The Company

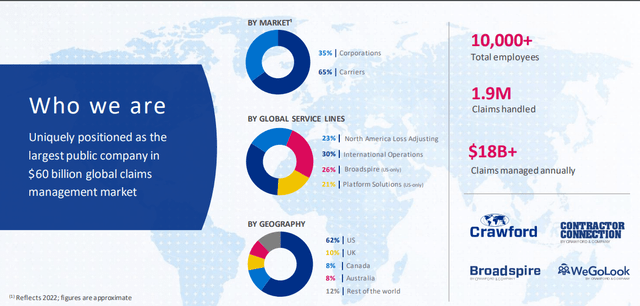

Crawford & Company (NYSE:CRD.A) (NYSE:CRD.B) is a $450-million market cap Atlanta-based firm that provides claims management and outsourcing solutions globally, operating through 4 segments, according to the latest 10-Q filing:

- North America Loss Adjusting [~23% of total sales] – serves the North American property and casualty market, including U.S. and Canadian operations;

- International Operations [~29%] – offers services for the global property and casualty market outside North America, covering regions like the U.K., Europe, Australia, Asia, and Latin America;

- Broadspire [~25%] – provides third-party administration for workers’ compensation, auto and liability, disability absence management, medical management, and accident and health in the U.S.

- Platform Solutions [~20%] – encompasses the Contractor Connection, Networks, and Subrogation service lines in the U.S., including Catastrophe operations and WeGoLook.

Basically, they handle various insurance claims, including property, liability, workers’ compensation, and medical management services. The latest IR presentation states Crawford is the largest public company in the $60 billion global claims management market:

CRD’s latest IR presentation

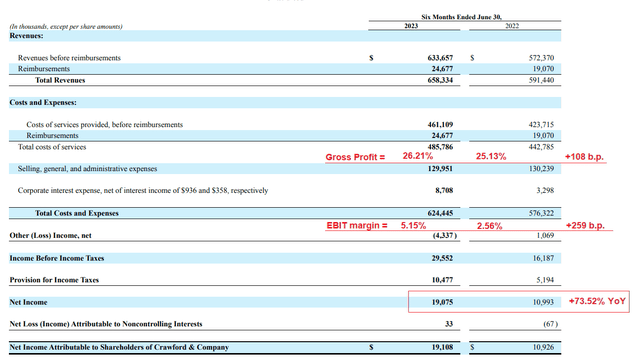

In Q2 2023, Crawford & Company achieved substantial results across all its operating segments. Revenues increased in North America Loss Adjusting [+15.3% YoY], International Operations [+1.7% YoY], Broadspire [+4.7% YoY], and Platform Solutions [+22.1% YoY]. That was the 11th consecutive quarter of revenue growth. At the same time, the gross profit and EBIT margins improved significantly YoY in 1H 2023, leading to a net income increase of 73.5% YoY:

CRD’s 10-Q, author’s notes

The company benefited from favorable changes to acquired entity projections and reduced pension costs.

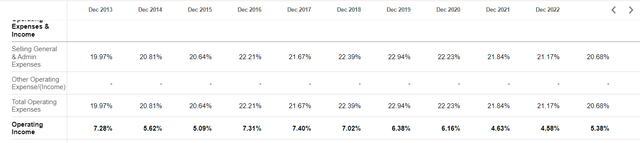

The unpredictability of weather-related cases and occurrences of natural and man-made disasters can affect case volumes and CRD’s revenue trends, which are challenging to forecast accurately. Still, the firm managed to cope well with this challenge over the past few years, sustaining its 4-7% of EBIT margin:

Seeking Alpha

As of June 30, 2023, they had $47.5 million in cash and $242.8 million in total debt. The company generated $27.2 million in cash from operations during 1H FY2023, compared to an outflow of $12.8 million for the same period last year. CRD hasn’t repurchased any shares in 2023 so far, while in 1H FY2022 they bought back ~$26.7 million worth of them.

