There’s no locality on the web – every market is a global market. – Ethan Zuckerman

The iShares MSCI EAFE ETF (NYSEARCA:EFA) is designed to track the investment results of the MSCI EAFE Index, which includes large- and mid-capitalization developed market equities, excluding the U.S. and Canada. This fund offers exposure to more than 800 stocks across Europe, Australia, Asia, and the Far East.

Anyone who has attempted to diversify outside the US S&P 500 (SPY) has badly underperformed. If we look at the EFA to SPY ratio, we can see it’s been in an incredible downtrend for well over a decade. Looks easy to avoid with hindsight, but there were plenty of false relative momentum signals along the way that badly hurt anyone who tactically tried to rotate here.

Tradingview.com

The Impact of the U.S. Dollar

The U.S. dollar has a significant impact on international investments. A strong dollar often acts as a headwind for international equity investments, while a weak dollar can serve as a tailwind.

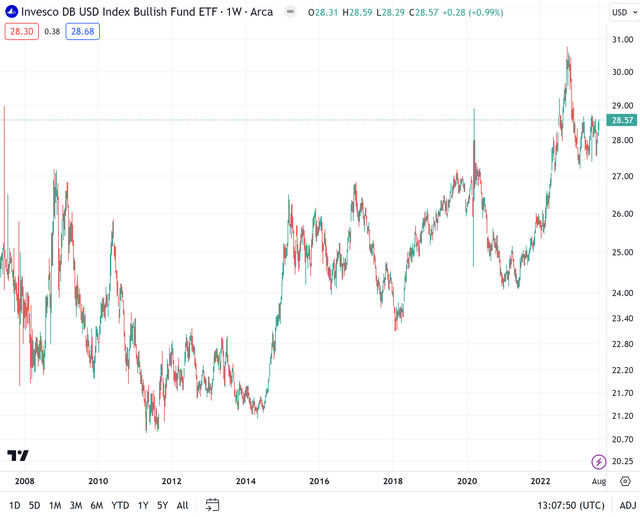

Over the past decade, despite zero interest rate policy and endless money printing, the dollar (UUP) has enjoyed a strong run. Much of this I believe is due to the Fed essentially eliminating left tail US stock market risk with the unfair advantage of the money printer, causing foreign capital to favor US markets more broadly.

Tradingview.com

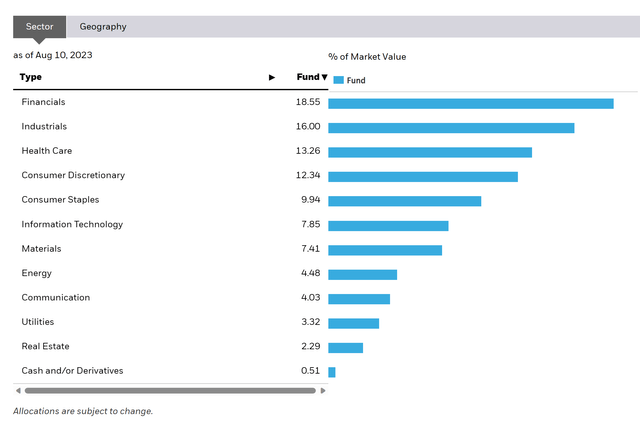

It’s more than just the Dollar though. This is ultimately a story of technology over everything else. If we look at EFA’s sector composition, it’s clear that it is value tilted with a heavy allocation to Financials, and a Technology allocation which is miniscule compared to the S&P 500.

iShares.com

This may be precisely why now could be the time to rotate out of US markets into international. If you believe we are in a Tech mania driven by AI, and that the tech sector (XLK) is particularly vulnerable to a correction, then investing in EFA could be one way to “suffer less” in the event risks remain elevated in global markets.

Final Thoughts

The iShares MSCI EAFE ETF presents an enticing opportunity for investors seeking to diversify their portfolios and tap into the potential of international markets, despite being admittedly a horrible performed for well over a decade. I personally believe the Dollar long-term will likely be under pressure, although any kind of risk-off phase in the short-term through a credit event would push the greenback higher and be a headwind for all stocks globally.

The EFA ETF is just one of the many tools available to investors seeking to diversify their portfolios and capitalize on international markets. While it’s not without its risks, with the right strategy and careful risk management, it could prove to be a valuable addition to your investment portfolio. Just be mindful that this ultimately will depend on the Dollar’s movement, and Technology dominance. I have argued recently that value is likely to outperform growth, but for all we know, that could still be way too early to allocate to.

Diversification is supposed to be a good thing, right?

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here