Result Summary

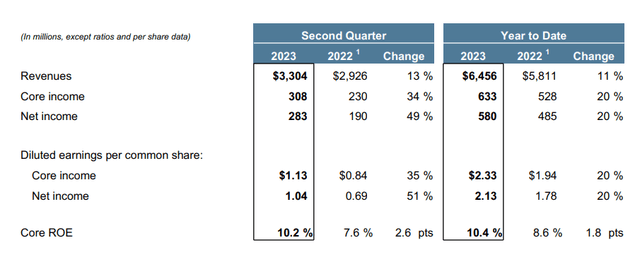

CNA Financial (NYSE:CNA) recently disclosed its second-quarter results, reporting steady net income of $283 million resulting in a year-to-date post-tax profit of $580 million, vs. $485 million one year ago in the same period.

CNA Financial Presentation – Q2 2023

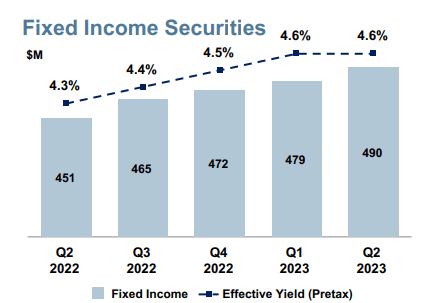

During the quarter, CNA Financial witnessed favorable earnings from higher yields on fixed-income securities, with the effective income yield on fixed income rising from 4.3% to 4.6% year-over-year. The fixed-income portfolio generated a pre-tax income of $490 million.

CNA Financial Presentation – Q2 2023

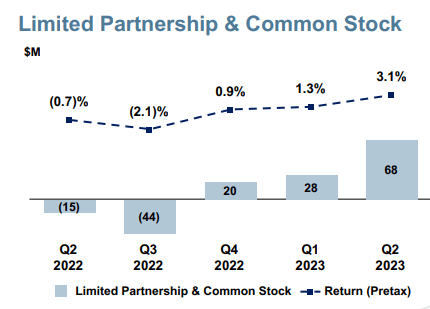

On a year-to-date view, the fixed-income portfolio recorded a pre-tax profit of $969 million. The overall investment income was also fueled by the security portfolio which recorded a $90 million gain during the first six months of the year.

CNA Financial Presentation – Q2 2023

On the underwriting performance side, CNA Financial was adversely affected by higher catastrophe losses, resulting in a drop in the quarterly underwriting income to $138 million. However, the insurer maintained a decent combined ratio of 93.9% on a year-to-date view, resulting in an underwriting gain of $268 million or $73 million lower than one year ago in the same period.

Although the current valuation might not appeal to investors seeking aggressive returns, the insurance company has consistently generated steady results, enabling it to distribute regular dividends to shareholders.

Stable Production Metrics But Deteriorated Underwriting Margins

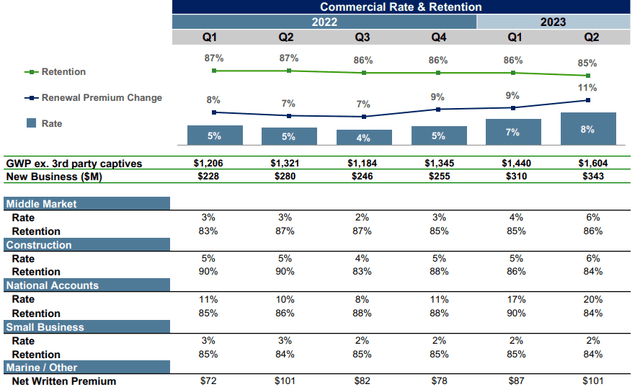

The property and casualty segments experienced a premium growth of 10%, primarily driven by a high retention rate of 86% overall and a 5% increase in premium rates.

Specialty Business Overview:

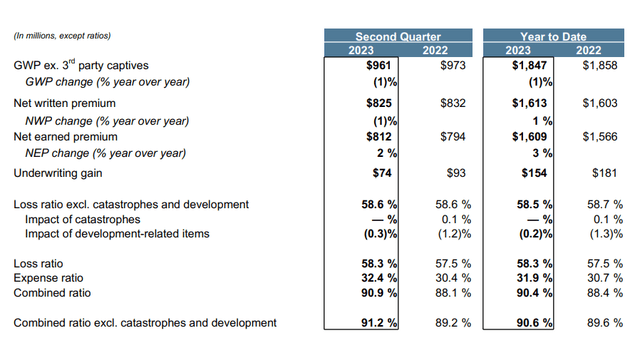

The specialty business, a vital part of the insurance portfolio, maintained a steady 90.9% combined ratio compared to 88.1% in the same period of the previous year.

CNA Financial Presentation – Q2 2023

On a year-to-date view, the combined ratio increased by 2 points from 88.4% to 90.4%, resulting in a lower underwriting income of $154 million for the first months of the year. The reduced underwriting income was primarily driven by a lower positive prior year claims development and an 1.2 point increase in the expense ratio.