With its prudent capital allocation strategy and improved cash generation, the company achieved a leverage ratio of 1.8 times EBITDA, surpassing its goal of being below two times EBITDA by the end of 2023.

According to the latest IR materials, CRD returned >$120 million of capital to shareholders through share buybacks and dividends over the last 4 years, equating to >24% of today’s market cap.

As far as I understood from the earnings call, the management is going to focus more on enhancing the Platform Solutions segment, which is growing the fastest among other business units. The investments in digital offerings go hand in hand with the M&A-driven growth strategy the company has chosen for its development. In recent years, CRD has acquired many new companies while divesting from old ones to simplify its operations.

As an example of recent M&A deals, in August 2021 Crawford acquired Edjuster, a leading contents valuation company in North America that offers on-site and digital content inventory services through a proprietary platform. CRD paid a total purchase price of $33.1 million, and already in FY2022, Edjuster recorded revenues of $14.3 million, bringing two decades of industry experience and blue-chip carrier clients to Crawford.

Another example: in October 2021, Crawford acquired BosBoon Expertise Group B.V., a specialist loss adjusting company in the Netherlands, for $4.9 million. BosBoon offers expert services for construction, liability, bodily injury, marine, and property lines, as well as third-party administration. This acquisition strengthened Crawford’s talent pool with over 100 adjusters and provides opportunities for cross-selling expertise. BosBoon’s addition also bolstered Crawford’s Global Technical Services in the Benelux region. BosBoon recorded revenues of $3.4 million in FY2022.

Based on the 1H Fy2023 results reported by the company, I conclude that management’s strategic objective is generally being gradually implemented: Financial results are improving against a backdrop of more efficient operations achieved through the addition of new businesses in various regions and the digitization of processes.

But how cheap is Crawford stock and is it time to think of buying it now?

The Valuation

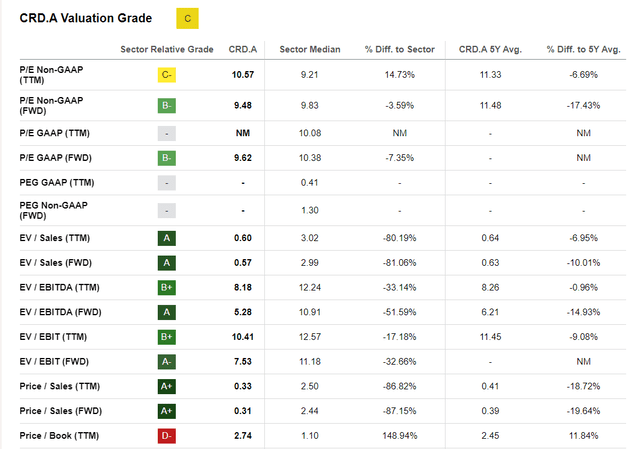

CRD stock has a “C” grade according to Seeking Alpha’s Quant System, primarily because its next-year price-to-book ratio is more than double what we see in the Financials sector:

