BB Seguridade (OTCPK:BBSEY) has recently unveiled its financial results for the first half of the current year, building upon a strong foundation established in the previous year (2022). The company’s performance has showcased substantial growth, particularly evident in the considerable increase in net profit. The company has also declared a noteworthy dividend payout alongside these impressive financial outcomes.

Furthermore, in an unusual move for companies with significant government influence, BB Seguridade has initiated a share buyback program. This initiative is particularly remarkable as it highlights potential undervaluation in the company’s stock.

These developments bolster my optimistic outlook on BB Seguridade as a company poised to consistently deliver a dividend yield of over 10%.

Q2 Earnings: strong results

BB Seguridade has unveiled robust Q2 results, paralleling the impressive performance of its parent company, Banco do Brasil (OTCPK:BDORY).

Equally noteworthy is that these outcomes have been achieved on the foundation of an already solid base. The groundwork laid in 2022, particularly during the first semester and the entire year has been exceptional. Delivering strong results in a year that builds upon the high standards the previous exceptional year sets underscores a significant achievement.

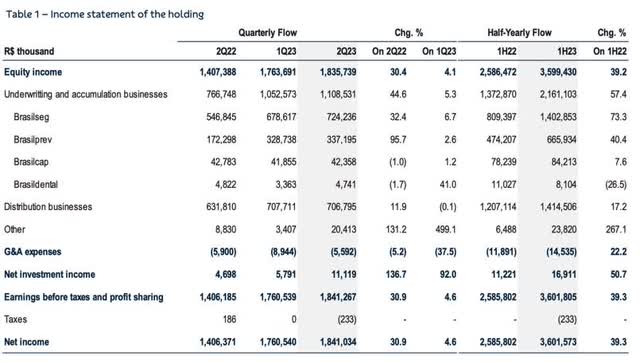

BB Seguridade’s IR

The net income for the quarter surged by 31% compared to the same period last year, reaching R$1.84 billion, signifying a substantial growth rate. Few companies worldwide are achieving such rapid expansion in profits.

While all of the company’s units maintained a commendable performance, the standout factor behind this impressive outcome lies within its subsidiary, Brasilseg. Notably, Brasilseg reported a remarkable 32% year-over-year profit growth. Furthermore, the financial results have been favorable, drawing particular attention to exceeding expectations. The company has surpassed its guidance for the first half of 2023, with non-interest operating (excluding holding) exceeding the upper end of guidance by 8.7 percentage points.

Although Brasilseg’s premiums written experienced a slowdown during this quarter, there’s an anticipation of a rebound in the second half of the year with the release of the Safra Plan 23/24 at the end of June. Banco do Brasil, as a whole, has consistently outperformed its promised results and market guidance. Both operating results and premiums written have demonstrated robust improvements.

In the first half of the year, the unit’s premiums written growth exceeded the upper end of guidance by 0.7 percentage points, while pension plan reserves adhered closely to guidance but neared the upper end with a deviation of -0.7 percentage points.

The pension unit, Brasilprev, reported a net profit of R$438 million, maintaining stability in the quarterly comparison but showcasing a substantial yearly expansion of 90.8% year-over-year. The enhancement in the result owes much to the financial sector, which recorded R$223.4 million compared to a loss of R$89 million in 2Q22. This shift is attributed to the reduction in liability costs due to the deflation of the Brazilian General Price Index – Market (IGP-M), coupled with positive mark-to-market impacts from the closure of the yield curve.

The capitalization unit, Brasilcap, attained a profit of R$ 63.4 million, reflecting a 1.2% quarter-over-quarter growth and a slight decrease of 1.3% year-over-year. This decline was partially influenced by the solid financial result of R$ 110.8 million, constituting a 10.0% growth year-over-year. Revenue generated from capitalization bonds witnessed a notable expansion of 14.7% quarter-on-quarter and 35.3% year-over-year, driven by higher sales volume of single-payment bonds. Revenues from quota share also experienced more moderate growth, expanding by 2.9% quarter-on-quarter and 23.3% year-over-year.

The brokerage firm, BB Corretora, recorded a profit of R$ 706.8 million for the quarter, showcasing an 11.9% year-over-year growth. The annual expansion was propelled by a robust financial result of 15.5% year-over-year, amounting to R$ 106.4 million. Additionally, the yearly profit evolution was bolstered by increased brokerage revenue, which escalated by 12.2% year-over-year due to strong commercial performance and the recognition of deferred insurance commissions, particularly in the rural and credit life sectors.

Dividends remain robust

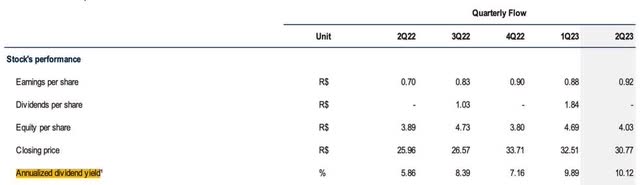

Following the impressive second-quarter results, BB Seguridade has announced its dividend payout, previously set at R$3.2 billion reais. This translates to R$1.60 per share, equating to a 5% yield per semester. Historically, BB Seguridade disburses dividends twice a year, in August and again after six months. The ex-dividend date is slated for August 16, with the actual payout scheduled for August 28.

BB Seguridade’s IR

In line with BB Seguridade’s commitment to generous payouts, this dividend disbursement encompasses 86% of the first quarter’s profit. Contrastingly, the dividend payout for BB Seguridade reached 95% last year, culminating in an average yield of 5.83% throughout 2022. The current year boasts an average yield of 8%, with projections forecasting an ascent to nearly 10% by the close of 2023. As for the subsequent year, analysts envision a yield of 10.3% for 2024.

