Summary

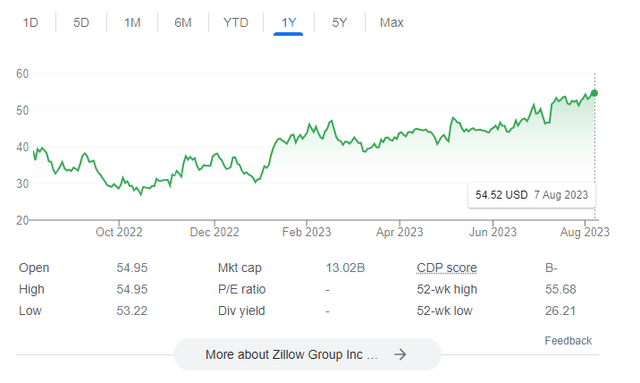

Following my coverage on Zillow Group (NASDAQ:ZG), which I recommended a buy rating as the business showed a very successful first quarter, with management showing solid execution and progress across its growth initiatives. This post is to provide an update on my thoughts on the business and stock. I reiterate my buy rating for ZG as the business continues to consolidate market share, supported by its strong execution, in the current operating environment. This puts it in a better position to grow once the economy recovers. The market also seems to be gradually aligning with my view as the share price continues to inch towards my price target of $100.

Investment thesis

ZG continues to report strong results. The success of Premier Agent helped push 2Q23 revenue to $506 million. Since the previous several quarters had all been in the negative region, the growth in 2Q23 was extremely encouraging as it marks a change in trajectory. In addition, ZG continued to outperform the real estate industry (gaining market share), with Residential Revenue falling by only 3% Y/Y compared to a 22% Y/Y decline in industry transaction dollars.

“As we gain to the results with you this quarter, we are particularly pleased that our residential revenue outpaced the broader real estate market decline of 22% by 1,900 basis points, marking four consecutive quarters of outperformance.”

Further, ZG’s Premier Agent outperformance and robust momentum in augmented markets are driving the company toward its goal of capturing 6% of total industry transactions by 2025. Again, notably, in spite of a 22% drop in the dollar volume of US real estate transactions, Premier Agent revenue was down 4%, suggesting market share gains driven by stronger-than-anticipated customer connections. Management updates on the growth of the company’s current enhanced market footprint are also leading indicators of expansion. For instance, in the most developed enhanced markets, such as Phoenix and Atlanta, ZG has seen year-over-year growth in its customer transaction share of 50%.

ZG’s strong execution was also demonstrated in its performance in the Rental vertical, where it saw an increase in rentals-related traffic in Zillow.com. The rapid increase of both multifamily and new single-family listings on Zillow contributed to a 15% year-over-year increase in rental-related traffic in 2Q23, when the site saw an average of 31 million monthly unique visitors. Since falling occupancy rates necessitate more landlord advertising, I anticipate ZG Rental vertical to continue reaping industry benefits.

The weaker-than-expected 3Q23 revenue and adjusted EBITDA guidance was the only real letdown, I believe, because management expects high mortgage rates and low inventory to weigh in that quarter. Premier Agent Revenue is forecast to grow at a faster rate than the market average in 3Q, but at a slower rate than in 2Q. In my opinion, management 3Q23 guide probably reflect their conservative outlook, but has nothing to do with the long-term outlook.

An aspect of ZG that shines in the current capital market environment is its balance sheet. Relative to peers like Opendoor Technologies and Redfin Corp., ZG has a much lower leverage ratio (debt to equity). This has allowed ZG to afford a much more shareholder-friendly capital allocation strategy. In 2Q23, ZG announced a $750 million extension to its current share purchase authorization program, bringing the total available authorization to around $1 billion.

Valuation

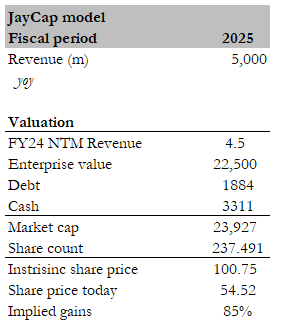

Google Own calculation

I continue to believe the fair value for ZG based on management’s FY25 target is around $100. The stock has been working its way towards my price target, which is reflective of the fact that the stock market is giving more credit for management execution. At the rate that management executes, I believe it will be able to achieve the $5 billion target in FY25. In fact, I think the weakness in the current period has given ZG more opportunity to consolidate market share (as evidenced by the outperformance), which puts it in a better position to grow once the economy recovers.

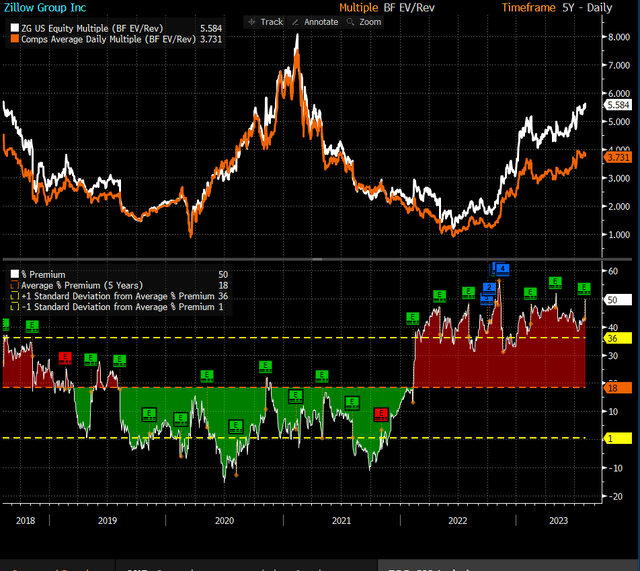

Peers include Redfin and Opendoor Technologies. The median forward revenue multiple peers are trading at is 3.7; the expected 1Y growth rate is a decline, while ZG is expected to grow. The expected growth, scale difference, and balance sheet strength of ZG deserve a premium, in my opinion. However, to be conservative, I assume ZG will trade back at the same premium (18% premium), just like it did in the past. At an 18% premium, ZG should trade at 4.5x forward revenue.

Bloomberg

Conclusion

ZG has demonstrated impressive execution and progress across its growth initiatives, reflected in its strong market share gains. The company’s success in Premier Agent and augmented markets, coupled with its resilience during industry challenges, positions it well for future growth. Despite a cautious outlook for 3Q23, ZG’s long-term potential remains robust, supported by its solid balance sheet and shareholder-friendly capital allocation strategy. With a continued focus on execution and consolidation of market share, I believe ZG is poised to capitalize on economic recovery. Considering its growth trajectory and comparative strengths, I maintain a bullish stance on ZG, reaffirming my buy rating and a fair value target of around $100 based on its management’s FY25 projections.

Read the full article here