Introduction

Mullen Group Ltd. (OTCPK:MLLGF), at its present valuation, represents a compelling investment opportunity within the trucking and logistics sector. The company boasts a robust track record of rewarding shareholders through dividends and Share Buyback programs. As an individual who places a premium on the potential for consistent income through dividends while also anticipating appreciation in the company’s valuation, I regard Mullen Group Ltd. as worthy of consideration.

Moreover, I find it noteworthy that shareholders are afforded exposure to the company’s comprehensive real estate holdings. This aspect draws parallels to McDonald’s business model, which includes real estate as a fundamental component of its success. I believe that Mullen Group Ltd. could be likened to a scaled-down version of McDonald’s (MCD) within the trucking and logistics industries, given its similar approach regarding real estate assets, which makes it even more interesting as an investment.

Mullen Group Ltd. is a leading trucking and logistics company operating in Canada and the United States, offers an extensive range of services, including Less-Than-Truckload deliveries for general freight, pharmaceutical products, and packages. Their Logistics & Warehousing segment provides full truckload services, specialized transportation solutions, and e-commerce-focused warehousing facilities. With technology-driven solutions, inventory management, and distribution services, Mullen Group presents a comprehensive suite of offerings in its segment.

Recent Results and Other Events

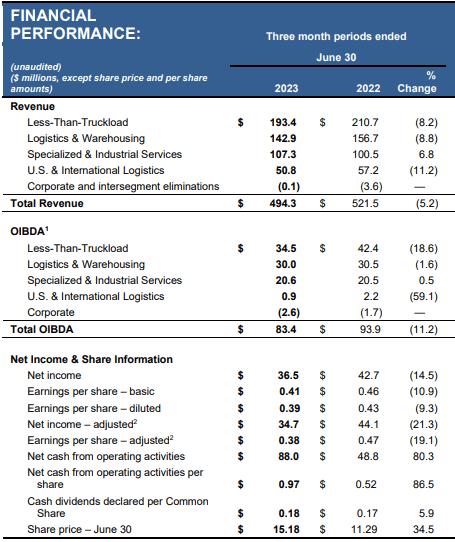

(As of June 30)

Mullen Group Ltd. recently released its Q2 earnings results, surpassing expectations with top-line revenue of $494.3 million, outperforming estimates by an impressive $115.15 million. The quarter’s net income stood at $36.5 million, translating to adjusted earnings per share of $0.38. Furthermore, the company reported a commendable return on equity of approximately 15.4%.

Q2 Report (Mullen Group Ltd. – Investor Relations)

During this period, Mullen Group demonstrated its commitment to enhancing shareholder value through a share buyback program, repurchasing 2,079,640 shares worth $31.5 million at an average price of $15.11 per share. This move comes after an earlier repurchase this year of 1.86 million common shares at an average price of $12.30. Share buyback programs shouldn’t solely be seen as an alternative or addition to dividends; they also signify the company’s belief in the undervaluation of its stock. In this case, this reinforces my own view that Mullen Group Ltd. is undervalued.

Amidst the evolving economic landscape, Mullen Group successfully completed the acquisition of B. & R Eckel’s Transport Ltd., an Alberta-based provider of less-than-truckload, full-truckload, and specialized hauling services. Moreover, the company invested $26.1 million in gross capital expenditures, strategically aiming to improve long-term operating efficiency.

Mullen Group’s commitment to rewarding shareholders with dividends is evident in its recent declaration of a monthly dividend payment of $0.06 per share, equating to total annual dividend payments of $0.72 for the fiscal year of 2023. As of today, August 7, this represents a dividend yield of approximately 6.00% based on today’s share price of $11.53.

Mullen Group has a strong track record of distributing profits reliably to its shareholders, as emphasized on their Investor Relations Site, where their “dividends paid clock” proudly ticks at about $1.4 billion (rounded) in total dividends paid to shareholders until today.

Outlook

Mullen Group outlined its business plan for 2023, anticipating softening freight and logistics demand due to changing economic conditions and inventory rebalancing cycles. However, the much-anticipated economic recession did not materialize, and although a slowdown occurred in the post-COVID environment, consumer spending remains robust, particularly in travel and experiences. The company’s diversified service offerings and cost management strategies mitigated collateral damage from market conditions.

