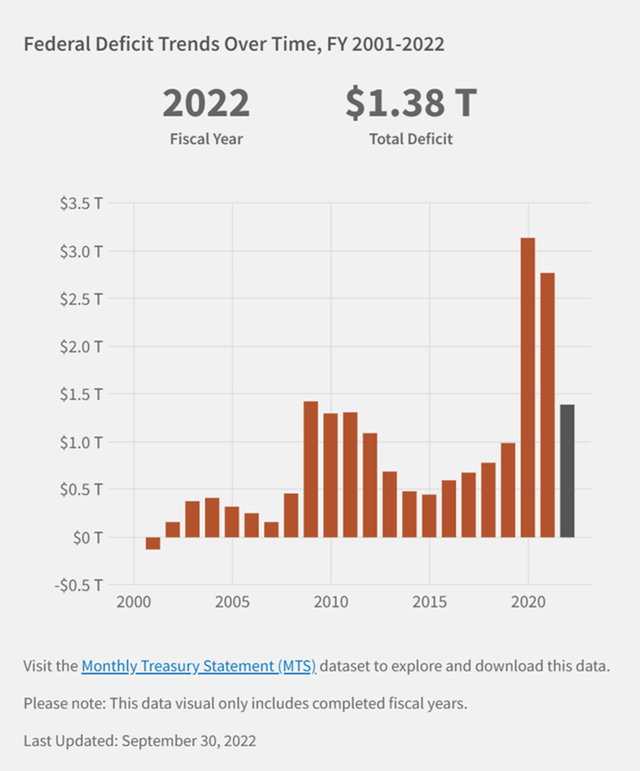

In fact, the U.S. government has not had a budget surplus since 2001 (Figure 12).

Figure 12 – U.S. government has not had a surplus since 2001 (CBO)

While extraordinary deficits in 2020 and 2021 were due to the COVID pandemic and are transitory, the fact that annual deficits from 2023 to 2033 are all expected to be greater than the prior peak deficit in 2008 should give investors some cause for concern.

Shouldn’t governments strive to run budget surpluses (or at the very least, a small deficit) during economic expansions so that they have spare capacity to spend during crises like 2008 and 2020 when the private sector cannot? If deficits are large and increasing even during an economic expansion, then what will happen during any eventual economic downturn?

At the margin, the U.S. government’s fiscal profligacy may be causing angst among bond investors such that they demand higher interest rates as compensation. The real worry is if the deficit is measured in the trillions of dollars every year, who will be the buyer of all this debt?

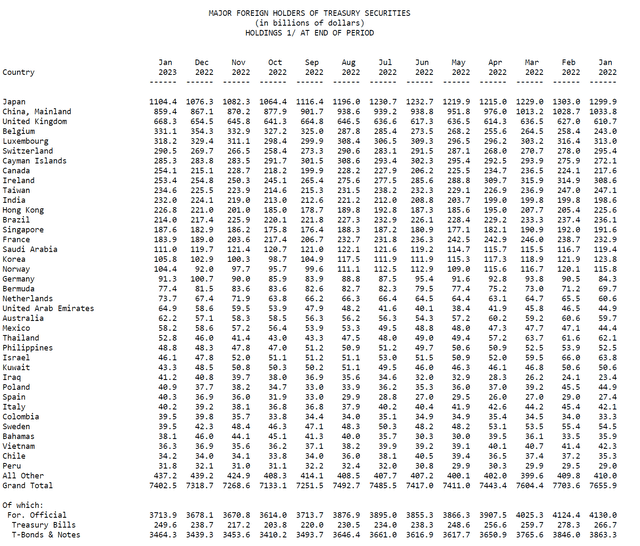

Already, major foreign holders of U.S. debt like Japan and China have been reducing their holdings (Figure 13).

Figure 13 – Foreign holdings of U.S. treasuries (U.S. Treasury)

Furthermore, note that the U.S. deficits are measured in trillions of dollars whereas foreign holdings are in the hundreds of billions. What entity will step in to finance the difference?

Conclusion

In the short-term, the BOJ’s surprise move to widen the 10-Yr JGB YCC band may be causing global investors to unwind carry trades and sell foreign assets like U.S. treasuries, leading to higher long-term interest rates. In the medium-term, a resilient U.S. economy is allowing the Fed to maintain its ‘higher for longer’ monetary policies, which is pushing up long-term interest rates. Finally, in the long-term, the U.S. government’s out of control spending may be causing investors to demand higher interest rates to compensate for higher risks associated with U.S. debts.

Overall, I continue to recommend the PFIX ETF as a good hedge for investors who are worried about higher long-term U.S. interest rates.

Read the full article here