Societe Generale (OTCPK:SCGLY) (OTCPK:SCGLF) reported results for Q2 2023 on August, and topped analyst expectations with regards to both topline and earnings. in the period from April to end of June, SG accumulated EUR 1.2 billion of net profits, which suggests a P/E of approximately ~x4 on an annualized basis, a discount of more than ~100% to the respective valuation median of the European banking industry. In addition, and anchored on strong results, France third largest lender announced the start of a EUR 440 million share buyback program to be completed by end of 2023. Needless to say, at a valuation of ~x0.3 P/B this buyback program should be highly value accretive for shareholders.

I continue to like Societe Generale stock as a deep value bet on an underappreciated European bank; and, reflecting on Q2 results paired with supportive management guidance, I update my EPS expectations through 2025; I now calculate a fair implied target price for GLE.PA of approximately EUR 51.75/ share.

(Note: For the purpose of this article, I reference the GLE.PA Paris listing, which is the most liquid equity paper for Societe Generale stock. The core takeaway, however, that Societe Generale is deeply undervalued is not influenced by the exchange listing of the underlying, and percentage upside/ downside estimates remain consistent across listings.)

Strong Q2 Supports Bullish Thesis

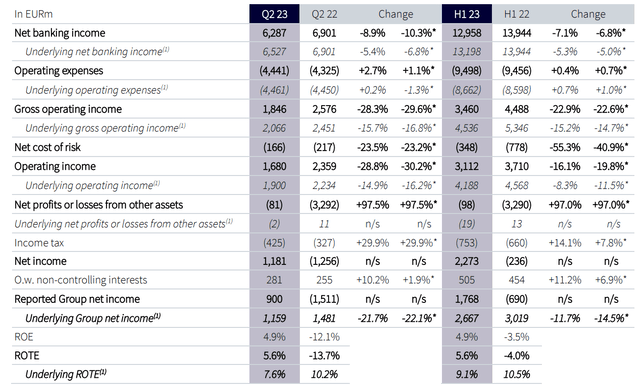

Societe Generale posted a strong Q2 2023, with both revenues and earnings slightly ahead of analyst consensus. During the period from April to end of June, SG generated about EUR 6.3 billion of revenues, down about 10% YoY vs. the same period in 2022, but almost EUR 200 million above analyst consensus expectations according to data compiled by Refinitv.

With regards to profitability, operating income was reported at EUR 1.8 billion, lower than the exceptional 2.6 billion achieved in the same period for 2022 (30% YoY contraction), but again approximately EUR 200 million higher than what analysts estimated; Societe Generale’s Q2 2023 net income after tax came in at EUR 1.2 billion

Interestingly, SG’s cost of risk remained very low, at EUR 166 million. In fact, contrasting to what has been reported by other banks, including Deutsche Bank, J.P. Morgan, BofA, Citi and Barclays, Societe generale’s cost of risk actually decreased vs. 2022 by 23% YoY, with total cost of risk for Q2 being only 12 basis points of the loan portfolio.

After years of restructuring, SG’s profitability metrics are starting to solidify in line with peers: For Q2 2023, SG reported an underlying cost-to-income ratio of 66, and an adjusted return on tangible equity equal to 7.6% (vs. 5.6% on a reported basis)

Societe Generale Q2 2023 results

By division, Societe Generale’s French Retail business delivered better-than-expected results, accumulating EUR 372 million of operating income (vs. EUR 345 projected by analysts). The insurance business also performed well, topping expectations with EUR 175 million of premia collected, while International Retail, Global Markets and Financing & Advisory all performed in line with expectations.

New CEO Likely To Focus On Shareholder Value

SG’S Q2 2023 was the first quarter managed by new CEO Slawomir Krupa, who used the conference call with analysts as a platform to make clear to investors his intentions of pushing value creation through capital allocation discipline and shareholder distributions.