Looking ahead, Mullen Group maintains its 2023 Business Plan and Budget, banking on the resiliency of the North American economy. The company’s focus remains on margin protection and pursuing accretive acquisitions, anticipating favorable supply/demand fundamentals within the Specialized & Industrial Services segment and expecting recent acquisitions to contribute to revenue and OIBDA growth.

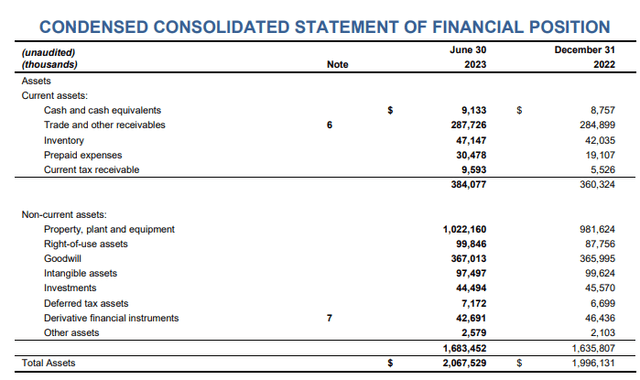

Financials

Mullen Group Ltd. exhibits a decent financial position (based on the company’s balance sheet as for the six-month period that ended at the end of June), with total cash amounting to approximately $9.133 million. However, the company’s total debt stands at about $656.6 million, including $473.8 million from private placements (with an average interest rate of 3.93% p.a.). Notably, the debt from private placements will be repaid with two principal repayments, due in October 2024 ($217.2 million) and October 2026 ($207.9 million).

The company’s total net debt to operating cash flow ratio was 1.95:1 at the end of June 2023. To remain in compliance with this financial covenant, Mullen Group would need to generate approximately $187.6 million of operating cash flow on a trailing twelve-month basis. This highlights a potential risk to the company’s future.

It is essential to note that the nature of Mullen Group’s business, which includes acquiring other firms, often results in lower cash levels and relatively higher debt levels. Despite managing these aspects successfully and maintaining a decent two-figure return on equity figure, the elevated debt remains a potential concern, in my personal assesment of the company.

Q2 Balance Sheet – Total Assets (Mullen Group Ltd. – Investor Relations)

Real Estate

Mullen Group’s balance sheet for the six months ended June 30, 2023, reports property, plant, and equipment worth approximately $1,022,160 million. The most significant portion of this amount is attributed to real estate, which reflects one of the company’s key business strategies: owning the real estate that supports its operational activities.

This draws inspiration from the success of visionary business figures like Ray Kroc, the astute investor behind McDonald’s. The strategy of owning real estate allowed McDonald’s to expand rapidly and become a global giant in the fast-food industry.

Similarly, Mullen Group’s strategic focus on owning real estate assets has proven valuable, akin to McDonald’s burger stands. The company’s sizeable and valuable real estate portfolio was largely acquired before real estate valuations surged, with a combined historical cost of $637.4 million as of year-end 2022. As a shareholder in Mullen Group, investors are not only part-owners of the company’s business operations but also stakeholders in its substantial and valuable real estate holdings.

To me, this adds an additional layer of appreciation for the underlying value of Mullen Group’s assets and its long-term growth prospects.

Valuation

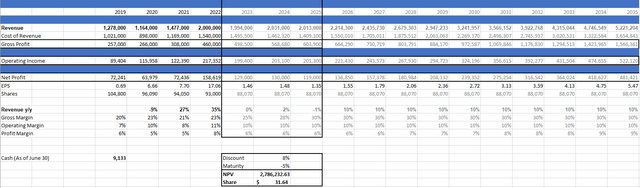

In the quest to determine Mullen Group’s fair value, it is important to acknowledge that many variables involved are based on assumptions, and the model itself is a simplified representation aiming to provide a tendency for what is likely to unfold in the future.

