ReneSola is a company I have mentioned over the last few years as a smart solar industry pick. Unfortunately, the stock quote has lagged and declined for long-term holders, mostly from disappointing operating performance. The good news is something of a restructuring, including divestments of Chinese assets, with a refocus on U.S. and European markets has been underway since early 2023. The business has changed its name to Emeren Group Ltd. (NYSE:SOL), keeping the same ticker symbol. Not only are operations focused on building solar farms for electric utilities and independent energy investors, but remaining an owner (partner) of solar energy producing assets is the new business model.

Company Homepage – August 17th, 2023

For new investors in Emeren, the value proposition appears to be the cheapest since 2020, especially on price to tangible book value (0.56x). With the company sitting on $76 million in cash and $215 million in total current assets vs. just $105 million in total liabilities at the end of March, today’s equity market capitalization of only $170 million (at $3.30 per share) means future operating results are available at minimal cash-adjusted cost!

I recently repurchased a position as a net-asset play with real growth drivers appearing this year and next. The 2023 business model is projected by Wall Street analysts to deliver consistent profits and cash flows soon, although you couldn’t tell it from the weak share price trend.

Price to Book Value Analysis

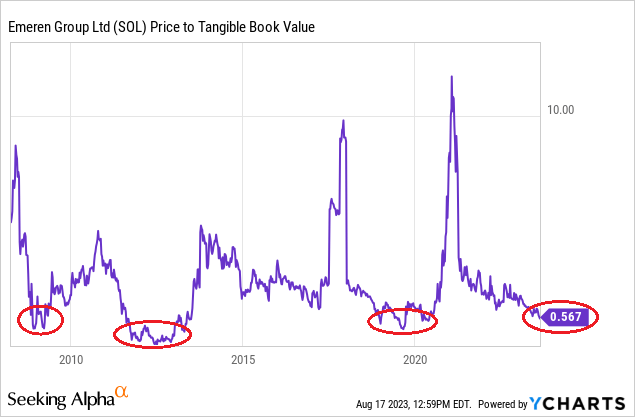

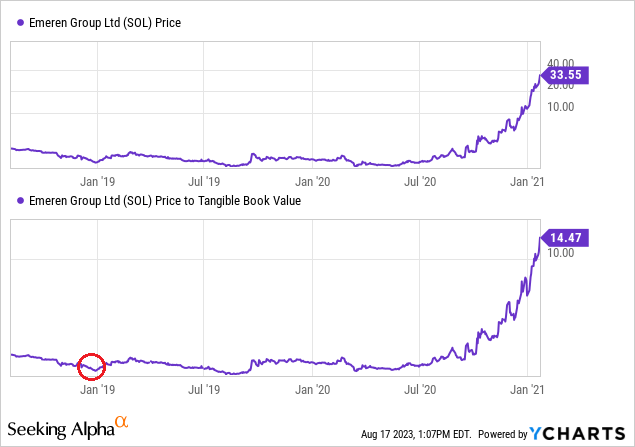

The biggest “bottom fishing” pull for me in this security is the price to tangible book value calculation. ReneSola was a very cyclical investment between 2008’s IPO and the latest restructuring decision. The best times to buy the stock have been when large discounts vs. accounting book value have existed.

Below is a graph of ever-changing price to net hard-asset values over the past 15 years. Only three other instances have produced a multiple of 0.6x or lower. And, each proved to be an excellent time to load up with SOL shares.

YCharts – Emeren Group, Price to Tangible Book Value, Author Reference Points, Since 2008

Let’s take a deeper dive into each net hard-asset buy period, including 2008-09, 2011-12, and 2018-20. You will notice all three presented opportunities for huge gains a year or two later, had you purchased a stake and patiently waited for your money to multiply.

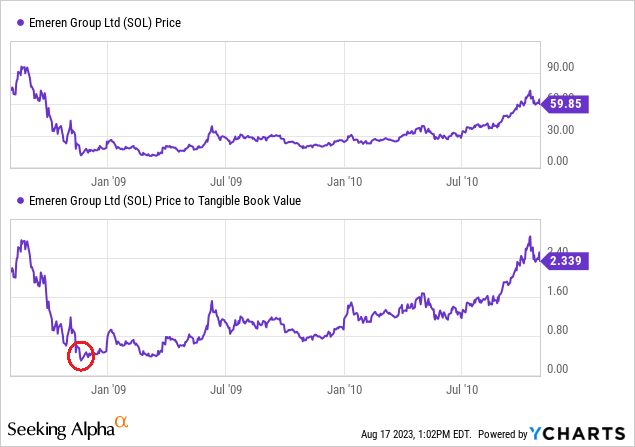

2008-09 Buy

The first instance of price to tangible book value falling below 0.60x was in late 2008 during the Great Recession. Had you purchased on the first break below this 0.60x multiple in November 2008 (circled in red) under $20 per share, you would have been quite happy with a $70 SOL price by October 2010 (23 months later). This +250% advance whipped the equivalent period price climb of roughly +100% for the S&P 500 index.

