Key takeaways

- Berkshire Hathaway saw its earnings climb 6% to a new quarterly record of $10 billion

- The conglomerate benefited from higher insurance returns, Apple stock and Treasury bills, with Berkshire Hathaway sitting on $147 billion in cash

- Berkshire Hathaway shares climbed 3.4% and 3.6%, respectively, to hit a record for the stock

It was fingers-in-all-pies conglomerate Berkshire Hathaway’s turn in the spotlight for earnings season, and the results didn’t disappoint. With earnings reaching a quarterly record and the company holding massive amounts of cash, Wall Street investors pushed the stock prices up to record highs on Monday.

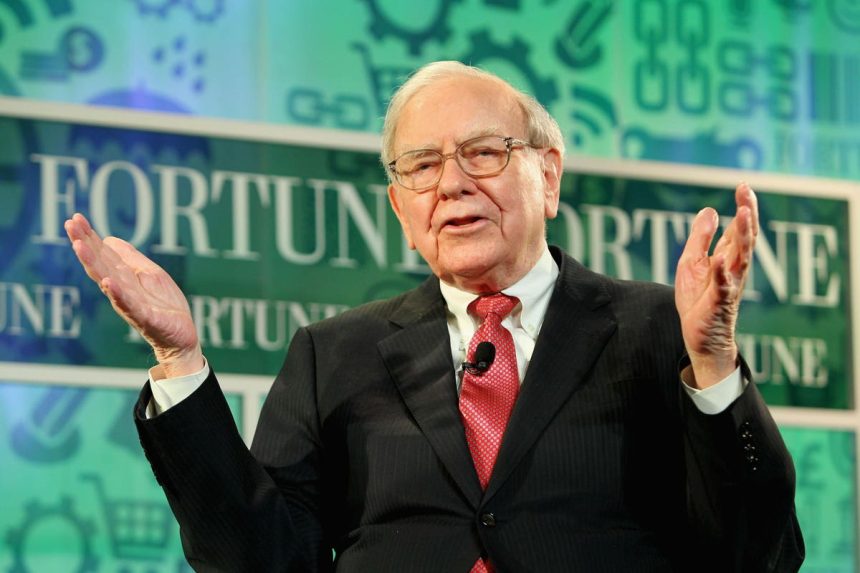

As investors watch the Oracle of Omaha’s every move, the quarter was buoyed by Berkshire’s mammoth stake in Apple but was an otherwise muted quarter for stock buying. Here’s a closer look at the winners and losers of Berkshire’s companies and its investment portfolio.

Warren Buffett’s illustrious investing career is down to his focus on good-value companies – and you can take the same approach with Q.ai’s Value Vault Kit. It packs up businesses with sturdy financials and relatively low valuations to help you cash in on low-cost stocks.

This is all made possible by a clever AI algorithm that takes on the data-digging, forecasts where the potential rewards lie, and adjusts the Kit’s holdings to help keep you leading the pack. View it as your nifty AI teammate in your investment journey.

Download Q.ai today for access to AI-powered investment strategies.

What were Berkshire Hathaway’s Q2 earnings results?

It was a weekend bonanza for investors after investment firm Berkshire Hathaway unveiled its second-quarter earnings on Saturday – and what a beat it was. The company’s operating earnings climbed 6% to $10 billion in Q2, marking a new quarterly record.

The profit picture from last year to now couldn’t have looked more different. While 2022’s second quarter saw a loss of $43.6 billion, Berkshire Hathaway’s equity portfolio pendulum has swung the other way to deliver a $35.9 billion profit. Operating profits were apparently boosted by a standout performance from the company’s insurance business and higher investment income.

Berkshire Hathaway’s cash pile grew to $147.38 billion in the second quarter, significantly higher than the previous quarter’s $130.62 billion. Meanwhile, Berkshire Hathaway’s total asset base is now worth over $1 trillion as of the second quarter.

Meanwhile, operating earnings per Class A share arrived at $6,928 – up 8% from last year, setting another quarterly record. We reckon Berkshire Hathaway had the champagne popping open.

How did Berkshire’s businesses fare?

