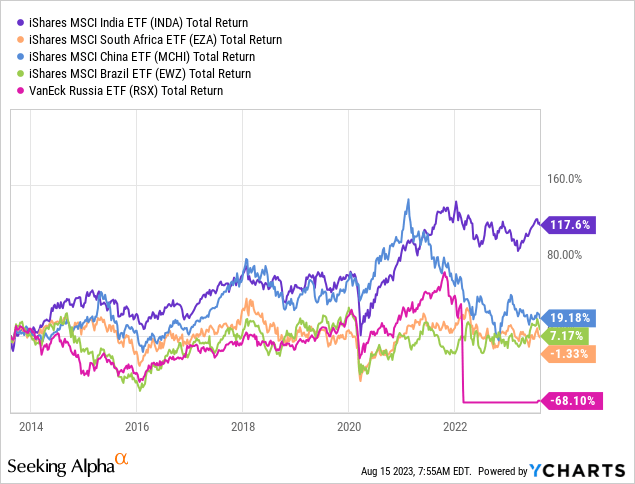

Today’s analysis covers the iShares MSCI India ETF (BATS:INDA), whose scintillating performance in the past decade warrants further attention. Many expected, and still expect, Chinese stocks to outperform other BRICS nations’ assets. However, we would like to turn our attention to India today, as we believe the region is underappreciated from a trend growth vantage point; moreover, we think the market has been slow to price the recent shift in iShares MSCI India ETF’s key influencing variables.

Central to our argument is the recent shift in Indian stocks’ risk premiums, which the market seemingly hasn’t spotted as yet. As such, we herewith deliver a bullish thesis; let’s traverse into the body of the report.

INDA ETF’s Characteristics

The iShares MSCI India ETF is an exchange-traded fund that uses representative sampling in an attempt to mimic the returns of the broad-based Indian stock market. With a regional allocation of 85%, the exchange-traded fund, or ETF, provides foreign investors (mainly U.S.) with a currency-hedged investment vehicle, which also phases out regional inflation risk.

iShares

Although the emerging market nature of the investment product often causes the ETF to incur tracking errors, its regional exposure is generally well quantified, providing investors with a novel diversification instrument.

Risk Premiums and Realized Returns Mismatch

I plotted India’s equity risk premiums in the diagram below to formulate an understanding of expected returns. Regional equity risk premiums have abated significantly in the past year, leading to a justification for higher stock valuations (all else being equal). However, the iShares MSCI India ETF has suffered a price decline of 0.53% (at the time of writing this article) in the past year, suggesting that realized returns have not aligned with expected returns.

Although the mismatch between the ERP and realized returns does not warrant a valuation gap by itself, it certainly provides a valid baseline, especially considering regional GDP growth of 6.1%!

Author’s Work – Data from Market Risk Premia

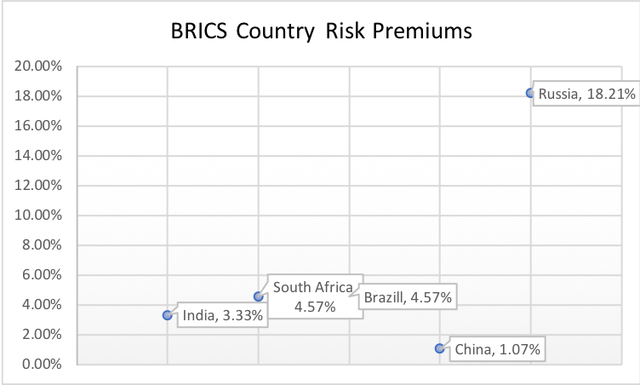

I went ahead and plotted BRICS country risk premiums, which were calculated by Seeking Alpha author and well-respected academic, Aswath Damodaran. Based on the data, India has a moderate country risk premium of 3.33%, which we cannot argue against as large parts of the nation remain underdeveloped while foreign relationships are yet to be consolidated.

However, having said the above, we would not be surprised if India’s country-specific risk premium converges with China’s in the coming years.

As things stand, frictions between the U.S./EU and China are intensifying, with trade agreements at risk. Moreover, we think China’s current deflation risk and continuous political turmoil were unanticipated by global investors who were slightly overzealous regarding China’s future growth prospects (mixing up past growth and future growth) in recent years.

In essence, we think investors are slowly starting to realize that they underscored China’s country risk premium while overscoring India’s, as illustrated by a recent survey conducted by Invesco, which recorded a substantial year-to-date shift into Indian capital markets from Chinese capital markets by global sovereign wealth funds and central banks.

