Company Presentation

Founded in 1998 and based in Dallas, Texas, Builders FirstSource (NYSE:BLDR) is a leading supplier of building materials and construction services in the United States. BLDR operates a network of distribution centers and manufacturing facilities across the country, serving customers in the residential construction, remodeling, and commercial construction markets. The firm operates in 42 states with over 550 locations.

The company offers a comprehensive range of building products, including lumber, windows, doors, roofing, siding, insulation, and more. BLDR partners with top manufacturers to ensure the quality and reliability of its products. The company’s extensive inventory and strategic partnerships enable it to provide customers with a wide selection of materials for their construction projects.

With a customer-centric approach, the company strives to understand its customers’ needs and provide tailored solutions to meet their clients’ needs. With teams of experienced professionals, the group offers expert advice, design assistance, and estimation services to help customers plan and execute their projects successfully. In addition, BLDR also offers onsite project support, with experts available to assist customers at construction sites, ensuring smooth project execution.

Finally, BLDR also provides value-added services such as customization and millwork. The company’s skilled craftsmen can fabricate materials to precise specifications, offering customized solutions for unique project needs.

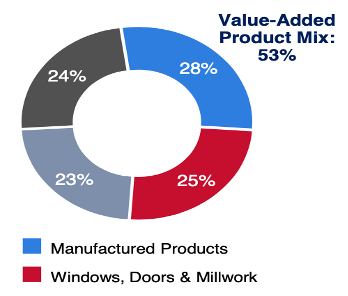

Here’s how BLDR revenues are segmented:

BLDR’s revenues segmentation (BLDR Q2 earnings presentation)

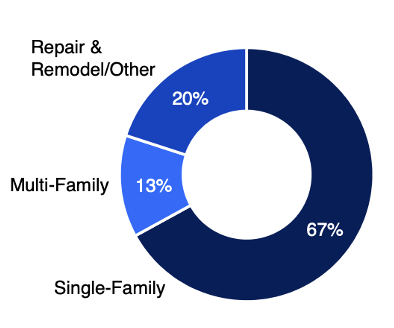

Here’s BLDR revenue segmentation per End Market:

BLDR end market segmentation (BLDR Q2 earnings presentation)

U.S. Housing Market Undersupply as a Key Catalyst

The United States is experiencing a prolonged housing shortage due to the insufficient construction of new homes to accommodate the growing population. This problem has been exacerbated by increased costs of materials, supply chain challenges, and labor shortages resulting from the Covid pandemic.

According to the White House and the National Association of Realtors, the United States currently faces a shortage of 5.5 million homes. This gap is so significant that it would take more than ten years to address, even if there is a significant increase in new home construction.

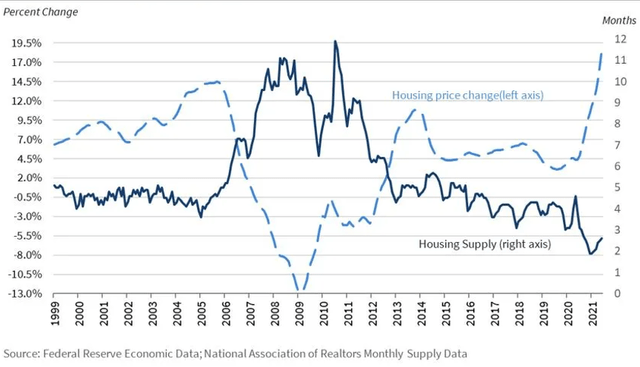

Housing supply and prices (Federal Reserve )

I expect this undersupply of housing in the United States to be a strong positive catalyst for BLDR.

In my view, this context should lead to an increased demand for building materials. I expect the housing shortage indicating a high demand for new homes, to create a greater need for building materials.

Furthermore, to address the housing shortage, there is a need for increased construction activity. More construction projects combined with an undersupply of homes mean a higher demand for building materials, which will result in increased sales for BLDR supported by a favorable pricing environment implying higher profit margins.

The long-term nature of the housing shortage suggests that the demand for building materials and construction services will persist over time. In my opinion, this will be a key catalyst for BLDR representing a stable and consistent business opportunity, contributing to its long-term growth.

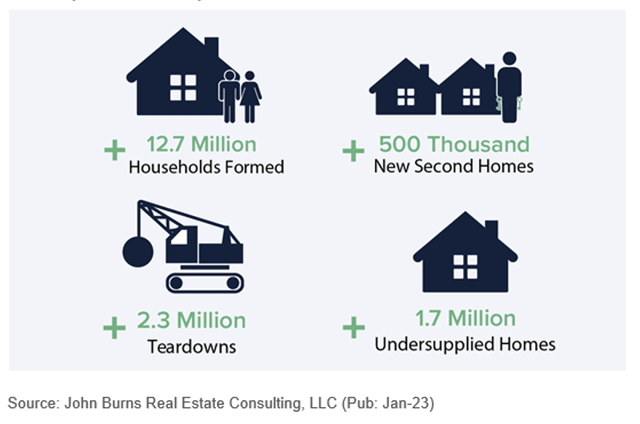

Furthermore, the COVID-19 pandemic exacerbated existing supply chain constraints in the housing market, resulting in sharp price increases for both owned homes and rental units. However, the pandemic did not create the underlying supply constraints; they have persisted for many years. Indeed, When looking at the char above it is interesting to see that the housing supply as tremendously decreased after the subprime crisis. Too many houses have been seized leading to an oversupply in the U.S. housing market which didn’t supported initiation of new constructions leading to current the inventory problems. The shortage of housing supply, both in rental and ownership markets, has been a long-standing issue, with housing starts failing to keep pace with population growth as shown below.