YCharts – Emeren Group, Share Price vs. Tangible Book Value Multiple, Author Reference, Aug 2008 to Oct 2009

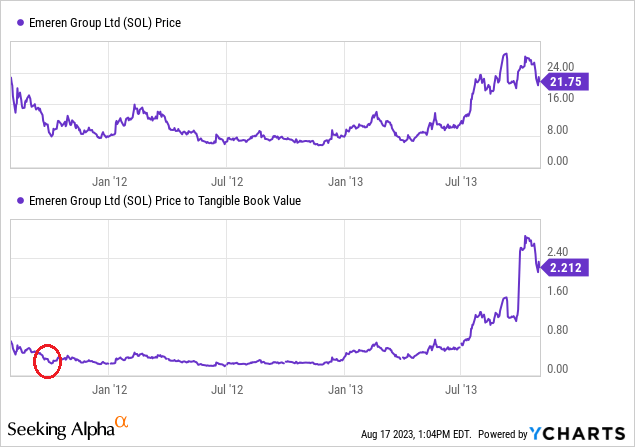

2011-12 Buy

Again, had you purchased a position under $12 per share in October 2011, a $30 price in August 2013 (22 months later for a climb of +150%) would have been a wonderful gain, far outpacing the slight rise in the S&P 500 index over the same span of +35%.

YCharts – Emeren Group, Share Price vs. Tangible Book Value Multiple, Author Reference, Aug 2011 to Oct 2013

2018-20 Buy

The best signal of all started in late 2018. From under $2 in December 2018 to a quote greater than $30 in January 2021, investors were able to reap an amazing +1,500% on their investment. Over the same 25-month period, the S&P 500 was able to climb +65% in price.

YCharts – Emeren Group, Share Price vs. Tangible Book Value Multiple, Author Reference, Aug 2018 to Jan 2021

Bargain Forward Valuation Stats

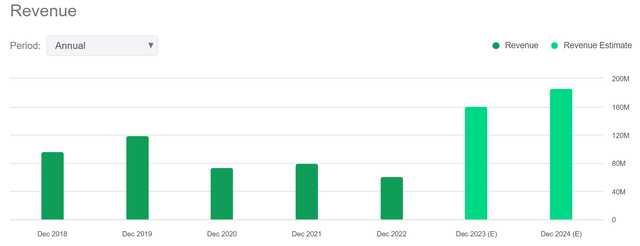

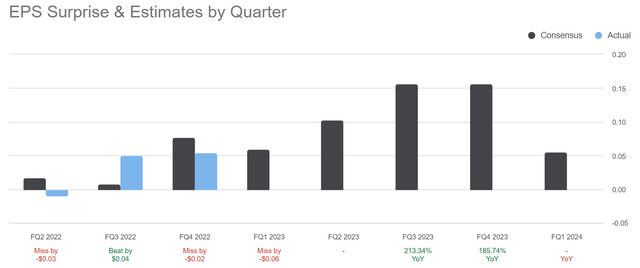

Another reason to like the company is its restructuring is expected to yield nice progress this year and next, in terms of less cyclical revenue and earnings results. The knock on ReneSola was it would only produce solid earnings every once in a while, as management struggled to find projects to build. A more consistent and predictable business outlook should help shares to be rerated higher as a going concern. Below are graphs of the projected progress being made on the sales and EPS fronts into 2024.

Seeking Alpha Graph – Emeren Group, Analyst Annual Revenue Forecasts for FY 2023-24

Seeking Alpha Graph – Emeren Group, Analyst Quarterly EPS Forecasts for FY 2023

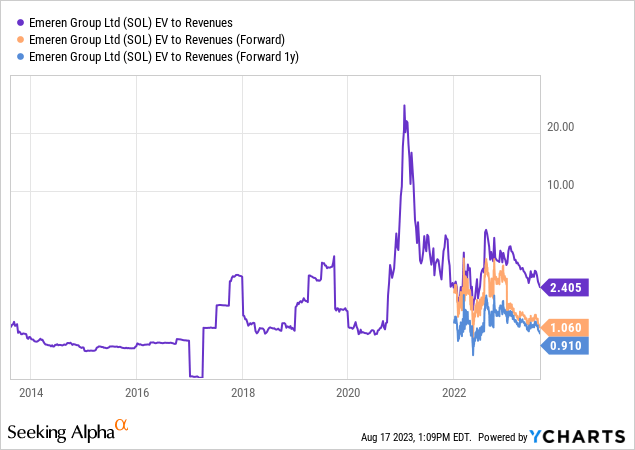

After subtracting large cash holdings from the market cap, then adding back total debt, we find enterprise valuations have become incredibly inexpensive. If analyst projections prove correct, I can argue the whole value and growth proposition offered by Emeren represents a ground-floor opportunity with enormous upside as solar farm demand remains strong industry-wide for years.