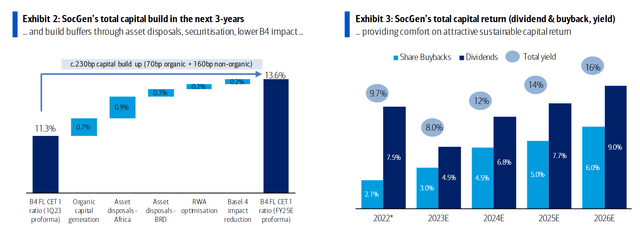

In that context, Societe Generale announced the start of a EUR 440 million share buyback program; after the bank’s CET1 Capital topped 13%. In addition, Krupta didn’t reject speculations that the French lender may seek to fully exit its African as well as the Romanian retail business, which could add up to 125 – 135 basis points to the bank’s CET1, according to my calculations.

With shareholder distributions taking center stage, as the major driver to rerate the bank’s low valuation multiples, BofA has estimated that SG’s total capital return could likely grow to 12%, 14% and 16% in 2024, 2025 and 2026, respectively. Needless to say, if BofA’s projections are correct, SG is on track to distribute close to 50% of its market capitalization within only 4 years.

BofA research

Target Price: Raise To EUR 51.75

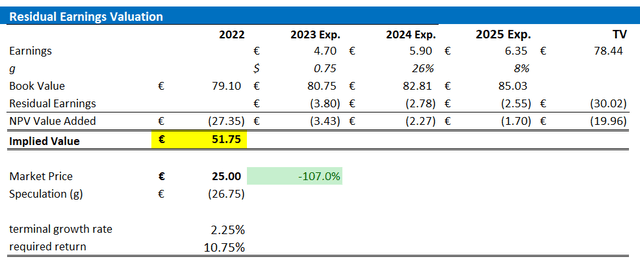

Following Societe Generale’s strong Q2 2023 results, I update my EPS expectations for the French bank through 2025: I now estimate that SG’s EPS in 2023 will likely expand to somewhere between EUR 4.5 and EUR 4.9. Moreover, I also raise my EPS expectations for 2024 and 2025, to EUR 5.9 and EUR 26.35 respectively.

I continue to anchor on a 2.25% terminal growth rate (approximately in line with nominal global GDP growth to reflect conservatism), as well as a 10.75% cost of equity.

Given the EPS update as highlighted below, I now calculate a fair implied share price for GLE.PA equal to EUR 51.75, seeing more than 100% upside vs. EUR 25/ share as of early August 2023.

Company Financials & Analyst Consensus Estimates; Author’s Calculations

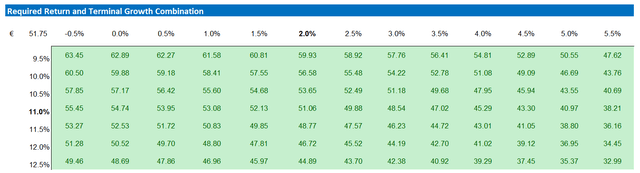

Below is also the updated sensitivity table.

Company Financials & Analyst Consensus Estimates; Author’s Calculations

Conclusion

Societe Generale reported strong Q2 results, surpassing analyst expectations for both revenue and earnings. With the earnings tailwind supporting, SG’s new CEO aims to focus on creating shareholder value through capital allocation discipline and potential business exits.In that context, the bank has already announced a EUR 440 million share buyback program; but more is likely to come.

Overall, I continue to like Societe Generale stock as a deep value bet on an underappreciated European bank, and my valuation model calculates more than 100% upside based on fundamentals. I reiterate a “Strong Buy” rating.

For reference, although Societe Generale stock has shown some strength recently, the bank remains a relative underperformer: for the trailing twelve months, Societe Generale stock is up only about 9%, as compared to a gain of 15% for industry leader JPMorgan (JPM) and a gain of 15% for the S&P 500 (SP500).

Seeking Alpha

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here