BRICS Country Risk Premiums (Author’s Work – Data From Aswath Damodaran )

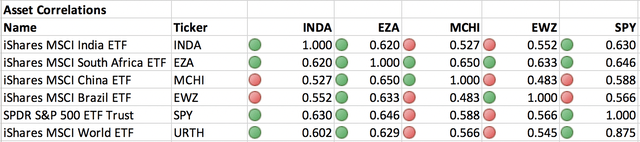

Let’s look at emerging market asset class correlations pertaining to iShares’ ETF products.

As an asset allocator, I generally look for uncorrelated asset classes to diversify my portfolio’s risk. However, when I look at geographic risk, I usually search for emerging markets that are “integrating” with developed markets and examine the reasons why, as I, as well as other researchers, have discovered that evolving integration paired with high regional growth often results in superior risk-adjusted asset class returns.

As illustrated in the diagram at the bottom of the section, the iShares MSCI India ETF provides diversification prospects relative to the world and the U.S. market; however, with correlation coefficients above 0.6, the product exhibits better pairwise correlations than Brazil and China (Russia was left out, but I assume its integration is low at the moment).

Based on my anecdotes, there are improvements in global trade agreements, and liberalization of money flows in India. Thus, I believe India will continue its global integration and provide iShares MSCI India ETF investors with lucrative risk-adjusted return prospects.

Author’s Work – Data from Portfolio Visualizer

‘BICS’ Stock Valuations and Trend Growth

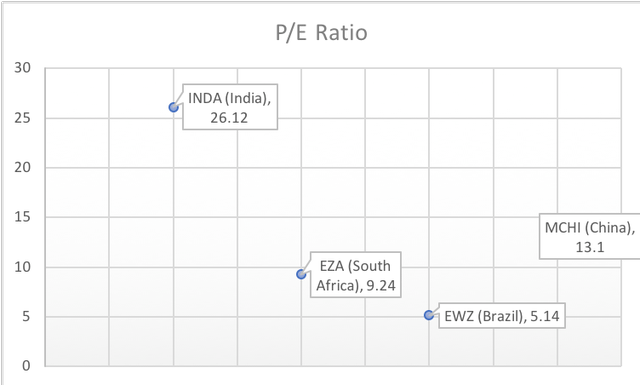

I compared the iShares MSCI India ETF’s price-to-earnings multiple with other iShares BRICS products (phasing out Russia as it isn’t very tradable at the moment).

It’s quite clear that the iShares MSCI India ETF product possesses a much higher price-to-earnings multiple than most other products, which raises cause for concern if looked at in isolation.

Author’s Work – Data from iShares

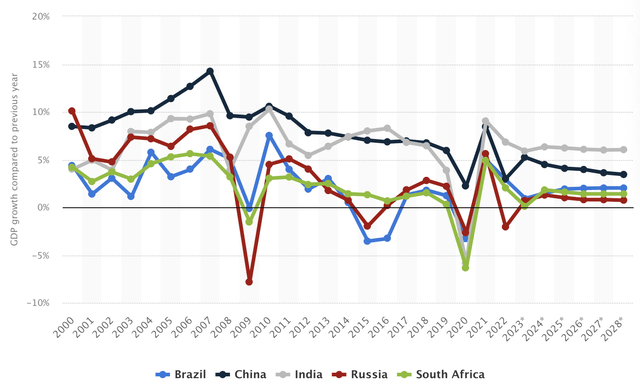

However, expanding the analysis to trend growth suggests that iShares MSCI India ETF’s high price-to-earnings multiple might be warranted. I back my claim up with the fact that India’s compound annual GDP growth rate is forecasted to settle above 6% until 2028, which builds on its impressive realized growth rate during the past three years.

By assuming GDP growth will translate into high nominal earnings growth, I’m willing to bet that the iShares MSCI India ETF’s heightened price-to-earnings multiple is sustainable based on the equation’s denominator. I’m well aware that other factors must be considered to formalize a robust conclusion; however, I am merely using the variable as a parsimonious baseline estimate.

GDP Trend Growth (Statista)

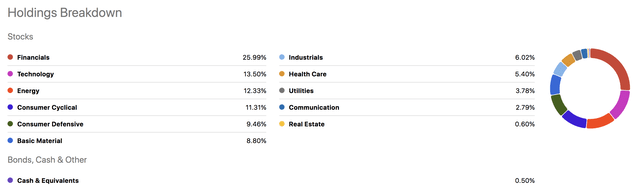

To conclude this section, I would like to mention that I believe the iShares MSCI India ETF has a low sector concentration risk. The ETF is well-diversified across sectors, meaning its crash risk is likely lower than most other emerging market ETFs because diverse sector exposure generally combats cyclical market behavior (in simple terms, I don’t think this ETF will become top-heavy).