I adopted the Net Present Value (NPV) approach, focusing on the company’s net income. Although Free Cash Flow figures are higher, I chose net profits, encompassing non-cash expenses, to err on the side of caution in estimating the company’s true fair value.

Mullen Group Ltd. – NPV Analysis (The Author of this Article)

The NPV formula accounts for a discount rate of 8%, taking into consideration the prevailing interest rate environment, and incorporates a risk premium tailored to the industry Mullen Group operates in. Additionally, I assumed a 30% gross margin, aligning with the industry median provided by Seeking Alpha, and a 10% operating margin, slightly surpassing the industry median. These assumptions are justified by Mullen Group’s history of bolstering margins and its unwavering commitment to strategic investments in this realm.

Regarding revenue projections, I envisioned a steady 10% year-on-year growth, while profits were expected to witness an average rise of 15%. Although these estimates might seem conservative, they aptly reflect the company’s track record of consistent growth and its dedication to sustainable progress.

As for the figures between 2023 and 2025, I relied on average analyst estimates provided by MarketScreener, which I deem reasonable and in line with market expectations.

To arrive at the ultimate NPV number and price per Share, I projected a gradual decline in Mullen Group’s operations, anticipating a 5% decrease by fiscal year 2036, eventually ceasing operations by fiscal year 2050.

This simplistic yet comprehensive model considers a range of estimates and simplifications, all while maintaining a cautious outlook for the company’s future trajectory.

Based on these calculations, the estimated price per Share amounts to approximately $30, signaling a substantial upside potential compared to the current share price of around $12. That underscores my belief that Mullen Group’s true value is not yet fully appreciated by the markets.

Risks

Despite the promising outlook, it’s important to acknowledge certain risks that could impact the investment proposition for Mullen Group Ltd. Chief among these is the company’s elevated debt levels, particularly its total net debt to operating cash flow ratio, which stood at 1.95:1 as of June 2023. While Mullen Group has historically managed its debt well and demonstrated a strong return on equity, the dependency on consistent cash flows to meet debt obligations remains a potential concern, especially given the current interest rate environment and tight financial conditions that could influence the company’s ability to effectively manage its debt burden.

Furthermore, the company’s acquisition-focused growth strategy carries inherent risks. Mullen Group’s success in acquiring businesses is noteworthy, but integration challenges and potential unexpected financial liabilities associated with acquisitions could impact profitability and divert management’s attention from core operations.

In addition, Mullen Group’s business model is inherently exposed to economic cycles. While my current view aligns with the expectation of avoiding a near-term recession, a severe economic downturn in the U.S. economy could have a pronounced impact on Mullen Group’s operations and financial performance.

Conclusion/Opinion

Summing up, this analysis of Mullen Group Ltd. underscores the company’s robust business model, thriving within the dynamic trucking and logistics landscape. With a diverse portfolio of trucking and logistics services spanning both Canada and the United States, Mullen Group has firmly established itself as a key player in the industry.

The recent Q2 earnings results exemplify the company’s resilience in the face of shifting economic conditions, showcasing top-line revenue surpassing expectations by a significant margin and net income delivering strong figures.

Mullen Group’s decision to reintroduce substantial dividend payments reflects its confidence in its financial standing and its commitment to rewarding shareholders with significant returns. For investors like myself, who are drawn to dividend-oriented investments with the potential for share price growth, Mullen Group Ltd. emerges as a compelling option. Nevertheless, even with its well-established record of profitability and robust cash flows, it’s crucial for investors to remain vigilant about certain risks, primarily tied to the company’s considerable debt levels.

In the broader context, my outlook remains highly optimistic regarding the investment prospects of Mullen Group Ltd., and I firmly advocate assigning a BUY rating, particularly given its current share price. This conviction is reinforced by my NPV analysis, which provides valuable insights into the potential upside for the company’s share price. The commitment the company has demonstrated in creating shareholder value, coupled with the notable success Mullen Group has achieved in acquiring businesses-especially those of the family-owned variety-adds further weight to this recommendation. Additionally, the company’s strategic real estate approach bolsters my confidence in endorsing this enterprise

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here