Introduction

In the past few months, I have been building a position in some of the baby bonds issued by Sachem Capital (NYSE:SACH), an alternative lender focusing on real estate the “fix and flip” segment. As Sachem requires its borrowers to provide personal guarantees, it has so far been able to keep loan losses limited. That’s good to see, but I’m still keeping a close eye on the REIT’s quarterly performance.

Sachem’s financial results were pretty robust

This article is meant as an update to fine-tune my investment thesis. For a better understanding of the REIT’s business model and strategy, I’d recommend you to read my older articles, or articles written by other authors here on Seeking Alpha.

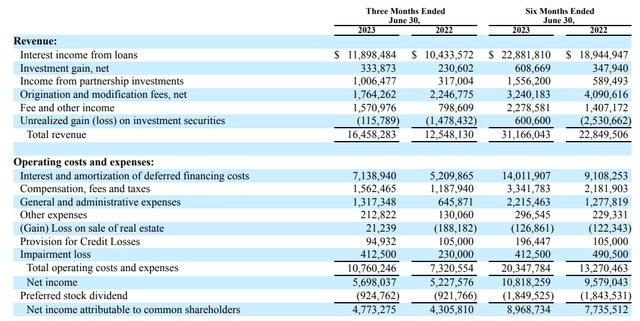

The REIT reported total revenue of $16.5M in the second quarter of the year, and the interest income from the loans increased at a nice pace to $11.9M. The main operating cost of Sachem still is its own interest bill, but thanks to its decision to predominantly use fixed rate debt there are no real surprises there. As you can see the total amount of operating costs increased to $10.8M, but this includes in excess of $0.5M in impairment charges and loan loss provisions.

Sachem Investor Relations

The loan loss provisions were expected and are slightly lower than in the first half of last year. And if you compared the impairment losses it’s true the Q2 2023 impairment loss was substantially higher than in the second quarter of last year, but on a H1 basis, the total amount of impairment losses was lower than in the first half of last year.

The REIT remained profitable as it generated a net profit of $5.7M of which about $0.93M was needed to cover the preferred dividend payments. This means the net income attributable to the shareholders of Sachem Capital was $4.77M or $0.11 per share. This also means the current quarterly dividend of $0.13/share is not covered by the earnings and even if you would add back the $0.5M in loan loss provisions and impairment charges, the dividend still wouldn’t be fully covered.

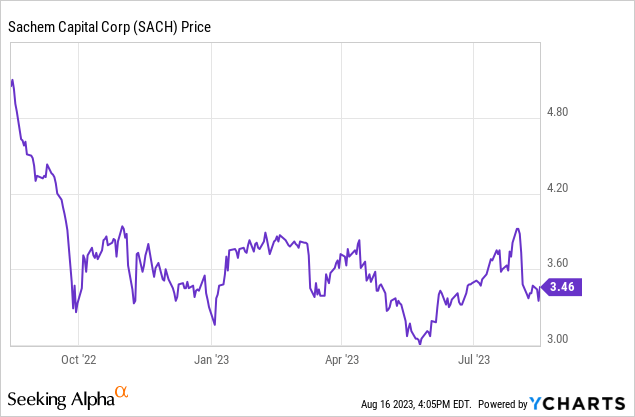

That’s the main reason why I currently have no position in the common shares. They are attractively priced at just 8 times earnings and at a 15% discount to its book value, but I think a distribution cut is likely, and I’m not sure that risk has been priced into the share price yet. That being said, whereas I was reluctant to consider the preferred shares (SACH.PA) before, the preferred dividend still is quite well-covered. That being said, the current yield on the preferred stock is “just” 9.45%. While that’s high in absolute numbers, most of the baby bonds offer a higher yield, and as they also rank higher in the capital structure (baby bonds are senior to preferred equity), I’m sticking with my exposure to the baby bonds for now.

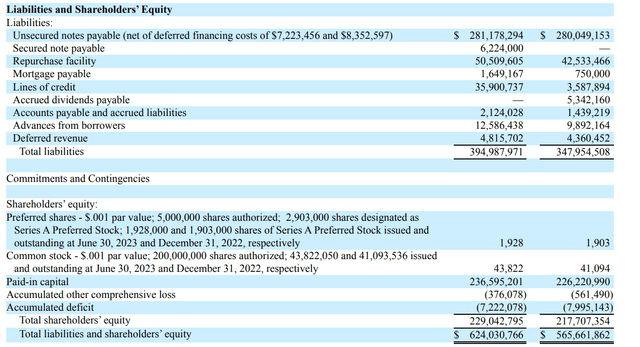

Looking at the liabilities side of the balance sheet, there’s about $229M in equity ranked junior to the debt securities. Meanwhile, there’s less than $95M in debt ranked senior to the unsecured notes

Sachem Investor Relations

The YTM of the debt securities has come down, but still offer value

In my previous article, I focused on the 2027 baby bonds trading with (NYSE:SCCG) as ticker symbol. For simplicity sake, I’ll use this one as an example again. As explained in the previous article, this was a relatively small issue ($40.25M) and mature on Sept. 30, 2027 (so in four years and six weeks from now). SCCG is currently trading at $23.24 per share, resulting in a yield to maturity of just under 10%.

That’s already substantially lower than the yield to maturity when the previous article was written as the price of the baby bond has increased by about 10%. And despite seeing the interest rates on the financial markets increasing again, the yield on Sachem’s debt has gone down, which indicates the market is now more comfortable with the risk profile offered by this REIT.

Investment thesis

On the Q2 conference call, Sachem management commented they expect to see “the amount of foreclosures and loan modifications to trend down”:

The term of our loan runs its course, we have a choice. I can either foreclose, send a demand letter and foreclose where we can extend and modify. And our team is really good at figuring out is our borrower doing what they should, what they agreed to do? Have they maintained the property? Is the construction on process?

If in fact, the borrower has done as agreed, we can extend and modify his loan for another year. We are seeing an awful lot of this. And it’s really a result of our people, not having a place to go where they have completed projects and no bank financing to assist them really with lower payments and long-term debt capital. So to be very specific, we see this, I don’t want to say coming to an end, that would not be fair. We do see the amount of modifications and extensions slowing down tremendously towards the end of the year.

I own the baby bonds and I feel pretty comfortable doing so. I currently have no position in the common shares or the preferred shares as I wanted the extra layer of safety by being a creditor rather than being a (preferred) shareholder.

Read the full article here