INDA’s sector exposure (Seeking Alpha)

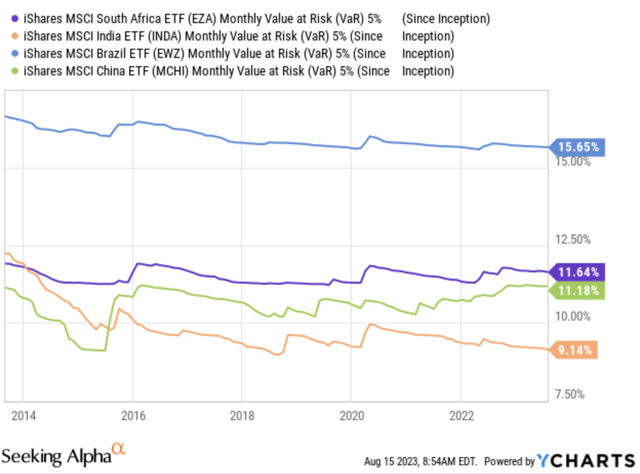

Below is a chart plotting cross-sectional data of iShares’ India, South Africa, Brazil, and China ETFs. The data somewhat substantiates my “crash risk” claim as it shows the iShares MSCI India ETF possesses a lower monthly VaR than its counterparts.

Seeking Alpha; YCHARTS

INDA ETF’s Idiosyncratic Features and Risks

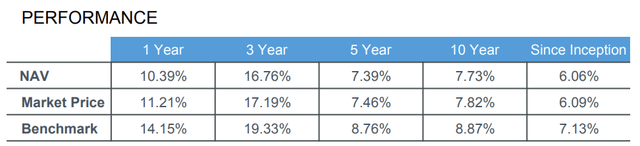

Although we are bullish on Indian stocks and the iShares MSCI India ETF alike, the ETF possesses a few unwanted risks relating to the portfolio management team’s efficiency and the vehicle’s income-based prospects.

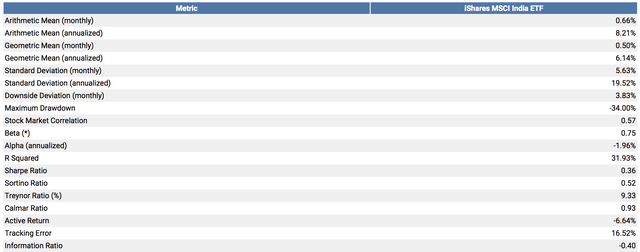

A regression analysis shows that INDA’s information ratio is in negative territory at -0.4, which is moderately concerning. The IR ratio measures a portfolio’s excess returns (versus its benchmark) relative to its excess benchmark risk. In essence, it determines whether your portfolio manager is adding or subtracting value. Thus, the ETF’s IR communicates low management efficiency; however, fortunately for iShares, broad exposure to India’s stock market isn’t accessible to everyone; therefore, the vehicle has pricing power over its investor base.

Click on Image to Enlarge – (Author in PortfolioVisualizer)

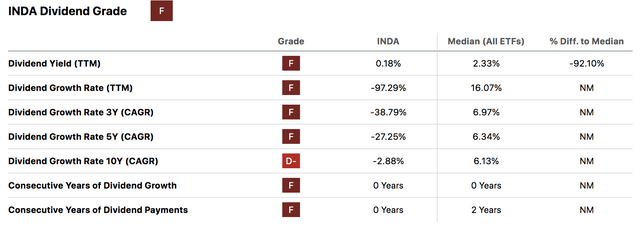

Further, INDA ETF doesn’t provide a desirable dividend profile. In fact, its dividend yield of 0.18% is accompanied by negative annual distribution growth; therefore, it leads to the argument that income-seeking investors would probably be better off looking elsewhere.

Seeking Alpha

Final Word

Our analysis shows that the iShares MSCI India ETF is possibly lagging behind a shift in key market indicators. As such, we believe an opportunity exists for price returns. Moreover, India’s trend growth and integration suggest the asset is well-placed as a long-term investment opportunity.

Consensus: Buy rating assigned with an indefinite horizon in mind.

Read the full article here