Berkshire Hathaway’s insurance business saw a significant boost to its insurance underwriting profits, which reached $1.25 billion compared to $700 million at the same time last year. The Geico insurance business was a key profit driver, making $500 million in Q2; the firm’s insurance float is now at $166 billion.

This helped to offset some of the losses in Berkshire’s railway business, which recorded a 24% plunge in operating income to $1.26 billion. Higher operating expenses and lower freight volumes caused the drop.

As for Berkshire Hathaway Energy, earnings were essentially flat – the business made $785 million, a fraction lower than last year’s $789 million quarterly result.

What is Berkshire Hathaway’s investment portfolio made up of?

As always, the focus was on which companies Buffett had bought or sold, but the second quarter was muted as the firm bought $7.4 billion worth of stocks but sold $25.8 billion.

Berkshire Hathaway made a small killing from holding Apple stock, which rose 17% in value in Q2 and accounts for about half of the firm’s total equity portfolio. Its sizable stake in the company is now valued at $177.6 billion.

As for what it sold, Berkshire Hathaway divested some of its stock in Activision Blizzard, which is going through a will-they-won’t-they merger with Microsoft, and also reduced its stake in energy provider Chevron to about 123 million shares, having already cut down its exposure in Q1.

The company has also reacted to the changing interest rate environment and bought up Treasury bonds, with Berkshire now holding more than $97 billion in short-term Treasury bills. Buffett has previously commented he’s bought $10 billion worth of short-term T-bills every Monday.

Has Warren Buffett’s bet on Japan paid off?

It’s safe to say that investors took notice when Warren Buffett first started investing in the Japanese stock market, which has been largely stagnant for 30 years.

Berkshire Hathaway first announced it had invested in five Japanese trading houses back in 2020. Since then, it’s increased its stakes in Itochu, Marubeni, Mitsubishi Corp, Mitsui & Co and Sumitomo to an average of 8.5%, with the end game aiming for a 9.9% stake. Buffett’s even visited Japan this year to strengthen Berkshire Hathaway’s ties with the firms.

Things have looked promising for a while: the five trading houses posted their first-quarter results last week, and they all beat net income estimates for the quarter, with Mitsubishi and Mitsui stating they’re considering additional shareholder returns in the future. Not to mention, the iShares MSCI Japan ETF has risen nearly 14% in value this year.

As for Berkshire Hathaway’s investment, the company reported $465 million in foreign-exchange profits due to the dollar rising against the Japanese yen. Buffett’s bet on Japan is a long-term play, so expect more to come from this part of the world.

Wall Street’s reaction

Berkshire Hathaway shares rallied to record highs at the news, with the Class A share price climbing 3.4% during Monday trading to reach $551,920 and beating out the previous high from March 2022. Class B shares had a similar gain, hiking up 3.6% and closing at a new record high of $362.58.

The Monday moves bolstered Berkshire Hathaway’s 2023 performance, producing impressive returns. Berkshire Hathaway Class A shares have gained 17.5% since the start of the year, while Class B shares have seen a similar 17% climb. In comparison, the S&P 500 has climbed 18% in the same period.

Given Berkshire Hathaway is one of the biggest stocks on the S&P 500, investors are likely taking it as a good sign that the conglomerate has done so well this quarter. With the S&P 500 up for the first half of 2023 and the Nasdaq closing a record half-year, the signs look positive for the rest of 2023.

The bottom line

Berkshire Hathaway’s earnings beat didn’t disappoint – it was a highly successful quarter for the investment titan. It’s a testament to Warren Buffett’s legendary investment acumen, risk management and ability to spot growth across various sectors. It’s no wonder the share price has hit new highs, with more potential to grow in the coming months.

Are you inspired by Warren Buffett’s legendary focus on value? With Q.ai’s Value Vault Kit, you can follow the same philosophy. The Kit gathers businesses boasting solid finances and appealingly low valuations, providing a path to invest in undervalued stocks.

A nifty AI algorithm is your handy digital ally that sifts through the data, predicts where the potential upside is and refines the Kit’s holdings to help keep you ahead in the investment game.

Download Q.ai today for access to AI-powered investment strategies.

Read the full article here