Seeking Alpha, CRD, Valuation

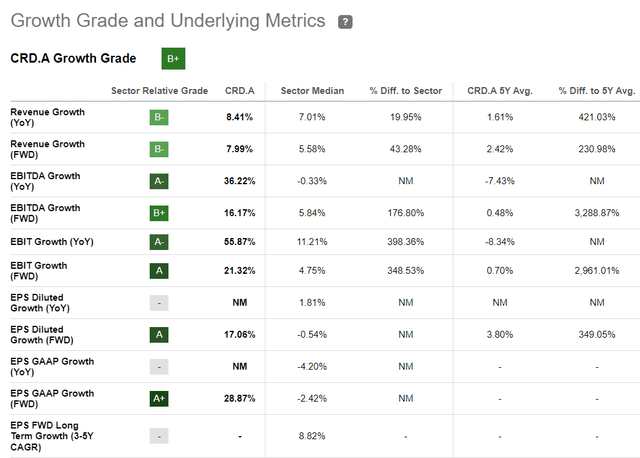

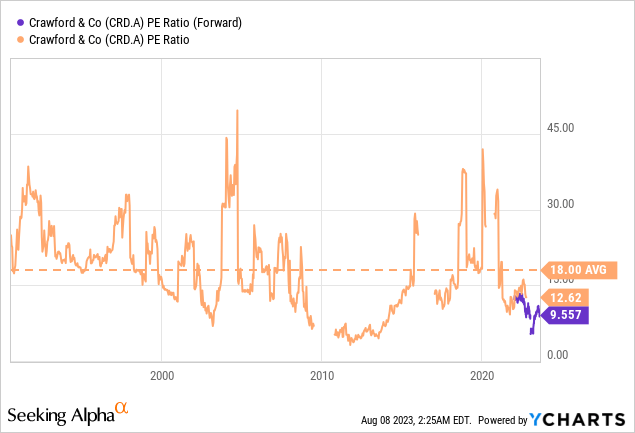

However, in terms of the next-year price-to-earnings ratio, CRD is valued like an average financial stock, even though its growth rates are far superior to most companies in the sector:

Seeking Alpha, CRD, Growth

Crawford has an FWD dividend yield of ~2.8% at a TTM dividend payout ratio of 26.37%, according to Seeking Alpha. At the same time, the current valuation of the company suggests that the market either does not notice CRD or that it prices a cyclical downturn in insurance stocks.

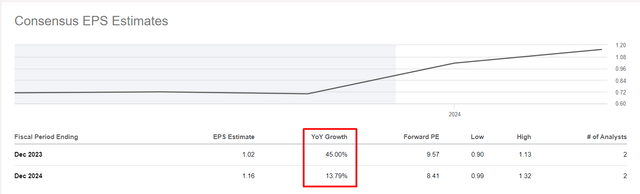

If the second option is true, then CRD’s earnings per share are unlikely to grow as Wall Street consensus expects:

Seeking Alpha, CRD, Earnings Estimates

If CRD does achieve the above +13.79% EPS growth in FY2024, then the stock is going to be worth $11.6 at a P/E of only $10, or ~19.5% more than what we can see on the screen today.

The Bottom Line

Everyone interested in Crawford & Company stock should consider the multiple risks surrounding the company and its industry. To list a few: Market fluctuations (the firm is <$1 billion in market cap), industry-specific influences like insurance cycles and natural disasters, intense competition, revenue concentration, currency fluctuations, regulatory and legal compliance challenges, client dependency, technology adaptation, integration risks from acquisitions, and operational vulnerabilities such as cybersecurity. To make informed investment decisions, potential investors should carefully consider these risks and implement proper risk management strategies, diversification, and make sure they make their own due diligence.

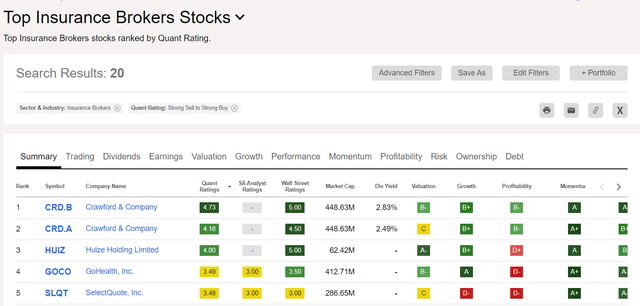

But despite the risks involved, I think CRD deserves your attention. The company has obviously invested quite a bit in digitizing its processes in recent years and has expanded into other regions. In the first half of 2023, CRD is showing good financial results, and at the same time, the stock is not valued too much when we look at its key valuation multiples. Due to its relatively small market capitalization, CRD remains hidden from the general market, but thanks to its improving financial results and earnings revisions, it has recently become one of the top-rated stocks here on Seeking Alpha within its industry:

Seeking Alpha, Insurance Brokers Screener

I estimate the value of Crawford & Company’s business over the next 12-24 months to be 19.5% higher than its current capitalization. Therefore, I rate the stock as a “Buy” this time around.

Thanks for reading!

Read the full article here