During the second quarter, the retention rate remained high at 89% at the price of negative rate changes. In other words, the company accepted to reduce policy prices for keeping the profitable policyholders.

Commercial Business Overview:

CNA Financial’s commercial business demonstrated strong topline performance in the second quarter, with premium growth of 15% on a net of reinsurance basis, driven by a 8% rate change and an 85% retention rate.

CNA Financial Presentation – Q2 2023

However, the underwriting gain reduced to $42 million during the second quarter, driven by higher catastrophe losses. On a year-to-date view, the pre-tax underwriting income was $34 million lower than one year ago. The reduced underwriting gains were driven by the higher claims activity resulting from the catastrophe events, while the underlying loss ratio remained stable at 61.5%.

International Business Overview:

The international activities experienced lower year-to-date underwriting gains due to an adverse run-off, which had a 2.5-point impact on the loss ratio, already recorded during the first quarter. The second quarter combined ratio amounted to 92.2%, or a 0.6-point deterioration from Q2 2022. Despite the 11% earned premium growth, the year-to-date underwriting income reduced from $43 million to $31 million.

Higher Yields: Costs and Benefits

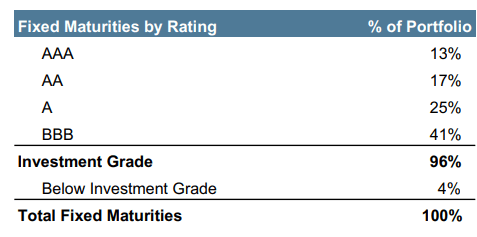

CNA Financial, like other insurers, benefited from the rise in fixed-income average yields. Most of the investment portfolio (about 90%) is invested in fixed-income securities with an average credit rating of “A.”

CNA Financial Presentation – Q2 2023

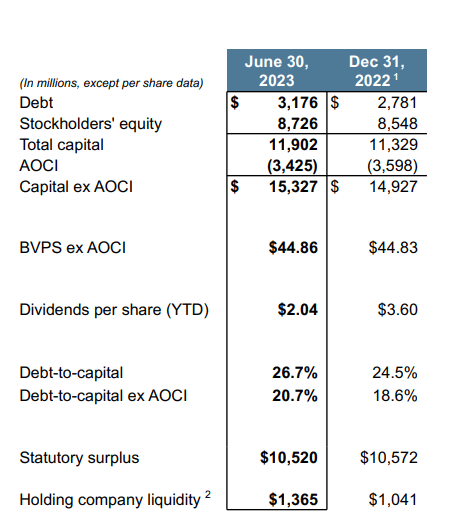

The company’s debt stands at $3.1 billion, resulting in a debt-to-capital ratio of 26.7%..

CNA Financial Presentation – Q2 2023

The debt maturities range from 2023 to 2030, and while debt rollover might become more costly as interest rates increase, the company’s A+/stable credit rating from S&P and Fitch is expected to help control costs compared to lower-rated peers.

Current Valuation

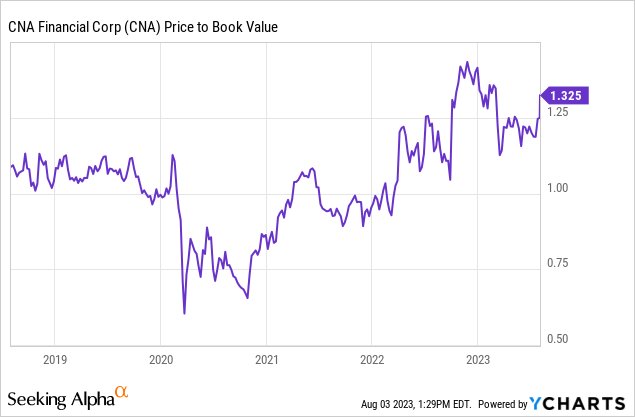

CNA Financial’s book value per share is currently $32.2 indicating a price-to-book valuation of circa 1.33, with the recent stock price rise.

This valuation suggests that the company might be relatively inexpensive compared to other property and casualty insurers, as they usually trade at 1.5 times their book value or higher. Despite its solid underwriting performance, CNA’s valuation is inherently affected due to its significant ownership by Loews (L) (circa 90%). As a result, the insurer’s fate is closely tied to Loews’ management and capital allocation decisions.

Final Thoughts

Although CNA Financial is not a fast-growing or significantly undervalued stock, it offers potential for recurring cash flows due to its stable positions in niche markets. However, investors should remember that CNA is largely owned by Loews, making it dependent on Loews’ capital allocation decisions.

While the upside potential is somewhat limited, the company’s consistent performance makes it an attractive option for retirees or dividend-oriented investors seeking steady returns. For those investors, purchasing the stock at around 1.0 times the book value might be a good choice, providing a safety margin.

Read the full article here