Projected Housing Demand (John Burns Real Estate Consulting)

Strong Capital Allocation and Attractive Valuation

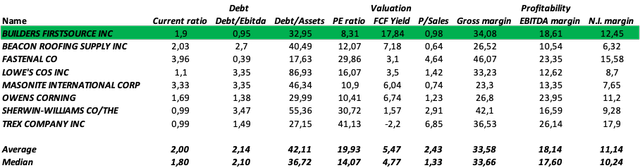

Fundamental Analysis (Bloomberg)

Aside from its strong tailwinds, that should help the stock to continue to perform, I also believe that BLDR fundamentals make it an attractive play.

Whether in terms of Debt, Valuation, or Profitability the company is very attractive. Looking at the table above where I compared BLDR to several peers, you can see that the company has a rather low level of debt while being one of the cheapest and most profitable. The more striking is the FCF Yield which stands close to 18% showing that this company is a real cash machine.

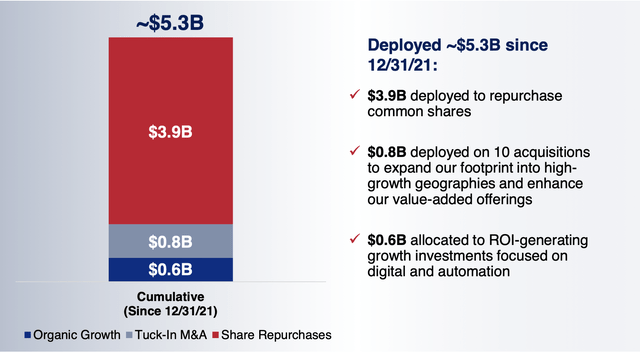

Having this much cash in the current environment is truly appreciable. Since December 2021, the firm has repurchased 39% of its outstanding share. I expect more buybacks to come.

Capital deployed since December 2021 (Company presentation)

The firm M&A dynamic has been very strong during the last several years and management has been very successful to complete integrations of newly acquired businesses. Having a strong execution is key in such a fragmented market. That’s the case for BLDR. For these reasons, I expect more M&A in the upcoming quarters.

The firm has a long-term view and announced in 2021 its objective to deploy between $7 to $10 billion in capital. These objectives have been confirmed in the recent earnings call which leaves a window between $2 and $5 billion of capital until 2025 that could be deployed.

Risks

Despite the attractiveness of BLDR, several risks still have to be considered:

- Macroeconomic risk: The construction industry is subject to market cyclicality, which can impact demand for building materials and construction services. Should we enter a recession or should interest rates rise more or stay higher than expected, this could negatively affect BLDR’s revenue and profitability.

- Raw Material Costs: BLDR’s profitability is dependent on raw materials prices such as lumber, steel, and other construction-related inputs. Fluctuations in commodity prices, trade policies, or supply chain disruptions could impact BLDR’s cost structure and profitability.

- Competition risk: BLDR operates in a highly competitive industry with numerous local, regional, and national competitors. Intense competition may lead to price pressures, reduced margins, and a potential loss of market share, which could impact BLDR’s financial performance.

- Integration and Acquisition Risks: BLDR has pursued growth through acquisitions in the past, and future acquisitions may pose risks related to integration, cultural differences, operational challenges, and potential overpayment for acquired assets. Failure to effectively integrate acquired businesses could impact financial performance.

Conclusion

In my opinion, BLDR represents an attractive investment opportunity for several undeniable reasons. The company operates in an industry poised for growth due to the ongoing housing shortage in the United States. The undersupply of homes and increased construction activity create a strong demand for building materials, which benefits BLDR’s sales and profitability. Another key element to consider is the firm extensive network of distribution centers and manufacturing facilities which makes BLDR well-positioned to meet this demand and capitalize on the favorable pricing environment.

Furthermore, BLDR demonstrates strong fundamentals with a balance sheet I consider a fortress. The company has low debt levels compared to its peers, attractive valuation metrics, and a track record of profitability. Its robust free cash flow generation further enhances its financial strength and provides opportunities for capital allocation strategies such as share buybacks and potential future mergers and acquisitions.

Taking all these elements into account, I initiate on BLDR with a STRONG BUY rating.

Read the full article here