Seeking Alpha

The remarkable aspect that deserves attention is the company’s remarkable growth through dividend payments, a feat accomplished by only a handful of companies globally. Achieving growth through dividend disbursements necessitates an initial foundation of expansion and robust returns on invested capital.

In the case of BB Seguridade, its astounding 80.3% Return-on-Equity (ROE) stands among the highest globally within the insurance sector. This remarkable efficiency is driven by its ability to leverage the Banco do Brasil channel for sales. This negates the need to establish independent sales channels (although BB Seguridade does manage to generate over a billion in sales outside the Banco do Brasil channel). However, the lion’s share of business invariably transpires within the Banco do Brasil network, with approximately 90% to 95% of BB Seguridade’s insurance operations occurring within its branches or the Banco do Brasil channel.

Buyback program announced

In addition to continuing to grow profits while distributing robust dividends, BB Seguridade is a rare case of a state-owned company implementing share buyback initiatives.

Considering that Banco do Brasil holds the reins of BB Seguridade, the launch of a buyback program assumes paramount importance. This program encompasses 64 million shares, accounting for slightly less than 10% of the outstanding shares. The duration spans 18 months, implying that the company isn’t compelled to execute purchases immediately; it holds the liberty to make acquisitions within 18 months. However, the initiation of such programs generally occurs when companies are reasonably certain about execution.

I regard this development as exceedingly positive. It underscores my belief that a company capable of fulfilling its expansion prerequisites while maintaining robust profitability should allocate excess funds back to its shareholders, typically via dividends. During the conference call, the management alluded to the possibility that the buyback initiative could influence the dividend payout ratio, which presently stands within the 80-90% range.

Moreover, given the current undervaluation of the stock, the rationale behind buybacks is further reinforced.

Valuations, the icing on the cake

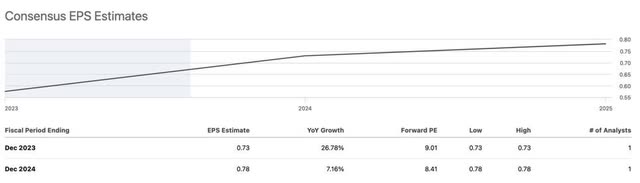

Observing the trading activity of BB Seguridade shares, it becomes evident that they are currently valued at a forward price-to-earnings (P/E) ratio of just 9x for 2023. This figure stands 14% below the industry average. Looking ahead to 2024, the P/E ratio is even more appealing at 8.4x. This is attributed to the projected deceleration in earnings per share (EPS) from 2023. Such metrics underscore the distinct position of BB Seguridade as an income-oriented stock, trading at remarkably low multiples.

Seeking Alpha

The enticing projected dividend yield of 10% further strengthens this investment proposition. This aspect is a rarity, as it presents an income-generating opportunity within a stock characterized by its significantly discounted valuation.

The recently disclosed buyback program serves as an additional endorsement of this stance. The fact that the company’s management team, arguably those with the most comprehensive understanding of the company, perceives the shares as undervalued lends credence to this perspective.

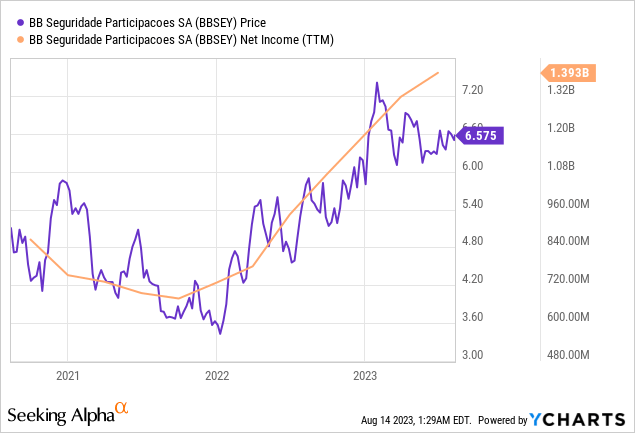

The chart below illustrates the correlation between BB Seguridade’s share performance and profit generation. This graph underscores a robust correlation between the two factors, further affirming the strategic alignment between financial performance and shareholder value.

Risks and governance considerations

Given its affiliation with Banco do Brasil and its status as a state-owned company, BB Seguridade is exposed to significant risks that demand ongoing vigilance. The broader political risk within Brazil could manifest in utilizing the company’s resources, potentially diverging from a primary focus on maximizing shareholder value.

Nevertheless, Brazilian regulations have responded by implementing governance protocols aimed at overseeing publicly and partially state-owned companies to mitigate such concerns. These protocols entail specific criteria for appointing directors, CEOs, and board members.

Towards the previous year’s close, discussions emerged regarding the relaxation of these governance standards. However, in contrast to state-owned counterparts like Petrobras (PBR), Banco do Brasil displays a comparatively lower susceptibility to potential political manipulation. This resilience can be attributed to its distinguished status, boasting the highest corporate governance designation on the Brazilian stock exchange – the “New Market.” This designation mandates that companies exclusively issue common shares with full voting rights, regardless of shareholders’ status.

However, there is an additional layer of protection concerning BB Seguridade’s governance, which distinguishes it slightly from the average state-owned companies in Brazil. The subsidiaries of BB Seguridade, namely Brasilseg, Brasilprev, Brasilcap, and BB Corretora, are under private company control.

The bottom line

BB Seguridade, as a state-owned enterprise, requires continuous vigilance due to the potential intervention risks associated with its government ownership. However, without these risks materializing, I am confidently reiterating my “strong buy” recommendation for BB Seguridade. The company’s remarkable Q2 performance underpins this affirmation, the recent announcement of a generous dividend, and the implementation of a buyback program. Notably, these positive developments coincide with the stock traded at discounted valuation multiples, further enhancing its investment appeal.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here