Using EV to forward analyst forecasts of revenues in 12 months (0.91x ratio), SOL is again priced close to the 2020 pandemic bottom, achieved before the massive spike higher in shares into early 2021.

YCharts – Emeren Group, EV to Sales, 10 Years

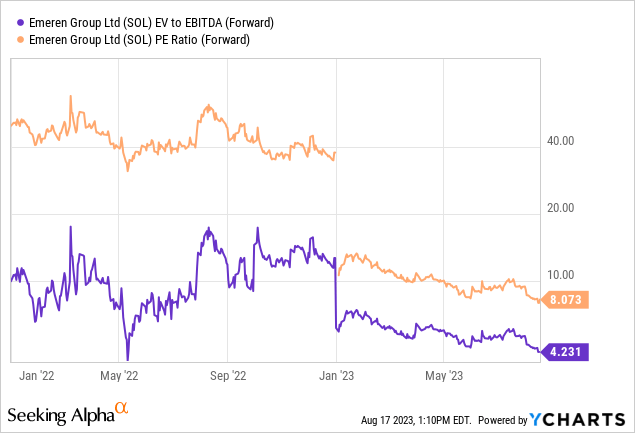

In addition, EV to basic cash EBITDA forecasted in 6-12 months sits at a multiple of just 4.2x. Plus, where else can you locate a conservative balance sheet in a high-growth industry, priced at only 8x forward EPS into the middle of 2024?

adsf

When you combine the bargain valuation on tangible book value (with nearly half of present market value backed by cash holdings), with low ratios on future income and EBITDA generation, it appears new investors are getting something of an asset steal for their money. At least, that’s the way I see it.

Final Thoughts

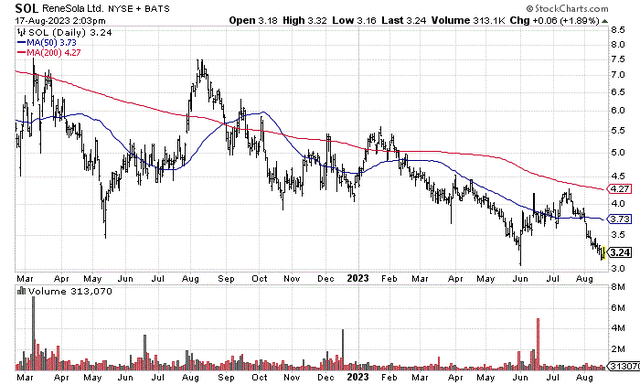

My Buy rating on Emeren Group is purely a function of its low valuation. The trading chart is quite ugly. I cannot find much to put my bullish hat on, regarding the technical trading readout. The stock is holding above its intraday 52-week spike low of $3.06 on June 1st. But, a minor move under this level will not affect my outlook much. It’s entirely possible the quote will flatline for 3-6 months before rebounding dramatically higher in 2024.

StockCharts.com – Emeren Group, 18 Months of Price & Volume Changes

What’s the downside risk? Clearly, it’s all about management execution of its solar buildout and ownership plans. The company doesn’t need to raise capital, won’t be hurt by rising interest rates, and has solar industry growth trends at its back.

In this regard, the upcoming August 31st quarterly earnings release will give us better clues on progress with the restructuring. If the news is positive, it could be the catalyst for a price reversal, perhaps even a sharp one.

Guidance for the second half of 2023 and next year will also be key. If SOL can avoid disappointing EPS like last quarter, a meaningful turnaround for investors may be on deck.

Otherwise, future investor attention to the undervaluation setup may allow price to again retake its tangible book value, today around $5.83 per share. In terms of a bullish price outlook, renewed earnings generation and a rerating of the business above its tangible book value (climbing north of $6 in 2024) would easily support a DOUBLE (+100%) on your investment in the low-$3 range currently.

And, if management can execute on its plans (some Chinese rooftop panel assets were sold in June), stabilized and predictable revenue and earnings streams from solar farm ownership could support $8 to $10 again, maybe in 18-24 months. If this is our future, a TRIPLE (+200%) on your investment is absolutely possible for patient shareholders.

Yes, I am looking for history to repeat (or at least rhyme) from today’s ultra-low price to tangible book value multiple under 0.60x. I believe Emeren deserves a spot in most portfolios for solar industry exposure on the cheap.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here